Category Archive: 9a.) Real Investment Advice

Rally Into Year-End: 3-Reasons To “Buy Dips”

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

10-17-25 The Leverage Trap: Why The Next Selloff Could Be Brutal

Leverage drives bull markets higher—but when sentiment shifts, it accelerates the fall.

In this Short video, I explain how margin debt above $1 trillion fuels gains today but can trigger a rapid, cascading selloff when the tide turns. $SPX $QQQ

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-22-25 Teaching Kids About Money – Lessons From Investing’s Biggest Mistakes

How do we raise the next generation to be financially wise in a world obsessed with “getting rich quick”?

Lance Roberts and financial writer Benjamin Gran discuss teaching children about money, work, and investing.

#FinancialEducation #TeachingKidsAboutMoney #InvestingWisely #FinancialLiteracy #MoneyLessons

Read More »

Read More »

10-17-25 Six Crucial Steps to Medicare Open Enrollment

Medicare’s Fall Open Enrollment runs from October 15 through December 7, and this is your chance to review, compare, and adjust your coverage for 2026.

Richard Rosso & Jonathan McCarty review six crucial steps to help you make smarter Medicare choices — from evaluating plan changes and comparing drug coverage to avoiding common enrollment mistakes.

Whether you’re already on Medicare Advantage or reviewing Part D drug plans, understanding how...

Read More »

Read More »

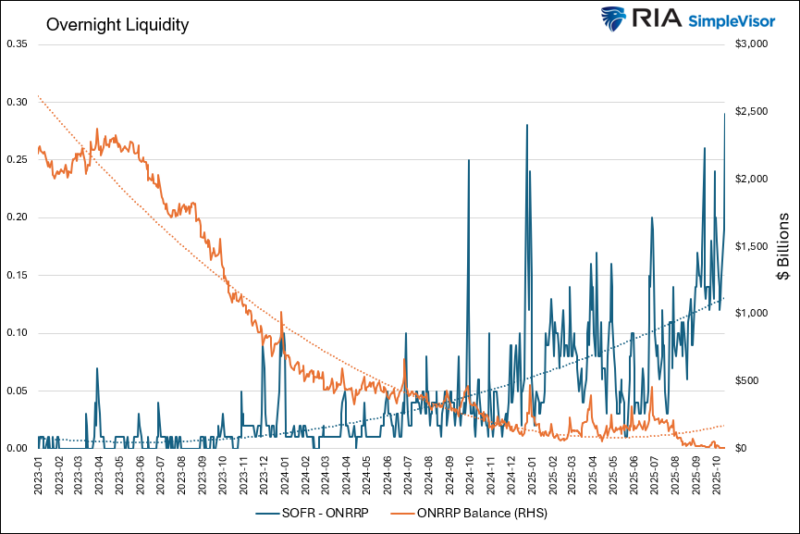

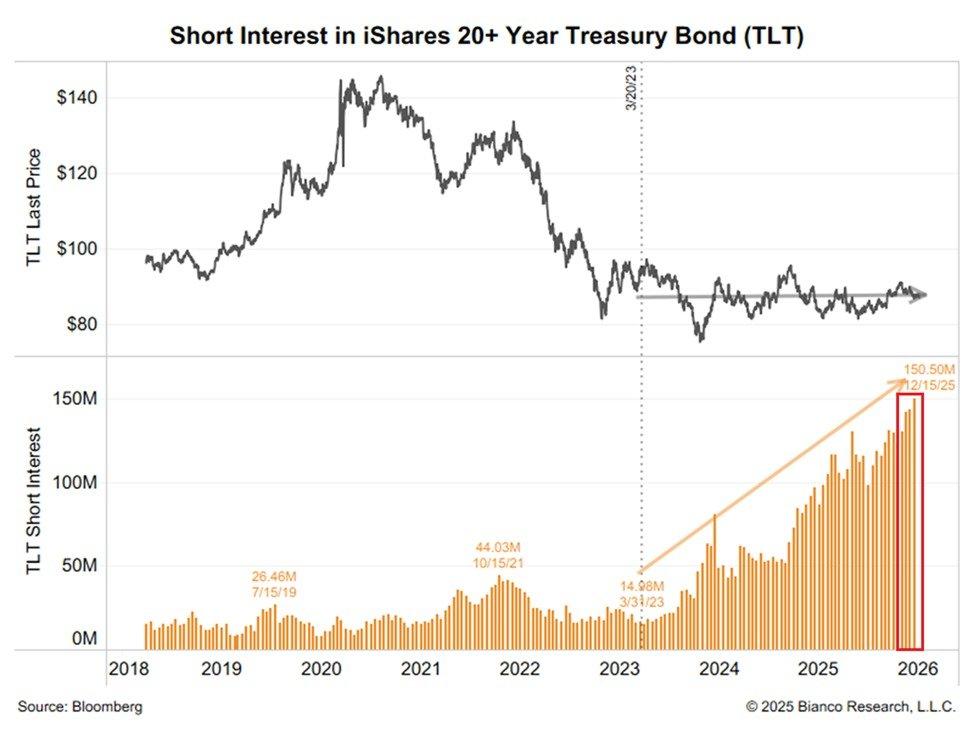

Liquidity Warning: SOFR Raises The Red Flag

In our Daily Commentary from October 9th, we alerted readers to the fact that the Fed’s Overnight Repurchase Program was warning that the financial system was running out of a reliable store of excess liquidity. While not a concern, as we share in our quote below, it was worth monitoring. Said differently, after years of …

Read More »

Read More »

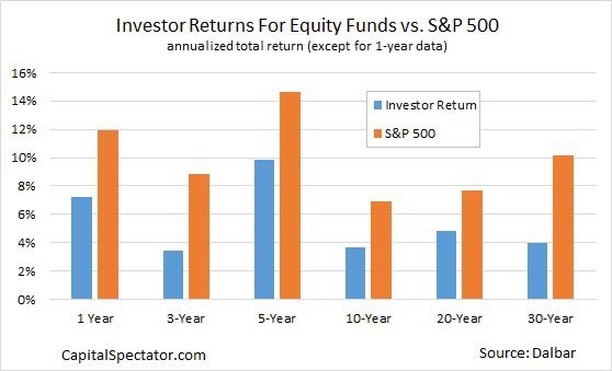

The Psychology Of Investing In A Zero-Risk Illusion

Every market cycle eventually changes investor psychology to believe risk has been conquered. The storylines may change, from “this time it’s different” to “the Fed has our back,” but the psychology does not. When markets rise steadily and volatility remains low, investors confuse stability with safety. That’s precisely the illusion forming in markets today. The …

Read More »

Read More »

10-16-25 Guidance, Buybacks, & The Case For a Year-End Rally

Near-term tape will be choppy and guidance-sensitive, especially for AI / Mag 7 stocks.

In this short video, Lance Roberts discusses how massive buybacks and year-end seasonality could still lift markets higher despite short-term volatility.

Watch the full episode:

Catch Lance Roberts daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-16-25 Capitalism: The Real Path to Wealth & Happiness

What makes capitalism the most successful wealth-building system in history?

Lance Roberts & Michael Lebowitz explore how economic freedom, private ownership, and innovation incentives have lifted billions out of poverty and created unmatched prosperity.

Why do societies that embrace free markets and entrepreneurship tend to enjoy higher standards of living, longer lifespans, and greater personal happiness? Lance & Michael examine the...

Read More »

Read More »

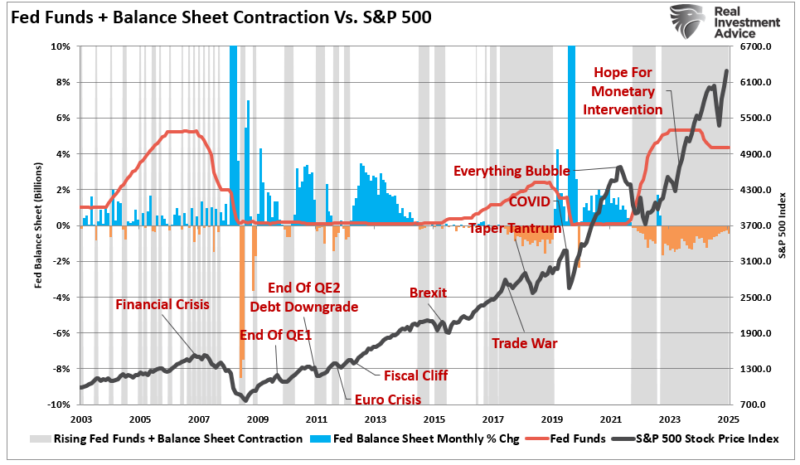

Is QT On Its Last Lap?

Chairman Powell spoke on Tuesday, addressing several topics. Of note was the following quote: "We may be approaching the end of our balance sheet contraction in the coming months." The market interpretation is that QT is ending soon. As a reminder, QT, also known as quantitative tightening, has been in effect for over three years. … Continue reading...

Read More »

Read More »

10-15-25 The Fed’s Quiet Pivot: Ending QT Is Bullish for Risk Assets

The Fed just made a quietly bullish move. In this short video, I explain how ending quantitative tightening and stabilizing its balance sheet adds liquidity, supports Treasuries, and sets up a stronger backdrop for risk assets.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-15-25 Is the Fed Poised to Pause Quantitative Tightening?

Federal Reserve Chair Jerome Powell just hinted that the Fed may soon pause its balance-sheet runoff — a potential shift that could reshape market liquidity and investor sentiment.

Lance Roberts breaks down:

* Why the Fed may pause QT — and what it signals about financial conditions.

* How ending balance-sheet runoff affects liquidity, yields, and asset prices.

* What history tells us about QT pauses and subsequent market rallies.

* Why the Fed’s...

Read More »

Read More »

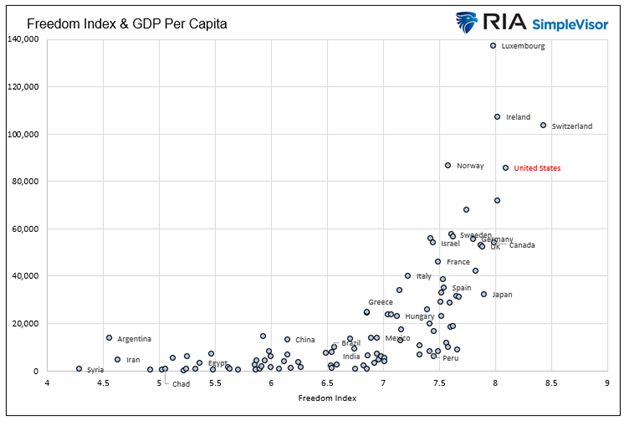

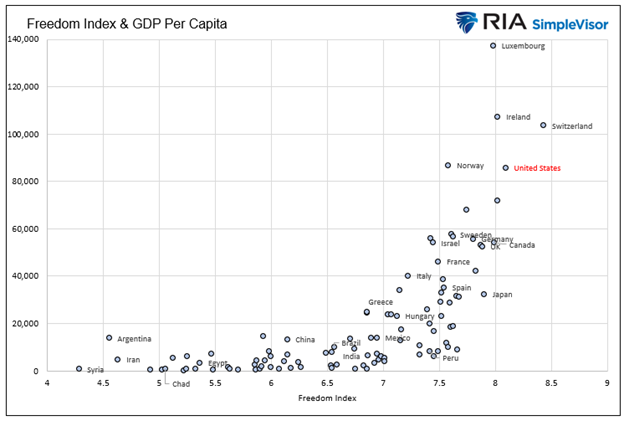

Capitalism: The Road To Wealth And Happiness

The graph below presents another opportunity to revisit how capitalism and the economic freedom it entails lead to prosperity. The scatter plot below shows the intersection of The Fraser Institute’s Economic Freedom Index with per capita GDP for 102 of the largest economies. Before analyzing the graph and what it implies for capitalism, let's gain …

Read More »

Read More »

Dollar Correlation: Implications For Foreign Stock Indexes

On Tuesday morning, Bloomberg featured an article entitled The Great Debasement Is Rippling Across Markets. From the start of the year until its low in the middle of September, the US dollar index fell by nearly 15%. The weak dollar seems to fuel the debasement narrative, benefiting a few asset classes. The most obvious assets …

Read More »

Read More »

10-14-25 If The Market Fails Here, A 3-7% Pullback Comes Next

$SPX is standing at a critical inflection point.

In this Short video, I explain why failing to reclaim the 20-day moving average could trigger a 3–7% pullback toward key support levels — and why now’s a good time to take some profits and manage your risk.

Full episode: https://www.youtube.com/live/2hiFV4mdSY4?si=OGnPf2U2xFVcmMgy

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-14-25 Annuities: Good, Bad, & Ugly

Are annuities the safe retirement solution they’re sold as — or a financial trap in disguise?

Lance Roberts & Jonathan Penn unpack the good, the bad, and the ugly sides of annuities.

10:03 - Kitchen Sets & Intramural Flag Football

14:52 - Annuities - Good, Bad, & Ugly

18:08 - What is an Annuity?

20:16 - Different Flavors of Annuities

22:07 - The Ugly Truth About Early Surrender Fees

27:29 - Why Might You Need an Annuity?

31:20 -...

Read More »

Read More »

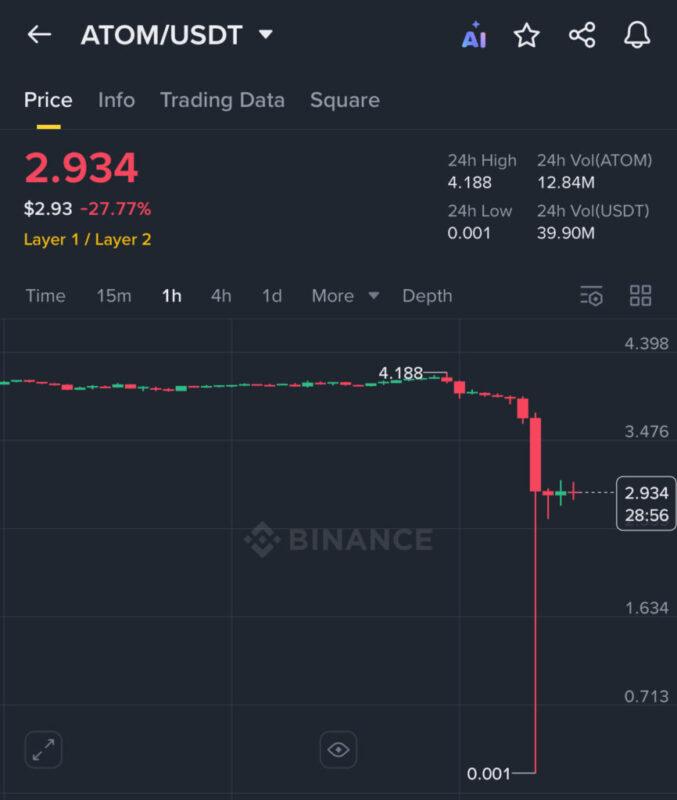

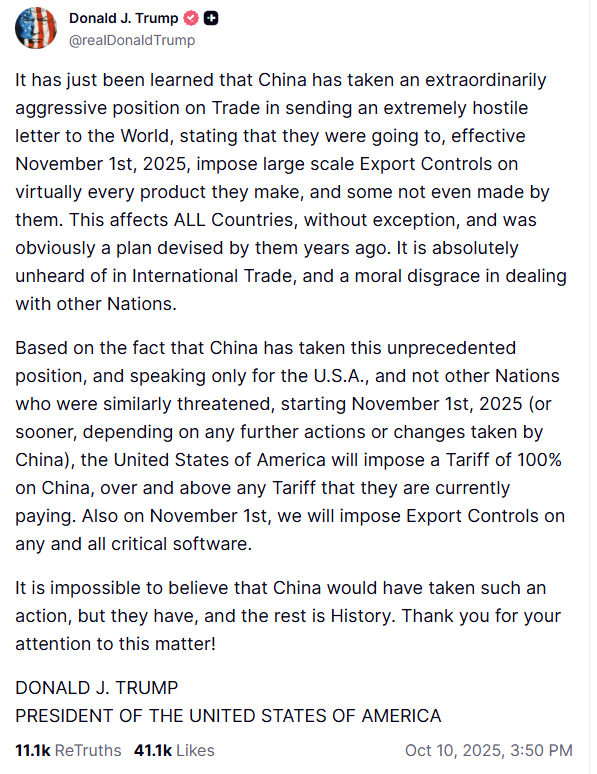

The AltCoin Liquidity Bloodbath

Last Friday, the cryptocurrency market experienced a violent crash. The trigger was President Trump's announcement of a 100% additional tariff on Chinese imports. The sudden and unexpected action reignited fears of a full-blown trade war. Global risk assets fell sharply. Of these, the most notable declines occurred in the cryptocurrency markets, particularly the altcoin market. …

Read More »

Read More »

10-13-25 Bitcoin vs Stablecoins: What Central Banks Actually Want

Bitcoin will never become a true reserve asset for central banks.

In this Short video, @dlacalle_IA and I discuss why its volatility and illiquidity make it unsuitable—and why stablecoins backed by Treasuries could be the more practical alternative.

$IBIT $CRCL $USDC

Watch the full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

ChatGPT Gives Financial Advice On Volatile Markets

Following Friday's selloff amid the resurgence of tariff threats on China, I asked ChatGPT a simple question: " How to Stay Calm In The Stock Market?" That simple question generated an engaging and humorous take on financial advice for navigating volatile markets. In this week's post, I thought it would be helpful to review ChatGPT's advice …

Read More »

Read More »

First Brands: Canary In The Rehypothecation Coal Mine?

The First Brands Group, manufacturer of auto parts, including Raybestos brakes and FRAM, filed for bankruptcy on September 29th. This bankruptcy is troubling in two ways. First, per the ZeroHedge chart below, the price of First Brands loans fell by 80% in a day. In other words, the loan market had no clue of financial …

Read More »

Read More »

Market Crack Or Beginning Of Something Bigger

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »