Category Archive: 9a.) Real Investment Advice

Financial Nihilism & The Trap Young Investors Are Walking Into

The article from the Wall Street Journal titled “Why My Generation Is Turning to Financial Nihilism” by Kyla Scanlon argues that Gen Z is embracing high-risk financial behavior out of despair and detachment. Of course, it is essential to recognize that Kyla, although well-intentioned, is a young twenty-something influencer with limited real-life experience, and sees …

Read More »

Read More »

Century Bonds: A Long Term Bet On Google

Google's parent, Alphabet, just issued $32 billion in global debt, including £1 billion of rare century bonds. Alphabet's century bonds are called such because they do not mature for 100 years (2126). While the century bond is a small piece of its recent debt offering and even less of its outstanding debt ($78 billion), the … Continue...

Read More »

Read More »

The ECB Unexpectedly Raises Rates But Pauses

"Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to target." And with that statement, the European Central Bank (ECB) appears to have halted its rate hiking cycle. …

Read More »

Read More »

Understanding Different Types of Investment Vehicles: Stocks, Bonds, and Mutual Funds

Exploring Investment Vehicles: An Overview Navigating the Investment Landscape Investing wisely requires a thorough understanding of various investment vehicles. Delve into the essentials of stocks, bonds, and mutual funds to make informed choices that align with your financial goals. The Role of Investment Vehicles Investment vehicles serve as the channels through which individuals can invest …

Read More »

Read More »

The Pros and Cons of High-Yield Bonds

Understanding High-Yield Bonds: An Overview Defining High-Yield Bonds High-yield bonds, also known as junk bonds, are debt securities issued by companies with lower credit ratings. These bonds offer higher interest rates compared to investment-grade bonds, but they come with their own set of benefits and risks. The Role of High-Yield Bonds High-yield bonds can play …

Read More »

Read More »

How to Avoid Common Bond Investing Mistakes

Navigating the World of Bond Investing: A Comprehensive Guide The Importance of Informed Bond Investing Bond investing can be lucrative, but avoiding mistakes is crucial for maximizing returns and minimizing risks. Learn about the common pitfalls and how to steer clear of them. The Role of Bonds in Investment Portfolios Bonds offer stability and income, …

Read More »

Read More »

The Pros and Cons of Investing in Gold and Other Precious Metals

Understanding Gold and Precious Metal Investments Exploring the Appeal of Precious Metals Investing in gold and other precious metals has long been regarded to preserve wealth and hedge against economic uncertainties. Discover the potential benefits and drawbacks of including these commodities in your investment strategy. The Role of Precious Metals in Diversification Adding precious metals …

Read More »

Read More »

How to Buy Commodity ETFs: A Guide for Investors

Understanding Commodity ETFs: What You Need to Know Exploring the World of Commodity ETFs Commodity Exchange-Traded Funds (ETFs) offer investors exposure to a diverse range of commodities, such as precious metals, energy resources, agricultural products, and more. Learn how to navigate this investment option and incorporate it into your portfolio. Benefits of Investing in Commodity …

Read More »

Read More »

The Different Types of Commodity Investments and Their Characteristics

An Introduction to Commodity Investments Understanding Commodity Investments Commodity investments involve putting money into raw materials or primary agricultural products that are typically traded on commodity markets. These investments offer exposure to the fluctuations in commodity prices, making them a unique and potentially rewarding addition to investment portfolios. Why Invest in Commodities? Commodities serve as …

Read More »

Read More »

BLS Labor Report Defies Consensus

The delayed BLS employment report came in well above expectations, showing the economy added 130k jobs in January. Furthermore, the unemployment rate slipped to 4.3% versus expectations of a 0.1% increase to 4.5%. The more encompassing U6 unemployment rate fell from 8.4% to 8.0%. The BLS labor report contradicts the monthly and weekly ADP reports, …

Read More »

Read More »

2-11-26 Q&A Wednesday: You Ask ’em, We’ll Answer

It’s Q&A Wednesday—you bring the questions, we bring the answers.

Lance Roberts & Danny Ratliff tackle what’s on your mind right now: market volatility, Fed policy, inflation and rates, earnings, portfolio risk management, and what to do (and not do) when headlines get loud.

Lance & Danny break down the why behind the market’s moves, translate the macro data into what it means for portfolios, and walk through practical, process-driven...

Read More »

Read More »

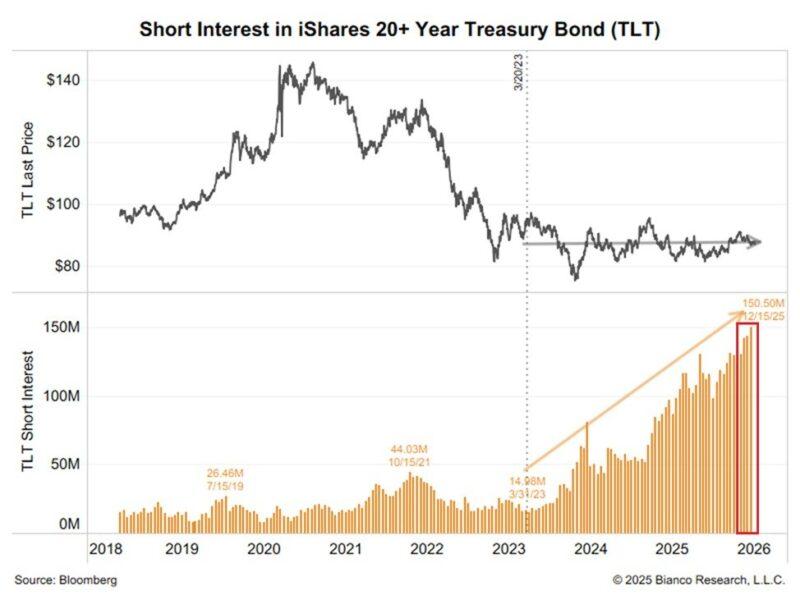

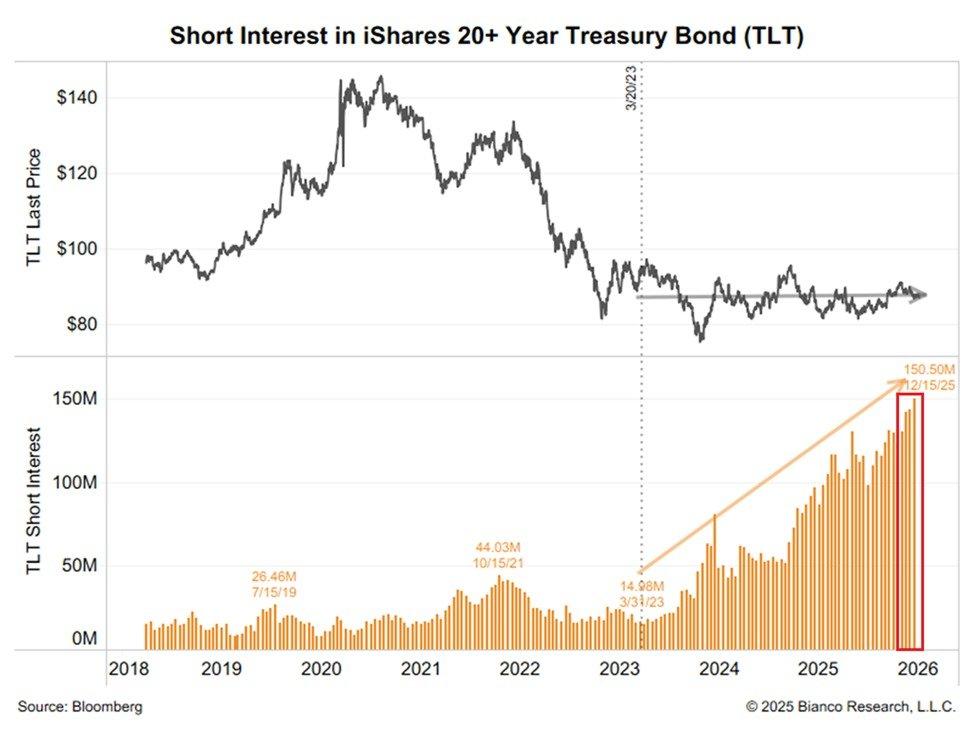

Bond Yields May Plummet: Five Potential Catalysts

The top graph below, courtesy of Bloomberg, shows that the price of TLT, the 20+ year Treasury bond ETF, has been drifting sideways for the last couple of years. Often, when a security trades in a tight range over an extended period, as we see with bonds currently, a breakout from the range can be … Continue...

Read More »

Read More »

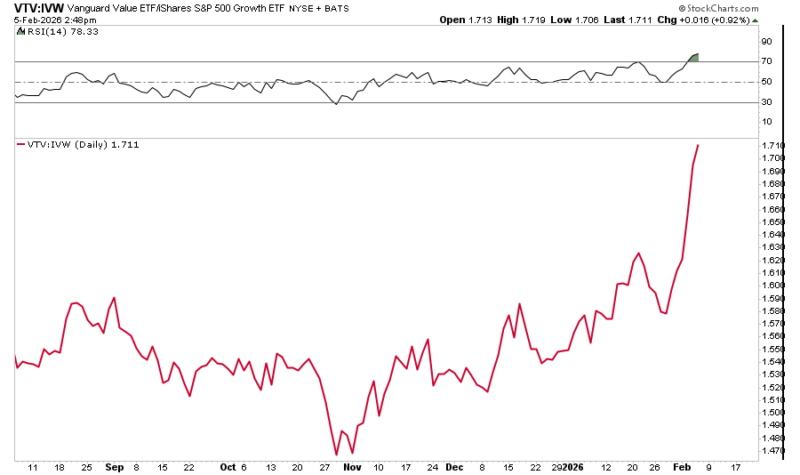

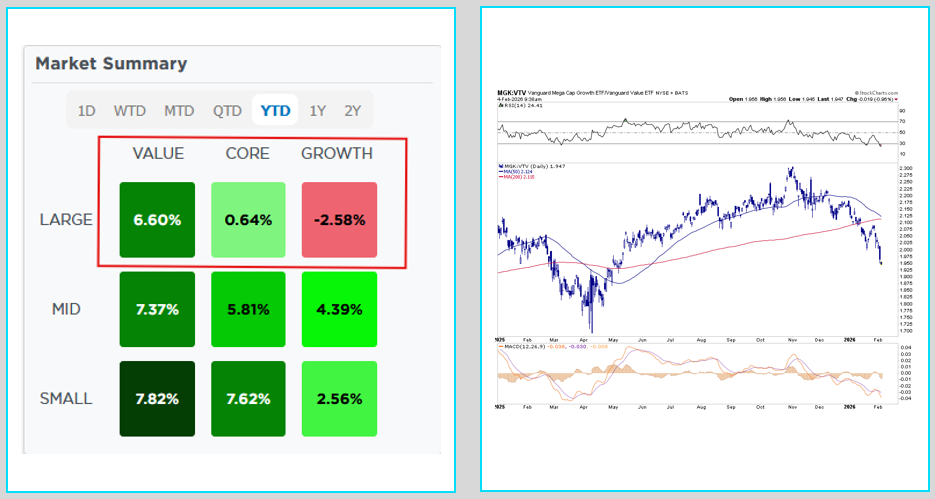

The Value Rotation Illusion

“Value is back in vogue”, the media claim. Investors are rushing out of the high-flying mega-cap tech stocks and into the boring staples, utilities, and healthcare stocks. Given the huge outperformance of value stocks versus growth stocks, it appears investors are going all in on the value rotation. What some of these investors don’t know …

Read More »

Read More »

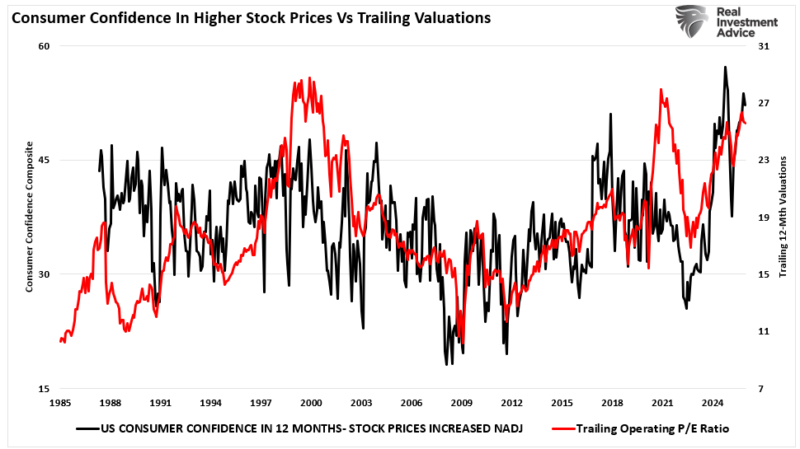

2-10-26 Opportunities Emerge at Maximum Fear, Not Peak Optimism

Markets swing between hype and panic, and investors often get trapped by both.

When prices rise, narratives justify overpaying; when prices collapse, fear convinces people assets are going to zero.

In reality, markets rarely move in extremes forever.

The best opportunities tend to appear when fear is highest, not when optimism is loudest, which is why disciplined, fundamentals-focused investors look for value during selloffs rather than...

Read More »

Read More »

2-10-26 Duct Tape & WD-40 Your Portfolio Together

Markets rallied back into positive territory today, but the real risk-management lesson isn’t the chart—it’s behavior. Lance Roberts & Jon Penn unpack the “WD-40 & Duct Tape” framework: WD-40 reduces emotional friction when headlines and volatility try to lock up decision-making, and duct tape is the discipline that keeps your portfolio plan intact (allocation, diversification, rebalancing rules, time horizon, liquidity).

We also hit...

Read More »

Read More »

Sanae Takaichi And The Yen Carry Trade

In a blog last week titled Japan Is Normalizing: Risks To The Yen Carry Trade, we discussed Japan's path to economic normalization and how it might affect a great source of global liquidity, the yen carry trade. A week after publishing the article, Japan had a stunning election. As a result, its new Prime Minister, … Continue...

Read More »

Read More »

Rallies Can Be Exit Traps After Selloffs

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More....

Read More »

Read More »

2-9-26 Technology Stocks: Dead… or the Next Opportunity?

Technology stocks started February on the back foot as volatility spiked and leveraged trades unwound across markets—crypto first, then metals, then equities. The key question: is this a real breakdown in tech leadership, or a mechanical liquidation that’s creating selective opportunity?

0:00 - INTRO

0:19 - Superbowl Recap & Looking for BLS & CPI

4:41 - More Trapped Longs & Volatility to Come

10:38 - Market Volatility May not Be Over...

Read More »

Read More »

Software Or Staples?

As we wrote in yesterday's Commentary, efficiently rotating between overbought and oversold sectors, factors, or stocks is a well-established method for outperforming markets. Like any strategy, the hard part is timing, or properly estimating when a pair of sectors, factors, or stocks is about to reverse their respective trends. Currently, there is a massive divergence …

Read More »

Read More »

Speculative Narrative Unwinds

For nearly two years, markets were driven by the same speculative narrative that "this time is different.” Bitcoin, precious metals, and AI-linked equities rose not only because of robust fundamentals, but also because investors clung to powerful narratives about inflation, disruption, and monetary collapse. Those speculative narratives are not only seductive but also contribute to …

Read More »

Read More »