Category Archive: 9a.) Real Investment Advice

1-20-26 Tariff Headlines = Another Buying Opportunity?

Tariff headlines over Greenland are creating noise, not new risk.

In this Short video, Lance Roberts explains why past tariff threats didn’t derail earnings or inflation, why this pullback looks normal, and how markets often turn headline panic into buying opportunities.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-20-26 Is a House Still a Good Investment in 2026?

Is buying a house still a good investment—or has the market pulled too much future return forward? Lance Roberts & Jonathan Penn break down the housing investment debate through a time-horizon lens, comparing housing to stocks, examining historical “win rates,” and explaining why transaction costs, leverage, and holding period matter far more in real estate than most buyers realize.

0:00 INTRO

0:19 - Moving into the Heart of Earnings Season...

Read More »

Read More »

The Money Supply Myth: Context Matters

Supporting the dollar-debasement narrative is the claim that money supply growth is out of control. For instance, we saw a post claiming “US money creation is happening at an alarming pace.” Specifically, he says the money supply increased by $1.65 trillion in 2025. Quoting the money supply, as he does, in absolute dollar terms is …

Read More »

Read More »

1-19-26 The Illusion of Economic Acceleration: What’s Really Driving Markets

The economic acceleration story doesn’t hold up when you look at the data.

In this Short video, Michael Green and I discuss why GDP trends look unchanged, earnings quality is weakening, small-cap profits are negative, and passive flows—not growth—are driving markets.

📺Full episode: -GazpbG0

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-17-26 Why Position Size Matters More Than Stock Picks

Position sizing, not stock picking, is what determines long-term investing success.

In this Short video, Lance Roberts explains why oversized positions create hidden risk, how greed compounds losses, and why managing exposure is essential for compounding wealth over time.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Rotation Continues As Markets Remain Bullish

Sector rotation is this weekend's 2026 Investment Summit. I am presenting at the conference as you are reading this. However, I would be remiss not to share a brief market update as we head into next week. The full newsletter will return next week. That said, U.S. equity markets delivered mixed performance last week. Major …

Read More »

Read More »

1-16-26 Why Silver Might Be the Next Micro-Bubble

$SLV recent surge looks more like a narrative-fueled micro-bubble than a durable macro trend.

In this Short video, Michael Lebowitz and I discuss why key cross-asset signals fail to confirm dollar debasement and what that means for #silver risk ahead.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-16-26 Social Security Reform: Expansion or Cuts?

Congress is debating major changes to Social Security—and the outcome could mean benefit expansion or future cuts. With trust fund shortfalls projected by 2033, lawmakers have introduced a wave of bills aimed at increasing benefits, changing cost-of-living calculations, and redefining how and when Americans claim Social Security.

Richard Rosso breaks down the key Social Security reform proposals currently circulating in Congress, what they would...

Read More »

Read More »

A Weak Yen, The BOJ, And The Carry Trade

Bank of Japan (BOJ) officials are increasingly discussing the weak yen as a source of inflation. Their concern is that prolonged yen weakness raises import costs and encourages businesses to pass those costs on to consumers. Bear in mind that […] The post A Weak Yen, The BOJ, And The Carry Trade appeared first on … Continue reading...

Read More »

Read More »

AI Productivity, Employment and UBI

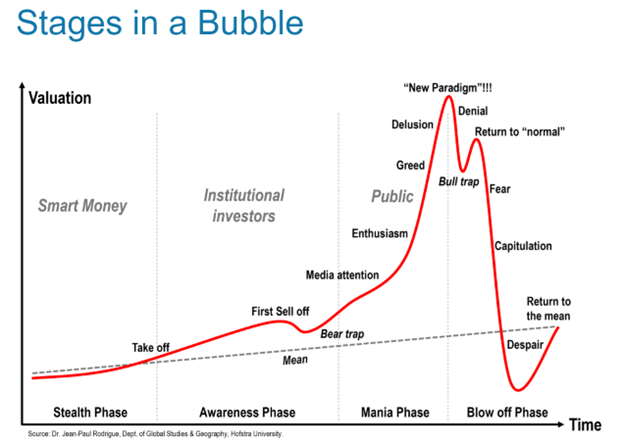

A funny thing about bull markets is that investors develop a very short memory about the previous bear market. Such is why cycles repeat throughout history as lessons must be learned and relearned. The post AI Productivity, Employment and UBI appeared first on RIA.

Read More »

Read More »

1-19-26 The Metric that Matters – The Michael Green Interview

What really matters for markets in 2026—and why are most forecasts focused on the wrong metrics?

Lance Roberts visits with Simplify Portfolio Manager & Chief Investment Strategist, Michael Green, CFA, to examine the structural changes inside today’s markets that are reshaping price discovery, volatility, and risk. From the rise of passive investing and ETF dominance to the growing disconnect between fundamentals and flows, the mechanics of how...

Read More »

Read More »

1-15-26 Why Growth-Driven Inflation Threatens the Rate-Cut Thesis

Markets may be mispricing the Fed by betting too aggressively on rate cuts in 2026.

In this Short video, Michael Lebowitz and I discuss why growth-driven inflation could return and derail the rate-cut thesis that’s fueling the current rally.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-15-26 Silver’s Surge: Bubble or Fundamentals?

Can we classify Silver as a microbubble?

Lance Roberts & Michael Lebowitz take a disciplined, valuation-driven look at silver through the lens of post-2020 micro-bubble cycles.

#SilverMarket #PreciousMetals #MarketBubbles #InvestorRisk #MacroInvesting

Read More »

Read More »

Luxury Slump Bankrupts Saks Fifth Avenue

“With the debt payment looming, time ran out.” That succinct summary ended a Wall Street Journal article titled: Saks Global Files for Bankruptcy, Undone by Debt and a Luxury Slump. A year ago, Saks Fifth Avenue’s parent company purchased its […] The post Luxury Slump Bankrupts Saks Fifth Avenue appeared first on RIA.

Read More »

Read More »

1-14-26 Why “Just Hold Forever” Isn’t a Good Strategy

The market isn’t about to crash, but it is pressing against a rare, long-term resistance zone at historically high valuations. That raises the risk of lower future returns and periodic corrections.

In this Short video, Lance Roberts discussed why ignoring valuation and mean reversion can leave long-term investors short of their goals.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-14-26 Q & A Wednesday – Your Money & Market Questions Answered

Lance Roberts & Danny Ratliff take your real-time questions directly from our YouTube live chat window, and break down today’s most important money, market, investing, and retirement topics.

0:00 - INTRO

0:19 - Big Banks' Earnings & Trading Revenue

4:00 - Markets Decline off All-time Highs

9:05 - Fun with Charts - Understanding Market Dynamics

16:17 - Contributing to Roth in Retirement?

20:27 - SimpleVisor Alerts

21:10 - Determining...

Read More »

Read More »

The Silver Surge: Micro Bubble Or Reasonable Valuation?

Silver has been on a tear, rising fourfold in the last few years. The price is driven by the narrative of dollar debasement. Furthermore, there are indications that limited supply, along with growing industrial demand for silver, warrants higher prices. As we have stated in recent articles (Debasement, What It Is And Isn’t & Dollar …

Read More »

Read More »

Transportation Stocks Are At Odds With Truck Sales

Yesterday’s Commentary noted the recent strength in transportation stocks. For example, the transportation ETF (XTN) has outperformed the S&P 500 by more than 9% over the last 25 trading days. The leading stocks within the ETF over this period include. ARCB (trucking), MATX (shipping), WERN (freight shipping), and FedEx (shipping). Some of the recent gains …

Read More »

Read More »

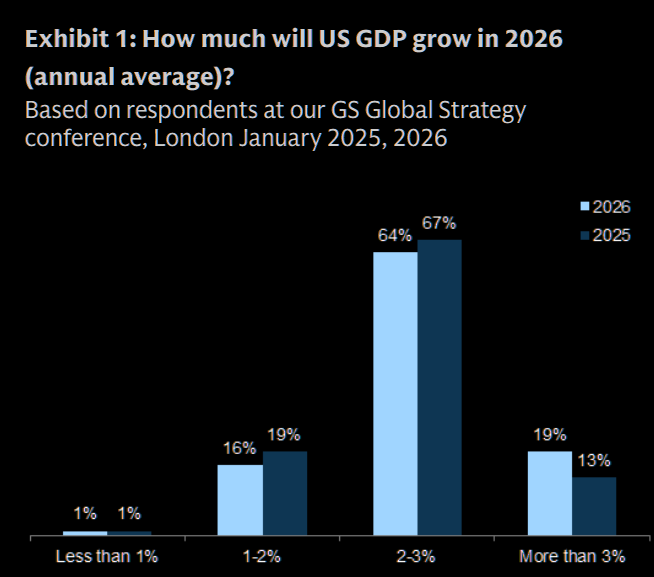

1-13-26 The Reflation Trade Explained

Markets are priced for a perfect reflation outcome after three years of big gains. Everyone expects strong growth, falling inflation, and rate cuts at the same time.

In this Short video, Lance Roberts argues why these expectations may be setting investors up for disappointment.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-13-26 The Economic Reflation Narrative Is Back

The economic reflation narrative is back—but is it durable or just another market storyline driven by optimism and liquidity?

Lance Roberts explains what investors mean by “economic reflation,” why markets are once again pricing in stronger growth, and which data points are reinforcing the bullish case. We examine the role of monetary policy shifts, fiscal spending, labor market dynamics, and commodity trends that are supporting expectations for...

Read More »

Read More »