Category Archive: 9a.) Real Investment Advice

Why Is Gold Surging?

Record deficit spending, soaring money supply, and inflation are among the likely responses we would hear from investors to the question of why gold is surging. Instead of presuming those or other market narratives about gold prices are correct, let’s analyze historical correlations between gold and economic and market data.

In addition to helping you better appreciate why gold is surging, our analysis will help you recognize that market...

Read More »

Read More »

Achieving 6% Returns with Simple Portfolio Math and Easy Gains

Learn how to strategically build a portfolio for success! ?? #InvestingTips #FinancialFreedom #EasyMath

Watch the entire show here: https://cstu.io/2f49c9

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Residential Construction Jobs At Risk

The number of residential construction workers has almost doubled since the aftermath of the financial crisis and housing bust. The graph below on the left shows that after a brief hiccup during the early days of the pandemic, the number of jobs in residential construction continued to rise despite higher interest rates. Moreover, the job …

Read More »

Read More »

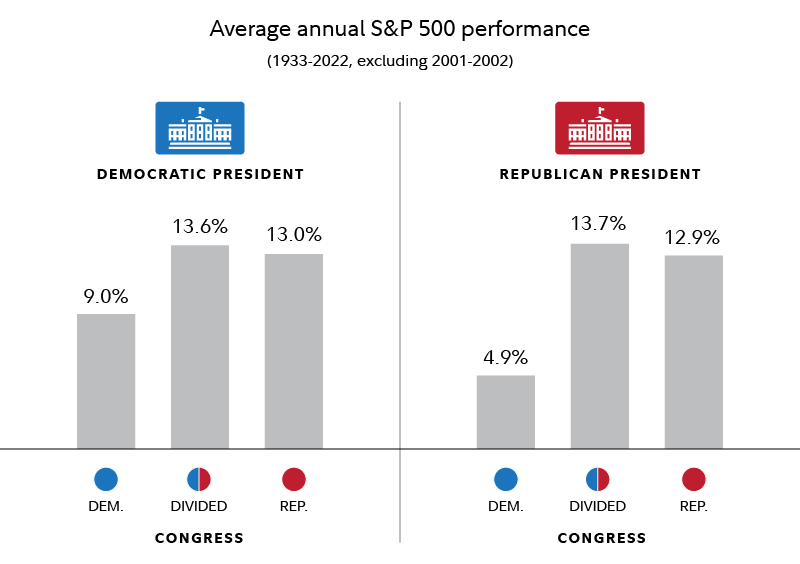

Election Day! Plan For Volatility

With Election Day finally here, markets are bracing for potential volatility. History shows that the stock market can react unpredictably to election outcomes, especially when the results are unclear or contested. In past elections, sudden policy shifts, political uncertainty, or contentious outcomes caused heightened volatility—making it essential to prepare your portfolio now to weather whatever …

Read More »

Read More »

11-5-24 Election Day! Plan For Volatility

Will the 2025 Election be The Most Important Election Ever? Yes...until 2028. Vote for the policy, not the personality: Child Care Credits case study. Markest are hangin' on ahead of the election, setting up for a post-election rally.Bond yields are the result of pre-election positioning; bond auction is next week. It's hard to buy when it's unpopular. Why are Small Caps having a hard time: They're not growing earnings. Most sensitive to difficult...

Read More »

Read More »

Election Day! Plan For Volatility

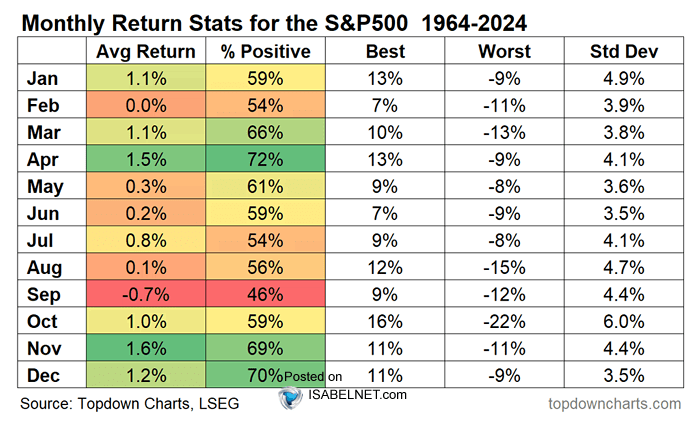

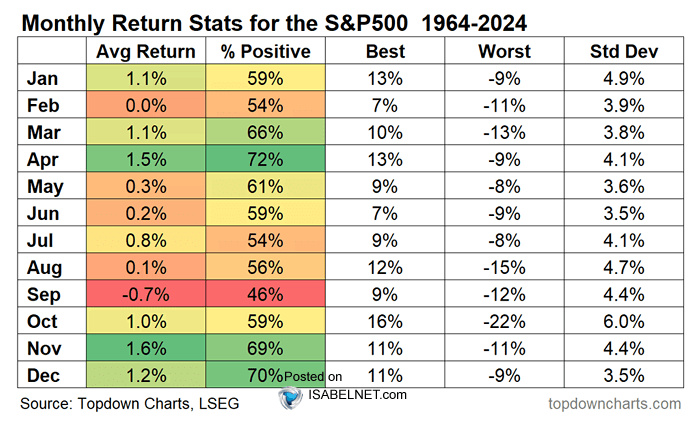

With Election Day finally here, markets are bracing for potential volatility. History shows that the stock market can react unpredictably to election outcomes, especially when the results are unclear or contested. In past elections, sudden policy shifts, political uncertainty, or contentious outcomes caused heightened volatility—making it essential to prepare your portfolio now to weather whatever the day brings.

The S&P 500 has averaged a...

Read More »

Read More »

Assessing Investment Risks: How to Protect Your Money When Things Go Wrong

?? Don't speed through investments! Just like driving fast, taking too much risk can lead to trouble. Remember, it's about minimizing losses! #InvestWisely ?

Watch the entire show here: https://cstu.io/d6282c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

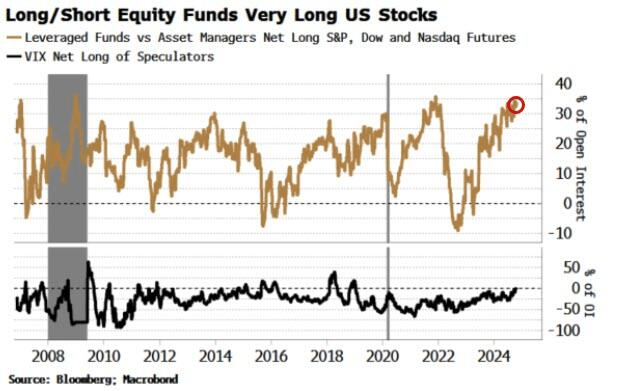

Market Polls To Help Handicap The Election

With election eve upon us, we thought it would be helpful to share market based presidential election polls along with Greg Valliere's final thoughts. The graph on the top left shows the price of Trump Media & Technology Group (DJT), which runs Truth Social Media. Truth will be a clear beneficiary if Trump wins and …

Read More »

Read More »

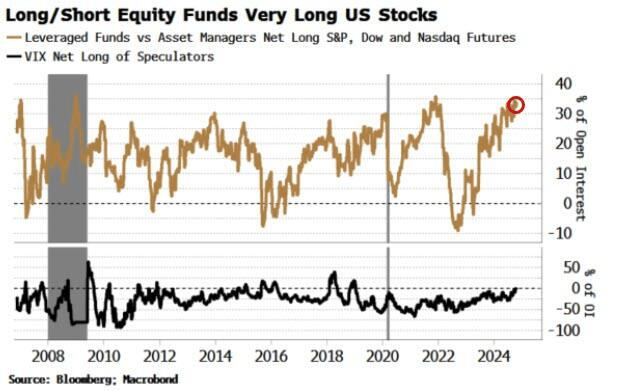

11-4-24 The Presidential Election Cometh

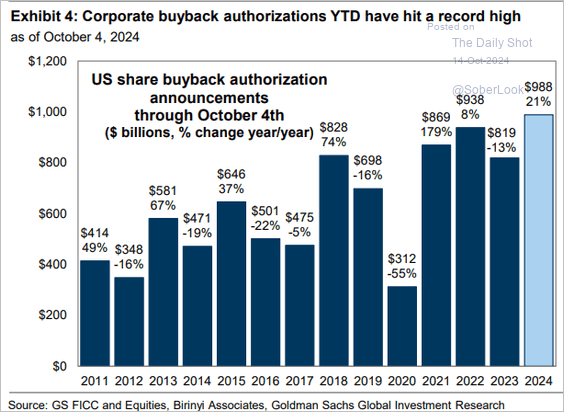

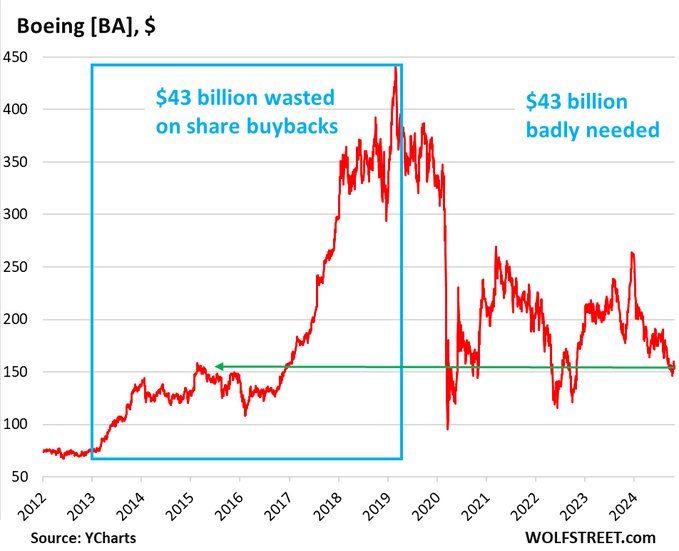

It's 2024 Election-eve: Hedge funds are long on a presumed outcome; watch for a pick up in volatility. The Fed meets on the day after the election; there are still about 100 S&P Companies left to report. Reference Lance's weekend article on buy backs, Wolf in Sheep's Clothing: Apple spent $100-B on stock buy backs, when they could have purchased Intel for $99-B and produced their own chips. But, no. investors should do nothing on this day...

Read More »

Read More »

Why Investors Are Overpaying for Assets in Today’s Market

Are we overpaying for assets? ?? Investors, beware! With the current market trends, we might be paying more than it's worth. #InvestingTips

Watch the entire show here: https://cstu.io/019b45

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Market as a Living Organism

Ever thought of the market as a living organism of a million minds? ?? Trading futures, stocks, options - it's all just a big bet that moves prices! #finance #trading

Watch the entire show here: https://cstu.io/201d33

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

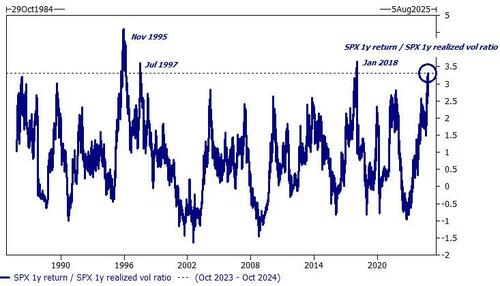

The Presidential Election Cometh

Inside This Week's Bull Bear Report One The Greatest Risk-Adjusted Returns...Ever Last week, we discussed the break of the rising wedge pattern. "Unsurprisingly, the market stumbled a bit this past week, breaking the "rising wedge" pattern to the downside. However, the market continues to find buyers at the 20-DMA as portfolio managers are unwilling to …

Read More »

Read More »

Understanding Moving Averages: Momentum Clues in Market Trends

? Understanding moving averages is key to gauging market momentum! Watch to learn more! #stockmarket #tradingtips #investing ?

Watch the entire show here: https://cstu.io/d5add4

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

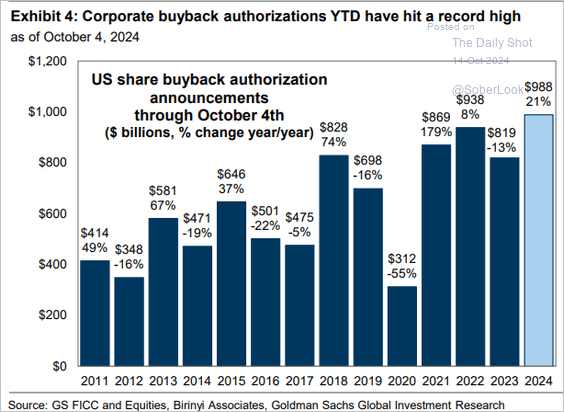

Corporate Buybacks: A Wolf In Sheep’s Clothing

Corporate buybacks have become a hot topic, drawing criticism from regulators and policymakers. In recent years, Washington, D.C., has considered proposals to tax or limit them. Historically, buybacks were banned as a form of market manipulation, but in 1982, the SEC legalized open-market repurchases through Rule 10b-18. Although intended to offer companies flexibility in managing …

Read More »

Read More »

PCE Price Index Is Back Into The Pre-Pandemic Range

It's too early for the Fed to claim the infamous "mission accomplished" for inflation. However, yesterday's PCE price index is now within the Fed's mission accomplished range. The PCE price gauge rose 0.2% monthly and 2.1% year over year. That yearly rate is down 0.2% from last month and 0.6% over the previous six months. …

Read More »

Read More »

11-1-24 Ten Money Smart Things To Do Before Year’s End

2024 isn’t over yet. So here are 10 smart money moves to make right now.

Saving money should be a year-round endeavor, but life gets in the way just like anything else. So with 2024 coming to a swift, thankful end, take advantage of the fourth quarter to accelerate your financial acumen, bolster your balance sheet and successfully springboard into the new year. Danny and Matt share year-end financial planning tips , smart money moves, and...

Read More »

Read More »

Corporate Buybacks: A Wolf In Sheep’s Clothing

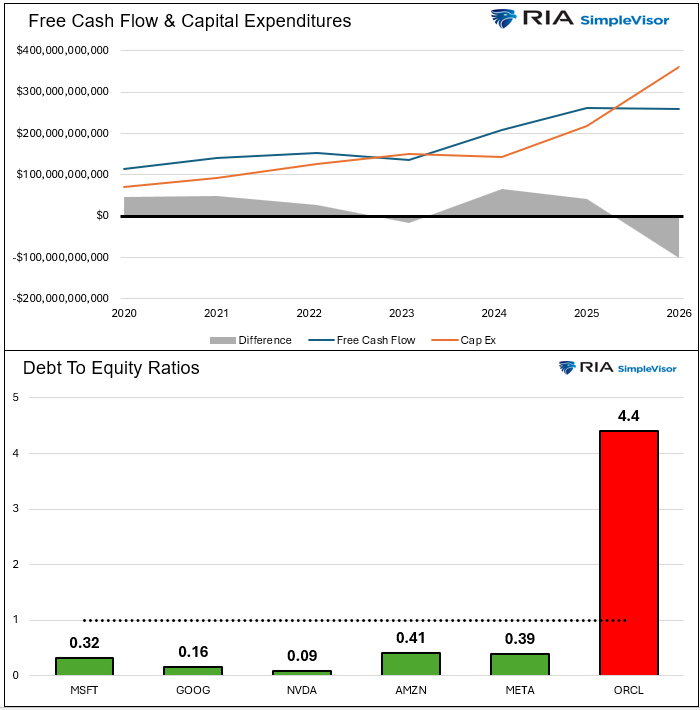

Corporate buybacks have become a hot topic, drawing criticism from regulators and policymakers. In recent years, Washington, D.C., has considered proposals to tax or limit them. Historically, buybacks were banned as a form of market manipulation, but in 1982, the SEC legalized open-market repurchases through Rule 10b-18. Although intended to offer companies flexibility in managing capital, buybacks have evolved into tools often serving executive...

Read More »

Read More »

Living Trusts vs. Testamentary Trusts: Essential Information for Managing Assets

?? Ensure your assets are titled correctly in your living trust! Learn about pour over wills and testamentary trusts for a secure financial future. #EstatePlanning #FinancialTips

Watch the entire show here: https://cstu.io/49bf64

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

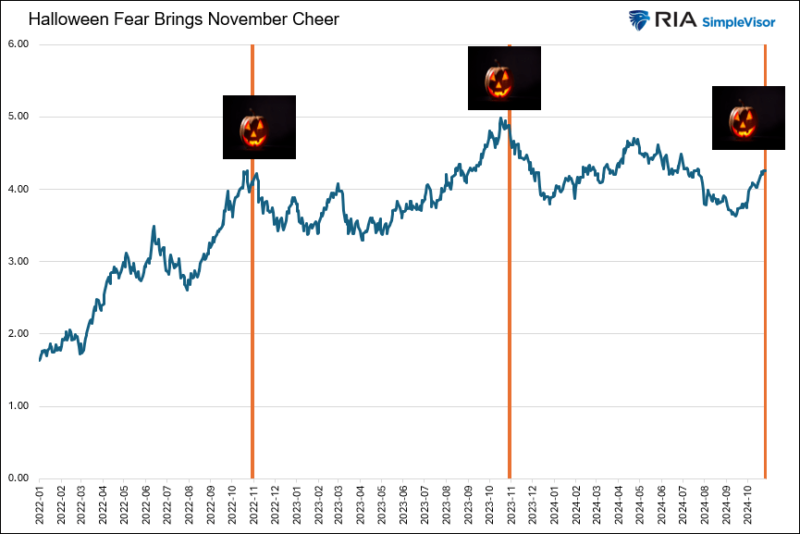

Will Halloween Fear Bring November Cheer For Bondholders?

The last two Halloweens capped off a few frightful months for bondholders. However, as we share below, 10-year bond yields reversed course on Halloween in 2022 and 2023. Will 2024’s harrowing October for bondholders end with Halloween's ghosts and goblins? Accordingly, will November be better for bonds as it has been for the last two …

Read More »

Read More »

10-31-24 Fact-checking Paul Tudor Jones and Stanley Druckenmiller

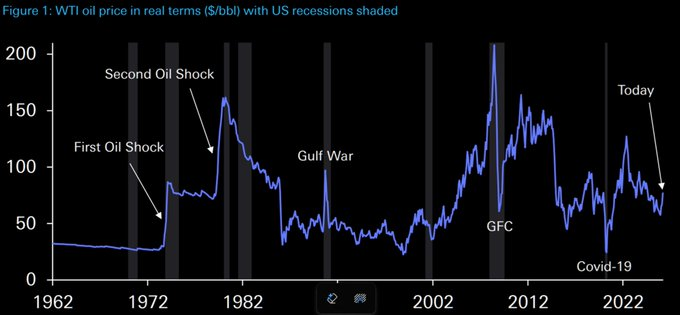

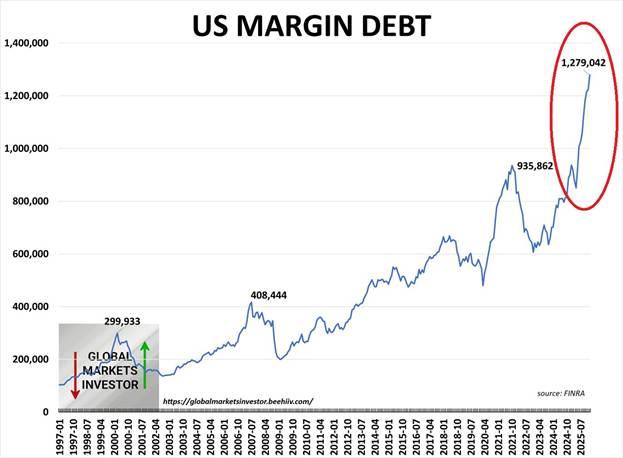

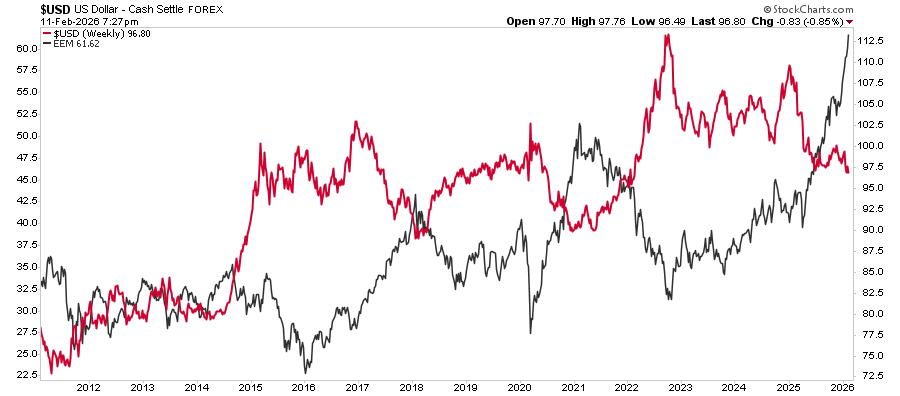

Earnings Season continues as October ends: Microsoft and Meta reports reveal lowered expectations for 2025; Microstrategy is raising stakes on Bitcoin w $42-B buy: Will prove to be either brilliant or disastrous (only 6% of Bitcoin owners are active users); Apple & Amazon results will reveal more about consumer spending. Can famed investors Paul Tudor Jones and Stan Druckenmiller, who recently proclaimed they are short bonds, thus betting on...

Read More »

Read More »