Category Archive: 9a.) Real Investment Advice

Why You Need a Financial Advisor

RIA Advisors' Chief Investment Strategist recounts how you can tell you need a financial advisor, and why the group of advisors at RIA can best fill your needs.

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:...

Read More »

Read More »

Relationship Between Fed Rate Cuts and Treasury Yields Explained

During a rate cutting environment, treasury bonds tend to do well. Fed funds cuts lead to falling ten year treasury yields due to Fed control over the short end of the curve. #investing #economy

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-18-24 Irrational Exuberance Then And Now

Walking the tightrope between irrational exuberance and reality is complex. Therefore, appreciate the market for what it is. This bull market has no known expiration date. Active management, using technical and fundamental analysis along with macroeconomic forecasting, is crucial to managing the potential risks and rewards that lie ahead. What if we are experiencing rational exuberance and AI is an economic game changer? What if current valuations...

Read More »

Read More »

Mastering Hurdle Rates: How to Achieve Financial Success

Ever wonder about hurdle rates in your financial plan? It's the key return needed for success. Patience is key in investing. No shortcuts! ? #FinanceTips

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-17-24 Avoiding the Sexy Stock Plays

With a slowing economy, what's the best play for investors? The market has been sustained essentially by seven large-cap stocks, but that dynamic appears to be shifting, and the appeal of making big money quickly may blind you to the realities in the market.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

Articles mentioned...

Read More »

Read More »

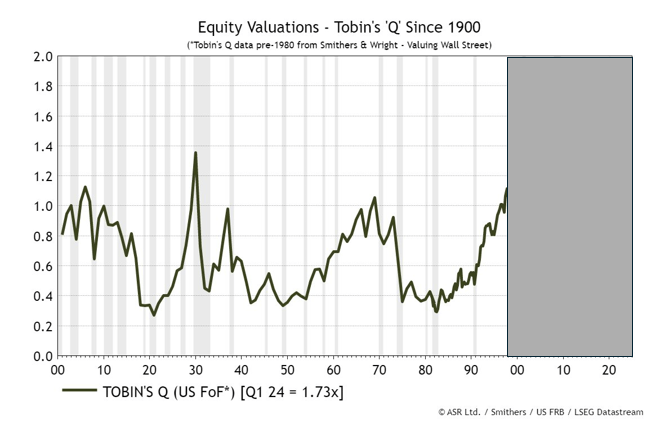

Irrational Exuberance Then And Now

On December 5, 1996, Chairman of the Fed Alan Greenspan offered that stock prices may be too high, thus risking a correction that could result in an economic fallout. He wondered out loud if the market had reached a state of “irrational exuberance.”

Read More »

Read More »

Knowing When to Get Out: Mastering Market Timing

Want to make your cash work for you? Buy back shares at a better price! But the real challenge is knowing when to get out and when to buy the dip. #InvestingTips ??

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-16-24 Fed Rate Cuts – A Signal To Sell Stocks And Buy Bonds?

With both economic and inflation data continuing to weaken, expectations of Fed rate cuts are rising. Notably, following the latest consumer price index (CPI) report, which was weaker than expected, the odds of Fed rate cuts by September rose sharply. According to the CME, the odds of a 0.25% cut to the Fed rate are now 90%. Since January 2022, the market has repeatedly rallied on hopes of Fed cuts and a return to increased monetary accommodation....

Read More »

Read More »

Strategies to Sell Investments for Maximum Profit

Want to make money selling? Sit above all arguments and debates. Stay realistic, avoid extreme optimism or pessimism. #InvestingTips ??

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-15-24 The “Broken Clock” Fallacy & The Art Of Contrarianism

“Bears are like a ‘broken clock,’ they are right twice a day.” While that may seem true during a rising bull market, the reality is that both “bulls” and “bears” are owned by the “broken clock syndrome.” The statement exposes the ignorance or bias of those making such a claim. If you invert the logic, such things become more evident. “If ‘bears’ are right twice a day, then ‘bulls’ must be wrong twice a day.” In the investing game, the timing of...

Read More »

Read More »

Investor dilemma: Hold, buy more, or react emotionally?

Investor dilemma: Hold, buy more, or react emotionally? Understand how investments work to navigate the upside. ? #InvestingTips #FinancialAdvice

Want to learn more? Subscribe to our YouTube channel via our profile link or:

https://cstu.io/a76a0b

Read More »

Read More »

Are you part of the third of households struggling to pay expenses?

Are you part of the third of households struggling to pay expenses? Many Americans find themselves behind on credit card payments. #financialstruggle #householdexpenses

Want to learn more? Subscribe to our YouTube channel via our profile link or:

https://cstu.io/006abe

Read More »

Read More »

Markets can stay illogical longer than you can stay solvent!

Markets can stay illogical longer than you can stay solvent! ? Stay strong and remain solvent in the tough fight of trading. ? #financialadvice

Want to learn more? Subscribe to our YouTube channel via our profile link or:

https://cstu.io/ff156d

Read More »

Read More »

Struggling with fluctuating bitcoin values?

Struggling with fluctuating bitcoin values? ? Stay ahead with a stable currency like the dollar for your business transactions! ? #BusinessTips #StableCurrency

Want to learn more? Subscribe to our YouTube channel via our profile link or:

https://cstu.io/a6f2a8

Read More »

Read More »

Market volatility can be unpredictable. Remember 2008?

Market volatility can be unpredictable. Remember 2008? A single unknown event can change everything. Stay informed and be prepared. #financialmarkets #2008crisis

Want to learn more? Subscribe to our YouTube channel via our profile link or:

https://cstu.io/9759ab

Read More »

Read More »

AI is changing the job market

AI is changing the job market - eliminating some roles, creating others. Who knows, in 20 years we might all be brain surgeons thanks to AI. ??⚕️ #AI #FutureJobs

Want to learn more? Subscribe to our YouTube channel via our profile link or:

https://cstu.io/58bab6

Read More »

Read More »

Maximizing Social Security benefits for high-earning couples

Maximizing Social Security benefits for high-earning couples. Consider waiting until 70 for maximum benefits based on lifestyle and health. #SocialSecurity #RetirementPlanning

Want to learn more? Subscribe to our YouTube channel via our profile link or:

https://cstu.io/732116

Read More »

Read More »

2024 July Vacation

Yes, we're on a break!

Lance and Brent & the Gang will return, live, on Monday, July 15, 2024.

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:...

Read More »

Read More »

100-Year Strategy for Berkshire Hathaway

Investing tip: #WarrenBuffett buys companies with a 100-year holding period in mind. You, as an investor, can't think that far ahead. #BerkshireHathaway! ? #Investing #LongTermStrategy

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-3-24 Why Berkshire Hathaway’s 100-Year Strategy Won’t Work for You

The saga of the Roberts' Rental house concludes, at the cost of a coffee maker and other electrical appliances. How much will it cost to feed your hoard on July 4th? Market Commentary: light volume expected for the remainder of the holiday-shortened week. Adam Taggart, Jon Huntsman analysis: Symptoms vs reality. The importance of doing your own due diligence and sticking to an investing discipline. Lance and Danny discuss concentration risk and the...

Read More »

Read More »