Category Archive: 9a.) Real Investment Advice

Give Us Five Minutes…

If you're not already regularly perusing our content at www.realinvestmentadvice.com, you're missing out on a treasure trove of research by Lance Roberts, Michael Lebowitz, Nick Lane, Richard Rosso, Danny Ratliff, and the rest of the RIA Team.

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Subscribe now and watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:...

Read More »

Read More »

8-7-24 Is the Crisis Over?

Is the crisis over? Too soon to tell, but the Nikkei did rebound, the Yen is coming down, and the BOJ is hold steady on rates. Earnings season continues; and it's too soon to suume the market has found the bottom. Admonition to be wary of the narratives. Market rally into the 100-DMA, buyt unlikely to test resistance the 50-DMA just yet. Understanding the Yen Carry Trade; risk management vs greed. Diversification worked on Monday. The Fed soesn't...

Read More »

Read More »

Confidence Is The Underappreciated Economic Engine

Ask economists how they forecast economic activity. It’s likely they will mention productivity, demographics, debt, the Fed, interest rates, and a litany of other elements. Economic confidence is probably not at the top of the list for most economists. It is tricky to gauge as it can be inconsistent. However, confidence can sometimes change quickly and often with significant economic impacts.

Look at the two pictures below. Can you spot a...

Read More »

Read More »

Questioning Societal Expectations: Navigating Financial Freedom on Your Own Terms

Creating a better future is key. Do we really need to follow these societal norms? Let's rethink our priorities and pave our own path. ? #FutureGoals #SocietalPressure

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-6-24 Is the Selling Over?

Monday's Carry Trade-inspired blowout saw lots of selling , but a little bit of recovery before the dust settled. The ISM Services Report clocked-in a little stronger than expected, taking fears of imminent Recession off the table. The Fed might not have to cut rates as much. Markets are now over sold by three standard deviations off the moving average; a bounce is in the office, but this could be the beginning of a bigger correction. Lance and...

Read More »

Read More »

Yen Carry Trade Blows Up Sparking Global Sell-Off

On Monday morning, investors woke up to plunging stock markets as the “Yen Carry Trade” blew up. While media headlines suggested the sell-off was due to fears of a recession, slowing employment growth, or fears over Israel and Iran, such is not the case.

Read More »

Read More »

8-5-24 Understanding Yield Curves: Inversion Doesn’t Guarantee a Recession

August begins with weaker employment and the Fed hinting at the possiblity of a 1/2% rate cut; The Japanese Carry Trade blos up: What is it and why does it matter? Look for the largest spike in volatility since the pandemic. Be careful amid emotional headlines; Markets have already been over sold and now need to bounce. Anything that is a risk assett will be affected; bonds are over bought: Today is a day to do nothing. Lance's movie reviwe of...

Read More »

Read More »

8-5-24 Emergency Alert Bulletin – The Carry Trade

What's going on with the unwinding of the carry trade, and should you be concerned? Lance Roberts & Michael Lebowitz provide perspective, explain the significance of the Carry Trade and what is happening in the Japanese economy, and why it is effecting global markets today (8/5/24)...plus their advice on what you can and should do today.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael...

Read More »

Read More »

Toughest Hurdle for Investors: Entering the Market at the Right Time

Asset management is crucial, but timing the market is the real challenge. There's never a perfect time to invest, just take the leap! ? #InvestingTips #FinancialAdvice

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Why Market Comparisons Can Hinder Your Portfolio’s Performance

Don't fall for the trap of comparing your portfolio to the market. Focus on your own financial goals! #InvestingTips ?? #FinancialAdvice #StocksBonds

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Credit Card and Auto Loan Delinquencies Impact Small Businesses

Small businesses heavily rely on credit card payments for cash flow. Recent trends show rising delinquencies in both credit cards and auto loans. #SmallBusiness #CreditCardPayments

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Longest Bond Bear Market Since 1790: Are Better Days Ahead?

? Are we out of the woods yet with bonds? ? This bear market is the longest since 1790! Economic slowdown and low inflation are driving yields down. #FinanceFacts #EconomicTrends

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-2-24 Is Inflation Beating or Benefiting You?

Richard and Danny discuss the week's market moves, and how bad news is actually bad news now; Intel's poor performance should be no surprise to astute investors; sometimes "value" stocks are value traps. Understanding (and avoiding) the day-to-day media hype. How to use "Money Buckets" to balance risks and demands on retirement funds; 2024 looks to be a mirror of 2023, with weaker economics. How to balance two sides of the...

Read More »

Read More »

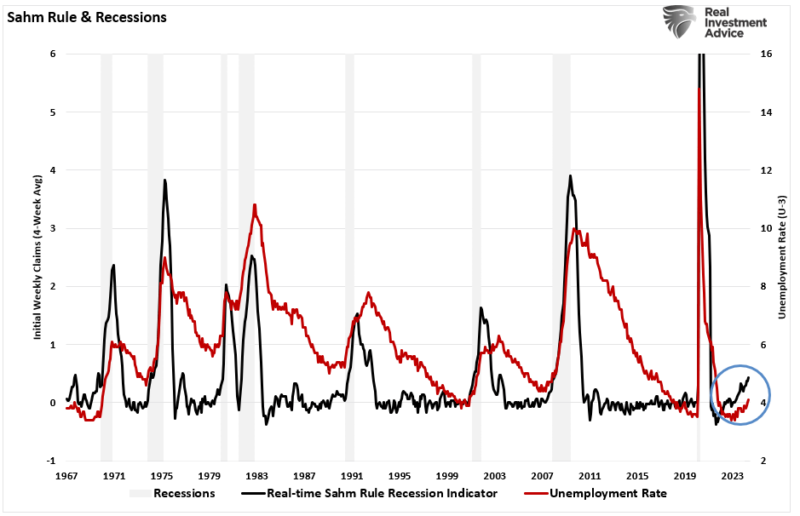

The Sahm Rule, Employment, And Recession Indicators

Economist Claudia Sahm developed the “Sahm Rule,” which states that the economy is in recession when the unemployment rate’s three-month average is a half percentage point above its 12-month low. As shown, the latest employment report has triggered that indicator.

So, does this mean a recession is imminent? Maybe. However, we can now add this indicator to the long list of other recessionary indicators, also flashing warning signs.

As...

Read More »

Read More »

Inflation Drops Below Fed’s 2% Goal, Signaling Weakening Economic Pressures

Inflation index drops to 1.5% below Fed's target. Wage growth declining, no real pressure seen. Stay tuned for more insights in tomorrow's article (8/2) on the SAHM rule.

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Using Home Equity to Maintain Financial Independence

Survival mode activated! My house may be a frozen asset, but it's also a lifeline for income. Not selfish, just smart. #financialfreedom

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-1-24 The Fed Stands Pat

Jerome Powell & Co. hold fast to the current doctrine...Lance and Michael discuss the ramifications for investors now.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

Articles mentioned in this report:

"Is There Value In Small Cap Value Versus Large Cap Growth?"...

Read More »

Read More »

Aging in Place: How Reverse Mortgages Can Help You Stay Comfortable

Considering aging in place? Learn how a reverse mortgage line of credit can help maintain your lifestyle without worrying about lawn mowing. #FinancialTips #ReverseMortgage

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-31-24 Should You Share Your Wealth Sooner than Later?

Many wealthy people choose to pass on wealth when they die, but that's not the only way. Passing on assets during your lifetime can have big benefits, both psychological and practical, and beyond alleviating financial stress, early inheritance can provide a test run for future big gifts.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive...

Read More »

Read More »

How Your Confidence Can Boost or Break the Economy

Confidence is key for a thriving economy! Feeling good about finances drives spending & market growth. Investor sentiment plays a vital role too! ?? #EconomicImpact

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »