Category Archive: 9a.) Real Investment Advice

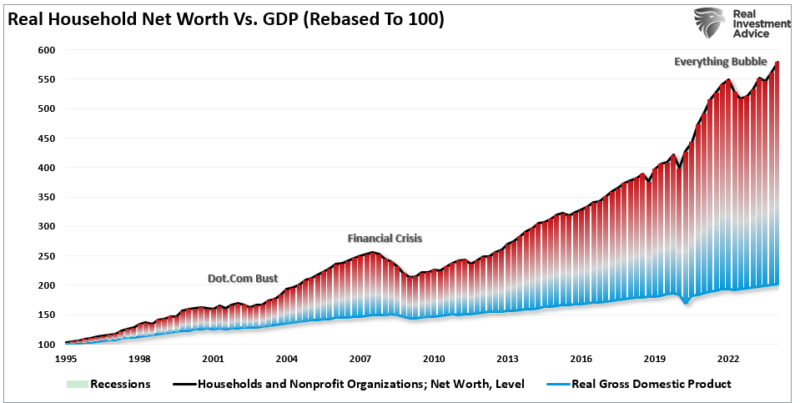

Economic Growth Myth & Why Socialism Is Rising

I was recently asked about the seemingly strong “economic growth” rate as the Federal Reserve prepares to start cutting rates.

“If economic growth is so strong, as noted by the recent GDP report, then why would the Federal Reserve cut rates?”

It’s a good question that got me thinking about the trend of economic growth, the debt, and where we will likely be.

Since the end of the financial crisis, economists, analysts, and the Federal...

Read More »

Read More »

Understanding Recession Risks During Market Decline and Fed Rate Hikes

? Worried about recession risks and market declines? ? Stay informed about the Fed's rate hikes and market trends to make wise investment decisions! #FinanceTips #MarketInsights

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-15-24 How to Buy a Dividend Stock

July CPI clocks-on on-target for the Federal Reserve to cut rates, as it indicate inflation is trending downward. This would set-up the Fed for up to four rate cuts by the end of the year, but not so great for stocks. Watch for seasonal adjustments to Retail Sales reports. Markets will challenge 50-DMA, and could end its correction today. Your personal experience with inflation is not the same as Government calculations, which is what markets look...

Read More »

Read More »

Boost Your Portfolio with Collectible Coins

Owning gold coins with collector's value can outperform gold price over time! Understand what you own and why. #InvestingTips #GoldCoins

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-14-24 Looking for Rate Cut Clues in CPI Data

The PPI number came in weaker than expected with lower input prices. Today's CPI report (a 0.2% monthly increase = 3.2% annual rate) weakness could spur the Fed to lower rates, although to what extent remains unknown. The upcoming Jackson Hole Economic Summit could also provide impetus for the Fed's action in September. Meanwhile, markets on Tuesday cleared the 100-DMA, and are looking for confirmation at the 50-DMA. Will he or won't he? Danny's...

Read More »

Read More »

Stealth QE Or Rubbish From Dr Doom?

A recent article co-authored by Stephen Miran and Dr. Nouriel Roubini, aka Dr. Doom, accuses the U.S. Treasury Department of using its debt-issuance powers to manipulate financial conditions. They liken recent Treasury debt issuance decisions to stealth QE. Per the first paragraph of the article’s executive summary:

By adjusting the maturity profile of its debt issuance, the Treasury is dynamically managing financial conditions and through...

Read More »

Read More »

Capitalizing on Market Volatility: Strategies for Oversold Conditions

Market insight ? Don't wait to buy stocks in size. The market could stabilize, offering room for a bounce. Use the rally to reduce risk and rebalance your portfolio. #Stocks #Investing #MarketInsight

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-13-24 Four Reasons Mega-Caps Are Not Dead Yet

It's economic report week, with previews of today's PPI, tomorrow's CPI, and Thursday's Retail sales numbers for July; will weaker consumer spending appear? Stock buybacks have returned. Markets to re-test 100-DMA, and set up to move up to the 20-DMA. Are the “Mega-Cap” stocks dead? Maybe. But there are four reasons why they could be staged for a comeback. The recent market correction from the July peak certainly got investors’ attention and...

Read More »

Read More »

Are Mega-Caps About To Make A Mega-Comeback?

Are the “Mega-Cap” stocks dead? Maybe. But there are four reasons why they could be staged for a comeback. The recent market correction from the July peak certainly got investors’ attention and rattled the more extreme complacency. As we noted previously:

“While there have certainly been more extended periods in the market without a 2% decline, it is essential to remember that low volatility represents a high “complacency” with investors. In...

Read More »

Read More »

Options: Beneficial Tools When Used Properly

Options are like guns - beneficial if used properly, dangerous if not. Young investors need to understand the risks of speculative trading. ?? #InvestingTips

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-12-24 Be Careful of Market Predictions

Laying the groundwork for Fed rate cuts: Will they or won't they in September, and by how much? 80% of S&P companies have reported; stock buy back windows are back open for business; Q-2 earnings summary: Not great, not terrible. Is consumer spending slowing (and will earnings estimates fall)? Last week's market volatility: Still in the process of correction. Sell-off was recovered by Friday. After a muted open today, use any rally to reduce...

Read More »

Read More »

Focus on return, not taxes

Focus on the return first, not taxes! ? Avoid selling stocks to dodge taxes, it can turn winners into losers. Taxes are part of the total return. #InvestWisely

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Tech vs Value: Diversifying Between Tech and Value During Market Shifts

Market breadth has been poor for the last 18 months. Will tech pull back while consumer defensive sectors thrive? Balancing our portfolio with value stocks. #investing #stocks

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Economic Concerns Amid Market Fluctuations

? Worried about a recession? ? Economic experts say consumer behavior is key. Stay tuned to see how things unfold! ? #Economy #ConsumerBehavior

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-9-24 What Kind of Inheritance Will You Leave Behind?

With the turmoil of the past week, now is a good time to reassess your portfolio, and rebalance the risk. What is the deal with stocks advertising on TV? Wealth transferrence & Inheritances: How common is it for children to meet with parent and financial advisor? If there's money left... How RMD's can calter inheritances; how gift-giving works. Lance's kids are 'off the payroll.' Are you planning to receive an inheritance? How life-long...

Read More »

Read More »

UBI – Tried, Tested And Failed As Expected

A Universal Basic Income (UBI) sounds great in theory. According to a previous study by the Roosevelt Institute, it could permanently increase the U.S. economy by trillions of dollars. While such socialistic policies sound great in theory, history, and data, they aren’t the economic saviors they are touted to be.

What Is A Universal Basic Income (UBI)

To understand why the theory of universal basic income (UBI) is heavily flawed, we need to...

Read More »

Read More »

Understanding the Fear and Greed Index: What Does It Mean for Investors?

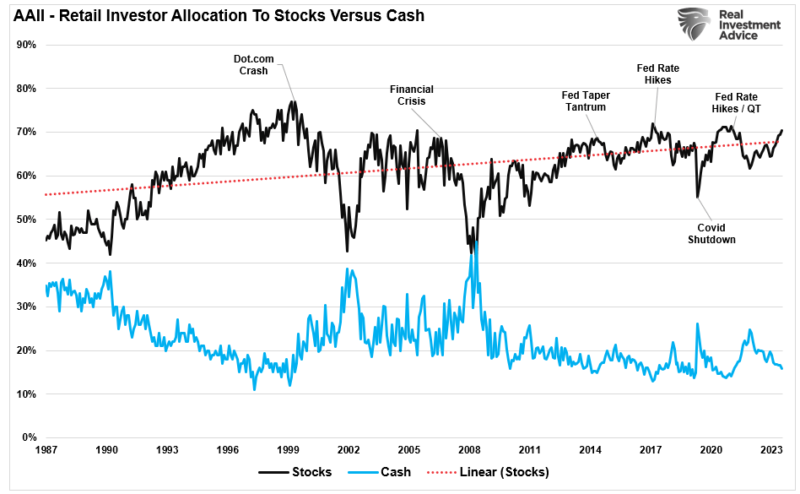

Check out our Fear Greed Index! Investor allocations have surged from extremely low to high, indicating bullish market sentiment. ? #Investing #MarketTrends

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-8-24 Trapped Longs Take the Exit

Economic Reports affected by Hurricanes Beryl & Debbie; market sell off continues. Inflationary data is still there; unwinding of Yen Carry Trade continues w/volatility. Lance recites a brief history of market crashes, causes & effects. The market correction actually started in July at peak; trapped-longs sold into market rally as exuberance reverses. Earnings Season has delivered a mixed back; 92% of companies have reported, opening buy...

Read More »

Read More »

What a Financial Advisor? Consider these Seven Concepts.

So, you need a financial advisor, but do you truly understand the full extent of the benefits? Consider these Magnificent Seven Concepts:

Concept One: Financial Advisors are NOT Portfolio Managers.

Most consumers believe that financial advisors are primarily investment selectors and asset managers. While these duties are valid, they are not at the top of an advisor’s list or priorities.

Many financial advisors outsource these duties to...

Read More »

Read More »

401k participation, poor returns, poor participation, critical issue, human capital machine, providi

Poor participation in 401ks is a big issue. We are our own human capital machine providing income. Let's rethink our approach. #401k #financialplanning

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »