Category Archive: 9a.) Real Investment Advice

Navigating 401K Challenges

Are you maximizing your 401K contributions? ? Let's make sure we're funding as much as we can for a secure retirement future! ? #RetirementPlanning

Want to learn more?

YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/74ac84

Read More »

Read More »

8-26-24 Risk Management Still Matters

Over the next few weeks to two months, the various signals of improving breadth and liquidity support higher prices. However, this does not mean investors should ignore the potential risks. An unexpected and exogenous event, as we saw with the “Yen Carry Trade” three weeks ago, is a good example. The things that tend to disrupt the markets are not what we know about; they are the things we don’t that send sellers rushing for the exit. Therefore,...

Read More »

Read More »

Understanding the Hidden Costs That Can Eat Away Your Returns

Understand your investment fees! Check your expense ratios, opt for low-cost options like ETFs/index funds. Watch those fees add up. ?? #FinancialTips

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/1cb2fe

Read More »

Read More »

Managing Capital Gains Tax for Increased Profits and Wealth

Managing long term gains is key. Take profits along the way for a more manageable position. Looking ahead for better chances! ? #investingtips

Want to learn more?

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch the entire show here: https://cstu.io/47695e

Read More »

Read More »

Stocks vs Bonds: Understanding the Key Differences for Investment Success

Stocks vs. Bonds: Understanding the difference. Stocks offer potential for higher yield, but bonds provide security with maturity value. ?? #Investing101

Want to learn more?

Subscribe to our YouTube channel = @ TheRealInvestmentShow

Watch entire show: https://cstu.io/deb5b1

Read More »

Read More »

8-23-24 How to Prepare for Recession (even when there isn’t one)

Joy, Gratitude, and the difficulty of knowing what narrative to believe. Still to come: Jerome Powell's speech at Jackson Hole, and reaction to negative revision to Jobs numbers. Four rate cuts by the Fed before the end of the year? How to make volatility work for you. Taxation of unrealized gains: It's a dumb idea. What about credits for losses?? (You absorb the losses, the Gov't takes the gains.) Thank goodness for Congressional gridlock. Schwab...

Read More »

Read More »

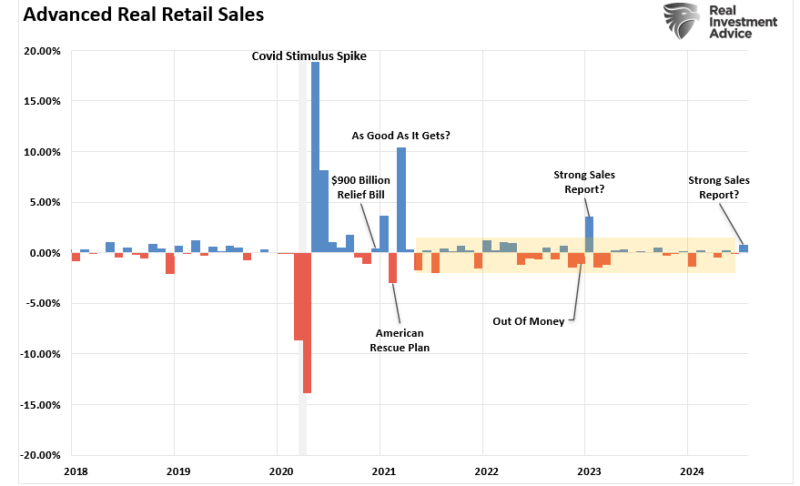

Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and...

Read More »

Read More »

Forecasting Market Risks: Events That Might Trigger a Downturn

Market outlooks are uncertain, but economics suggest challenges ahead. Setting a specific return target will be hard to do. #financialplanning #economics

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-22-24 Jackson Hole Preview

Markets are again approaching all-time highs, with the NASDAQ exhibiting a most v-like recovery, up 11% in ten days. Markets' response to the largest (818-k) negative Jobs revision since 2009: Shrugs. FOMC meeting minutes indicate the time is "appropriate" for the Fed to lower rates. French women apparently have the longest life expectancy; Lance & Michael review FOMC meeting minutes and mentions of "appropriate time" to...

Read More »

Read More »

Be Careful of Market Predictions

Markets are unpredictable. Always be cautious of what you think you know. Stay informed and be prepared for the unexpected. ? #marketinsights

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-21-24 Why Your Portfolio Performance Sucks

Why have portfolio performances been dragging? Lance Roberts examines the cause and effect phenomenon of public policy and outcomes, rhetoric and promises; who'll control the House & Senate have more bearing on future legislation promised vs passed. Market breadth is expanding, which bodes well for bullish trends. Most of markets' lift is coming from stock buy back activity. Interesting observation about the category launches of ETF's: Most are...

Read More »

Read More »

Fed Funds Futures Offer Bond Market Insights

Profitable bond trading opportunities arise when your expectations about Fed policy differ from those of the market. Therefore, with the Fed seemingly embarking on a series of interest rate cuts, it behooves us to appreciate how many interest rate cuts the Fed Funds futures market expects and over what period. Equally important, Fed Funds futures help us assess the market’s economic growth and inflation expectations.

Currently, Fed Funds futures...

Read More »

Read More »

Why Gen Z Is Saying No to Materialism and Collecting Less Stuff

Gen Z values experiences over material possessions. Are storage units the new trend for sentimental attachment? ? #Minimalism #GenZ

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-20-24 How Shall the Young Secure (Their Finances)

Investors are waiting for this week's Jackson Hole confab, and will respond accordingly; when will markets take a breather? The DNC begins with economic nonsense. You cannot fix poverty by giving money away. Markets' rally straight up for eight days; pullback is coming: This is no time to chase stocks. Why the correction is over; three elements of economic uncertainty. Lance answers an email about helping youth prepare financially; the financial...

Read More »

Read More »

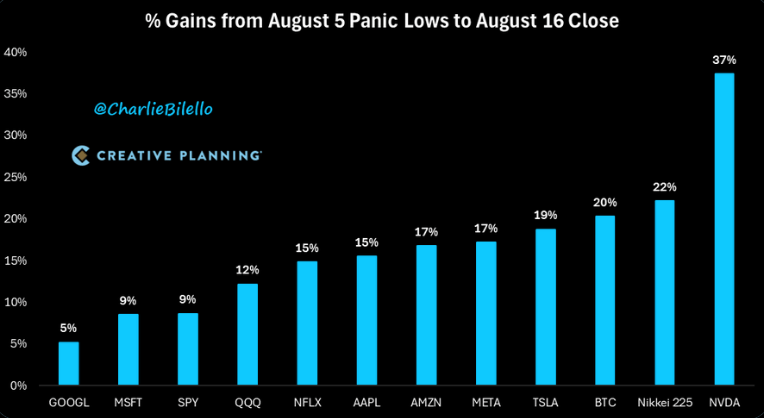

Market Decline Over As Investors Buy The Dip

The market’s 8.5% decline during August sent shockwaves through the media and investors. The drop raised concerns about whether this was the start of a larger correction or a temporary pullback. However, a powerful reversal, driven by investor buying and corporate share repurchases, halted the decline, leading many to wonder if the worst is behind us.

However, the picture becomes more nuanced as we examine the technical levels and broader market...

Read More »

Read More »

How Trusts Ensure Your Wishes Go Beyond Legal Documents

Don't let documents speak for you. Trust is for family protection, not an iron fist. Conversations matter. #FamilyTrust #ProtectYourWishes

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-19-24 Unpacking Kamalanomics and Economic Cycles in America

Previews of the DNC Convention and Jackson Hole meeting previews, plus four Fed speakers on tap this week; Monkey Pox & Covid on the upswing ahead of election season. Markets stage a phenomenal recovery over the past five days; could interest rates reverse? Kamalanomics: A historical perspective on Economic Cycles: Why Prices Controls will exacerbate inflation; the myth of price gouging; the Tytler Cycle revisited.

3:15 - Phenomenal Market...

Read More »

Read More »

Protecting Your Child’s Future: The Automatic Shift in Money Management

Becoming a parent shifts your perspective completely. The responsibility of protecting that little person transforms your entire mindset. #Parenthood #PerspectiveShift

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Yield Curves: Inversion Doesn’t Guarantee a Recession

Understanding yield curve inversion is key! Don't panic when it happens - it doesn't automatically mean a recession is imminent. Check out the chart to see the full picture. ? #Finance101 #YieldCurve

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Avoid Sleepless Nights_Financial Crisis Insights

Let's stay positive and focus on being okay. Self-fulfilling prophecies are real! Remember the crashes in 2008 and 2000? Stay strong ? #positivity #financialadvice #recession

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »