Category Archive: 9a.) Real Investment Advice

Japan Is Normalizing: Risks To The Yen Carry Trade

“Japan Bond Meltdown Sends Yields to Record High on Fiscal Fears,” read a January 2026 Bloomberg article. Headlines like this, and many others, warn that Japan’s abrupt interest rate increase is an omen of dire trouble. While that may be the case, given decades of economic woes, declining demographics, and extreme levels of outstanding debt, …

Read More »

Read More »

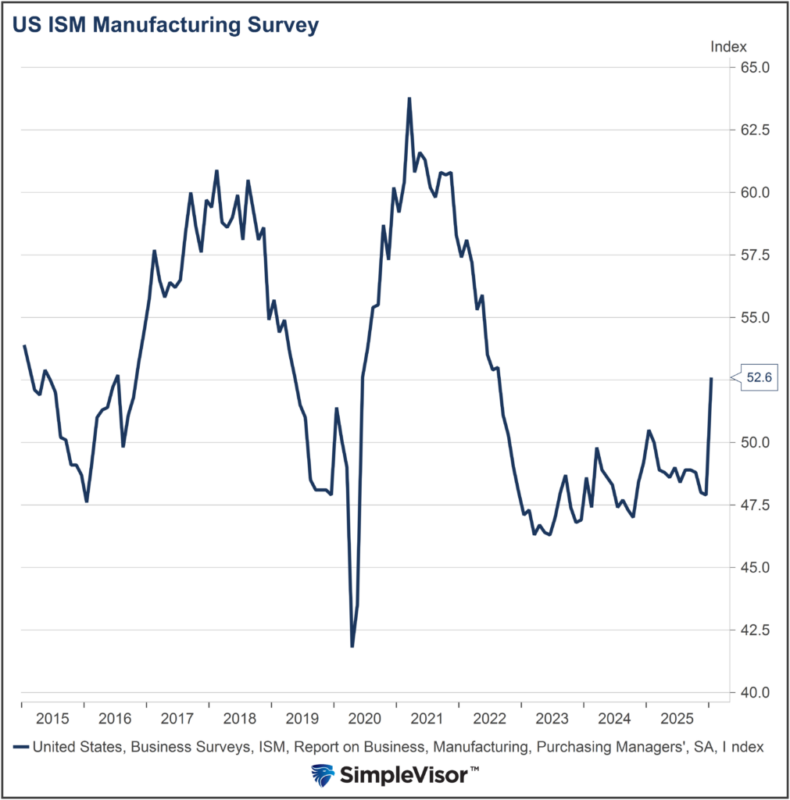

ISM Manufacturing Supports Reflationary Forecasts

Over the last couple of weeks, we have shared evidence that supports the reflationary narrative and some that defies it. Today, we share the latest ISM Manufacturing data, which lends credence to the reflationary narrative. The ISM Manufacturing survey showed a big improvement in sentiment, as shown below. The gauge shot up 4.7 to 52.6, …

Read More »

Read More »

2-3-26 Buy What Nobody Wants, Sell What Everyone Loves

Chasing what’s already performing well is how most investors buy tops—for example, $SLV last week.

Successful investing usually means owning assets nobody wants and selling them once everyone does—but most investors do the opposite.

This leads to complacency, unrealistic return expectations, and knee-jerk decisions driven by standout performers instead of the health of the overall portfolio, ultimately hurting long-term results.

📺Full episode:...

Read More »

Read More »

2-3-26 The Trap of Chasing Returns

Most investors don’t blow up because they “didn’t know enough.” They blow up because they frame the decision wrong.

Lance Roberts & Jonathan Penn break down narrow framing—the behavior where investors judge one investment in isolation (“Why don’t I own that?”) instead of evaluating results through the entire portfolio and a long-term plan.

When something becomes “hot,” it feels obvious, safe, and inevitable. But return-chasing often ends the...

Read More »

Read More »

Private Credit Funds Falling Out Of Favor

Private credit funds were all the rage in 2024 and 2025 as institutional and high-net-worth retail investors sought more risk and higher returns. Over the last few months, that trend has started reversing. The FT reports that private credit investors pulled more than $7 billion from some of the biggest private credit funds in the …

Read More »

Read More »

2-2-26 Bears Are an Endangered Species

Lance Roberts examines why bears have become an endangered species—and why that may be a warning sign rather than a confirmation of safety. Investor sentiment is extreme, margin debt is surging, speculative behavior is accelerating, and market leadership remains narrowly concentrated. When optimism becomes unanimous, history shows future returns tend to disappoint.

#MarketRisk #InvestorSentiment #StockMarketOutlook #RiskManagement #FinancialPlanning

Read More »

Read More »

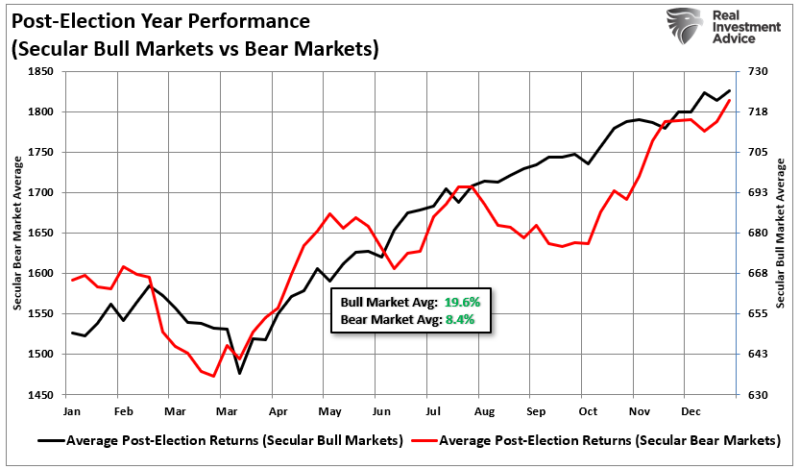

The Market Cycles Potentially Driving 2026 Returns

Market cycles are once again at the center of the investment narrative as we head into 2026. The optimism is familiar as earnings held up in 2025, the economy avoided recession, and big tech lifted the indexes. However, those victories are already reflected in the price. As we head into 2026, with valuations extended, the …

Read More »

Read More »

Warsh To Head The Fed

The wait is over, and President Trump has nominated Kevin Warsh to head the Federal Reserve. To better appreciate Warsh's views on monetary policy and what they may entail for markets, we summarize a recent Wall Street Journal editorial he wrote, The Federal Reserve's Broken Leadership. Our market-related thoughts are below the bullet points. From …

Read More »

Read More »

1-31-26 Margin Debt Explained: Bullish Today, Dangerous Tomorrow

In this short video, Lance Roberts & Michael LebowitzI discuss margin debt in detail.

Margin debt at record highs isn’t a sell signal. Rising leverage adds buying power and supports prices.

The real risk comes when margin debt reverses and deleveraging accelerates downside.

Watch the rate of change, not the headline level.

📺Full episode:

Catch Lance daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

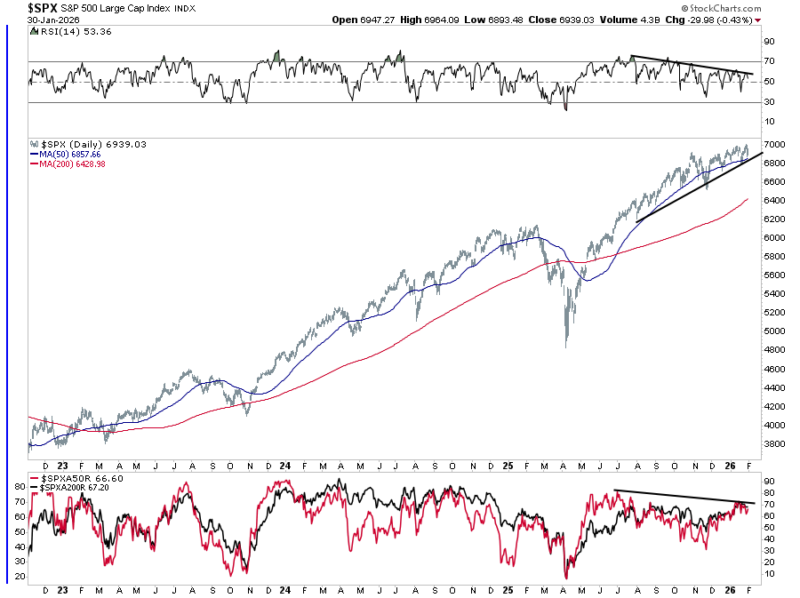

Bears Are An Endangered Species

🔎 At a Glance 🏛️ Market Brief - Market Volatility Returns Markets ended the week mixed as investors processed the Federal Reserve’s latest policy decision, rising geopolitical tensions, and the early results of the S&P 500 earnings season. The Fed held the federal funds rate steady at 3.50–3.75 percent, as expected. Chair Jerome Powell maintained …

Read More »

Read More »

1-30-26 This Indicator Is Screaming 2021-Level Speculation Again

Retail risk appetite has surged to extreme levels last seen in early 2021, a period marked by peak speculation.

Margin debt is accelerating as speculative money rapidly rotates across assets, with $SLV and $GLD the latest examples.

In this short video, Lance Roberts & Michael Lebowitz explain why history shows these conditions often lead to sharp volatility, not smooth market advances.

📺Full episode:

Catch me daily on The Real...

Read More »

Read More »

1-30-26 Retirement Income When Markets Are Expensive

Markets may still enjoy short-term momentum, but long-term retirement planning must confront a different reality: elevated valuations, lower forward returns, and rising sequence-of-returns risk.

Richard Rosso explains why retirees face a near-term tailwind in market returns—but potentially long-term secular stagnation that demands tighter portfolio guardrails. Rich will discuss why historically tested retirement income strategies matter more today...

Read More »

Read More »

Meta And Microsoft: Great Earnings But Different Results

On the heels of strong fourth-quarter earnings reports, Microsoft is opening down 8%, while Meta is trading up 10%. Microsoft topped expectations for earnings and revenues. However, there is some concern about its total cloud revenue. They reported cloud revenue of 26% versus expectations of 28-29%. That said, their leading cloud computing product, Azure, grew …

Read More »

Read More »

Mainstream Expectations: Hope Vs. Potential Risk

Mainstream expectations, those from Wall Street, economists, and corporate strategists, have congealed around a bullish economic outlook for 2026. Most forecasts project stronger economic growth, with contained inflation, and continued investment in technology and capital expenditure. As such, many institutional investors interpret this as a year of opportunity for markets and corporate earnings.That was a …

Read More »

Read More »

1-29-26 What The Fed Really Said & What To Expect Next

The Fed sees inflation easing and believes policy is already restrictive, making rate hikes very unlikely and keeping cuts as the more probable next move.

In this short video, @michaellebowitz and I break down what Powell actually said, what the Fed is signaling on growth and labor, and what to expect next for markets.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-29-26 Market Risks Behind Powell’s “Nonrestrictive” Stance

The Federal Reserve is holding interest rates steady, keeping policy in a 3.5%–3.75% range.

Lance Roberts and Michael Lebowitz examine how markets are reacting to Chair Jerome Powell’s message, and break down what the Fed is signaling—and why it could fuel market volatility ahead.

0:00 - INTRO

0:19 - Mega Reports & Fed Fallout

4:31 - Markets Struggle after 7,000

9:33 - Inflation, Truflation, & Labor

14:14 - Chances of Rate Changes Higher...

Read More »

Read More »

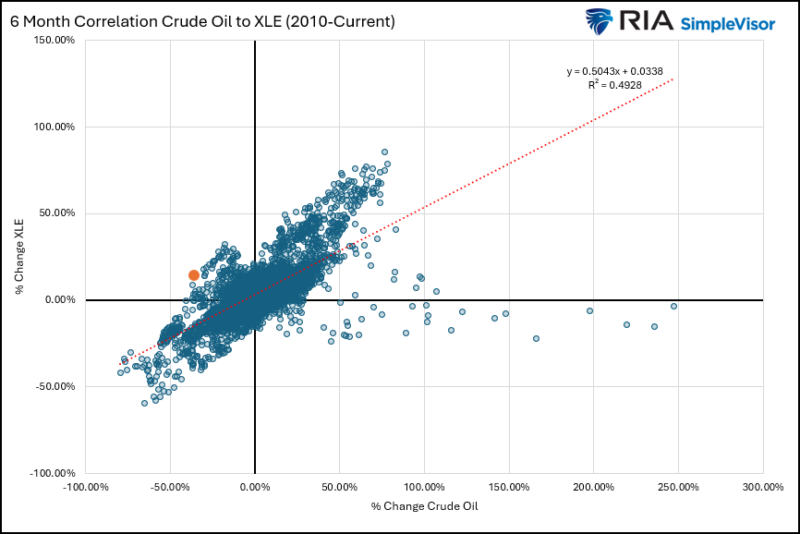

The Energy Sector Is Outpacing Energy Prices

Over the last year, energy stocks have traded well despite crude oil prices languishing. For instance, over the last six months, XLE, the energy ETF, has risen 14%, while crude oil prices have fallen by 12%. The two largest components of XLE, Exxon and Chevron, which account for 40% of the ETF, are up 30% … Continue reading...

Read More »

Read More »

1-28-26 The Narrative Trap: How Investors Justify Buying Silver Higher

$SLV rally is fueled by narrative and retail chasing.

Historically, it ended with painful mean reversion.

In this short video, I discuss why investors justify buying #silver higher, how psychology overrides fundamentals, and why parabolic moves in industrial metals rarely last. $GLD

📺Full episode: -IGAw

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-28-26 Q&A Wednesday, the YouTube Chat Free-for-all

Welcome to Q&A Wednesday: The YouTube Chat Free-for-All — our most interactive show of the week.

Lance Roberts & Danny Ratliff answer real-time questions straight from the YouTube live chat. No scripts. No pre-selected topics. Just timely, unfiltered discussion on the issues investors are wrestling with right now.

#QAWednesday #InvestorQuestions #MarketVolatility #FinancialEducation #RiskManagement

Read More »

Read More »

European Buyers Strike Or Performance Chasing?

Bloomberg recently published "Wall Street Grapples With A New Risk: A European Buyers Strike." The article notes that stock indexes in Europe, Japan, Canada, and South Korea are all beating US equities in both nominal and dollar terms. As a result, some European pension funds and other foreign buyers are trimming their exposure to US …

Read More »

Read More »