Category Archive: 9a.) Real Investment Advice

10-21-24 Q3-Earnings Estimates Remain Optimistic

Earnings estimates remain exceptionally optimistic, raising the question of whether consumer spending can sustain present levels (the source of earnings!) Investors should be careful averages, and remember that records are recrods for a reason. Why we're still expecting acorrection; we've had six strong weeks in a row, and a seventh is not out of the question this week. Lance looks at where earnings are really occurring (in the Mag-7 companies);...

Read More »

Read More »

Bond Yields Correct: The Reasons Behind the Market’s Reaction and Investor Panic

Understanding the current bond yield correction and why panicking won't help in the short term. Stay informed, stay calm. #finance #bonds

Watch the entire show here: https://cstu.io/a40d83

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Fed’s Tightening Policies and Future Rate Cuts: What Wall Street Expects

Wall Street bullish on rate cuts! ?? Fed tightening balance sheet, but Wall Street expects more cuts next year. ? #economy #finance #WallStreet

Watch the entire show here: https://cstu.io/580dca

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Consumer Spending Influences Economic Growth and Earnings

Understanding consumer spending is key for economic growth and earnings. It's all about the balance between current situation and future expectations. ?? #EconomicInsights

Watch the entire show here: https://cstu.io/c0084f

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Key Changes in Medigap Coverage: Don’t Miss These Crucial Updates!

Don't ignore changes in your Medigap plan! We're here to help you navigate through them. Your health and savings matter! #Medicare #Healthcare

Watch the entire show here: https://cstu.io/32da19

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Interest Rate Cuts Can Impact Your Investments

Cutting interest rates can be a sign of trouble in the economy. Stay informed to understand the market trends! #economy #finance #investing

Watch the entire show here: https://cstu.io/ba0879

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

10-18-24 COLA Boost & Medicare Shifts: What You Must Know for 2025

Richard & Jonathan recap their recent recruiting visit on the campus of Texas A&M University: There is hope for the next generation. Earnings season continues, discussion of Netflix and Lance's coffee rants. Anti-globalization & the China effect; the fallacy of International buys; "I love Lucy" & Vitametavegamin. Why fasting should be called slowing; Medicare Open Enrollment and changes in many plans: What happens when...

Read More »

Read More »

Bastiat And The “Broken Window”

In times of disaster and destruction, a common narrative often emerges that rebuilding efforts will lead to economic growth. The idea that repairing damage and replacing destroyed goods creates jobs that spur consumption and stimulate economic activity is tempting. However, as French economist Frédéric Bastiat explained in his famous “Broken Window Theory,” this reasoning is fundamentally flawed. Rather than generating net economic benefits,...

Read More »

Read More »

Fed Mandate Change: Could We See Three Rates Instead of Two?

Is the mandate changing to three instead of two? The Fed might be behind the curve again. Data shows consumer struggles and government spending remains high. #economy #Fed #finance

Watch the entire show here: https://cstu.io/828582

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

10-17-24 Volatility & The Market Climb: Should We Care?

The financial media frequently opines on what the daily gyrations of the VIX (implied volatility inde) signal regarding investor sentiment. Despite how often it is quoted and discussed, many investors do not truly appreciate what implied volatility measures. The VIX has been rising alongside the market in a non-typical fashion. With the presidential election in a few weeks, the Fed changing course on monetary policy, and Israel potential for...

Read More »

Read More »

10-16-24 You Ain’t Rich

Will the strength (or weakness) of the consumer be revealed in this week's Retail Sales report? Liquidity is continuing to flow into markets; if things are so good, why all the liquidity flows? Stock buy backs resume in 10-days, adding $6-B/day of more liquidity (which is NOT a return of capital to investors.) Energy stock eposure eoansion: As interest rates rise, so have oil prices. MACD Sell signal has been triggered, and we anticipate falling...

Read More »

Read More »

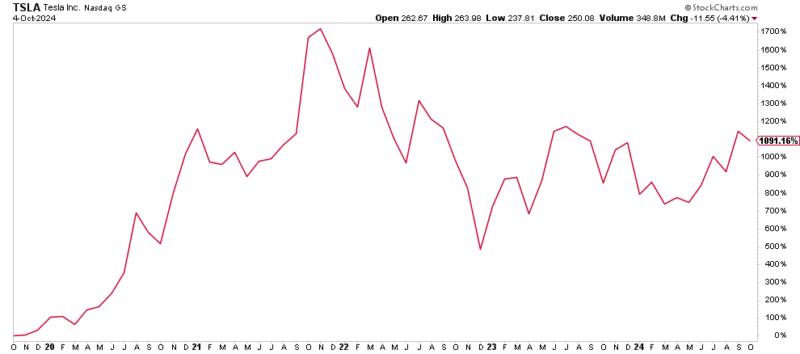

How to Grow Wealth with Smart Investment Strategies

Creating money and wealth over time by capturing upside and taking profits along the way! Letting our portfolio run and do its thing ? #InvestingTips

Watch the entire show here: https://cstu.io/b54b14

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The VIX And Market Climb: Should We Care?

The financial media frequently opines on what the daily gyrations of the VIX (implied volatility index) signal regarding investor sentiment. Despite how often it is quoted and discussed, many investors do not truly appreciate what implied volatility measures.

We take this opportunity to help you better understand implied volatility. Furthermore, we discuss other lesser-followed measures of implied volatility that help better assess whether...

Read More »

Read More »

Examining the Evidence Against Imminent Recession Predictions

? Debunking recession fears! ? Despite viral videos predicting doom, the data doesn't lie. Get the facts in this weekend's newsletter! #EconomicTrends #DataDriven

Watch the entire show here: https://cstu.io/75df3c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

10-15-24 Greed And How To Lose 100% Of Your Money

Retail Sales figures should be interesting, as retailers were stocking up ahead of the short-lived dockworkers' strike. Lance previews Thanksgiving at the Roberts' house, featuring brisket! Earnings week continues with a string of the most negative earnings revisions in a long while. Markets operating under a seasonal buy signal and an ever-upward trend: What could possibly go wrong? Lance discusses the importance of risk management in a bull...

Read More »

Read More »

Greed And How To Lose 100% Of Your Money

In the movies, greed is a trait often exhibited by the rich and powerful as a means to an end. Of particular note is the famous quote from Michael Douglas in the 1987 movie classic “Wall Street:”

“The point is, ladies and gentlemen, that greed, for lack of a better word, is good.

Read More »

Read More »

10-14-24 Wall Street vs. Main Street—Who’s Right?

It's Earnings Season "Rush Week" this week, with the bulk of companies reporting 3rd Quarter results; after that, the stock buy back window is prepared to re-open, providing nearlt $1-T in funds to flood the markets. The median value of stock portfolios is $250k, up from $190k. Demand for AI chips is not going away. Markets entering the seasonallt-strong period of the year after hitting new, all-time highs on Friday, triggering a buy...

Read More »

Read More »

Economy Growing at 3 Percent with Low Unemployment and Job Creation

Economy is cooking at 3%! Unemployment slightly up but historically low. Inflation down. Recent data not recessionary. Keep creating jobs! ?? #EconomicUpdate

Watch the entire show here: https://cstu.io/c219a4

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Economic Growth and High Fed Rates: Is a Huge Rate Cut Necessary?

145,000 new jobs created! With job growth and low inflation, an aggressive rate cut seems unnecessary. Fed rates aligning with economic growth is key. ?? #Economy #JobGrowth

Watch the entire show here: https://cstu.io/a80f84

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Investing Challenges: Quick Corrections and Consistent Market Rises

Managing capital in a market with quick corrections is challenging. Stay alert as the market consistently rises with minimal #investment opportunities. ? #FinancialTips

Watch the entire show here: hhttps://https://cstu.io/11e1f0

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »