Category Archive: 9a.) Real Investment Advice

Key Market Indicators for November 2024

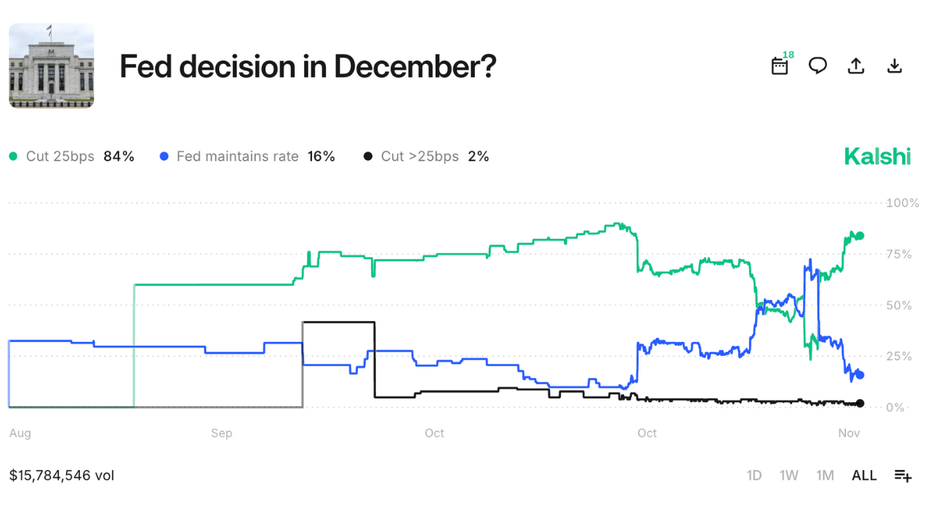

Key market indicators for November 2024 present a complex but opportunity-filled environment for traders and investors. Following the first phase of Federal Reserve rate cuts and growing global uncertainties, the technical landscape suggests several notable shifts. Let’s explore the key market indicators to watch.

Note: If you are unfamiliar with basic technical analysis, this video is a short tutorial.

Seasonality and Breakout...

Read More »

Read More »

10-28-24 Streaks Of Bullish Wins Are Not Sustainable

There is little risk of a bigger near-term correction, currently. However, some things could cause one, like a highly contested election. In the current political environment, such is not a low-probability event. As such, while we remain allocated to the markets, we are closely monitoring the amount of risk we take.

Hosted by RIA Advisors Chief investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Articles...

Read More »

Read More »

How Buyers and Sellers Influence Market Prices

? Understanding market dynamics ? Stay tuned to see how the balance between buyers and sellers influences price fluctuations! #Finance101 #MarketTrends

Watch the entire show here: https://cstu.io/d984d9

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Psychology Influences Asset Selection in Investing

Are you making investment decisions based on psychology or asset selection? ?? Join the discussion on navigating the market challenges! #InvestingTips #Finance101

Watch the entire show here: https://cstu.io/e7411a

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

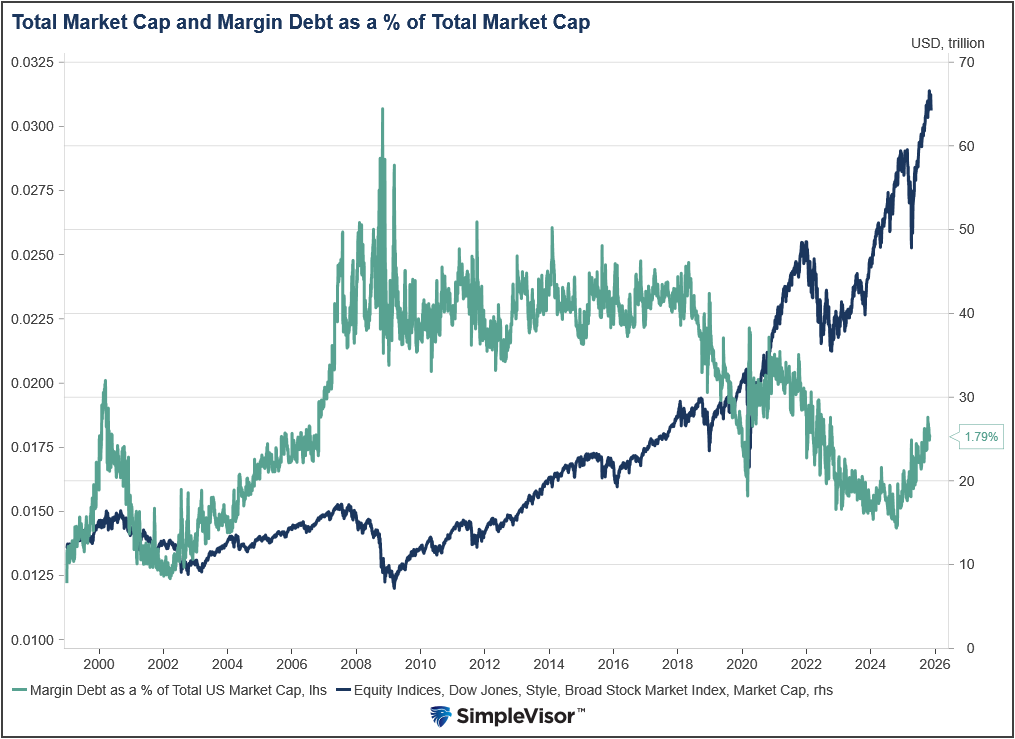

Title: How Money Flow Is Fueling the Market Frenzy

Money flow is driving markets higher, not your thesis. So much money chasing so few assets, creating the everything market! ?? #Investing #MoneyFlow

Watch the entire show here: https://cstu.io/bdde89

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Global Money Supply Boosts Asset Prices Explained

?? Ever wondered why asset prices keep going up? ? It all boils down to the massive flood of liquidity in the global money supply! ?? #Finance101

Watch the entire show here: https://cstu.io/8e45d1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Unusual Impact of Government Spending on Economic Activity

? Exploring the impact of government support on economic activity and consumer confidence! ?? #EconomicInsights #GovernmentSupport #ConsumerConfidence

Watch the entire show here: https://cstu.io/58d8f8

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

10-25-24 Can You Really Afford to Own a Home?

Gold Fish are changing their name to Chilean Sea Bass, and Spam will henceforth be known as Filet Mignon; the world has gone awry, and Richard & Jonathan discuss the surprise results from Tesla, Polymarket odds for the 2024 Election, and goal scooping and setting expectations for 2025. Richard compares the Saudi's newest, biggest building in the world to the Tiny Homes trend, and Gen-Z's housing preferences (No car, no garage = no problem!) The...

Read More »

Read More »

Unveiling Hidden Cash Reserves: Opportunities in Private Capital

?? Ever wondered about all the money sitting in accounts? ? Turns out, there's a lot waiting to be invested! ?? #Investing101 #FinancialTips

Watch the entire show here: https://cstu.io/945a39

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

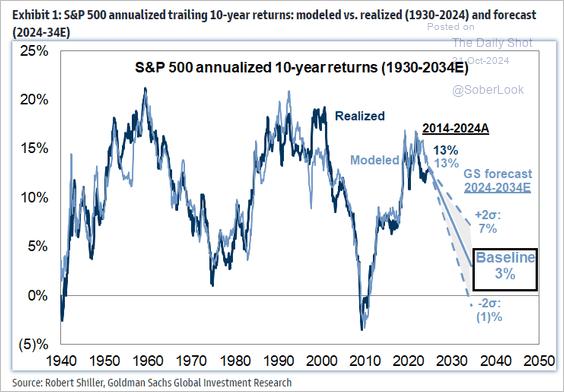

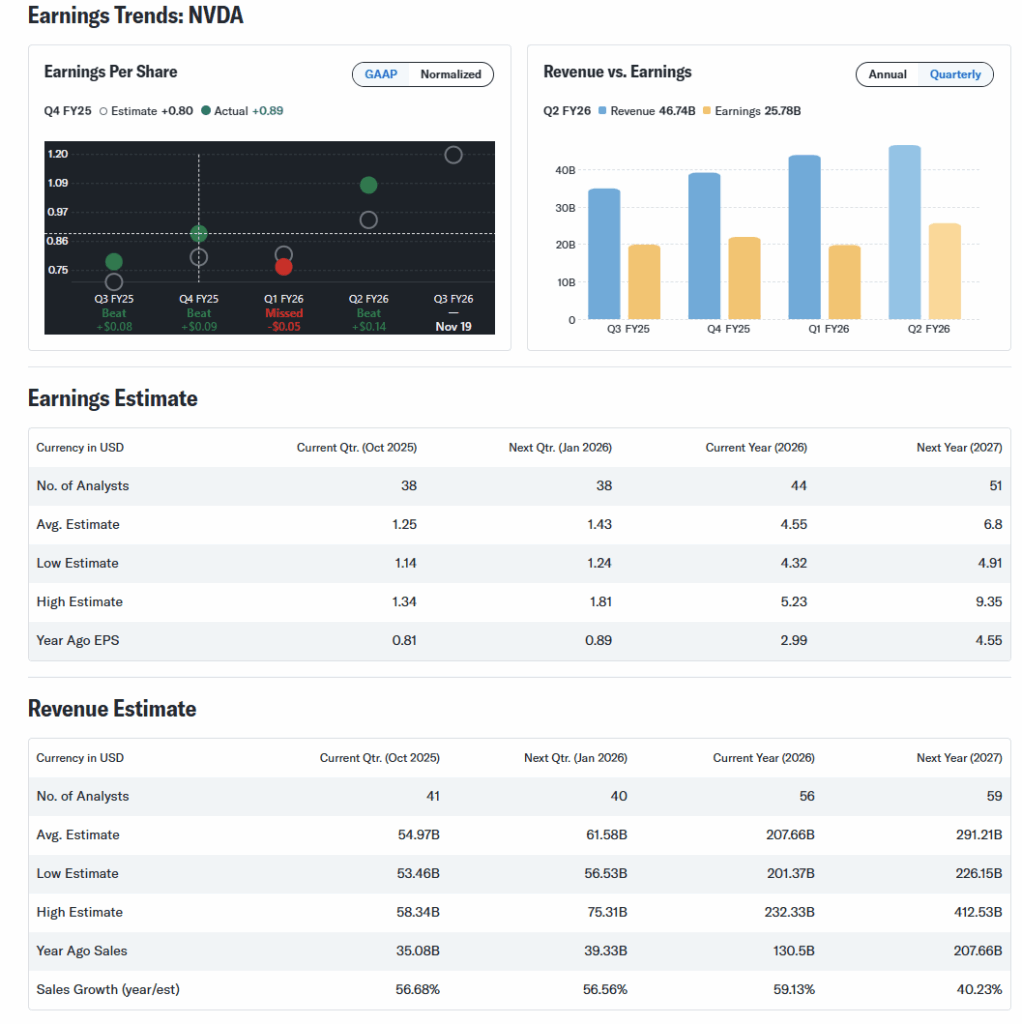

Lower Forward Returns Are A High Probability Event

I was emailed several times about a recent Morningstar article about J.P. Morgan’s warning of lower forward returns over the next decade. That was followed up by numerous emails about Goldman Sachs’ recent warnings of 3% annualized returns over the next decade.

While we have previously covered many of these article’s points, a comprehensive analysis is needed. Let’s start with the overall conclusion from JP Morgan’s article:

“The...

Read More »

Read More »

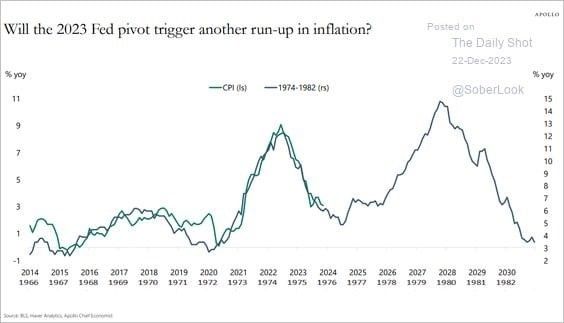

10-24-24 Memory Inflation Warps Bond Yields

The Conference Board's Economic Surprise Index gauges exactly that: How surprised economists are when things don't pan out as they expected. Like the economy doing better than they think it ought, under the current conditions. Economists are setting themselves up for disappointment; more Americans are living paycheck-to-paycheck. Lance and Michael discuss market psychology and a subset of PTSD known as memory inflation: Things were better (or...

Read More »

Read More »

How Fed Funds Rate Decreases Impact Mortgage Interest Rates

?? Wondering how interest rates affect mortgage rates? ? Keep an eye on the Fed funds rate - decreases there usually mean lower mortgage rates too! ?✨ #FinanceTips #MortgageRates

Watch the entire show here: https://cstu.io/5cc709

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

10-23-24 Technical Analysis Primer

As promised, here's the condensed, Director's Cut version of Lance's tutorial Technical Analysis tools he uses at RIA Advisors: Why we use it; keeping it simple. the $SPX & Moving Averages; Rules of Thumb: When markets break, that's an alert to pay attention to; are markets breaking, or is it a dip? Is the break confirmed? Give it time. The Realtive Strength Indicator and MACD tools: Converging or diverging?

SEG-2: Why & How We Use...

Read More »

Read More »

10-23-24 Technical Analysis Techniques

As promised, a show about that voodoo that we do!

(Actually, it's not voodoo, and Lance Roberts will explain why and how).

Markets sold off on Tuesday to break even. following six straight weeks of gains; still, markets have no fear of recession. Lance shares his personal strategy for Bonds (using his own money, not clients') When everyone is hating on Bonds is the time to buy. After the Election, the focus will return to Yields and Interest...

Read More »

Read More »

How Gen Z is Redefining Work-Life Balance and Challenging Hustle Culture

? Time to prioritize self-care and work-life balance! Gen Z leading the way in changing the hustle culture mindset. #selfcare #balance #genz ?♂️?

Watch the entire show here: https://cstu.io/c9ce2b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Memory Inflation Warps Bond Yields

The Mayo Clinic defines Post Traumatic Stress Disorder, or PTSD, as “a mental health condition that’s caused by an extremely stressful or terrifying event — either being part of it or witnessing it.” Within the field of PTSD research is a concept called “memory inflation.” Memory inflation occurs when memories of traumatic events become more intense over time.

Memory inflation of past events amplifies one’s emotions and behaviors. As we will...

Read More »

Read More »

Planning Retirement: Why Counting on 10% Annual Growth Could Be Risky

Are you saving enough for retirement? ? Don't wait too long to start investing! #financialplanning #retirementgoals ?

Watch the entire show here: https://cstu.io/0e9840

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

10-22-24 Is the Stock Market Party Over?

The era of double-digit growth in the stock market may be coming to an end...or is it?

Goldman Sachs strategist David Kostin estimates that the S&P 500 index will deliver an annualized return of 3% over the next decade — well below the 13% returns in the last 10 years, and the long-term average of 11%. Lance Roberts & Jonathan Penn discuss the potential for a market correction in 2024. Would a stock market downturn result from the end of...

Read More »

Read More »

How Lower Interest Rates Are Impacting the Real Estate Market

? Low home sales have created a sudden boom with lower interest rates! Time to refinance and pick up some extras! ? #RealEstate #FinanceTips

Watch the entire show here: https://cstu.io/c52e83

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

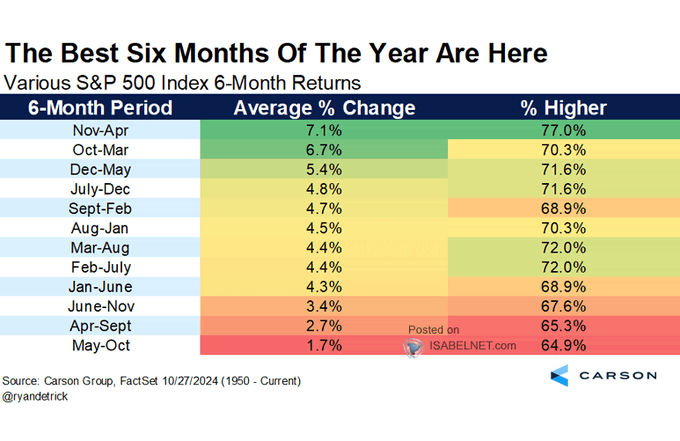

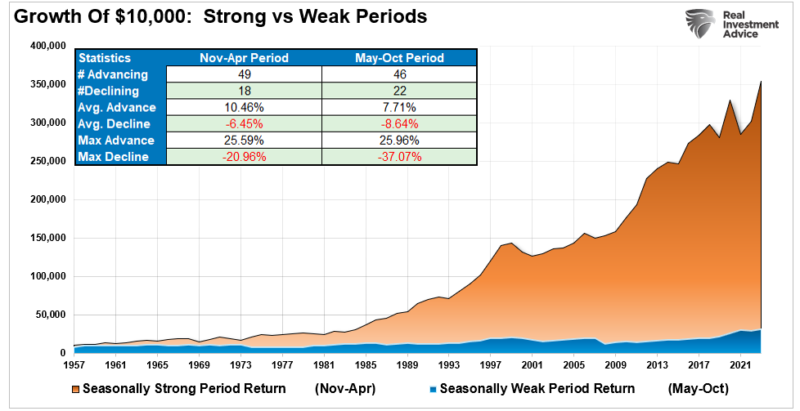

Seasonality: Buy Signal And Investing Outcomes

Seasonality has long influenced stock market trends, offering insights into predictable cycles of strength and weakness throughout the year. Yale Hirsch, the creator of the Stock Trader’s Almanac, is one of the most well-known contributors to studying these patterns. His research has highlighted that certain periods of the year consistently present better opportunities for investors to generate returns, while other times warrant caution.

The...

Read More »

Read More »