Category Archive: 9a.) Real Investment Advice

1-27-25 DeepSeek or Deep Sink?

The unfolding of China's DeepSeek tehnology, and history's shortest trade war (with Colombia) highlighted the weekend. What are the investing opportunities from DeepSeek? Too soon to tell; allow markets to sort it out today, and make no rash moves. What DeepSeek means to markets; what's the differene from AI? Lane ompares the 1960's spae rae to the AI tehnology ompetition today: Is this Ameria's "Sputnik Moment?" Lane provides a onise...

Read More »

Read More »

Advantages of Roth Accounts: Understanding Tax Benefits

Why consider a Roth? ?? The government benefits from taxing now! Learn more about the incentives in my latest video. #FinanceTips

Watch the entire show here: https://cstu.io/c7aaca

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Essential Guide to Tax-Efficient Financial Planning

Tax efficiency is not just a buzzword—it’s a cornerstone of a successful financial plan. Every dollar you save on taxes is a dollar that can be reinvested, saved for retirement, or used to achieve your personal goals. Whether you're planning for retirement, managing investments, or strategizing for future expenses, minimizing tax burdens can make a …

Read More »

Read More »

Strategic Crypto Stockpile And Political Uncertainty

Bitcoin and other cryptocurrencies are hitting record highs partly due to Donald Trump's pro-crypto policies. One such anticipated policy proposal was the establishment of a strategic crypto reserve. Presumably, this would be similar to currency strategic reserves the US holds but would hold cryptocurrencies. The plan, announced Thursday night, calls the strategic crypto holdings a … Continue reading »

Read More »

Read More »

How Consumer Spending Drives Inflation and Economic Growth

Consumer choices impact inflation and economic growth. Buying only necessities could slow down inflation. Interesting insights! ?? #Economics #Inflation

Watch the entire show here: https://cstu.io/b35016

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Federal Reserve’s 2% Inflation Target Explained

Ever wondered why 2% inflation is the target? It's all about the numbers! Check out this explanation. #economics #inflation #finance

Watch the entire show here: https://cstu.io/55daaa

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Inauguration Sends Confidence Surging Higher

Inside This Week's Bull Bear Report January Barometer On Track Last week, we noted that with the first five days of January making a positive return, such set the "January Barometer" in motion. If you missed our previous discussions, we reviewed the historical precedents of "So goes January, so goes the month." “However, even with …

Read More »

Read More »

1-24-25 Using Drone Mentality for Financial Success

Richard and Jonathan discuss markets' response to initial flurry of activity from the Trump White House; commentary on TrumpCoin and turbo-charged crypto: It's all about marketing. Richard reveals his penchant for scratch-offs (with discretionary money). Jeff Bezos, the CEO of Amazon, made big media headlines by suggesting that drones will be used to deliver light packages in the future, as opposed to the normal, albeit boring, methods we know now....

Read More »

Read More »

Choosing Tough Decisions Now for Financial Comfort Later

? Choose the hard button now to make life easier later! Investing wisely takes time and patience, not just luck. #InvestingTips #HardWorkPaysOff ??

Watch the entire show here: https://cstu.io/25607f

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

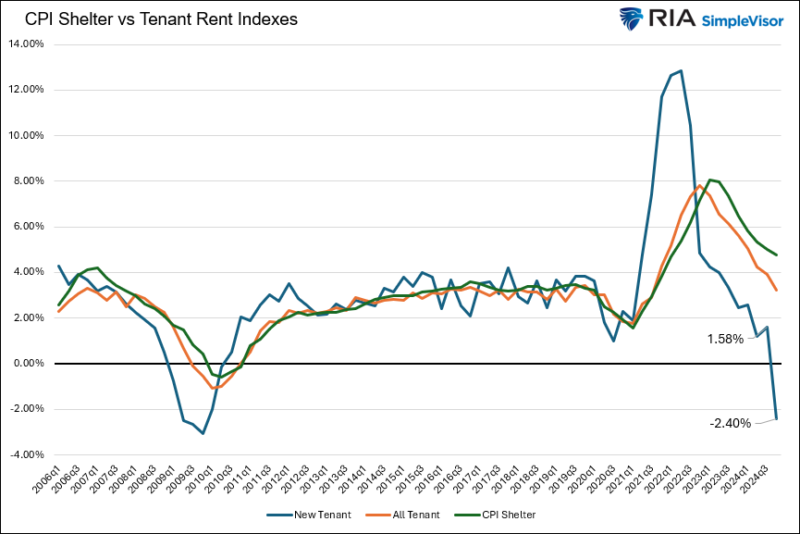

New Tenant Rent Prices Plummet

The latest BLS and Cleveland Fed release of their quarterly new tenant rent index was lower by 2.43% year over year and over 5% from the prior quarter. The sharp rate of decline was surprising. Moreover, the update gives us more confidence that inflation is heading toward the Fed’s 2% target. Unlike CPI shelter prices, … Continue...

Read More »

Read More »

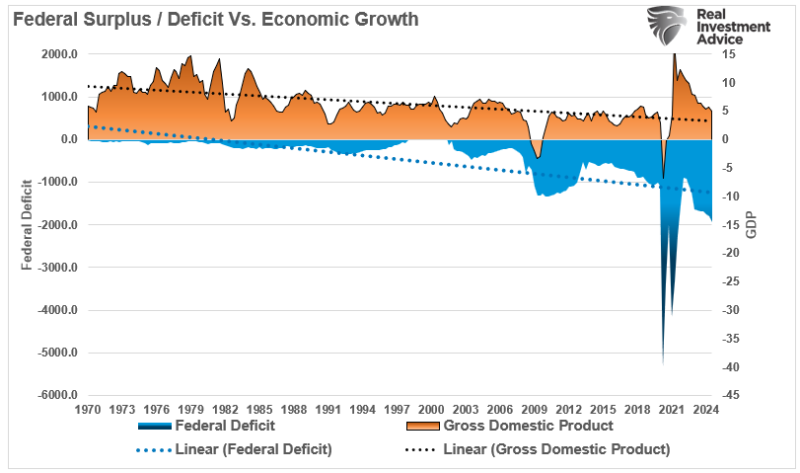

Do Money Supply, Deficit And QE Create Inflation?

I recently debated with Michael Pento, who made an interesting statement that increases in the money supply, the deficit, and a return to quantitative easing (QE) will lead to 1970s-style inflation. The recent experience of inflation in 2021 and 2022 would seem to justify such a view. However, is that historically the case, or was …

Read More »

Read More »

1-23-25 It’s the Dollar, Stupid!

Lance Roberts & Michael Lebowitz discuss the recent strong correlation between the appreciating dollar and rising yields and the reasons for the relationship, covering the US Dollar Impact on Economy, Global Currency Trends for 2025, and

Dollar Strength and Investments. Lance & Mike will also touch on Foreign Exchange Markets Analysis and USD vs Global Currencies.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w...

Read More »

Read More »

Analyzing Tax Implications in Light of New Abilities

? Planning for taxes just got more interesting! Who knows what the future holds? ?? #taxplanning #futureuncertainty #IRSvsERs

Watch the entire show here: https://cstu.io/59949e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Ultimate Guide to Income Planning in Retirement

Retirement is a time to enjoy the results of years of hard work and saving, but ensuring you have enough income to maintain your lifestyle is a challenge that requires careful planning. Effective retirement income planning focuses on creating a sustainable retirement income strategy that balances guaranteed income sources, investment growth, and the need to …

Read More »

Read More »

The Tariff Rollercoaster

With Donald Trump now officially President, we will learn which campaign promises were rhetoric and negotiating tactics and which he plans to enact. For many economists and nations, tariffs are at the top of the list of importance. China, in particular, closely followed by Canada and Mexico, appears to be at the most risk of … Continue...

Read More »

Read More »

Essential Tips for Creating Cash Flow and Savings for Beginners

Investing tip: ? Want to start investing? It's about creating cash flow, savings, and building wealth, not just throwing a dollar into the S&P! ?? #InvestingTips

Watch the entire show here: https://cstu.io/49f2e4

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

1-22-25 Are Return Expectations For 2025 Too High?

It isn’t just Wall Street analysts who are optimistic about 2025 returns. Retail investors are the most optimistic about higher stock prices in 2025 by the most on record. Unsurprisingly, that sentiment resulted in the psychological rush to overpay for assets, pushing forward 1-year valuations sharply higher.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Watch today's...

Read More »

Read More »

Meme Coins Transfer Wealth Not Create It

A reader of Tuesday's Daily Commentary made a very astute comment. The title of the Commentary was "Trump Meme Coin Creates Billions Out Of Thin Air." It doesn’t create anything… It transfers He is 100% correct. Meme coins and other forms of cryptocurrency do not create dollars. They transfer dollars from one person or entity …

Read More »

Read More »

Its The Dollar Stupid

Our recent article, Why Are Bond Yields Rising, explains that the recent 1% increase in yields, as shown below, is almost entirely due to negative sentiment. As we wrote, the bond market calls sentiment the term premium. Of the 1% yield increase, only 10% is due to fundamental factors, leaving 90% a function of bond … Continue reading »

Read More »

Read More »

Enhance Portfolio Stability with Growth to Value Rotation Strategy

? Understanding market rotations is key! Shifting from growth to value can lower portfolio volatility. Diversification is key! #InvestingTips ?✨

Watch the entire show here: https://cstu.io/29386c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »