Category Archive: 9a.) Real Investment Advice

10-2-24 Shutdown, Strikes, & Volatility: Safeguarding Your Portfolio Now

A brief recap of the VP-debate; market futures are lower in search of a catalyst, and dislike the uncertainty preceeding an election. Markets have pulled backk thanks to investor exhaustion; Oil prices are on the rise amid escalation of hostilities in the Middle East, creating short-term risks until resolved. The Port Strike isn't 'the thing' that will trigger markets. Look for alternative shipping as opportunities to invest (Daggett makes Jimmy...

Read More »

Read More »

Is Inflation Really High? The Role of Housing and Healthcare

Did you know that inflation is only 1.2% without healthcare and housing costs factored in? ? Interesting insights on insurance and rent stability! #economy #inflation

Watch the entire show here: https://cstu.io/76c014

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

A Crystal Ball Isnt Enough: The Importance Of Context

On September 18, 2024, the headlines read the Fed cut the Fed Funds rate by 50 basis points. At first blush, one would think that a trader with a crystal ball a couple of days before the Fed action would buy bonds and lick their chops over the money they would soon make. In this case, the crystal ball was a curse.

Bond yields rose following the rate cut despite what many investment professionals perceive to be a bullish event. If you scour the...

Read More »

Read More »

10-1-24 How Long Can the ‘Everything Market’ Last?

It's a big news week: The Dock Workers' strike has begun, Israel is launching a land assault into Lebanon, and celebrity deaths (Pete Rose, Kris Kristofferson) top the news. And Jimmy Carter turns 100. Meanwhile, Q3 Earnings Season commences after three very strong quarters of business in what has been one the of the best presidential years since the 1950's. A correction at this point would be healthy for markets. We think there will be a 3- to 5%...

Read More »

Read More »

How to Effectively Time an ETF for a Volatility Spike

Timing is key when trading ETFs for volatility. Just like options, trade strategically to avoid erosion of returns. ?? #TradingTips #ETFs

Watch the entire show here: https://cstu.io/efe548

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

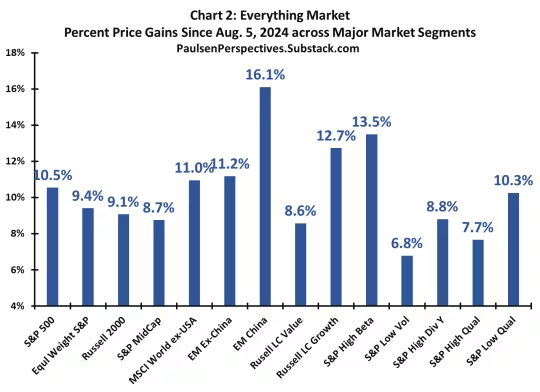

The “Everything Market” Could Last A While Longer

We are currently in the “everything market.” It doesn’t matter what you have probably invested in; it is currently increasing in value. However, it isn’t likely for the reasons you think. A recent Marketwatch interview with the always bullish Jim Paulson got his reasoning for the rally.

“It is this cocktail of ‘full support’ at the front end of a bull market which commonly has created an ‘Everything Market’ during the early part of a new bull....

Read More »

Read More »

9-30-24 Navigating A Confidence Dichotomy

The last day of September brings the end of the month, end of the quarter, and a preview of the next round of corporate earnings. So far, no evidence of recession is appearing. Regardless of your investment thesis, money flow still matters most, and there's lots of money flowing into markets. China is most over-bought in years, thanks to Chinese government stimulus. Earnings outlooks will matter going forward. Oil prices are getting thrashed, with...

Read More »

Read More »

Cut Spending Now: Focus on What You Can Control

Governments should focus on reducing spending and controlling costs by investing in projects better suited for private funding. ? #FinanceTips #SmartInvesting

Watch the entire show here: https://cstu.io/755f0a

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding S&P Yields: Avoiding High-Risk Investment Traps

Building wealth step by step ? Setting realistic goals and working towards them! #FinancialSuccess #MoneyGoals

Watch the entire show here: https://cstu.io/8d6e2b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Hidden Dangers of Comparing Investments to Indexes

Avoid tracking indexes over time! Brokerage firms benefit from your trades, not you. Money in motion creates fees.

Watch the entire show here: https://cstu.io/e9bf37

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-27-24 Is Micro-Retirement Right for You?

Jonthan & Jonathan stand in for Danny & Rich with a preview of today's PCE report, and inklings of dissent within the Fed on the latest rate cut. The handwriting is on the wall for Savers; time to reassess strategies as interest rates fall. Ho will the election outcomes affect your financial planning? Worst-case scenario: a contested election (the markets hate uncertainty). With the ebb and flow of markets, we make adjustments on the fly,...

Read More »

Read More »

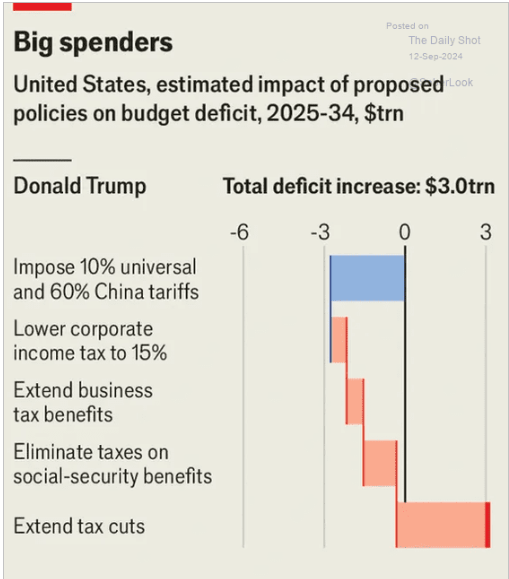

Tax Cuts – An Examination Of The 2017 TCJA Impact

An analysis of Presidential Candidate Trump’s policy proposals recently suggests that tax cuts will increase the deficit. While the raw analysis is correct, as it subtracts the potential for reduced tax collections from the tariff revenue, it ignores the impact on economic growth.

There is much rhetoric about the impact of tax cuts, mostly centering around “only benefitting the rich.” While it may seem that “the rich” are the ones who...

Read More »

Read More »

Differences Between Dividends and Buybacks: What Every Investor Should Know

? Understanding dividends vs buybacks! ?? Dividends = return of capital ? Buybacks = no return to you ? #Investing101 #FinancialLiteracy

Watch the entire show here: https://cstu.io/27237a

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-26-24 Bull Steepener Alert: How Agency REITs Can Supercharge Your Portfolio

Plenty of things to move markets this week, including economic numbers and multiple Fed members' commentaries on why they did what they did last week. Are there more cuts to come? Millennial Earnings Season and no buy backs will impact markets soon. Is the AI trade dead? Don't count on it. Micron turned in a strong earnings report, and the CIA's own AI investments(?) are doing verrry well. Markets' short term Cup & Handle formation confirmed...

Read More »

Read More »

Master Basic Technical Analysis to Understand Market Movements

Want to understand technical analysis? Learn the basics like moving averages, RSI, and MACD. It's like a window into the market activity! ?? #StockMarket

Watch the entire show here: https://cstu.io/5314f7

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-25-24 Rate Cuts & Recession Fears: Will Politics Drive Your Portfolio Off a Cliff?

Could the S&P hit 6,000 by the end of the year? Some prognosticators are saying so, hyped on exuberance, but consumer confidence is suggesting otherwise, and the foreshadowing is not great for the White House incumbent. Consumer spending & sentiment is incongruent with market expectations. Markets remain bullish, and another "Cup & Handle" formation has appeared, suggesting higher market prices in 2025. Markets, however, are...

Read More »

Read More »

Agency REITs For A Bull Steepener

In our recent two-part series on the yield curve (Part One Part Two) we discussed the four predominant yield curve shifts and what they imply about economic activity and monetary policy. Additionally, given the current bullish steepening trend of the yield curve, we provided data on how prior bull steepening environments impacted various stock indexes, sectors, and factors. Missing from our analysis was a discussion of a specific type of REIT...

Read More »

Read More »

How Expiring Tax Cuts Affect Federal Revenue and You

Tax cuts expiring soon can hit many individuals hard. Are fair shares paying most taxes? Stay informed! ?? #taxes #government #finance

Watch the entire show here: https://cstu.io/77daa3

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-24-24 Who Benefits Most from the Latest Fed Rate Cut?

Oil prices conitnue to weaken in the face of optimism from analysts now forecasting an 18% gain in earnings in 2025. One of them is wrong. Lance and Jonathan discuss market clarity, Fed rate cuts, and the impact on the markets. Markets trade on the effective Fed rates; what's the sweet spot among market sectors when rates are coming down? Lance reviews Gold behaviors during rate cutting cycles; big surges in Gold lead to longer-term bases. Why the...

Read More »

Read More »

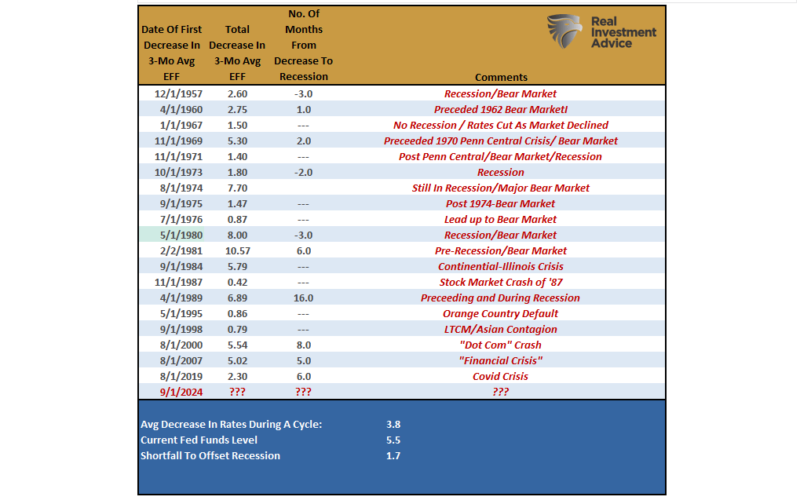

50 Basis Point Rate Cut – A Review And Outlook

Last week, the Federal Reserve made a significant move by cutting its overnight lending rate by 50 basis points. This marks the first rate cut since 2020, signaling the Fed is aggressively supporting the economy amid a backdrop of softening economic data. For investors, understanding how similar rate cuts have historically impacted markets and which sectors tend to benefit is key to navigating the months ahead.

In this post, we will explore the...

Read More »

Read More »