Category Archive: 9a.) Real Investment Advice

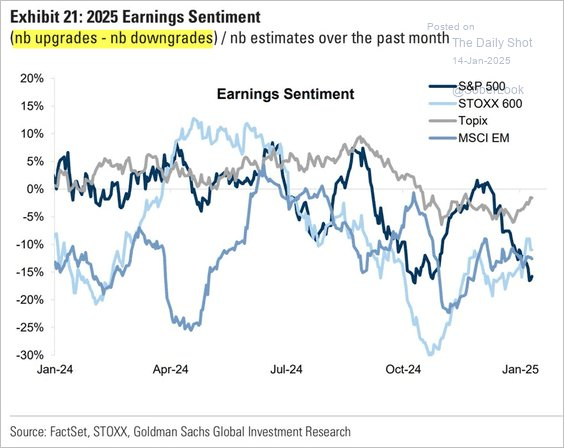

Are Return Expectations For 2025 Too High?

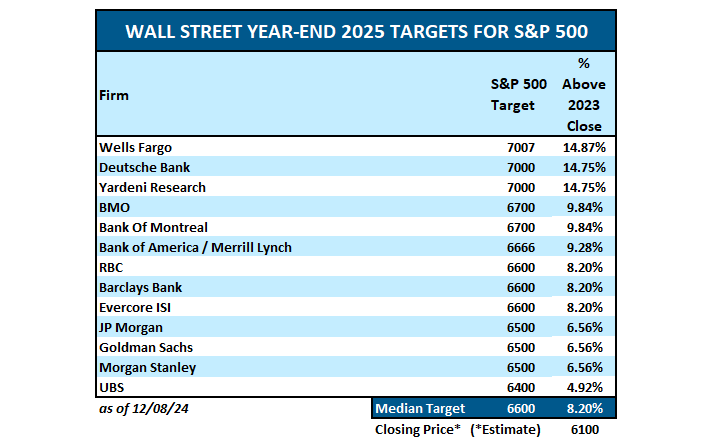

In a recent post, I discussed Wall Street's return estimates for 2025 for the S&P 500 index. To wit: "We have some early indications of Wall Street targets for the S&P 500 index, and, as is always the case, they are optimistic for the coming year. The median estimate is for the market to rise … Continue reading »

Read More »

Read More »

Trump Meme Coin Creates Billions Out Of Thin Air

With markets closed over the long holiday weekend and Donald Trump's inauguration and related politics taking center stage, no one thought the financial markets would make the headlines. They did. On Friday night, Donald Trump launched the largest meme coin in history. A meme coin is a cryptocurrency based on a meme. Like a baseball …

Read More »

Read More »

Strategic Investing Guide: Buying Beaten Stocks for Long-Term Gains

Investing tip: When stocks are down, it could be a good time to buy! Have a solid reason for each investment in your portfolio. ?? #InvestingTips #StockMarket

Watch the entire show here: https://cstu.io/2e3374

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

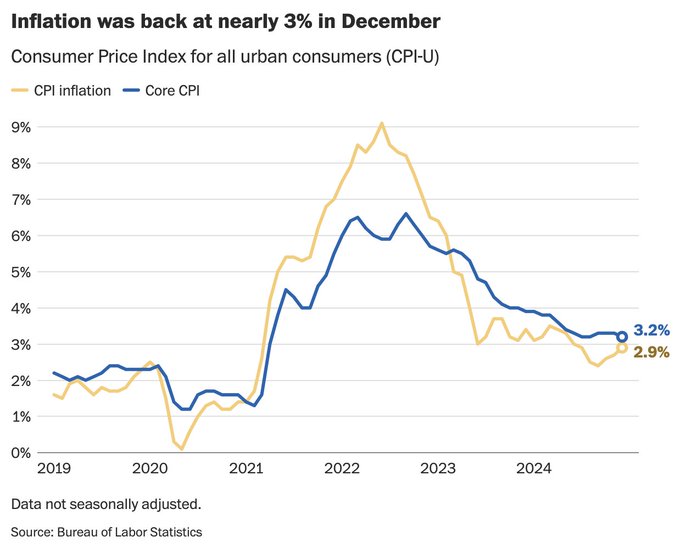

Was CPI Better Than Good

The latest CPI inflation news was OK. The 0.4% headline increase is higher than in prior months but aligns with expectations. Core CPI, excluding food and energy, is .1% lower than the consensus at .2%. The report relieved Wall Street as it did not show a resurgence in inflation. Stocks and bonds are trading much … Continue reading »

Read More »

Read More »

Estate Planning Essentials: Protecting Your Legacy

Creating an estate plan is a critical step in protecting your legacy and ensuring your assets are distributed according to your wishes. Estate planning essentials like wills, trusts, and beneficiary designations provide clarity for your loved ones while safeguarding your financial legacy. Whether you have a large estate or modest assets, an effective plan can …

Read More »

Read More »

Optimize Your Portfolio for Consistent Investment Success: Key Strategies and Tips

Diversification is key! Make sure a significant chunk of your portfolio is active in the market to grow your assets while you wait. ?? #InvestingTips #GrowYourWealth

Watch the entire show here: https://cstu.io/b7f9ab

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Strategic Loss Management for Optimal Gains

Offsetting losses with gains, managing trends effectively! ? #financialtips #investing #moneymanagement

Watch the entire show here: https://cstu.io/14d96c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Should Social Security Be Tax-Free? Examining Fairness

Why should I pay taxes on Social Security when I've already paid in? That money should come back tax-free! Double taxation isn't fair. #taxes #SocialSecurity

Watch the entire show here: https://cstu.io/705d46

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

1-17-25 What Fiduciary Advisors Can Learn from Jimmy Carter

The nation recently laid to rest former President Jimmy Carter who died at age 100. While his Presidency is still being measured by history, there is no dispute over the noble life he lived following his term as our 39th Commander-in-Chief. Richard and Matt glean important lessons from his sense of public fiduciary, as well as discuss the current state of stocks vs bonds in a new rate environment. Why the Fed doesn't need to cut rates, and a look...

Read More »

Read More »

Gardening Guide To Better Portfolio Returns In 2025

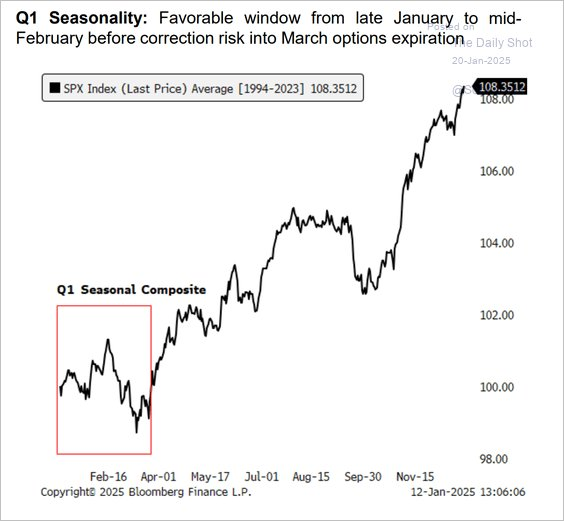

As we head into 2025, investors are giddy over the market returns of the last two years. As shown, the annual returns, while elevated, have come with only average volatility along the way. However, while most analysts and investors expect 2025 to be another bullish year, there is always a risk of a more disappointing …

Read More »

Read More »

Technical Bounce On Inflation Data

Inside This Week's Bull Bear Report Administrative Note I am publishing the report a day early as we are holding our Economic and Investment Summit tomorrow morning. As such, all the data in this report is either as of Thursday’s close or early Friday morning. Therefore, any erroneous conclusions will be corrected in Monday’s Daily …

Read More »

Read More »

Bond Vigilantes Are Building Tremendous Short Positions

Our Commentary from January 7, Outflows Of TLT Are Tremendous, discussed the 'tremendous' investor outflows of the bond ETF- TLT. While outflows are often associated with investors being bearish, that is not always true. Nonetheless, TLT is in a bearish trend, and indeed, some of the record outflows from TLT are due to the environment. …

Read More »

Read More »

Fed’s Restrictive Policy: Perception vs. Economic Reality

Interesting discrepancy between Fed's view on policy and the real economy. Credit card usage as a key indicator. ?? #Economy #Fed #Policy

Watch the entire show here: https://cstu.io/347dd5

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

1-16-25 CPI: What’s Next?

Lance and Michael interpret the latest CPI, PPI, PCE, and GDP numbers: Which one is most-meaningful to the Fed? Earnings Season continues with Big Banks reporting; JPMorgan kills it, but how are regional banks faring? Stock buy backs this time around are expected to exceed $1-Trillion. mostly benefitting large cap stocks. Markets cling to 100-DMA, and aim for the 50-DMA to set up to rally. Michael discusses portfolio management, and Lance previews...

Read More »

Read More »

The Impact of Healthcare Costs on Retirement Planning

Retirement planning often focuses on saving and investing for daily living expenses, but healthcare costs can significantly impact your financial security. With longer lifespans and rising medical expenses, preparing for healthcare costs in retirement is essential. This guide explores projected healthcare expenses, the role of Medicare and supplemental insurance, and strategies for managing retirement healthcare …

Read More »

Read More »

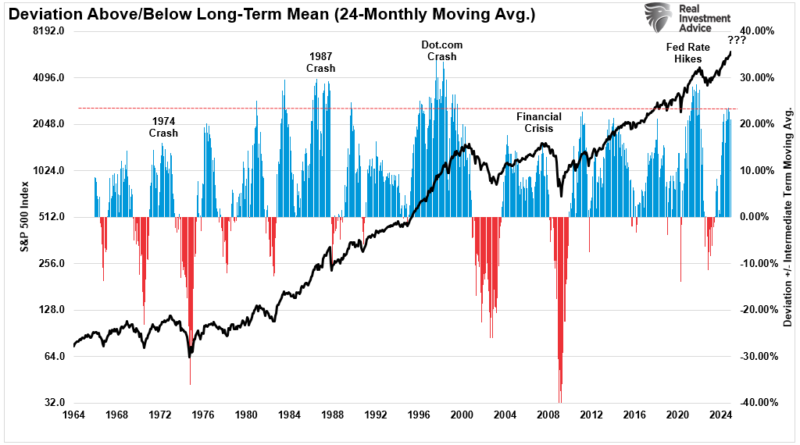

The Trump Bump And Dump

On Monday, the S&P 500 officially made a round trip back to the same levels as election eve. The equity rally that kicked off when Donald Trump won the election has been erased. The financial media blames the recent dump on prospects for wide-reaching tariffs and other policies. The reality is that higher bond yields … Continue reading...

Read More »

Read More »

1-15-25 CPI Day: The Big Reveal

With inflation at the wheel, driving the current economic narrative, the Consumer Price Index release, out this morning at 7:30 a.m. CT, is the week's headline event — and its results could ripple throughout the markets. Lance Roberts and Danny Ratliff discuss the CPI Report for January 2025 with Consumer Price Index Analysis, a look at Inflation Trends for 2025, the

Federal Reserve, and CPI Data. Economic Indicators January 2025December's data is...

Read More »

Read More »

How Rising Interest Rates Affect Hedge Funds and Bond Markets

Rising interest rates lead to hedge funds shorting bonds, driving prices down and rates higher. The cycle continues. #Finance101

Watch the entire show here: https://cstu.io/b62b7d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

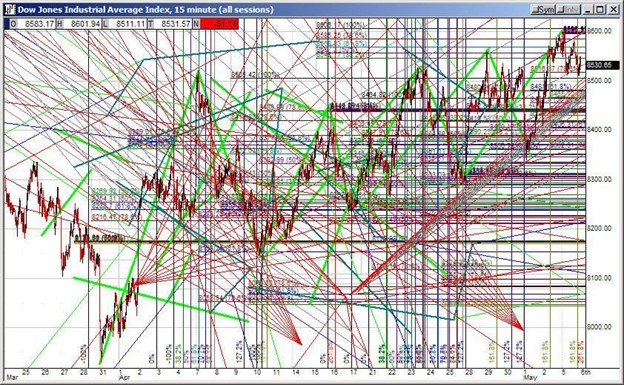

Technical Analysis Is Not Voodoo, Its Vital Context

If you draw enough lines on a stock chart, one of them is bound to predict the future accurately! Given that technical analysis is perfect in hindsight and flawed in foresight, many investors mock it as arbitrary. Some, like Aaron Brown, link its practice with horoscopes, tarot cards, and crystal balls. The difference between science …

Read More »

Read More »

The Inflation Narrative Versus Reality

Fed rate cuts, tariffs, deficits, California wildfires, and other narratives bolster a growing concern that inflation will surge again. While those narratives are concerning, and some may have merit, market and survey-based inflation expectations do not confirm them. The Fed and almost all economists use two types of gauges to measure inflation expectations: surveys and …

Read More »

Read More »