Category Archive: 9a.) Real Investment Advice

Bond Yields May Plummet: Five Potential Catalysts

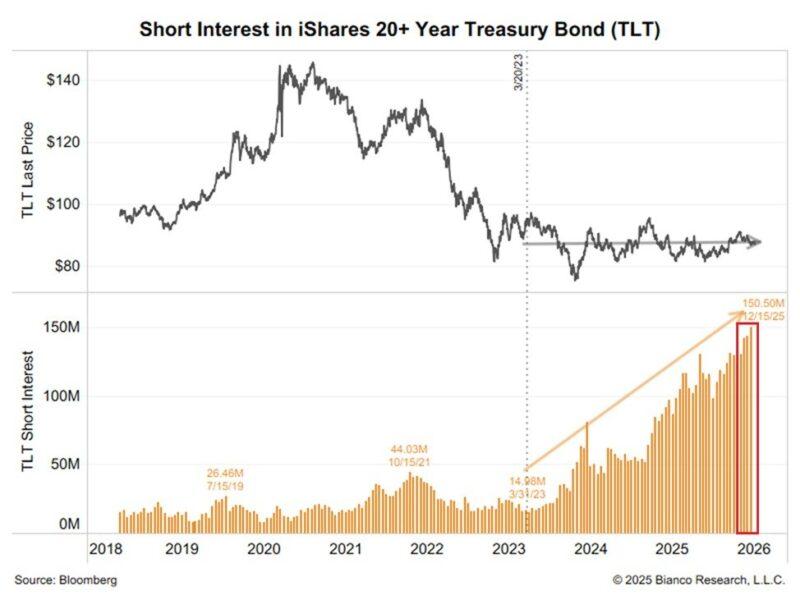

The top graph below, courtesy of Bloomberg, shows that the price of TLT, the 20+ year Treasury bond ETF, has been drifting sideways for the last couple of years. Often, when a security trades in a tight range over an extended period, as we see with bonds currently, a breakout from the range can be … Continue...

Read More »

Read More »

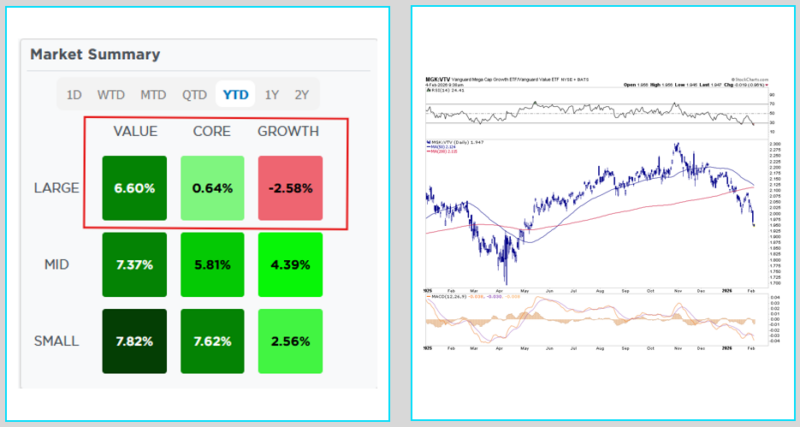

The Value Rotation Illusion

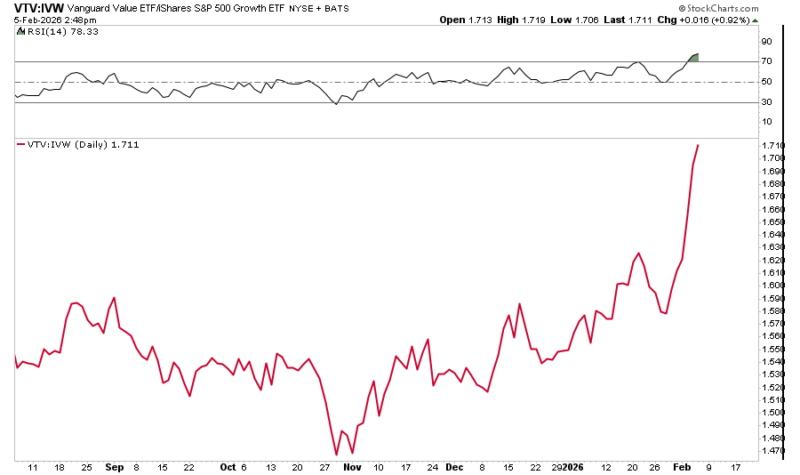

“Value is back in vogue”, the media claim. Investors are rushing out of the high-flying mega-cap tech stocks and into the boring staples, utilities, and healthcare stocks. Given the huge outperformance of value stocks versus growth stocks, it appears investors are going all in on the value rotation. What some of these investors don’t know …

Read More »

Read More »

2-10-26 Opportunities Emerge at Maximum Fear, Not Peak Optimism

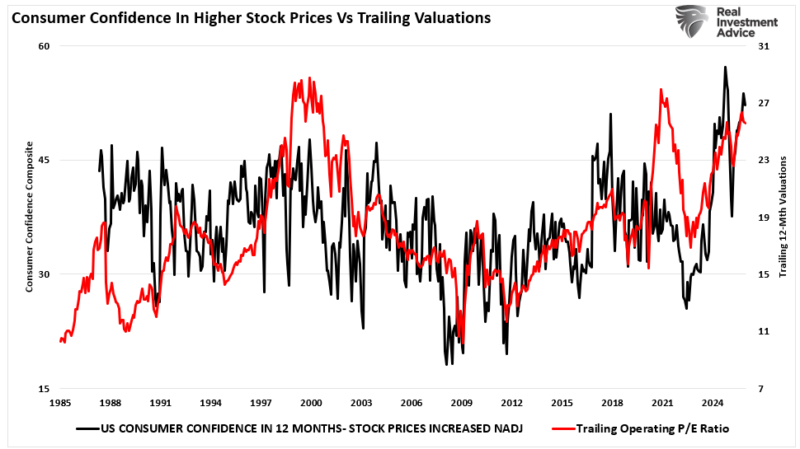

Markets swing between hype and panic, and investors often get trapped by both.

When prices rise, narratives justify overpaying; when prices collapse, fear convinces people assets are going to zero.

In reality, markets rarely move in extremes forever.

The best opportunities tend to appear when fear is highest, not when optimism is loudest, which is why disciplined, fundamentals-focused investors look for value during selloffs rather than...

Read More »

Read More »

2-10-26 Duct Tape & WD-40 Your Portfolio Together

Markets rallied back into positive territory today, but the real risk-management lesson isn’t the chart—it’s behavior. Lance Roberts & Jon Penn unpack the “WD-40 & Duct Tape” framework: WD-40 reduces emotional friction when headlines and volatility try to lock up decision-making, and duct tape is the discipline that keeps your portfolio plan intact (allocation, diversification, rebalancing rules, time horizon, liquidity).

We also hit...

Read More »

Read More »

Sanae Takaichi And The Yen Carry Trade

In a blog last week titled Japan Is Normalizing: Risks To The Yen Carry Trade, we discussed Japan's path to economic normalization and how it might affect a great source of global liquidity, the yen carry trade. A week after publishing the article, Japan had a stunning election. As a result, its new Prime Minister, … Continue...

Read More »

Read More »

Rallies Can Be Exit Traps After Selloffs

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More....

Read More »

Read More »

2-9-26 Technology Stocks: Dead… or the Next Opportunity?

Technology stocks started February on the back foot as volatility spiked and leveraged trades unwound across markets—crypto first, then metals, then equities. The key question: is this a real breakdown in tech leadership, or a mechanical liquidation that’s creating selective opportunity?

0:00 - INTRO

0:19 - Superbowl Recap & Looking for BLS & CPI

4:41 - More Trapped Longs & Volatility to Come

10:38 - Market Volatility May not Be Over...

Read More »

Read More »

Software Or Staples?

As we wrote in yesterday's Commentary, efficiently rotating between overbought and oversold sectors, factors, or stocks is a well-established method for outperforming markets. Like any strategy, the hard part is timing, or properly estimating when a pair of sectors, factors, or stocks is about to reverse their respective trends. Currently, there is a massive divergence …

Read More »

Read More »

Speculative Narrative Unwinds

For nearly two years, markets were driven by the same speculative narrative that "this time is different.” Bitcoin, precious metals, and AI-linked equities rose not only because of robust fundamentals, but also because investors clung to powerful narratives about inflation, disruption, and monetary collapse. Those speculative narratives are not only seductive but also contribute to …

Read More »

Read More »

2-7-26 The Rise of Passive Flows and What It Means for Returns

For the past 15 years, shallow dips and fast recoveries taught investors that risk management doesn’t really matter. That complacency won’t last forever.

Markets may stay supported this decade by liquidity, speculation, and passive flows, but the longer term points to more volatility and lower returns.

ETF growth funnels capital into the same stocks, creating a performance-chasing loop.

As assets become financialized, arbitrage compresses...

Read More »

Read More »

Technology Stocks: Dead Or An Opportunity?

🔎 At a Glance 🏛️ Market Brief - Market Volatility Returns Markets stumbled into February, a historically weak month. February tends to deliver modest returns, with average performance trailing the stronger gains typically seen in January and March. Seasonal tailwinds, such as earnings season and new-year fund flows, begin to fade, while macro headwinds, such …

Read More »

Read More »

2-6-26 Skate to Where the Money Is Going Next

Most investors lose money by chasing whatever narrative is hot, whether it’s $SLV or $MSTR.

Real investing is about anticipating where capital will rotate next and building positions gradually, not trying to time exact bottoms or going all in.

Start small, size positions wisely, and let rotations work in your favor.

In this short video, Lance Roberts & Michael Lebowitz discuss why fundamentals matter more than headlines, and being early...

Read More »

Read More »

2-6-26 This Inflation Signal Says “Trouble in Paradise”

Real-time inflation (Truflation) data is signaling sub-1% inflation, and historically CPI and PCE tend to follow it lower with a short lag. That puts pressure on hawkish policy narratives.

At the same time, consumer spending is staying elevated while incomes are flat and savings have fallen to stressed levels.

In this short video, Lance Roberts & Michael Lebowitz discuss the risk of a growing disconnect between the reflation narrative and...

Read More »

Read More »

2-6-26 The Wealth-Health Gap

Why do wealthier households tend to live longer and experience fewer chronic diseases? Richard Rosso & Jonathan McCarty break down the Wealth-Health Gap—how income, savings, and environment shape health through housing quality, access to care, and financial resilience. We also flip the lens: poor health can reduce earnings, drain savings, and create a vicious cycle that widens disparities across generations. Finally, we discuss systemic factors...

Read More »

Read More »

Value or Growth Is Not A Debate, Its An Opportunity

At the start of 2026, we introduced our Factor Rotation Model. The model summary below was posted in SimpleVisor: We launched a new model on January 2nd called the Factor Rotation Model. Historically, the performance of value and growth factors relative to the S&P 500 exhibits a strong negative correlation. Michael Lebowitz provided an overview …

Read More »

Read More »

The Reflation Narrative

The market got off to a strong start in 2026, with investors chasing industrials, materials, and commodity-related stocks as the reflation narrative gained traction. The "reflation narrative" is the belief that a range of policies will boost the rate of economic growth in the U.S. without triggering inflation. As I discussed at our recent 2026 …

Read More »

Read More »

2-5-26 Truflation vs CPI: What Inflation Is Really Doing Today

Is inflation actually cooling—or just being measured differently?

Lance Roberts & Michael Lebowitz break down Truflation’s real-time inflation readings (built from millions of point-of-purchase prices across multiple providers) versus the official CPI/PCE framework, which relies far more on surveys and sampling.

We’ll also address the big caveat: neither CPI/PCE nor Truflation perfectly captures what you feel “in the shops,” because...

Read More »

Read More »

Eli Lilly Shares Boosted BY GLP-1s

On Wednesday, Eli Lilly, the largest holding (15%) in XLV, the State Street healthcare sector ETF, reported earnings well above expectations, and its shares initially rose by 10%. Its fourth-quarter adjusted EPS of $7.54 easily beat the consensus estimate of $6.98. Further boosting Eli Lilly shares, its revenue surged 43% to $19.29 billion, almost $1.5 …

Read More »

Read More »

2-4-26 AI Isn’t Killing Software-As-A-Service — The Market Narrative Is

AI is pressuring software margins, but the market has pushed this narrative to an extreme.

Just like past cycles, investors are extrapolating disruption into total collapse.

SaaS stocks $IGV are now deeply oversold, with many down 40–60% $NOW $CRM and valuations near cycle lows.

Some companies will fail, but the entire sector won’t disappear.

Stepping away from the hype and analyzing businesses—not headlines—is how real opportunities begin...

Read More »

Read More »

2-4-26 Q&A Wednesday: Your Questions, Real Answers

Today’s live YouTube Chat Q&A covers the full spectrum—earnings season takeaways, the selloff-to-rebound pattern, and the big debate around Big Tech, AI, and margins. We walk through where tech and AI leadership stand now, whether AI is pressuring software profitability, and the “real world” constraint markets may be underpricing: power demand (including what ERCOT could mean for data-center expansion).

We also hit the energy transition...

Read More »

Read More »