Category Archive: 9a.) Real Investment Advice

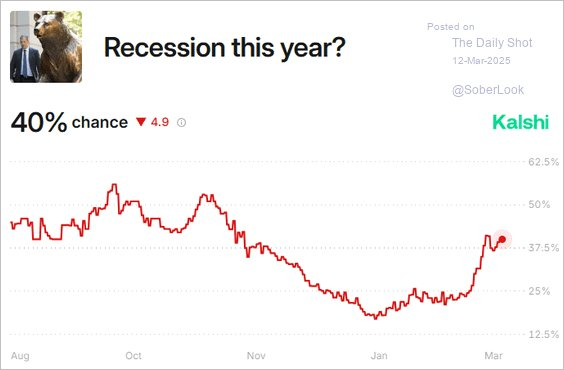

U.S. Recession Risks Not As High As The Media Suggests

U.S. recession risks have been a headline over the last few weeks as the markets sold off. "Goldman Sachs and Moody’s Analytics in recent days joined forecasters raising alarm about the increased likelihood of an economic downturn.

Read More »

Read More »

The Role of Dividend Investing in Generating Passive Income for Retirement

Building a secure retirement requires a reliable stream of income that can support your lifestyle without depleting your savings too quickly. A dividend investing strategy offers a way to generate passive income in retirement, providing consistent cash flow while preserving capital. In this article, we’ll explore how dividend-paying stocks can help retirees create sustainable income, …

Read More »

Read More »

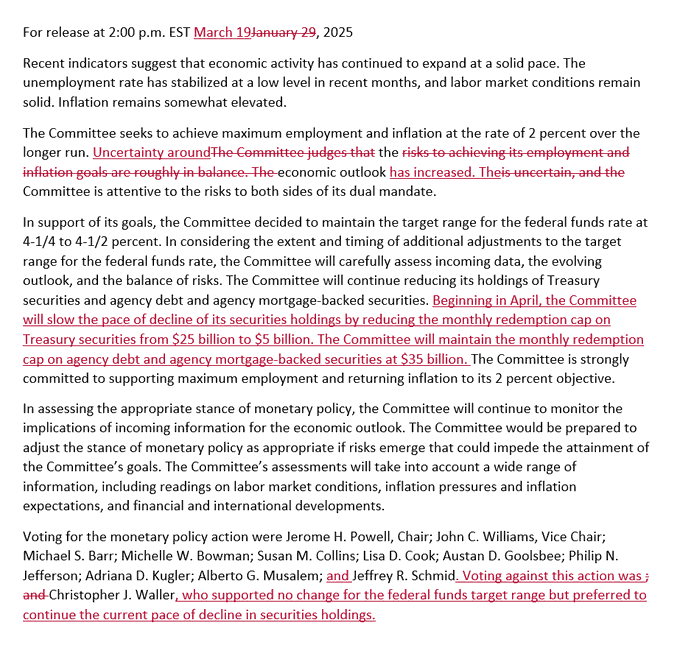

The FOMC Shifts To A Dovish Tone

As the market widely expected, the FOMC left the Fed Funds rate unchanged. However, the statement summarizing the meeting now includes an economic growth warning- "uncertainty around the economic outlook has increased." Moreover, they are reducing the amount of monthly QT. The roll-off of Treasury securities will fall to only $5 billion monthly, down from …

Read More »

Read More »

3-19-25 Recession or Slowdown?

UCLA issues its first "Recession Watch" since the 1950's as the media hype ramps up ("If it bleeds, it leads.") Fed meeting preview: No rate cut expectations, but comments regarding Quantitative Tightening will be key for markets. Tuesday's sell off part of the process of markets' finding a bottom. Bonds continue to provide a hedge against stocks. Lance and Danny discuss Lance's demise and how to provide important instructions...

Read More »

Read More »

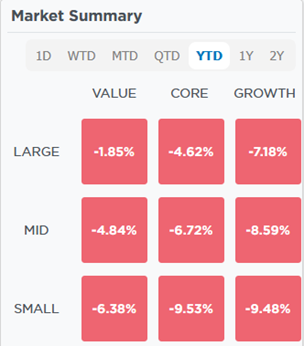

Growth To Value: Which Rotation Is Next?

The Magnificent Seven and many other large-cap growth stocks were among the winners in 2024. However, in 2025, investors are shunning the largest market cap growth and highest-beta stocks and moving into value, particularly large-cap value. Shifting investor preferences to large-cap value from large-cap growth and high beta provides an excellent example of sector and …

Read More »

Read More »

The Sentiment Bark Is Worse Than The Market’s Bite

The old saying that the bark is worse than the bite is a good description of the current state of the stock market and investors' sentiment. The following quote from a recent Commentary and our most recent article (summarized and linked below) point to the unusually poor sentiment. The AAII retail investor survey is now …

Read More »

Read More »

Managing Risk in Volatile Investments with a 5 Percent Portfolio Strategy

📈 Understanding recoverable losses and position sizing based on volatility! 💡 #StockMarket #InvestingTips #Finance101 📊

Watch the entire show here: https://cstu.io/954f75

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Transportation Stocks Continue To Lead Markets Lower

In our Commentary last week, we noted that Delta shares were down over ten percent due to their weak economic outlook. Per our Commentary- "Delta’s CEO offered similar caution: The outlook has been impacted by the recent reduction in consumer and corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand. He also …

Read More »

Read More »

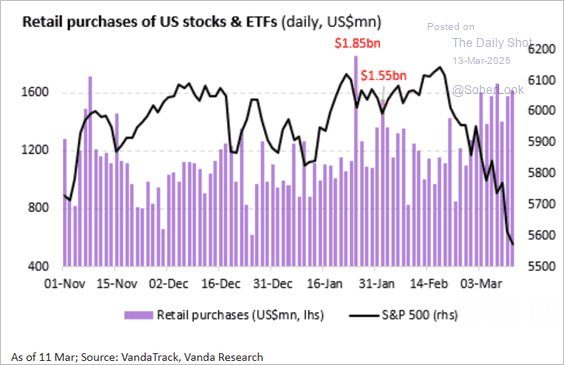

Retail Investor Buys The Dip Despite Bearish Sentiment

It has been an interesting correction. The average retail investor was "buying the dip" despite having an extremely bearish outlook. This is an interesting point because, as shown, the retail investor used to be considered a "contrarian indicator" as they were prone to be driven by emotional behaviors that led them to "buy high and sell low." …

Read More »

Read More »

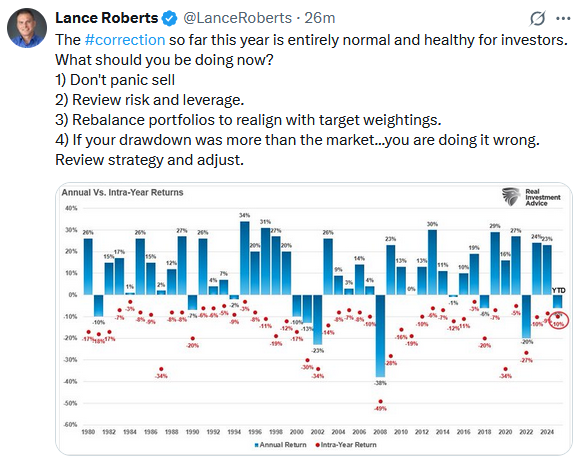

3-17-25 Recession Fears Emerge

Markets last week ripped through one of the fastest 10% corrections ever; that's what happens when markets are over bought. Media headlines whip investors into a frenzy with Recession talk, ignoring the fact that in order for a moving average to remain the average, markets must ebb and flow, above and below, in order to provide the average. The Government is shedding non-essential employees (which begs the question of why they were hired in the...

Read More »

Read More »

Investors Dismiss Fundamentals: Valuations Hold Little Weight in Modern Markets

Valuations haven't mattered. Fundamentals don't matter much due to the Momo chase. A whole generation of investors haven't seen this before. ? #Investing

Watch the entire show here: https://cstu.io/054b76

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How to Avoid Common Retirement Planning Mistakes That Could Cost You Thousands

Planning for retirement requires careful preparation and smart financial decisions. However, many retirees make critical errors that can drain their savings, reduce their income, and leave them financially vulnerable. Avoiding financial pitfalls is essential to ensuring a comfortable and stress-free retirement. Here’s a look at some of the most common retirement planning mistakes and how …

Read More »

Read More »

Orange Juice And Egg Prices Provide Welcome Relief

As we have mentioned numerous times, consumer sentiment greatly impacts economic activity. Accordingly, the price activity of particular goods can have an outsized influence on consumer inflation views. For example, orange juice and egg prices have been leading some consumers to have flashbacks of the recent high inflation. Based on the recent price trends of …

Read More »

Read More »

Understanding How Valuations Impact Future Returns in Investments

Unpredictable market returns explained! ?? It's a rollercoaster - 10% up, 20% down, then back up! Who knows what the future holds? ? #investing101

Watch the entire show here: https://cstu.io/d25fe1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Market Downturns: What Shrinkage Reveals About Hidden Investment Mistakes

? Market insights: Don't rely on a bull market to cover mistakes. Plan your portfolio wisely for long-term success! ?? #InvestingTips #Finance

Watch the entire show here: https://cstu.io/38a112

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

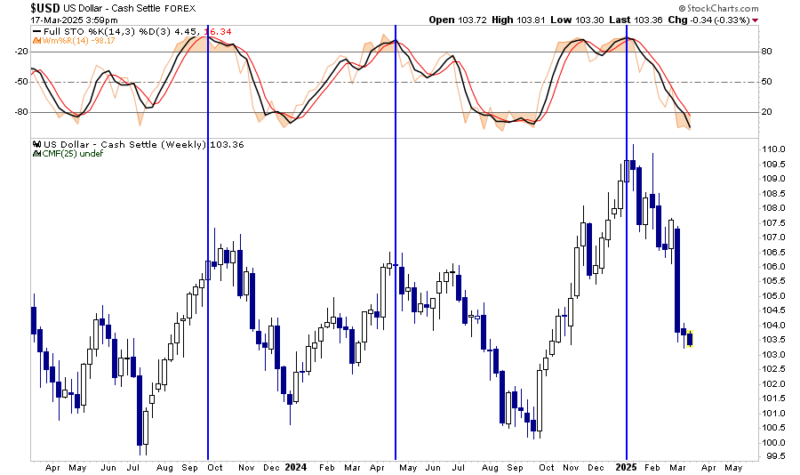

Sell Off Accelerates As Recession Fears Emerge

Inside This Week's Bull Bear Report Market Volatility Spikes Last week, we discussed that the market continues to track Trump's first Presidential term as he launched a trade war with China. "However, despite the deep levels of negativity, the current correction is well within the context of the volatility seen during Trump's first term as …

Read More »

Read More »

The Rotation To Value From Growth: What Comes Next?

In hindsight, markets are easy to assess, yet extremely challenging to forecast. For example, as we will show, it's undeniable that value, particularly large-cap value stocks, have been in vogue during the recent decline, while growth is being kicked to the curb. This rotation from growth to value is an example of how investors rotate …

Read More »

Read More »

Stupidity And The 5-Laws Not To Follow

Human stupidity is the one thing you can rely on in financial markets. I recently read a great piece by Joe Wiggins at Behavioral Investment, which discusses why "Investing is hard." The entire article is worth reading, but here are the five key reasons investors often fail at investing: These are great points, particularly now that …

Read More »

Read More »

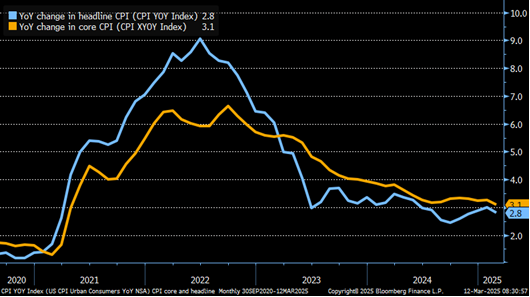

CPI Is Cooler Than Expected

Following a hot January CPI set of inflation data, the BLS CPI report cooled down in February. Headline CPI rose +0.2% versus +0.3% consensus and +0.5% in January. Core CPI was also +0.2% for the month. The year-over-year headline and core rates fell 0.2% from last month's figures to 2.8% and 3.1%. The 3.1% core … Continue reading »

Read More »

Read More »

The Importance of Asset Allocation in Building a Resilient Investment Portfolio

A well-structured asset allocation strategy is the foundation of a resilient investment portfolio. It determines how your investments are distributed across different asset classes, balancing risk and return to align with your financial goals. Proper asset allocation can help you navigate market fluctuations, protect wealth, and optimize long-term performance. In this article, we’ll explore the …

Read More »

Read More »