Category Archive: 9a.) Real Investment Advice

5-1-25 What’s Up with Yields?

Bond yields are rising — but why now, and what does it mean for your investments?

In this episode, we break down what's driving Treasury yields higher, how the Federal Reserve and inflation expectations are playing a role, and what the risks (and opportunities) are for stocks, bonds, and the broader economy.

Stay ahead of market shifts with expert insights and practical strategies for the changing rate environment."

Hosted by RIA Advisors...

Read More »

Read More »

A Comprehensive Guide to Tax Planning for High-Net-Worth Individuals

When your wealth grows, so does the complexity of your financial life. For high-net-worth individuals, tax planning is no longer just about filing accurately—it’s about strategically managing income, investments, and legacy plans to reduce taxable income and preserve wealth over the long term. From investment strategies and estate planning to charitable giving and tax-advantaged accounts, …

Read More »

Read More »

Port Plunge Myths: Why Headlines Don’t Tell The Whole Story

The headlines below lead some to believe the shelves in our stores will soon be empty. Moreover, reminiscent of 2020, an inflation spike due to fractured supply lines is imminent. Let's provide context to help make sense of the headlines and determine whether the plunge of Chinese inbound container ships to US ports represents truth …

Read More »

Read More »

4-30-25 The Problem with Buy-now, Pay-later

Companies that are participating in the buy-now, pay-later trend may be playing with fire because the risk pool is an unknown quantity of potential liability: If a borrower defaults, how do you recover your loss?

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen...

Read More »

Read More »

4-30-25 Why is the trade deficit at record levels?

Why is the trade deficit at record levels?

Lance Roberts breaks down the record-setting U.S. trade deficit and its far-reaching implications. From global trade imbalances and currency pressures to the potential impact on interest rates and inflation, we unpack what this growing deficit could signal for the U.S. economy in 2025.

Lance Roberts explores:

How the trade deficit affects GDP and growth

Whether trade surpluses or deficits are “bad” for...

Read More »

Read More »

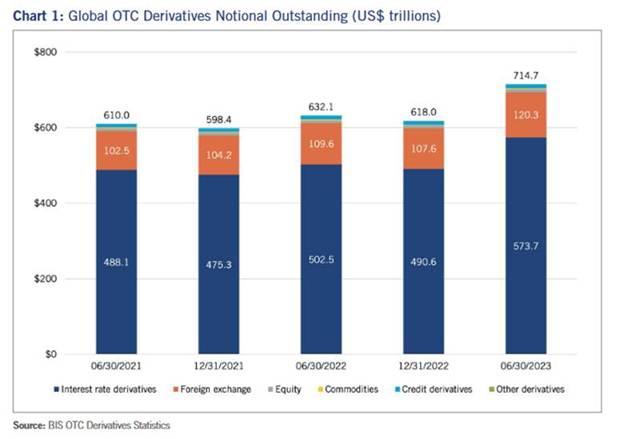

Interest Rate Swaps: Plumbing Of The Financial System

Our recent article, Swaps and Basis Trades Warn Of Mounting Liquidity Problems, touched on negative interest rate swap spreads as an omen of potential liquidity problems. To stay on the topic of liquidity, we didn’t provide much detail about swaps. Nor did we discuss their importance to the financial system. Accordingly, we ended the discussion …

Read More »

Read More »

Yale To Trim Billions Of Private Equity Holdings

According to Bloomberg, Yale University could sell as much as $6 billion of its private equity investments. Such a sale would represent about 15% of its total endowment fund and a third of its private equity holdings. Yale was a frontrunner among endowment funds investing in private equity. Its well-known ex-investment manager, David Swensen, believed …

Read More »

Read More »

4-29-25 Risk Management is Not Choice

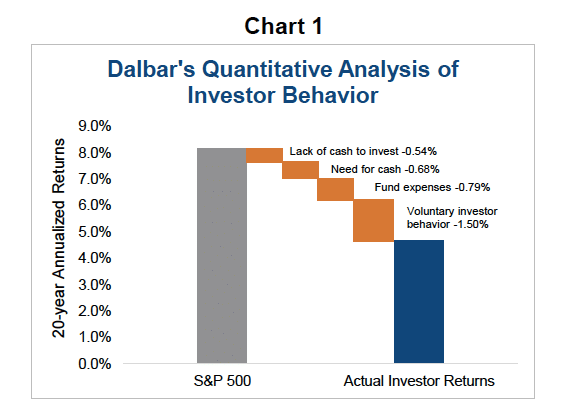

Understanding risk and what it takes to make up for losses is a key function in investing. Getting back to break-even is harder than it first appears.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisor Jonathan Penn, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »

4-29-25 Should You “Stay the Course” Now?

Are you wondering if you should stay invested during today's market volatility? Lance Roberts and Jonathan Penn dive into why staying the course could be your best long-term strategy — and when it might make sense to rethink your plan. Whether you're worried about a market correction or planning for the future, we'll help you navigate through the noise with smart, practical advice.

🔔 Subscribe for more insights on investing, financial planning,...

Read More »

Read More »

Understanding the Benefits and Risks of Annuities for Retirement Income

When planning for retirement, securing a reliable income stream is a top priority. Many retirees turn to annuities for retirement income as a way to guarantee financial stability. Guaranteed income strategies help retirees maintain cash flow throughout their lives, reducing the risk of outliving their savings. However, while annuities offer security and predictability, they also …

Read More »

Read More »

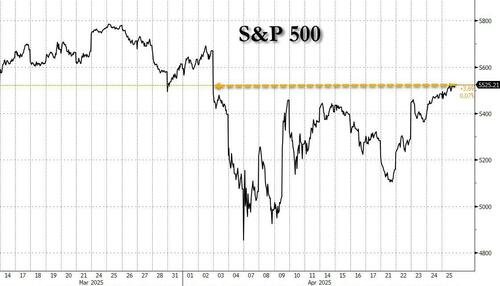

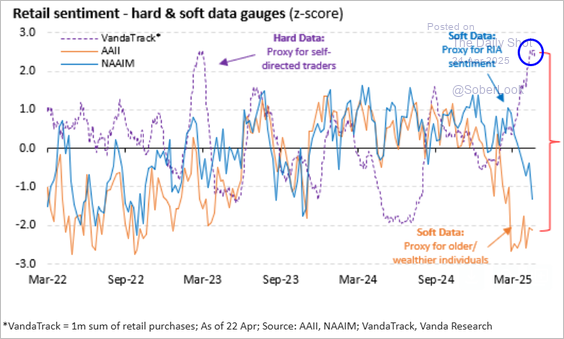

A Rare Zweig Breadth Thrust Provides Optimism

The Zweig Breadth Thrust, a rare technical indicator, triggered a bullish signal on Friday. The signal indicates rapid and significant changes in momentum. The calculation is based on the 10-day moving average of the percentage of stocks that were positive on a daily basis. The Zweig Breadth Thrust signal occurs when the moving average rises …

Read More »

Read More »

4-28-25 Focus on What You Can Control

A review of a bell curve of event probabilities places financial armageddon at the extreme end of the scale of events likely to occur. Best to focus energies (and investments) over those area which we can control.

Hosted by RIA Advisors Chief Investment Strategist, lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen...

Read More »

Read More »

4-28-25 Correction Continues: How Risk Management Protects Your Portfolio

The market correction continues, and understanding the value of risk management is more critical than ever. Lance Roberts breaks down why market volatility is a normal part of investing, how risk management strategies protect your portfolio, and practical steps you can take today to stay disciplined. Learn how to navigate downturns, control emotions, and plan for long-term success.

Key Topics:

• Market correction insights

• Importance of managing...

Read More »

Read More »

Banks Are Now Free To Trade Crypto

The Fed removed its handcuffs on banks, allowing them greater flexibility to trade and hold crypto assets. Before Thursday's action, banks were asked to seek advance approval from the regulators before participating in crypto-related activities. Further, the Fed removed guidance that banks exercise caution with crypto due to its volatility, liquidity, and legal uncertainty. The …

Read More »

Read More »

Correction Continues – The Value Of Risk Management

Despite the recent rally, the correction continues. While wanting to "buy the dip" is tempting, there has been enough technical damage to warrant remaining cautious in the near term. As we have discussed, managing risk requires discipline and the emotional ability to navigate more volatile markets until a more straightforward path for risk-taking emerges. The …

Read More »

Read More »

Spock And The Logic Based Approach To Volatility

Inside This Week's Bull Bear Report Market Finds Some Hope Last week, we discussed the issue with the spat between President Trump and the Federal Reserve chairman, Jerome Powell. As noted then: "While the markets await the next Federal Reserve meeting, the uncertainty over monetary policy weighs on markets as much as the uncertainty about tariffs.

Read More »

Read More »

4-25-25 You’re Going to Leave a Legacy

Roth "evangelism" is taking hold across the country as more and more discover the wisdom of converting traditional 401k and IRA's to "Roth's," paying taxes now so that funds accrue tax free.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisor, Jonathan McCarty

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

4-25-25 Wouldn’t You Rather Roth?

Are you contemplating a Roth IRA conversion in 2025?

With potential tax rate increases on the horizon, now might be the optimal time to act. Richard Rosso and Jonathan McCarty delve into:

* The benefits of converting to a Roth IRA before 2026

* Strategies to minimize taxes during conversion

* How Roth conversions can impact your retirement planning

* The role of Roth IRAs in estate planning

Rich and Jonathan explore how a Roth IRA can offer...

Read More »

Read More »

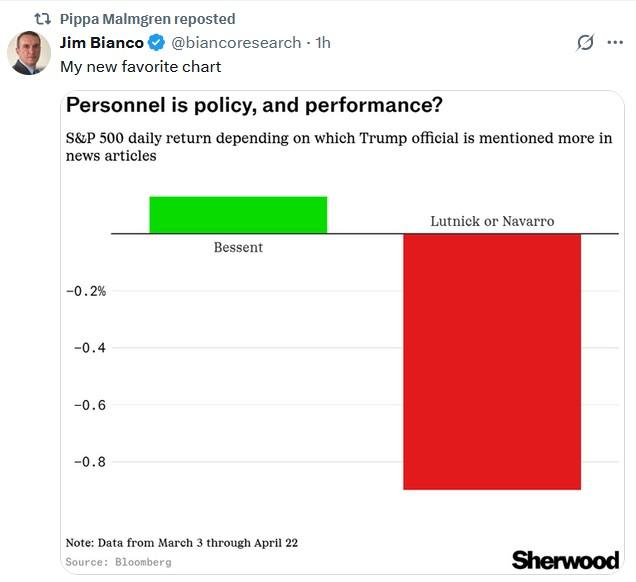

Scott Bessent Affirms The Dollar Is Not Dying

Despite a growing chorus of pundits claiming the "death of the dollar" is imminent, Treasury Secretary Scott Bessent said the dollar will remain the world's reserve currency. The following clip from Bloomberg was based on a speech Scott Bessent gave Thursday morning to the IMF and World Bank: More broadly, the Treasury secretary reinforced backing for the central role of the US and its dollar in the global financial system.

Read More »

Read More »

Speculator Or Investor? 10-Rules From Legendary Investors

Are you a "speculator" or an "investor"? This is an essential question that every individual deploying capital into the financial markets must answer. The reason is that how you answer that question determines how you should behave during market cycles.

Read More »

Read More »