Category Archive: 9a.) Real Investment Advice

The Deficit Crisis Is Really A Recession Problem

The graph below provides a clearer understanding of the US fiscal deficit. First, focus on the red line below, graphing the ratio of federal debt to GDP. Note that it is at the same level today as it was in 2021. Similarly, before the pandemic, it had been relatively flat for seven years. This highlights … Continue reading...

Read More »

Read More »

Does Consumer Spending Drive Earnings Growth?

It would seem evident that most investors would understand that consumer spending drives economic growth, ultimately creating corporate earnings growth. Yet, despite this somewhat tautological statement, Wall Street appears to ignore this simple reality when forecasting forward earnings. As discussed recently, S&P Global's current estimates show earnings are growing far above the long-term exponential growth …

Read More »

Read More »

6-5-25 Focus on the Data that Drives the Markets

The markets don't care about your personal inflation problem; they care only about the numbers generated by the government (whether they're accurate or not); so as investors, forget your personal narrative an focus on what's driving the markets.

Hosted by Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

6-5-25 Fed Rate Cuts Do Not Equal Inflation

Are investors wrong to assume that rate cuts will automatically tame inflation?

Lance Roberts and Michael Lebowitz challenge the belief that the Fed’s rate cuts always translate into lower inflation. Using historical data and current economic conditions, we explore how monetary policy really interacts with price pressures—and why rate cuts may actually stoke inflation under the wrong conditions. Specifically, Lance and Mike address the real impact...

Read More »

Read More »

An ETF Like No Others: The Pudgy Penguin Project

The cryptocurrency sphere and that of traditional finance continue to merge in ways that were previously unthinkable. To wit, Canary Capital filed documentation with the SEC to start the first ETF backed by non-fungible digital tokens. Non-fungible tokens are digital assets representing ownership of a specific piece of content. Most often, they are backed by …

Read More »

Read More »

Comprehensive Financial Planning: What It Means for High Net Worth Families

For affluent families, financial success isn't solely about accumulating wealth; it's about preserving it across generations, optimizing tax strategies, and aligning financial decisions with personal values and long-term goals. Comprehensive financial planning offers a holistic approach, integrating various financial aspects to provide clarity, control, and confidence in one's financial journey. Understanding Comprehensive Financial Planning...

Read More »

Read More »

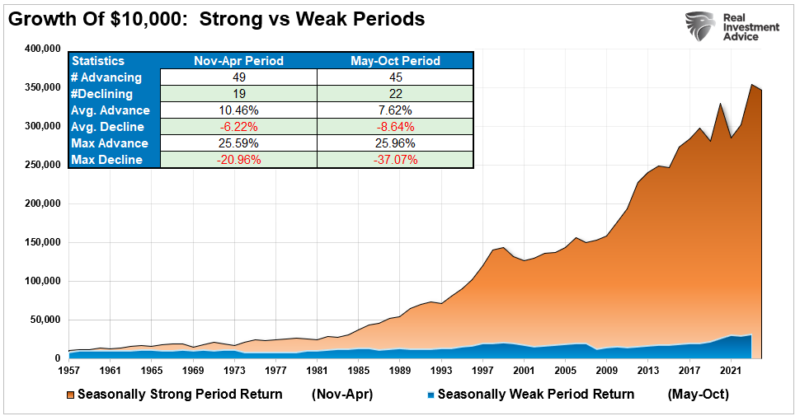

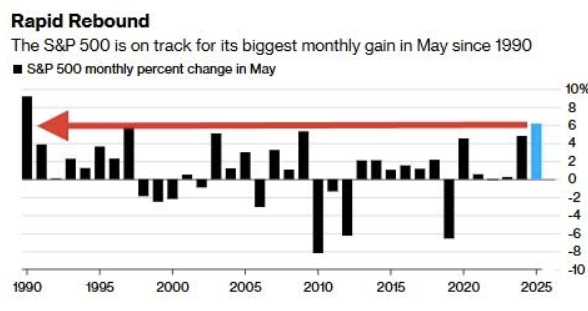

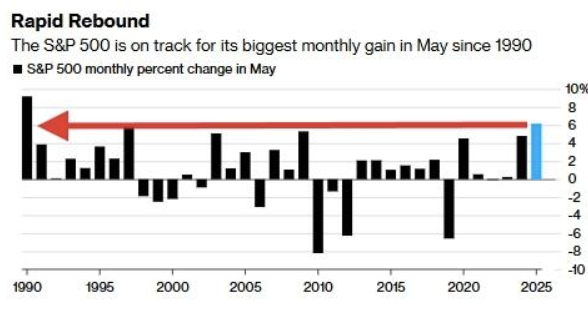

6-4-25 Be Careful of Market Maxims

"Sell in May and go away" is not necessarily good advice, because getting out of the market for the Summer could backfire, and the hard part is getting back into the market when it's time to do so.

Hosted by Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »

6-4-25 Will There Be a Summer Swoon?

Is a summer swoon looming in the stock market for 2025?

Lance Roberts & Danny Ratliff explore the historical performance of the S&P 500 and major sectors during the summer months—June through August, and examine whether investors should brace for a seasonal pullback, looking at historical June-to-August returns and volatility trends, what typically drives a summer slowdown in stocks, and sector-by-sector analysis: What holds up best in...

Read More »

Read More »

Sellers Outnumber Buyers In The Housing Market

The following commentary is from Redfin "There are 34% more sellers in the market than buyers. At no other point in records dating back to 2013 have sellers outnumbered buyers this much. In other words, it’s a buyer’s market. Redfin expects home prices to drop 1% by the end of the year as a result. … Continue reading...

Read More »

Read More »

Stablecoins To The Treasury’s Rescue

Digital Money was the title of TBAC’s April 30, 2025, presentation to the U.S. Treasury Department, and an important topic worth discussing. TBAC, short for the Treasury Borrowing Advisory Committee, is comprised of senior investment professionals from the largest banks, brokers, hedge funds, and insurance companies. Most often, the committee informs the Treasury staff on …

Read More »

Read More »

6-3-25 THe Multiplier Effect of AI Spending

For every $1-Billion spent on developing AI, it creates $3-Billion in economic growth.

It's called the multiplier effect, and if the Administration has $1.8-Trillion in commitments to spend on AI. Do the math: Multiply by three. That's where economic growth is coming from.

Hosted by Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

6-3-25 Reports of the Death of American Exceptionalism Are Greatly Exaggerated

Is America’s global leadership really fading?

Lance Roberts & Jonathan Penn reveal the truth behind the “decline of American exceptionalism” narrative, and why the U.S. continues to lead in economic strength, innovation, and global influence. Today's show also features several bonus elements, including a recap of Mrs. Robert's trip to the Vegas Bitcoin Expo and convention robots; an exposition on the alleged death of American Exceptionalism,...

Read More »

Read More »

How Long $2 Million in Retirement Savings Lasts in Every U.S. State

For many Americans, accumulating $2 million in retirement savings is a significant milestone. However, the longevity of these savings can vary greatly depending on the state in which you choose to retire. Factors such as cost of living, taxes, healthcare expenses, and lifestyle choices all play a role in determining how far your retirement funds …

Read More »

Read More »

Sell In May And Go Away?

An old Wall Street adage advises investors to sell in May and go away. Given that we have just turned the calendar to June, it's worth assessing whether selling stocks and holding cash for the next seven months makes sense. The graph and data below are based on two trading strategies, both starting in January … Continue reading »

Read More »

Read More »

6-2-25 You Can Always Rationalize a Reason Not to Buy Stocks

We can always rationalize why we shouldn't buy stocks. Lance Roberts shares one of The Most Stupid Excuses he's heard yet.

Hosted by Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

6-2-25 Why Buying Stocks is Always Hard

Why does the stock market test our patience and nerve?

Lance Roberts looks at the psychology of investing, how to master long-term strategies, and ways to navigate market volatility with confidence! Today is National Leave Work Early day...but before you do, make sure to tackle Lance's Monday Mandatory Reading list (links are provided below); Lance shares another tender moment from the Roberts' kitchen, and his essay on why buying stocks is hard...

Read More »

Read More »

Bond Market Paradigm Shift?

Some bearish bond investors in Japan and the US appear to believe that a paradigm shift is underway in the sovereign bond markets. To wit, consider the following statement from Jim Bianco on Thoughtful Money: “If these deficits are really going to kick in and cause problems, these rates are going to go much higher than … Continue...

Read More »

Read More »

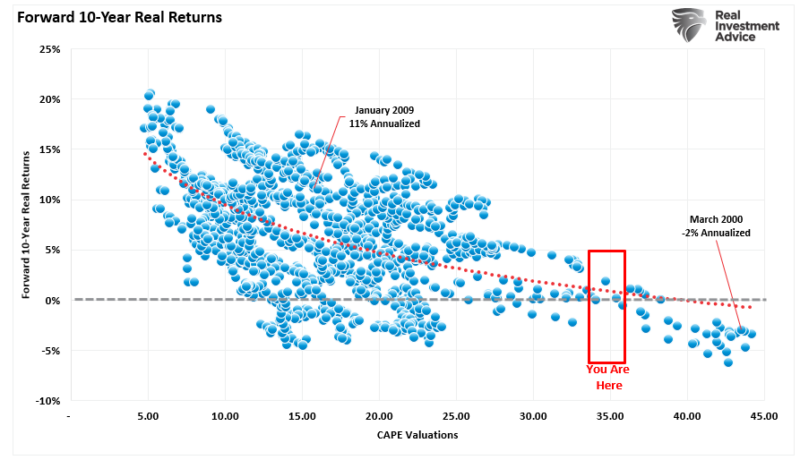

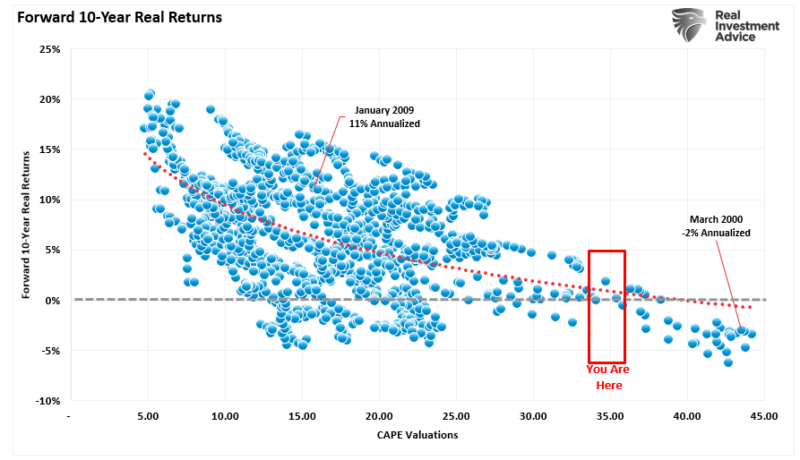

Buying Stocks Is Always Hard

Buying stocks is always hard. Particularly during corrections. Or, near market peaks. Or, when stocks are falling. And when they are rising. Oh, buying stocks is also tricky when valuations are high. And when they are low. You get the point. There is never the right time when it comes to buying stocks. I recently … Continue reading »

Read More »

Read More »

The Narratives Change. Markets Don’t.

Inside This Week's Bull Bear Report A Successful Test Last week, we discussed how this seems to be an "unstoppable" bull market. However, that doesn't mean markets won't pause before attempting to move higher. As we noted last week, the consolidation was expected. "Even with Bessent's comments, that market remains overbought in the short term, …

Read More »

Read More »