Category Archive: 9a.) Real Investment Advice

Fed Left Rates Unchanged Amid Elevated Uncertainty

The Fed left rates and the pace of QT unchanged as expected in Wednesday’s meeting. Powell’s opening statement was updated to reflect that uncertainty about the economic outlook has “diminished but remains elevated.” Powell emphasized that the Fed would maintain a data-dependent approach and isn’t in a hurry to cut rates, but left the door …

Read More »

Read More »

The Dollar’s Death Is Greatly Exaggerated

The narrative surrounding the "dollar's death" as the world's reserve currency has been on the rise recently. However, this happens whenever the dollar declines relative to other currencies. We previously wrote about the false claims of the "dollar's death" in 2023 (see here, here, and here). The recent decline in the dollar relative to other currencies is well within historical norms.

Read More »

Read More »

Why High Net Worth Investors Need a Different Wealth Management Strategy

High-net-worth individuals (HNWIs) face financial challenges and opportunities that go far beyond the scope of traditional investment advice. While most investors may focus on growing their nest egg, HNWIs must balance growth with preservation, manage complex tax situations, and prepare for legacy and philanthropic goals.

Read More »

Read More »

6-18-25 $1-Million Doesn’t Go as Far as It Did in 1980

$1-million in 1980 would generate a pretty good income against a comparatively small cost of living back then. Times have changed, ans thanks to inflation and other factors, $1-Million today will not keep up with most Americans' living expenses.

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢...

Read More »

Read More »

6-18-25 Fed Day Preview: Will They or Won’t They?

It’s Fed Day!

Will the Federal Reserve finally cut rates—or kick the can again? Lance Roberts & Danny Ratliff break down what’s at stake, what markets are pricing in, and what it means for your money. Thursday is Juneteenth, markets are closed, and so are we. Lance reviews the track for crude oil prices and the likely effect on inflation as the Iran-Israel conflict continues. What will Jerome Powell say following today's Fed meeting? Fed...

Read More »

Read More »

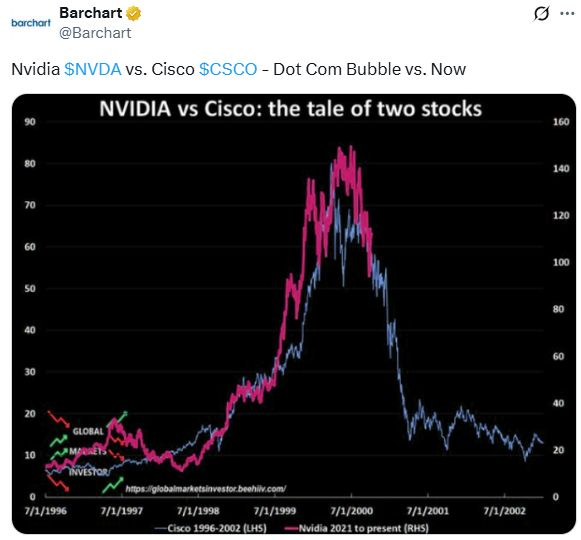

The Tech Bubble Analogy For Nvidia Falls Short

One of the most common parallels for AI stocks’ booming performance is the tech bubble of the 1990s. Both periods were and are being driven by transformative secular developments. On the surface, the remarkable growth, market performance, and high valuations of AI stocks resemble dot-com stocks from the years that created the tech bubble. We’ve …

Read More »

Read More »

6-17-25 Manage Risk & Volatility Rather Than Manage for Gains

A junk bond may pay more, but it's doing so for a reason: There's more risk. Similarly, if you have a company paying a dividend beyond what the 10-year Treasury is paying, there is risk you need to be aware of: What happens in a down market when you've lost 50% and the company cuts its dividend to zero?

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our...

Read More »

Read More »

6-17-25 What’s the Difference Between Fixed Income and “Stable” Income?

What's the difference between fixed income and "stable" income?

Lance Roberts & Jonathan Penn break down the key differences between Dividend Stocks vs fixed income investments like bonds and annuities, and other strategies often labeled as stable income; how each performs in various market environments, the risks you may not see, and what every retiree or income-focused investor should consider. Lance and Jon also address the #1...

Read More »

Read More »

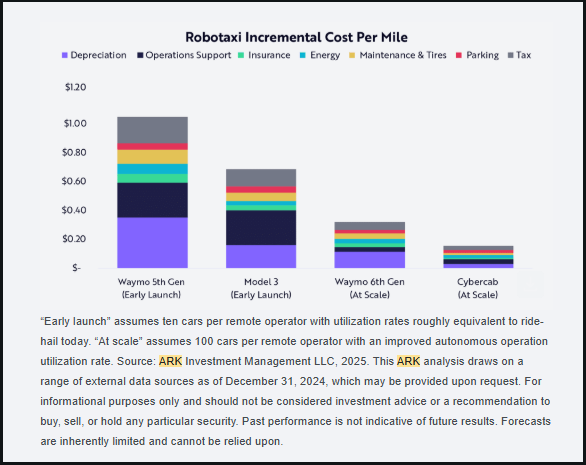

Robotaxi Race: Tesla is Behind the Curve

Tesla’s robotaxi service, tentatively set to launch June 22, 2025, lags behind Waymo’s established operations, which deliver 250,000 weekly rides across multiple U.S. cities. Elon Musk’s cautious approach, driven by safety concerns, has delayed the rollout of Tesla's robotaxi service. However, Tesla’s long-term strategy could position it to overtake competitors. Waymo, backed by Alphabet’s $5 …

Read More »

Read More »

How to Protect Your Wealth During Market Downturns

Economic downturns are an inevitable part of the financial cycle. For affluent investors, protecting wealth in recession periods is not just about weathering the storm but strategically positioning assets to avoid major losses and seize long-term opportunities. Whether it's a bear market, economic contraction, or sudden geopolitical shifts, understanding how to implement a solid financial …

Read More »

Read More »

6-16-25 Don’t Let Politics Impact Your Portfolio

It's important to not allow our personal bias or political persuasion to cloud our judgement in making investing decisions. The point is to make money, and where might you deploy your capital for the best result.

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

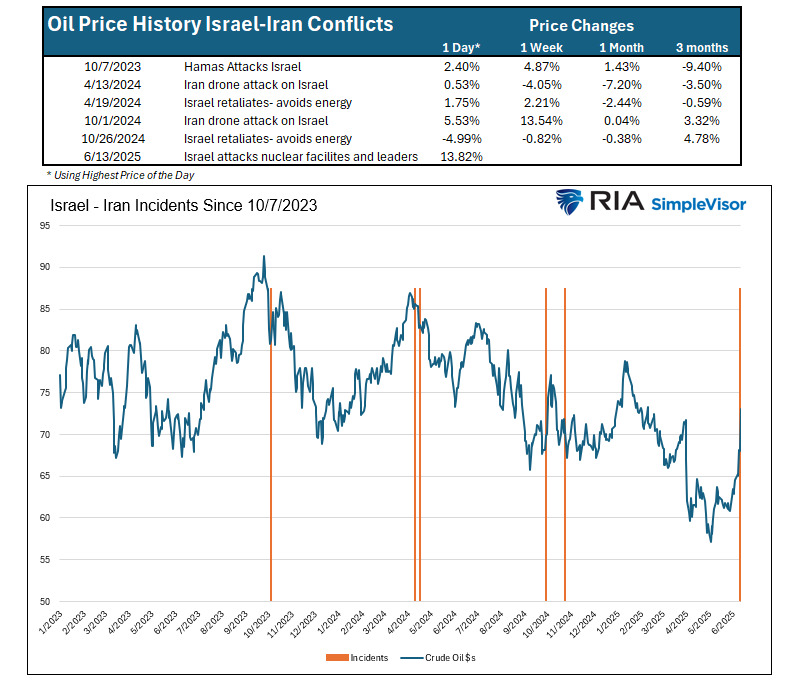

6-16-25 Market Effects of Iran-Israel Conflict

[NOTE: This is a "color-corrected" verson of our second show segment this morning, which unfortunately had audio issues.]

Lance Roberts breaks down the latest developments in the Iran-Israel conflict and what they mean for global markets: Be careful of headlines and re-allocating capital based on the "news of the day." By the time this show had aired, markets had already moved past the news of Israel's pre-emptive attacks on...

Read More »

Read More »

6-16-25 How the Iran-Israel Conflict Could Shock Global Markets

Lance Roberts breaks down the latest developments in the Iran-Israel conflict and what they mean for global markets, oil prices, and investor sentiment. With tensions rising in the Middle East, we explore how geopolitical risk is shaping the outlook for the S&P 500, energy stocks, safe-haven assets like gold and Treasuries. Lance touches on the impact of Middle East conflicts on the stock market, how oil prices typically respond to geopolitical...

Read More »

Read More »

Israel And Iran: Is This Time Different For Oil Prices?

Crude oil prices spiked by over $10 on the initial news that Israel was bombing Iran's nuclear facilities and targeting its key military leaders. The price surge should be expected, given that Iran accounts for slightly over 3% of global production and, more importantly, holds 12% of the world's proven crude oil reserves. For context, …

Read More »

Read More »

The Iran-Israel Conflict And The Likely Impact On The Market

The Iran-Israel conflict and equity markets are now in sharp focus. As direct strikes escalated in June 2025, global financial markets responded immediately. Israel’s airstrikes on Iranian nuclear and energy infrastructure triggered retaliatory missile and drone attacks from Iran. The Dow dropped nearly 2%, the S&P 500 lost over 1%, and oil prices surged by …

Read More »

Read More »

6-13-25 Is a College Degree Still Worth It?

Is a college degree still worth the rising cost?

As student loan debt climbs and tuition skyrockets, more families and young adults are asking whether a traditional four-year education offers a worthwhile return on investment. In this episode, we break down the financial data behind college costs, degree value by major, and explore growing alternatives like trade schools, certifications, and apprenticeships.

Richard Rosso & Susan Buenger posit...

Read More »

Read More »

Initial And Continuing Jobless Claims On The Rise

Initial and continuing jobless claims are as close to a real-time proxy on employment as we have. Thus, while they do not hold the same importance to the markets as the monthly BLS data, they are worth tracking. Moreover, when trends are changing, as they may be now, their importance increases. The two graphs below … Continue reading...

Read More »

Read More »

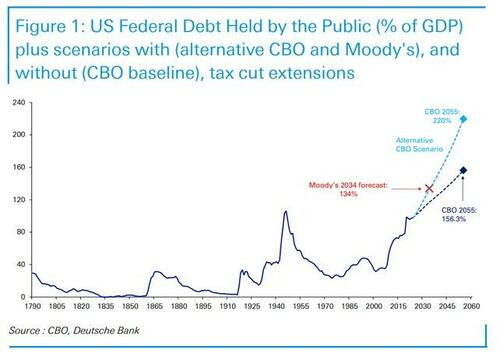

The Deficit Narrative May Find Its Cure In Artificial Intelligence

Lately, the "deficit narrative" has dominated much of the financial media, particularly those channels that are continual "purveyors of doom." In this post, we will discuss the "deficit narrative," the likely outcomes, and why the cure for the deficit may be found in Artificial Intelligence. The "deficit narrative" has dominated the media lately as President …

Read More »

Read More »

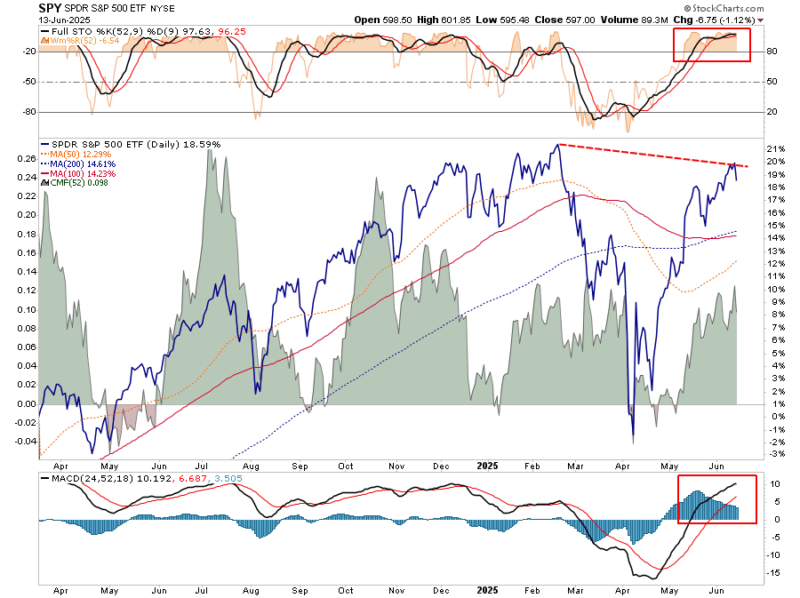

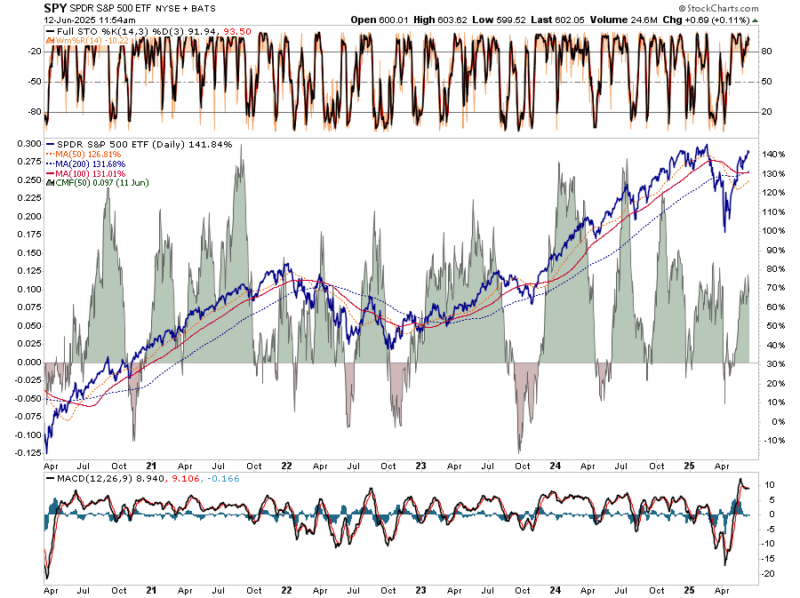

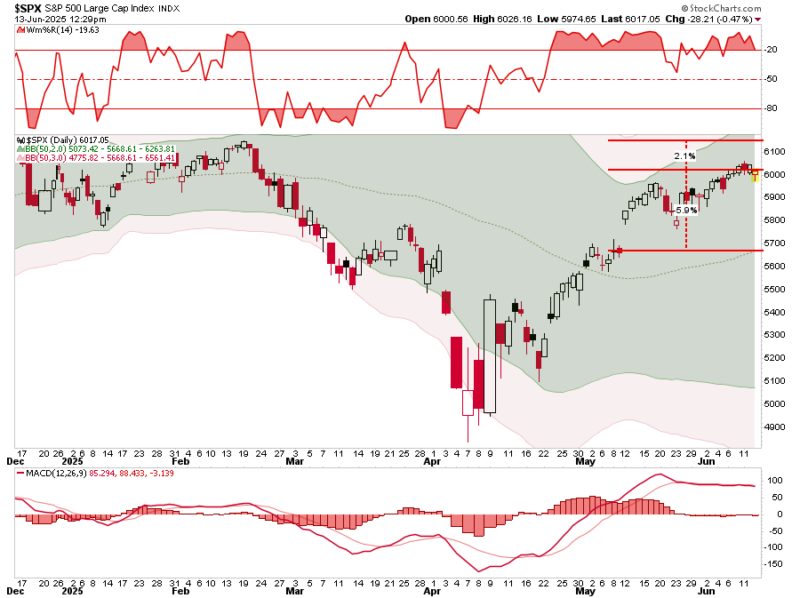

The Bull Rally Continues

Inside This Week's Bull Bear Report Risk/Reward Favors Patience I am traveling this weekend, so we are producing our weekly report a day early. As such, some charts using end-of-week data are using either Thursday or mid-Friday prices. All report will return to normal next week. Let's start with where we left off last week." … Continue...

Read More »

Read More »

6-12-25 Hindsight is a Terrible Way to Invest Money

Hindsight may be 20/20, but it's a terrible way to invest money. You should be focusing on where you are now, and where the next opportunity will be.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »