Category Archive: 9a.) Real Investment Advice

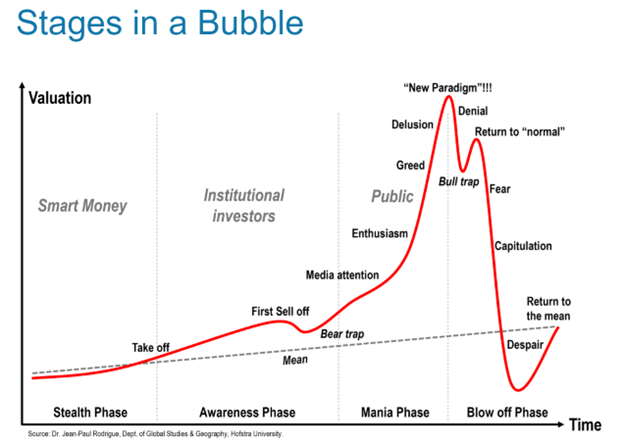

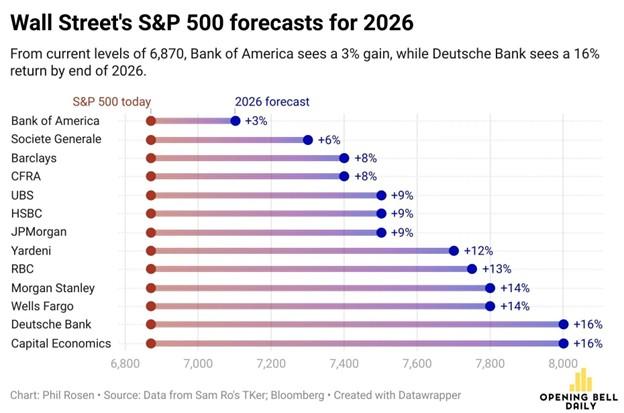

Smart Money Or Dumb Money? Who Will Be Right

The concepts of “smart money” versus “dumb money” refer to the level of investors’ information and experience. Smart money, typically institutional investors and often seasoned professionals, has extensive research and is more adept at data analysis. Therefore, they tend to […] The post Smart Money Or Dumb Money? Who Will Be Right appeared first on …

Read More »

Read More »

Employment Data Confirms Economy Is Slowing

While coming in much stronger than expected, the latest employment data confirmed what we already suspected: the economy is slowing. The reason the employment data is so important is that without employment growth, the economy stalls. It takes, on average, […] The post Employment Data Confirms Economy Is Slowing appeared first on RIA.

Read More »

Read More »

5-8-25 Some Trade Deficits are Okay

With all the focus on trade tariffs, we should not lose sight of the fact that some trade deficits are okay to have, and in some cases, needful things.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

5-8-25 The Fed Stays Hawkish

The Federal Reserve kept its stance firmly hawkish at their latest FOMC meeting — but what does that mean for stocks, bonds, and the economy? Lance Roberts & Michael Lebowitz break down the Fed’s latest interest rate decision, Jerome Powell’s comments, and the immediate market reaction, covering key sectors impacted, investor sentiment shifts, and the Fed’s outlook for inflation, growth, and monetary policy going forward. Lance and Michael...

Read More »

Read More »

How to Navigate Required Minimum Distributions (RMDs) and Minimize Taxes in Retirement

Required Minimum Distributions (RMDs) are an unavoidable part of retirement planning for many Americans. While they are designed to ensure retirees eventually pay taxes on their tax-deferred retirement savings, RMDs can also trigger unintended tax burdens if not planned for […] The post How to Navigate Required Minimum Distributions (RMDs) and Minimize Taxes in Retirement …

Read More »

Read More »

Market Is Tepid Over China Developments: Three Conclusions

“BREAKING: Treasury Secretary Scott Bessent says he will meet with Chinese officials in Switzerland to begin trade talks with China.” A month ago, when markets were grossly oversold, news of trade discussions between China and the US would have sent […] The post Market Is Tepid Over China Developments: Three Conclusions appeared first on RIA.

Read More »

Read More »

5-7-25 How Long Can You Stand to Wait?

Warren Buffett always says, 'buy-low, sell-high,' which is often easier said than done, and intellectually we know things will eventually get better. The question is not 'how long do you have to wait,' but 'how long can you wait" for the upturn to come?

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Advisor Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a...

Read More »

Read More »

5-7-25 China Blinks

The Federal Reserve Open Market Committee meeting concludes this afternoon; expect some volatility. As the U.S. pushes forward with new tariffs and a tougher trade stance, China appears to blink — signaling potential cracks in its economic armor. Lance Roberts and Danny Ratliff dive into the latest developments in the U.S.–China trade conflict, why China is making strategic concessions, and what it means for global markets, supply chains, and...

Read More »

Read More »

The Storm Before The Calm

Risk management is critical to wealth preservation, especially in today's turbulent market storm. However, during such volatile times, we must also not consider what tomorrow may have in store. Are you prepared to adjust your portfolio in the coming months for the possibility that calm, tranquil markets and a resumption of the bullish trend emerge?

Read More »

Read More »

OPEC Does The Unthinkable

This past weekend, OPEC, led by Saudi Arabia, announced it would increase production by 411k barrels per day. The action follows a 250k increase last month. The decision is different from OPEC’s decision-making in the past. OPEC typically would use production quotas to manage oil prices. For example, in the current environment, with oil prices …

Read More »

Read More »

5-3-25 Candid Coffee Live Chat Episode

What do the latest economic reports indicate about the strength of the economy? How do commodities like Gold and Oil relate to the US Dollar? Are there effective strategies for avoiding taxes in retirement?

RIS Advisors Director of Financial Planning, Richard Rosso, CFP, is joined by our Portfolio Manager, Michael Lebowitz, CFA, to answer these and other question in this live-chat edition of our popular Candid Coffee series:

INTRO

2:10 -...

Read More »

Read More »

5-6-25 The Beauty of Bonds’ Guarantee

Investing in a fixed income (bond) portfolio can guarantee precisely what your return will be on a future date.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Advisor Jonathan Penn, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

5-6-25 No Free Lunch: The Hidden Costs of ‘Free’ Investment Advice

Think you're getting "free" investment advice? Think again.

Lance Roberts and Jonathan Penn uncover the hidden costs behind so-called "free" financial services.

Learn how mutual fund share classes — A shares vs. B shares — reveal how advisors get paid, and why front-end and back-end loads can quietly erode your returns.

If you're not sure who's paying the fees, it's probably you.

Know the questions to ask to protect your...

Read More »

Read More »

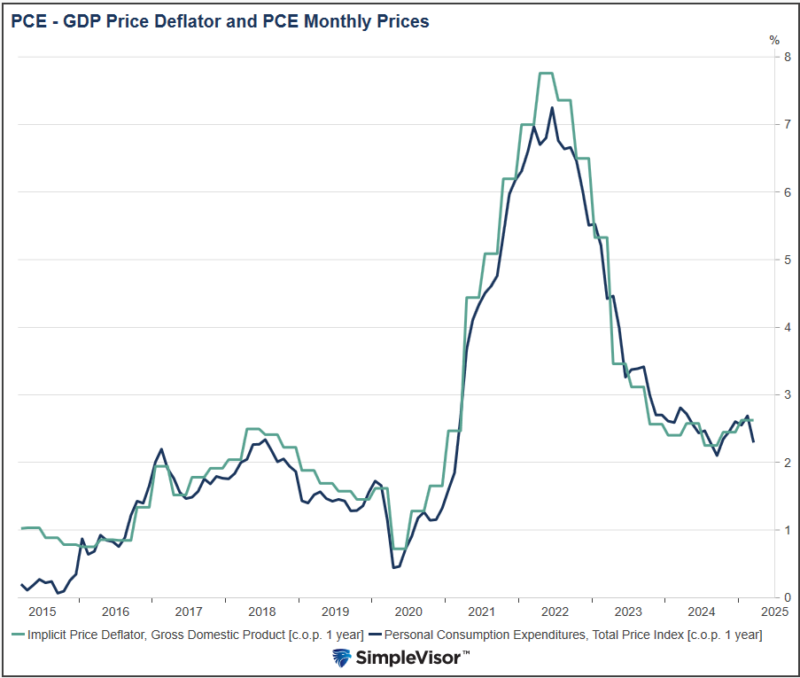

PCE Is Quite Confusing

An email from a reader of ours led with the title "PCE is quite confusing." He asked if we would explain the difference between the monthly PCE prices index and the quarterly PCE prices, i.e., the GDP deflator, accompanying the GDP report.

Read More »

Read More »

The Impact of Rising Interest Rates on Investments and How to Adapt

Rising interest rates are a powerful force in the financial world, capable of reshaping markets and shifting investment dynamics. As the Federal Reserve raises rates to combat inflation or stabilize economic growth, the ripple effect is felt across stocks, bonds, and real estate. While these rate hikes may be out of investors’ control, adapting your …

Read More »

Read More »

5-5-25 Cash Provides You with Optionality

➢ Listen daily on Apple Podcasts: Why is Warrent Buffett's Berkshire-Hathaway sitting on $380-Billion in cash? He's positioning himself to take advantage of the next buying opportunity. Be like Buffett.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on...

Read More »

Read More »

5-5-25 Resistance is Futile…for Bulls & Bears

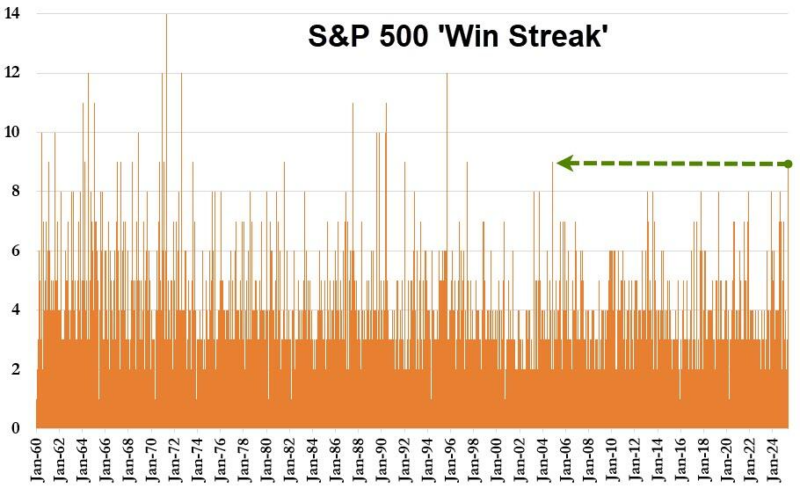

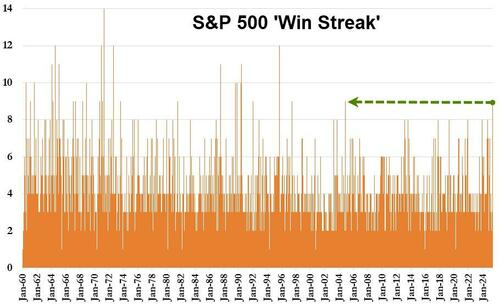

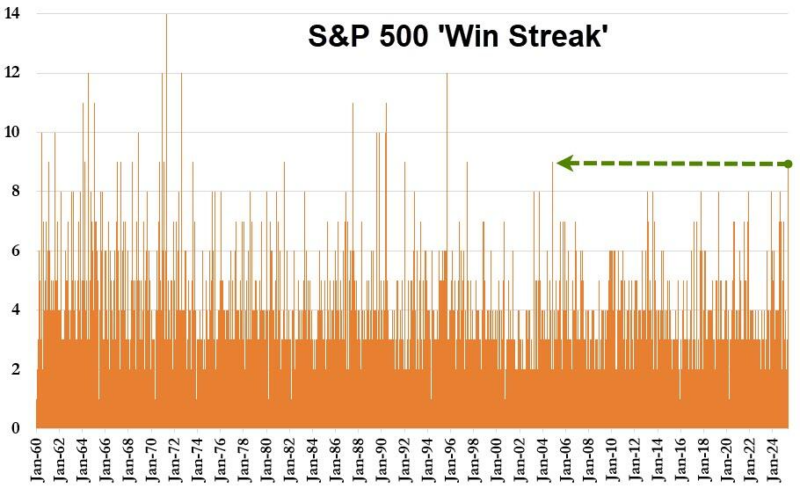

May begins and stock buy backs return; earnings season has been okay, on lowered expectations. Employment report is stronger than expected, but showing slippage. Lance Roberts explores why resistance levels are challenging both bulls and bears in today’s volatile market. Over the past two weeks, the market has had a furious nine-day rally, the longest winning streak in 21 years. However, there are two takeaways from such a historic advance. First,...

Read More »

Read More »

Might Japan Be The Treasury’s Knight In Shining Armor?

Japan holds over $1 trillion of US Treasury securities, making it the largest sovereign holder by a significant amount. Thus, the possibility has arisen that Japan might use its extensive holdings as leverage in tariff negotiations. Japanese Foreign Minister Katsunobu Kato said Japan has not made a decision on whether to include its holdings as …

Read More »

Read More »

“Resistance Is Futile” – For Both Bulls And Bears

"Resistance is futile" was a sentence that struck fear in the hearts of Trekkie fans during "Star Trek: The Next Generation," specifically in both of the "Best Of Worlds" and "First Contact" episodes. In those episodes, the "Starship Enterprise" crew encountered a species called the "Borg." The Borg's primary purpose was to achieve "perfection" by assimilating other beings …

Read More »

Read More »

Economic Decline Gains Momentum

Inside This Week's Bull Bear Report Market Runs Into Resistance Last week, we discussed that the market backdrop improved markedly following commentary from the White House that eased concerns about tariffs. To wit: "The market rallied above the 20-DMA this past week as investors found some "silver linings" to the ongoing tariff dispute. Despite China …

Read More »

Read More »