Category Archive: 9a.) Real Investment Advice

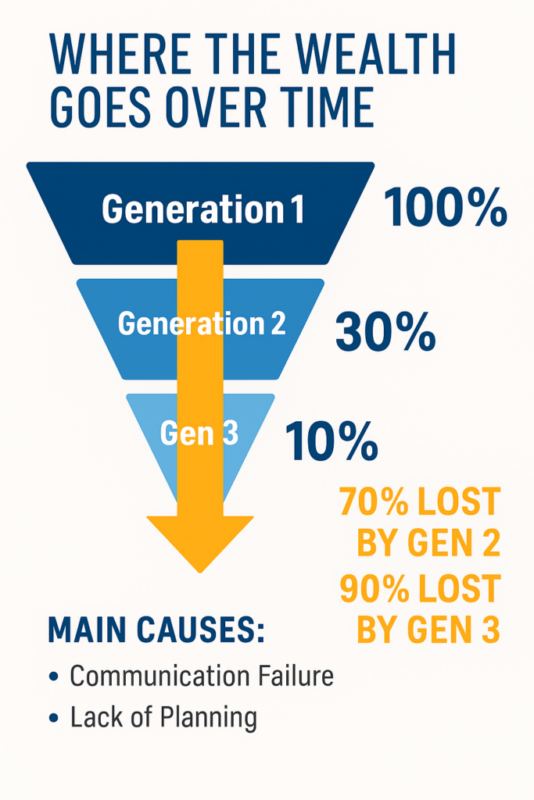

What High Net Worth Families Should Know About Generational Wealth Transfer

For high-net-worth families, passing wealth to the next generation involves more than just distributing assets. It’s about preserving a legacy, protecting what you’ve built, and preparing heirs to become responsible stewards. Generational wealth transfer is both a technical process and an emotional journey, and getting it right requires clarity, preparation, and expert guidance. In this …

Read More »

Read More »

7-7-25 Understanding Tariff Impact on Consumer Spending

Lance's recent visit to a U.K liquor store reinforced his thesis that tariffs are unlikely to trigger much inflation, if any, because merchants will eat the cost to remain competitive.

Hosted by RIS Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

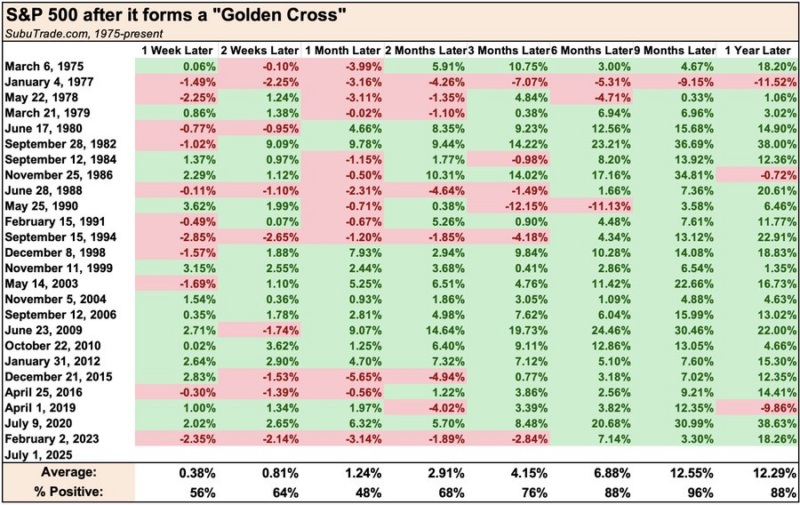

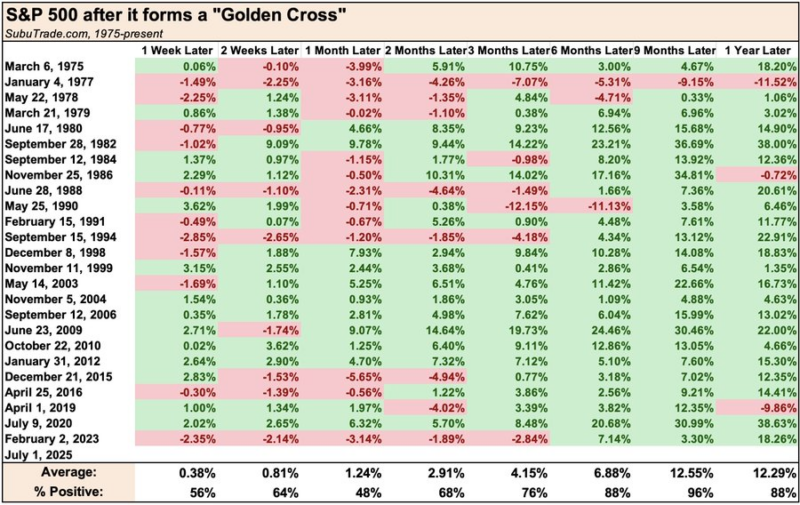

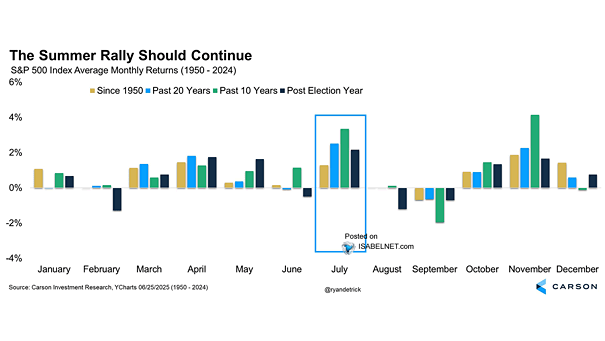

7-7-25 The Bull Market Is Alive And Well

Lance is back from vacation, and the markets did not crash in his absence! On the contrary, they're doing very well. President Donald Trump's Big Beautiful Bill has been signed into law; still to be seen: its impact on earnings. We express our sentiments for the families and friends of loved ones lost in the Central Texas Flash Floods over the July 4th Weekend. Investor greed is a record levels, along with technical indicators, meaning markets are...

Read More »

Read More »

Intel Pushes For Change: Will It Save Them?

In no uncertain words, Intel's stock has been a dog. As we share below, Intel stock has increased by a mere 2% over the last 20 years, while the tech-heavy NASDAQ 100 (QQQ) has risen by over 1,200%. Over the previous 20+ years, Intel's management has made many missteps, including: With dirt-cheap valuations compared to … Continue reading...

Read More »

Read More »

The Bull Market Is Alive And Well

The bull market is alive and well, even amid widespread talk of the “death of U.S. exceptionalism.” Early 2025 saw a sharp shift in investor sentiment. Concerns over erratic trade policy, soaring debt, and weakening dollar pressure challenged America’s long-standing market dominance. Markets fell sharply in April and May, feeding a narrative of declining "US …

Read More »

Read More »

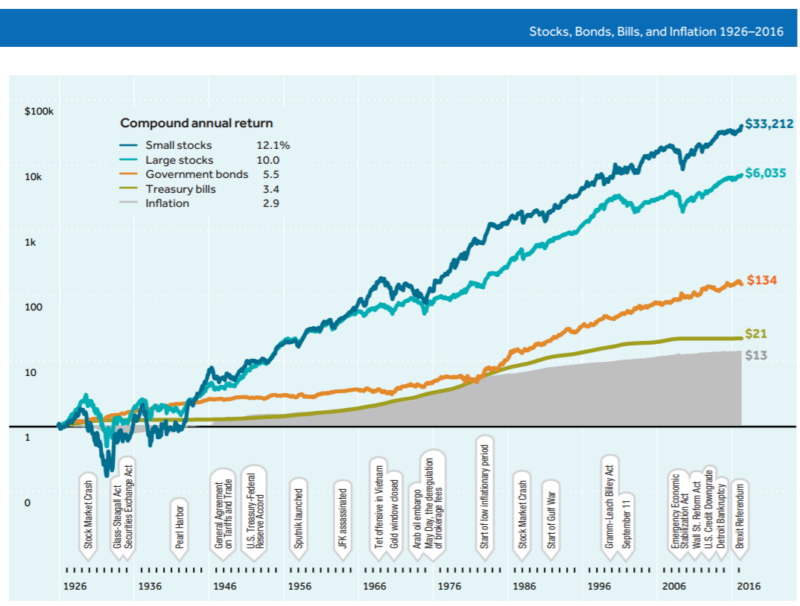

Investor Greed Returns With A Vengeance

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 📊 …

Read More »

Read More »

Annuities Are Not Your Enemy.

Utter the word ANNUITY and watch facial expressions. They range from fear to disgust to confusion. But hear me out: Annuities are not your enemy. Billionaire money manager and financial pitchman Ken Fisher appears as a haunting senior version of Eddie Munster in television ads. He stares with deep eyes ablaze with intensity. The tight camera …

Read More »

Read More »

What Sets a Fiduciary Financial Advisor Apart for High Net Worth Clients

When your wealth reaches seven figures or more, every financial decision carries greater weight and consequences. That’s why choosing the right financial advisor isn’t just a preference. It’s a necessity. High-net-worth individuals need more than cookie-cutter advice or product-driven sales pitches. They need strategic, objective, and comprehensive guidance. That’s where a fiduciary financial advisor stands …

Read More »

Read More »

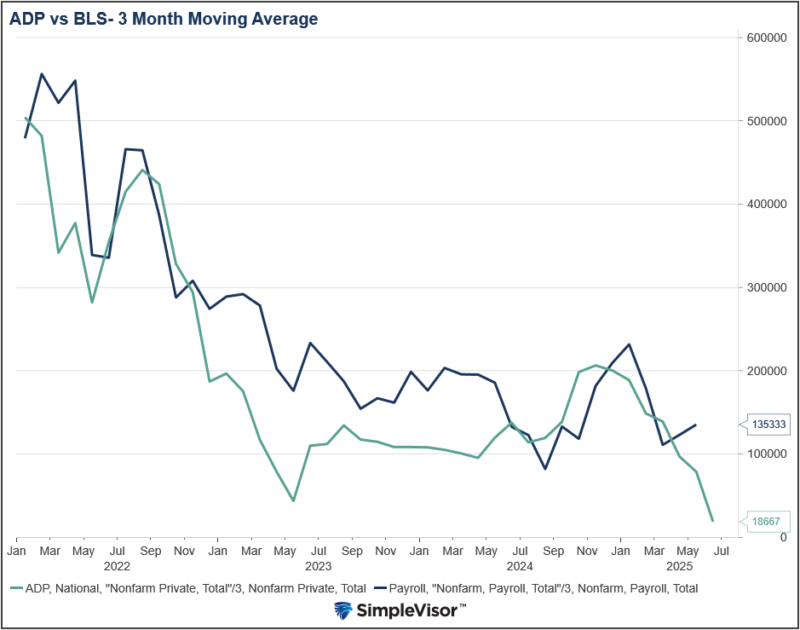

ADP Signals Labor Market Weakness

The Fed and most investors primarily assess the labor market based on the monthly BLS employment report. To better guide those estimates, various reports, such as the monthly ADP report, can be helpful. We say "can be" because, since the pandemic, ADP has been less correlated with the BLS than it was before the pandemic. … Continue...

Read More »

Read More »

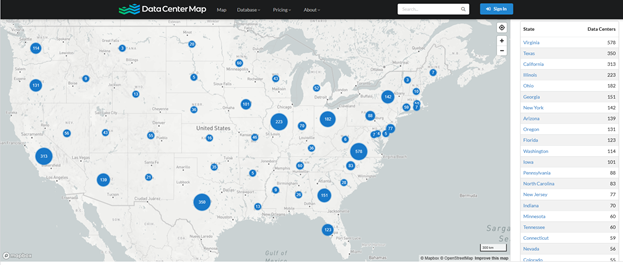

Behind The Meter Solutions Investment Guide- Part 2

Part 1 of this article (Fueling AI Data Centers: Behind The Meter Solutions) explained how data centers are leveraging the abundance and relative affordability of natural gas to fuel Behind the Meter (BTM) power generators. Part Two advances the discussion to investing in this promising innovation. This article looks past the data center operators and …

Read More »

Read More »

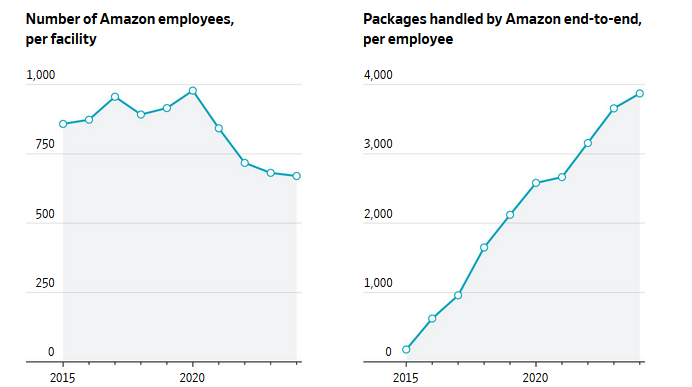

Amazon Has Over One Million Robots!

The age of robotics is no longer a futuristic concept. Per a Wall Street Journal article entitled, Amazon Is On The Cusp Of Using More Robots Than Humans In Its Warehouses, Amazon now has over one million robots in its warehouses doing the work that humans once handled. More impressively, the million robots are nearing … Continue...

Read More »

Read More »

How Executive Compensation Planning Can Boost Long-Term Wealth

For many executives, compensation isn’t just a paycheck—it’s a portfolio. Stock options, restricted stock units (RSUs), deferred compensation plans, and bonuses can significantly impact long-term financial security. Yet too often, these benefits are left underutilized or poorly timed. That’s where executive compensation planning plays a pivotal role. With the right strategies in place, you can …

Read More »

Read More »

The UM Survey: It Ain’t What It Used To Be

Recently, the media have highlighted anomalies in the University of Michigan (UM) consumer sentiment survey compared to other financial/economic sentiment surveys. It turns out UM changed their data gathering methods between April and July 2024. While it's challenging to determine the impact of these changes and whether they are responsible for the recent divergences from …

Read More »

Read More »

6-28-25 Candid Coffee – Financial Independence

Lance Roberts & Danny Ratliff host our mid-year review of markets, money, and financial mayhem: How to be a better investor without the tedium of the mainstream media noise.

INTRO/Origins

01:56 - Market Commentary - Markets at All-time Highs. Again.

(Jan 7 "Curb Your Enthusiasm")

Looking for another draw down this Fall - normal

End of Year Preview, Newsletter: What Do I Do If I Missed the Rally?

(Hope & Fear article)

06:00 -...

Read More »

Read More »

SLR: Could It End The Bond Bear Market

On June 25th, the Federal Reserve quietly announced a significant change to the Supplementary Leverage Ratio (SLR). While the headlines were muted, the implications for the U.S. Treasury market were anything but. For sophisticated investors, this technical shift marks a subtle but powerful pivot in monetary mechanics. It could create demand for Treasuries, improve market …

Read More »

Read More »

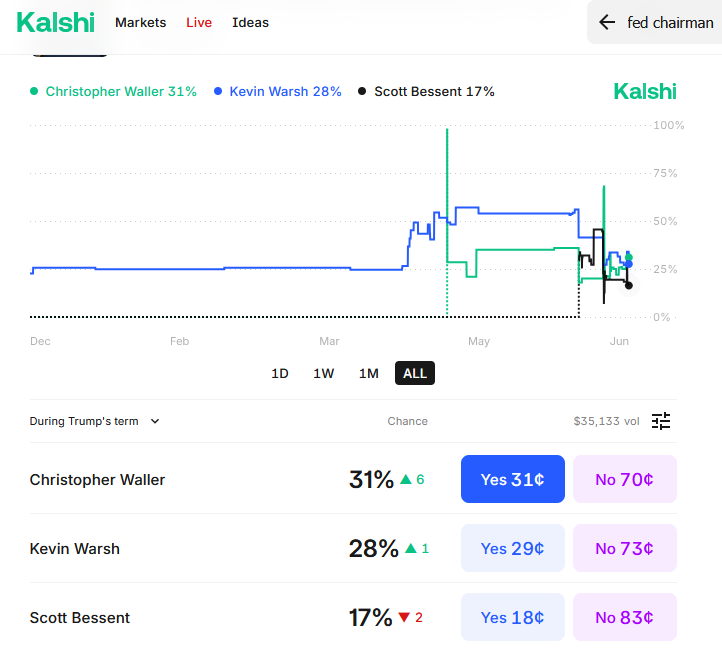

Shadow Fed Chair: Good Idea?

Donald Trump’s frustration with Chairman Powell increases by the day. Consequently, per The Wall Street Journal, expectations are that Trump will announce Powell's successor sooner than typical. Powell’s term expires May 2026. If Trump goes through with an early nomination, this "shadow Fed Chair" would espose views on the economy and monetary policy until Powell's retirement. Consequently, …

Read More »

Read More »

WWIII – The Death Of Another Narrative

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 📊 …

Read More »

Read More »

6-27-25 Ken FIsher Doesn’t Need an Annuity; You Might

Annuities are not your enemy, despite their bad rap; part of the fault lies with the financial industry, which too often SELLS annuities instead of PLANNING for them with a client.

Director of Financial Planning, Richard Rosso, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

2025 July Vacay

We are on vacation this week (6/30-7/4), returning with more fresh, live-content on Monday, July 7. In the meantime, feel free to peruse our playlists of features, market commentary, and financial advice segments here on our YouTube Channel.

Wishing you and your family a safe and happy Independence Day!

RIA Advisors Chief Investment Strategist Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Register for our next live...

Read More »

Read More »

6-27-25 Annuities Are Not Your Enemy

Are annuities always a bad deal? Not so fast.

In today’s episode, Richard Rosso & Jonathan McCarty tackle the myths and misconceptions around annuities. From income guarantees to tax-deferred growth, find out how annuities can actually support your retirement strategy—if used the right way. Jonathan shares his changed life as a new father, and a discussion of investor confirmation bias, who's likely to be the replacement for Jerome Powell,...

Read More »

Read More »