Category Archive: 9a.) Real Investment Advice

MP Materials Is Bought By Uncle Sam

In a unique event, the US government, specifically the Department of Defense (DoD), bought a 15% stake in the nation's largest rare earth miner, MP Materials (MP). The DoD is buying $400 million of MP’s convertible preferred stock. The transaction will make the government MP’s largest shareholder. The following quote on the benefits of the partnership …

Read More »

Read More »

Relative Returns Or Absolute. What’s More Important?

A couple of years ago, I wrote about absolute versus relative returns. Given the latest market run, I am getting a lot of questions about chasing returns, and individuals comparing themselves to the S&P 500 index. Historically, trying to beat a benchmark index leads to poor outcomes. However, understanding absolute and relative returns can help …

Read More »

Read More »

Is The Dollar Setting Up For A Comeback?

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 📊 … Continue...

Read More »

Read More »

7-11-25 Impact of the New $6,000 Tax Deduction on Middle-class Tax Payers

The "no-tax on Social Security" promise is a false premise, BUT passage of the $6,000 tax deduction DOES help a lot these middle class Americans who are paying taxes on social security.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »

7-11-25 What the Big Beautiful Bill Means for Your Money

What is the impact of the recently-passed Big Beautiful Bill on your money and retirement plans? Richard Rosso & Jonathan McCarty plumb the depths of the legislation to find the good--and the bad--effects it will have. Richard review the latest round of tariffs on Canada (markets don't care), and AI is promising to be a game changer in the middle management job market. The Big Beautiful Bill has benefits and drawbacks: there are caps and...

Read More »

Read More »

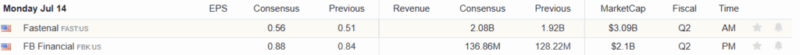

Q2-2025 Earnings Season Preview

Next week, the Q2-2025 earnings season will begin in earnest as a barrage of S&P 500 companies report, starting with the Wall Street money center banks on Tuesday and Wednesday. Since earnings drive the market by supporting investor expectations, what […] The post Q2-2025 Earnings Season Preview appeared first on RIA.

Read More »

Read More »

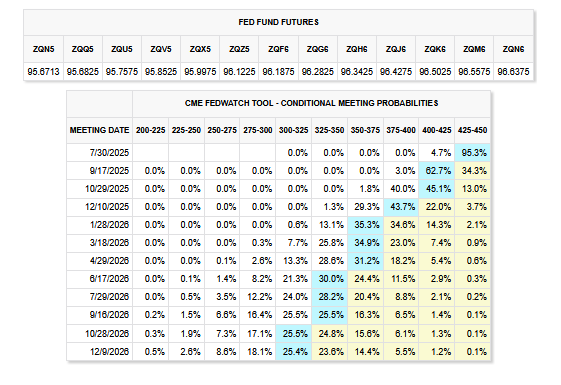

Is Immigration Not Tariffs Becoming Powell’s New Excuse

Jerome Powell has made it clear that tariffs could induce higher inflation. Accordingly, the Fed has resisted cutting interest rates. Despite his concerns, fears of tariff-based inflation, as judged by individual and business surveys, are fading. Moreover, even some Fed […] The post Is Immigration Not Tariffs Becoming Powell’s New Excuse appeared first on RIA.

Read More »

Read More »

7-10-25 Nvidia is Dead? Not Hardly.

Nvidia has defied the nattering naybobs of negativity who foretold its demise with the rise of AI. To the contrary, Nvidia beat out Apple as the first $4-Trillion company.

Beware the narratives!

Hosted by RIS Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »

7-10-25 Will Lower Rates Cure Higher Prices?

As inflation remains elevated and the Federal Reserve begins to shift its tone, markets are asking: Will lower interest rates actually bring prices down — or make them worse? Lance Roberts and Michael Lebowitz unpack the delicate balance between monetary policy, consumer behavior, and price pressures:

* The historical relationship between rate cuts and inflation

* Why inflation may be more “sticky” than expected

* How consumer demand and debt loads...

Read More »

Read More »

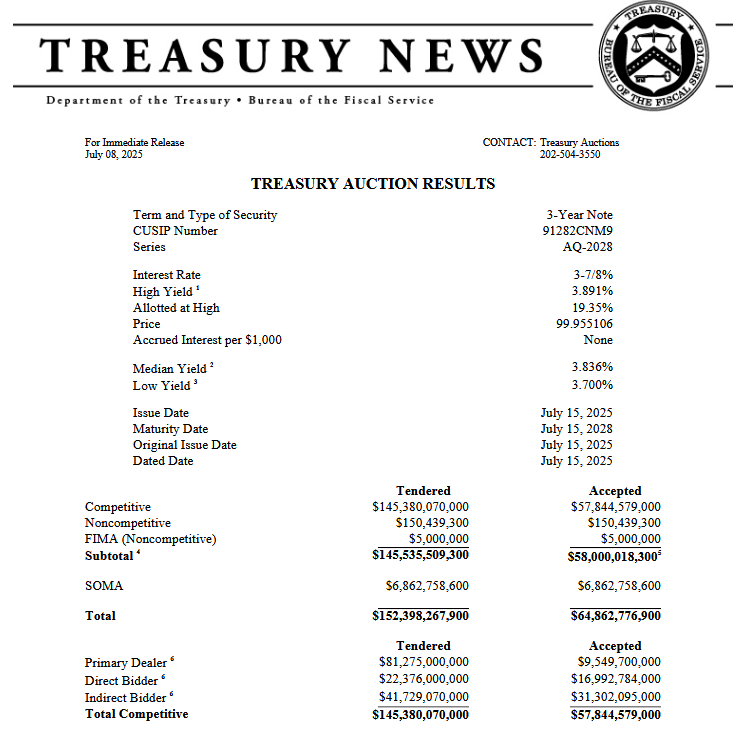

Treasury Auctions In Plain English

With the amount of Treasury debt now in sharp focus, it's worth cutting through the technical jargon used by the media to quantify demand at Treasury auctions. This summary of key Treasury auction terms will help you judge the auctions for yourself and not rely on others.

Read More »

Read More »

Capital Preservation Strategies for Retirees with Over $1 Million in Assets

When you've accumulated more than $1 million for retirement, your financial priorities shift. It's no longer just about growth but about protecting what you’ve built and generating reliable income that will support your lifestyle for decades to come.

Read More »

Read More »

Retirees with guaranteed income spend more.

David Blanchett and Michael Finke penned a June 2024 research paper for the Retirement Income Institute that shared insight into why retirees with a guaranteed income spend more. They deem guaranteed retirement income a "license to spend."

Read More »

Read More »

7-9-25 Make Sure You’re Not Too Conservative in Your Allocations

Yes, you can be too conservative in managing your retirement portfolio...just as you can be too risky. But don't be so conservative that you hamper your portfolio's ability to perform. And never wear a suit to a Radio show.

Hosted by RIS Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube...

Read More »

Read More »

7-9-25 How to Protect Your Multi-decade Retirement from Inflation

More Tariff trouble on the horizon, but markets have seen this movie before (The Stick & Carrot Show). Market risk remains, as markets are highly deviated. Sentiment remains positive; there's a large gap between market performance and economic data, however. Deviations tend to resolve themselves to the downside. Lance Roberts & Danny Ratliff reveal how to shield your retirement savings from decades of inflation: The necessity of Inflation...

Read More »

Read More »

Crisis At Apple: Can They Catch Up In The AI Race?

Apple (AAPL) shares are languishing this year. As we share below, the stock is down over 16% year-to-date and significantly lags all of the Magnificent Seven stocks except Tesla. While weak revenue growth and relatively few new products are culprits, it's also worth noting that Apple is considerably behind in AI development. Some Apple employees, …

Read More »

Read More »

Might Lower Rates Be The Cure For Higher Prices?

The Fed is resisting interest rate cuts to help soften inflation to its 2% target. Supporting their policy is the belief that high interest rates lead to lower inflation. Most investors assume that the Fed is all-knowing and that its theories are logical. Are they? Might they be wrong, and lower interest rates are what … Continue...

Read More »

Read More »

7-8-25 Implications of Surge in ETF Investing

The level of investor greed is "off the chain," levels we haven't seen since the late '90's. It's not necessarily a bad thing--that's how markets work--but it's also a warning sign.

Hosted by RIS Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »

7-8-25 Are ETF’s Eating the World?

Earnings season is upon us; will volatility pick up? A bigger question will be how tariffs may affect corporate earnings. Employment numbers are dipping into contraction zone as the economy slows. Markets sell off on renewed tariff news. Crude oil prices are creeping back up. No one is expecting correction...which is when they usually appear. Exchange-Traded Funds (ETFs) have exploded in popularity—driving a massive shift from active to passive...

Read More »

Read More »

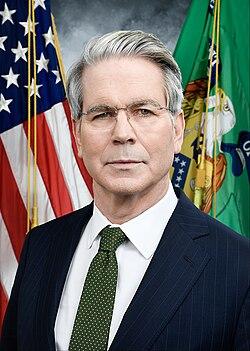

Can Bessent Juggle The Treasury And The Fed?

Hidden within a Bloomberg article published over the July 4th weekend was the following quote alluding to the possibility that Treasury Secretary Scott Bessent could simultaneously replace Jerome Powell as the Fed Chair, while continuing to serve as the Treasury Secretary. The president said Tuesday he has “two or three top choices” to potentially succeed …

Read More »

Read More »