Category Archive: 9a.) Real Investment Advice

Mag 7 Debt & Declining Free Cash Flow: Worrisome Or Not?

We have read a few articles expressing concern that the free cash flow for many of the Magnificent (Mag) 7 companies that are heavily involved in AI development and/or data center construction has leveled off. Furthermore, the hyperscalers, including Amazon, Microsoft, Google, and Oracle, issued over $120 billion in debt last year. Additionally, Google just …

Read More »

Read More »

Is China Really Dumping US Treasuries?

"China is dumping US Treasuries to get out of the dollar." This claim has been circulating the mainstream feeds lately, with the narrative that the "end of the dollar is near," or "the US will lose its funding base" and the "bond yields will surge." But are those claims valid? Such is what we will … Continue reading »

Read More »

Read More »

2-21-26 Ray Dalio Isn’t Predicting a Collapse — Social Media Is

Social media reactions to recent comments made by Ray Dalio at the World Economic Forum in Davos are exaggerated and misrepresented.

He is not predicting imminent hyperinflation or a dollar collapse. He is reiterating a long-term structural warning about unsustainable debt growth relative to economic growth.

In this Short video, Lance Roberts & Michael Lebowitz discuss that history shows that high debt levels do not automatically lead to...

Read More »

Read More »

The Business Cycle Narrative & War With Iran

🔎 At a Glance 🏛️ Market Brief - War With Iran On Friday, the Supreme Court struck down Trump’s signature tariffs. The ruling affects tariffs levied under the International Emergency Economic Powers Act (IEEPA) which includes the so-called reciprocal tariffs at various levels against nations all around the world to address trade imbalances, as well …

Read More »

Read More »

2-20-26 This Market Is Chasing Themes, Not Valuations

In this short video, Lance Roberts & Michael Lebowitz discuss how investors are piling into anything labeled “value,” “staples,” “industrials,” or “energy” without asking whether the stocks themselves are actually cheap.

Many of these names have gone parabolic — trading far above their historical norms — even though revenue growth is flat and earnings aren’t accelerating.

At the same time, some large-cap “growth” stocks like $NVDA $GOOGL may...

Read More »

Read More »

2-20-26 Mega Roth Questions & Senior Deductions

Some 401(k) plans let you put in extra after-tax money and move it into a Roth so it can grow tax-free—but you have to know what your plan allows. Richard Rosso & Jonathan McCarty share 10 questions to ask your 401(k) provider so you don’t miss it.

Rich & Jonathan also explain a new bill that would make the $6,000 senior deduction permanent. It’s not the same as “no tax on Social Security” for everyone—and the Social Security tax rules...

Read More »

Read More »

4 Percent Inflation: The Case For And Against

In a recent white paper, The Risk Of Higher US Inflation In 2026, Adam Posen and Peter Orszag argue that inflation could exceed 4 percent by year's end. To wit, they lead the article as follows: In our view, however, this optimism is premature. We think it is more likely that inflation will surprise to … Continue reading »

Read More »

Read More »

Money: The 10 Immutable Laws Of Building Wealth

Money - everybody wants it, but few actually have it. As shown in recent financial statistics, the "wealth gap" in America continues to grow between the "haves" and the "have-nots." That gap has led to a bombardment of narratives explaining why younger generations are financially oppressed. As shown, the top 10% of income earners own …

Read More »

Read More »

2-19-26 Defensive Stocks At 1999-Level Valuations?

In this short video, Lance Roberts and Michael Lebowitz discuss $WMT and that it is trading at valuations not seen since 1999.

Staples are no longer “cheap defensive value.”

They have become expensive.

Walmart is trading at roughly 48x forward earnings—valuation levels typically associated with high-growth tech companies expanding 20%+ annually. Yet, its growth rate is closer to 4–5%.

The bigger risk in this market isn’t AI or geopolitics —...

Read More »

Read More »

2-19-26 Dalio at Davos: Calm Markets, Hidden Currents

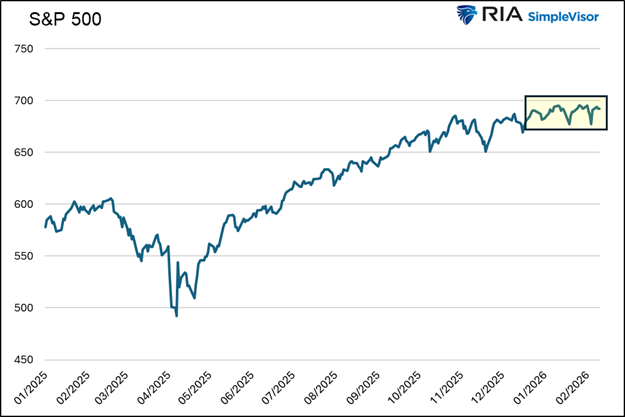

Ray Dalio’s Davos comments aren’t a “next-week collapse” call—they’re a long-cycle warning: rising debt supply can eventually force higher yields and tough policy trade-offs. Meanwhile, the S&P 500 looks calm on the surface, but sector/factor dispersion and low correlations show a fierce rotation under the hood. Lance Roberts & Michael Lebowitz examine the calm index ≠ calm market—watch dispersion and correlations for the next regime...

Read More »

Read More »

A No Landing Outcome Is Assumed: Should It Be?

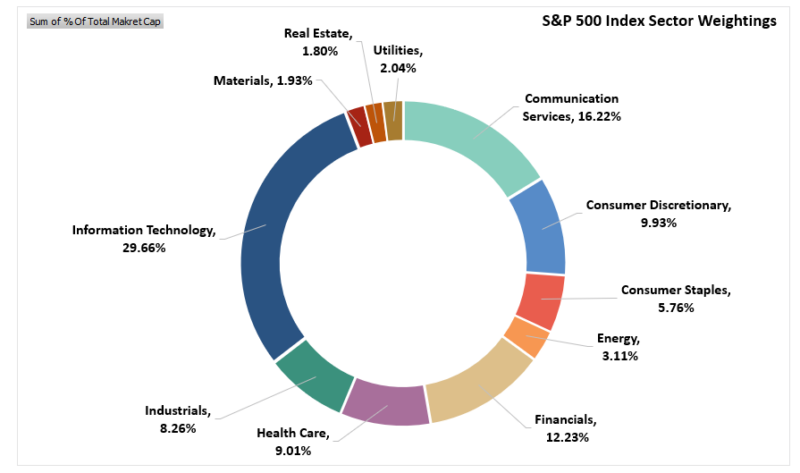

Quite often, investors describe economic forecasts as a hard landing (recession), a soft landing (weak growth but no recession), or no landing (moderate to strong economic growth). As evidenced by the massive rotation toward economically sensitive sectors like industrials and materials and the significant underperformance of interest-rate-sensitive growth stocks, the no landing, or as it's …

Read More »

Read More »

2-18-26 How To Manage Capital In A Rotation-Driven Market

Markets aren’t breaking — they’re rotating.

The smart move isn’t going all in or all out. Trim overbought sectors like energy $XLE, materials $XLB, and industrials $XLI, and gradually add to oversold areas with strong forward growth, such as software $XLK $IGV.

If you’re up this year, don’t rush to cash out and risk chasing back in later. Stay allocated, rebalance, raise selective cash, and let process and risk management guide decisions instead...

Read More »

Read More »

2-18-26 Q&A Wednesday: Markets, Money, and Your Questions

It’s Q&A Wednesday—your questions drive the show.

Lance Roberts & Danny Ratliff break down what’s moving markets right now, key economic and Fed signals to watch this week, and the practical portfolio decisions that matter most (risk, allocations, income, taxes, and retirement timing). Drop your question in the live chatroom and we’ll tackle as many as we can.

Topics we often cover: market volatility & trend levels, rates/inflation,...

Read More »

Read More »

Calm Market Waters Hide Fierce Undercurrents

The price movement in the broad S&P 500 index is relatively calm. Yet the market’s undercurrent, as measured by sharply diverging returns across stock sectors and factors, is anything but calm. The current market picture we paint is well embodied by a quote from Jules Verne in 20,000 Leagues Under the Sea. “The sea was …

Read More »

Read More »

Are Momentum Strategies Late To The Game?

Rather than focusing on valuation or fundamentals, momentum strategies use price behavior and relative performance to identify securities that are gaining or losing strength. One would think that, given the massive rotation trade and the resulting gaps in relative performance between various sectors and factors, momentum strategies would be doing well. While some such strategies …

Read More »

Read More »

2-17-26 Overbought Cyclicals, Oversold Tech — Time to Rebalance?

The market is deeply split.

Energy $XLE, materials $XLB and industrials $XLI are stretched and overbought, while technology $XLK, discretionary $XLY and communications $XLC are oversold.

Equal-weight has led recently, but tech still carries massive index weight. If oversold tech rebounds, leadership could flip quickly.

This is a risk management environment where trimming extended cyclicals and rebalancing exposure may matter more than chasing...

Read More »

Read More »

2-17-26 Bank, Brokerage, or Corporate Trustee?

Choosing a corporate trustee is one of the most important decisions in estate planning—especially if you’re naming a bank, brokerage trust department, or independent trust company to manage assets and carry out your wishes after you’re gone. Lance Roberts & Jon Penn break down how to compare corporate trustees beyond just “lowest fees,” including fiduciary standards, investment flexibility, service model, administrative capabilities,...

Read More »

Read More »

Time To Swap Gold For Bitcoin?

The dollar-debasement narrative is in full swing, as evidenced by the price of precious metals. However, one look at bitcoin, which should also rally on the debasement narrative, tells you something is amiss. We do not buy into the dollar-debasement narrative; instead, we believe much of the activity in gold and bitcoin is more closely …

Read More »

Read More »

2-16-26 How Margin Calls Turn Corrections Into Crashes

Record margin debt combined with shrinking disposable income has created a fragile market structure.

In this short video, Lance Roberts explains how elevated leverage and declining cash reserves increase the risk of forced margin calls, turning ordinary pullbacks into accelerated selloffs as mechanical liquidation pressure feeds on itself and amplifies volatility.

Lance also highlights a real example of a leveraged $SLV position that reportedly...

Read More »

Read More »

Market Sector Review: Extreme Market Bifurcation

Since the beginning of the year, we have discussed the "reflation trade" and its impact on specific market sectors. This past weekend's newsletter also showed some of these more extreme returns in various market sectors since the beginning of the year. To wit: "Despite what seemed like a rough week in the market, it really wasn’t as …

Read More »

Read More »