Category Archive: 9a.) Real Investment Advice

Bad Jobs Report = Good News For Markets?

A weak jobs print with sharp negative revisions could become bullish fuel, lifting hopes of a 50 bps Fed rate cut.

In this short video, I break down why bad news might be good news for $SPY / $QQQ.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/...

Read More »

Read More »

9/4/25 Stock Market Bubble? Extreme Valuations & What Investors Should Do Now

Stock valuations are at extreme levels — some call it a bubble, while others argue the bull market has more room to run. So, who’s right? And more importantly, what should YOU do as an investor?

Lance Roberts & Michael Lebowitz expose the conflicting market narratives and explain why selling everything may not be the smartest move. Instead, they’ll explore how active investing, technical signals, and disciplined risk management can help you...

Read More »

Read More »

Robots Are Tesla’s Future: EVs No Longer The Value Proposition

Tesla is the leading manufacturer of electric vehicles (EVs) in the US and second, behind BYD, in the world. Despite its strong position in the EV market, Tesla is only the fourteenth largest auto manufacturer. Despite its low ranking, it has a market capitalization that is almost four times that of Toyota, the second-largest auto …

Read More »

Read More »

9-3-25 Why Most People Fail at Day Trading

It's an interesting conundrum that some retirees go into day trading as a "side gig," which in turn becomes another full time job, monitoring all of the data and news. Just because you have access to information doesn't mean you have to act upon it. Sometimes it's better to let the dust settle before making a move.

RIS Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisors, Danny Ratliff, CFP

Produced by...

Read More »

Read More »

9/3/25 10 Reasons You Shouldn’t Retire (but what to do if you do)…

Thinking about retirement? Think again.

Lance Roberts & Danny Ratliff present 10 powerful reasons you shouldn’t retire too soon—from financial stability to maintaining purpose and health. But if you do decide to retire, they’ll also show you exactly what steps to take to protect your money, lifestyle, and long-term security.

0:19 - How ChatGPT Saved Google in Anti-trust Court

2:49 - Why the 50-DMA is Key

8:18 - Looking Ahead to Employment...

Read More »

Read More »

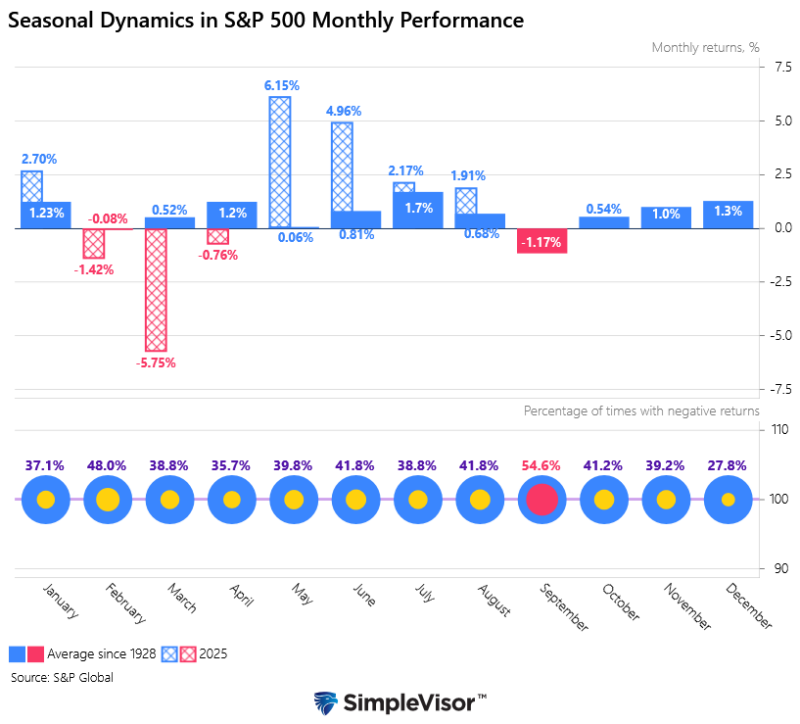

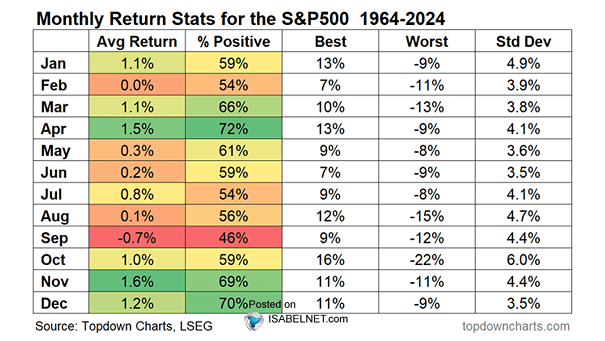

Monthly Market Trends: Do They Matter?

The graph below breaks down the monthly performance of the S&P 500 since 1928. As shown, September is the only month that has seen more negative monthly performances than positive ones. September's record joins February as the only two months with a negative average, albeit February is only down 0.08%, versus the more significant 1.17% …

Read More »

Read More »

Valuations Are Extreme: Navigating A Bubble

Some pundits warn that, given extremely high stock valuations, one should sell everything. Yet, despite having the same information, other pundits show little concern and believe the bull market has further to run. The stark contradiction of opinions in today’s market leaves many investors understandably confused and anxious about what to do. Based on valuations, …

Read More »

Read More »

9-2-25 Investing is About Patience

Investing is all about patience, especially when you're young. Speculate if you want, but put most of your nest egg money into the S&P and allow it to grow and do it's thing. Over the long haul, you're better off.

RIS Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a...

Read More »

Read More »

9/2/25 DIY Investing Mistakes & Why Swing Trading Isn’t Long-Term Wealth

Think you can outsmart the market?

Many DIY investors fall into the same traps: chasing hype, trying to time the market, concentrating in one hot sector, or lacking patience. Lance Roberts & Jonathan Penn break down five of the biggest mistakes DIY investors make — and why they can derail your financial future. They'll also explore swing trading vs. long-term investing:

* How short-term trading chases quick wins with high risk.

* Why...

Read More »

Read More »

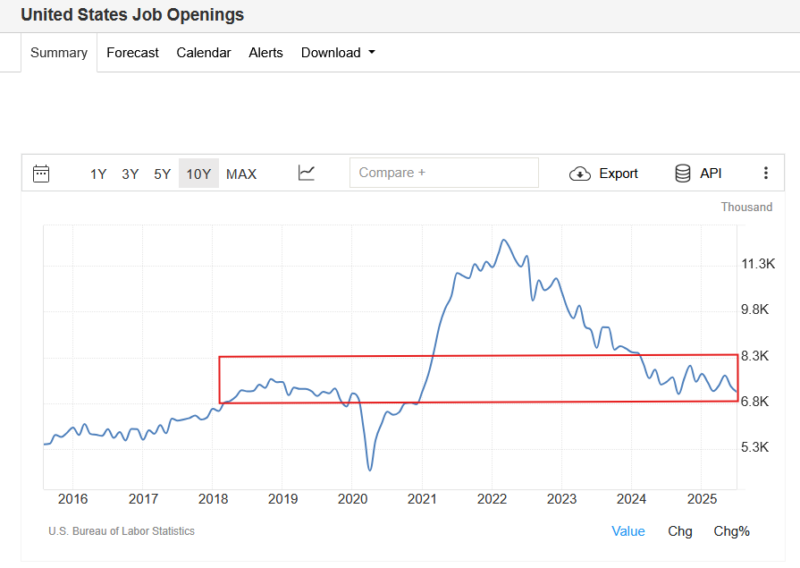

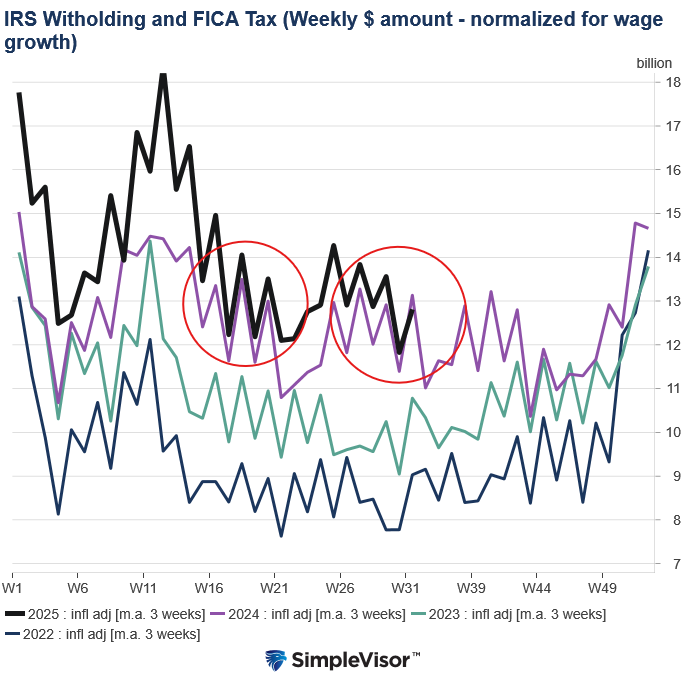

Withholding Taxes: Better Forecasting Employment Data

Once again, we find ourselves waiting on the all-important BLS labor report. The markets and the Fed are heavily dependent on the monthly BLS employment data; however, there are other labor market data sources that can provide a more frequent indication of labor market conditions. For instance, the weekly BLS data on jobless claims helps …

Read More »

Read More »

Portfolio Risk Management: Accepting The Hard Truth

Alfonoso Peccatiello recently wrote an interesting piece on portfolio risk management, starting with a quote from Steve Cohen: ‘’I compile statistics on my traders. My best trader makes money only 63 percent of the time. Most traders make money only in the 50 to 55 percent range. That means you’re going to be wrong a …

Read More »

Read More »

Meme Markets: Investing vs. Entertainment

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

9-1-25 Labor Day Special

Millennials are turning everywhere for financial advice—from TikTok influencers and YouTube gurus to Reddit forums and traditional advisors. But where should they really go for smart money guidance?

Lance Roberts, Danny Ratliff, and Jonathan Penn explore the pitfalls of following social media “experts,” the real risks of private equity and alternative investments, and why annuities and insurance require the right questions before committing....

Read More »

Read More »

8-29-25 Profits are Good

Do you freeze up when considering selling a stock at a profit because you don't want to pay taxes? Remember, if you have to pay taxes, you made money, and isn't that the whole point of investing?

RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Relationship Manager, Matt Doyle, CFP

Produced by Brent Clanton, Executive Producer

-------

Sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢...

Read More »

Read More »

8/29/25 Why Do Investors Hate to Sell?

Why do investors struggle when it comes to selling stocks?

Richard Rosso & Matt Doyle look at the psychology of investing—exploring concepts like loss aversion, behavioral finance traps, and the emotional biases that make it so hard to hit the sell button. Whether you’re a DIY investor or managing money professionally, understanding why we hold on too long is critical to protecting and growing your wealth.

* Why fear and regret drive poor...

Read More »

Read More »

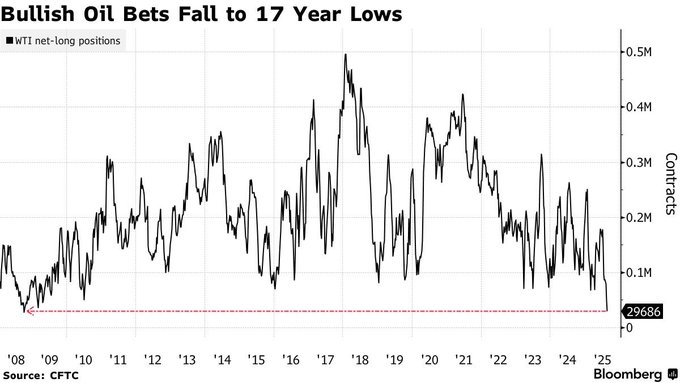

Energy Price As An Economic Indicator

What are energy prices telling us about the economy? A recent article on Bloomberg noted that: "Hedge funds slashed their bullish position on crude to the lowest in about 17 years as risks of additional sanctions on Russian crude oil waned, bringing concerns about a global supply glut back to the fore. Money managers’ net-long position on …

Read More »

Read More »

The Nvidia Earnings Train Keeps On Rolling

Once again, Nvidia continues to see its earnings and revenues grow at astonishing rates. Consider the following: As we noted, data center revenue is driving Nvidia's fantastic earnings and revenue growth. Helping maintain this growth is its Blackwell GPU architecture. In the last quarter, the new Blackwell products saw a 17% jump in revenue. As …

Read More »

Read More »

9-1-25 Labor Day Special Show

Lance Roberts is joined by Jonathan Penn and Danny Ratliff to break down ten rules for navigating excess market bullishness so you can protect your portfolio while still participating in market gains. Lance also examines earnings growth forecast justification, and why retail investors are the last resort for Wall Street.

In this episode of Two Dads on Money, Lance Roberts & Jonathan Penn dive into how Millennials find financial advice in...

Read More »

Read More »

8-28-25 The “Gamification” of Markets Does Not End Well for Young Investors

Retail trading as a percentage of total volume is at all time highs; Retail trading of Zero-days-to-expiration Options are 60% of total options volume. We've turned the investing market into an entertainment market. This does not end well.

RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch...

Read More »

Read More »

8/28/25 Nvidia Falls Short

Nvidia reported earnings with strong overall results, but Wall Street was not impressed. Despite solid forward guidance, a data center revenue miss rattled investors and sent the stock lower. Lance Roberts & Michael Lebowitz break down Nvidia’s earnings highlights, why guidance failed to wow the bulls, and what this means for tech stocks going forward; the ongoing soap opera that is the Federal Reserve: Jerome Powell, Lisa Cook, and dovish vs...

Read More »

Read More »