Category Archive: 9a.) Real Investment Advice

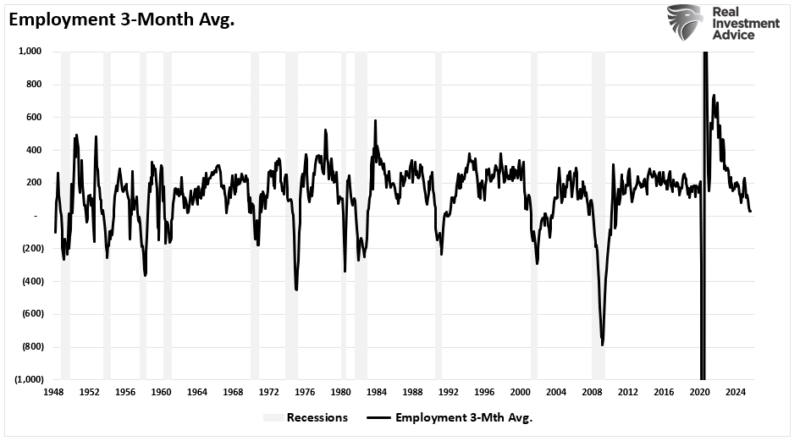

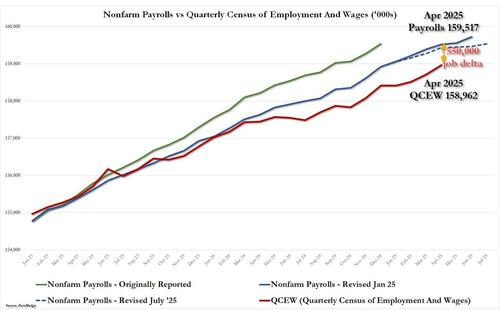

Corporate Earnings Slowdown Signaled By Employment Data

The latest employment data strongly warned of a potential corporate earnings slowdown ahead. This is the first time we have warned about the employment data and its impact on corporate earnings. In May, we penned "Employment Data Confirms Economy Is Slowing." wherein we stated: "Given the importance of consumption in the economy and that employment (production) must come …

Read More »

Read More »

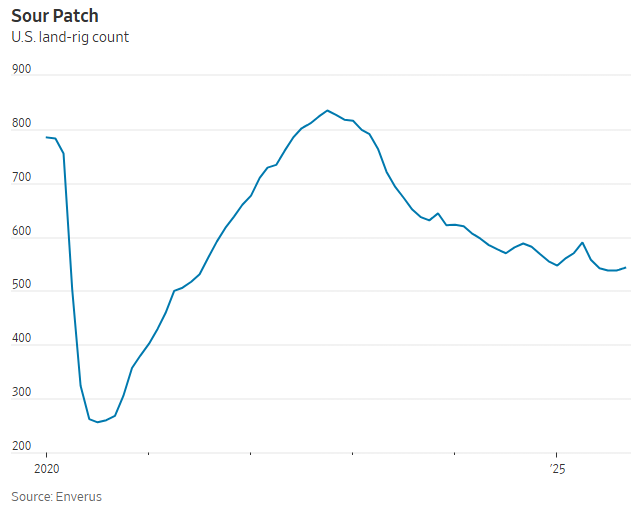

Oilfield Servicers Find New Hope in AI Power Demand

Oilfield service companies are fighting an uphill battle after years of weak demand from traditional energy producers. A relentless multi-year decline in U.S. rig counts has resulted in beaten-down oilfield service companies turning to an unlikely new customer base: technology firms racing to power AI data centers. According to the WSJ, companies such as Solaris …

Read More »

Read More »

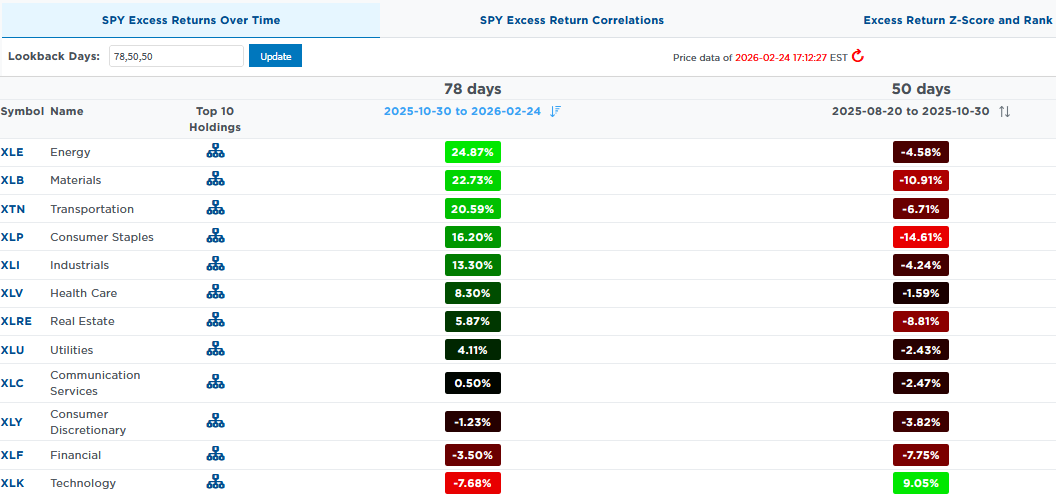

9/11/25 When Most Sectors Bullish – Major Correction Risk Low

The Risk Range Report (link below) shows that most sectors have turned bullish. With only a few bearish signals left, the chance of a 20–30% correction is low.

In this short video, I show how this tool can help you spot danger before markets turn.

📉 The Risk Range Report: https://simplevisor.com/risk-range-report

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#StockMarket #MarketCorrection...

Read More »

Read More »

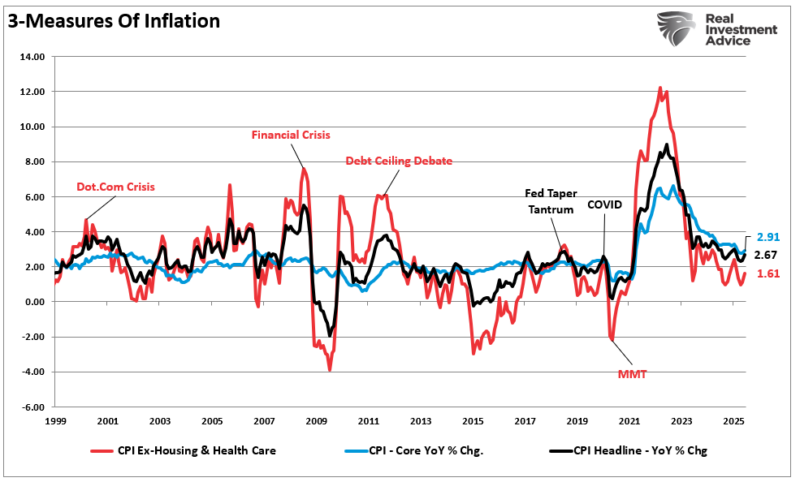

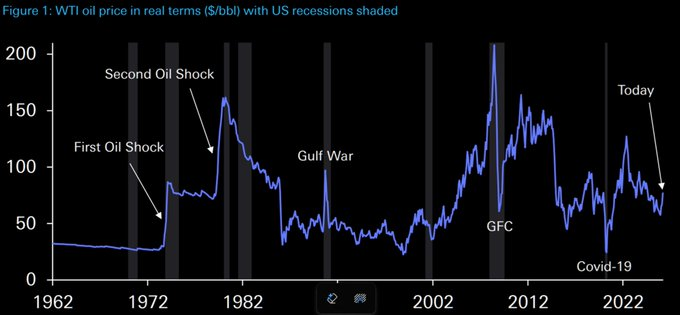

9/11/25 There Ain’t No Inflation

Markets and the Fed keep talking about inflation, but what’s really happening? Lance Roberts previews the upcoming CPI, PPI reports, and real-world data to explain why the official numbers don’t always match what you're feeling. From wages and rents to energy prices--is inflation is truly under control, or just hiding in plain sight.

Discover how “disinflation” differs from “deflation,” why Wall Street’s narrative matters for stocks, and what it...

Read More »

Read More »

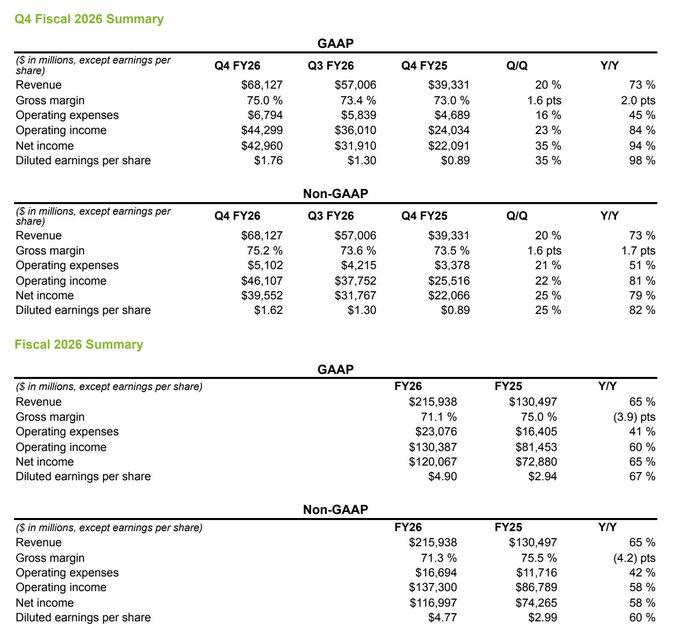

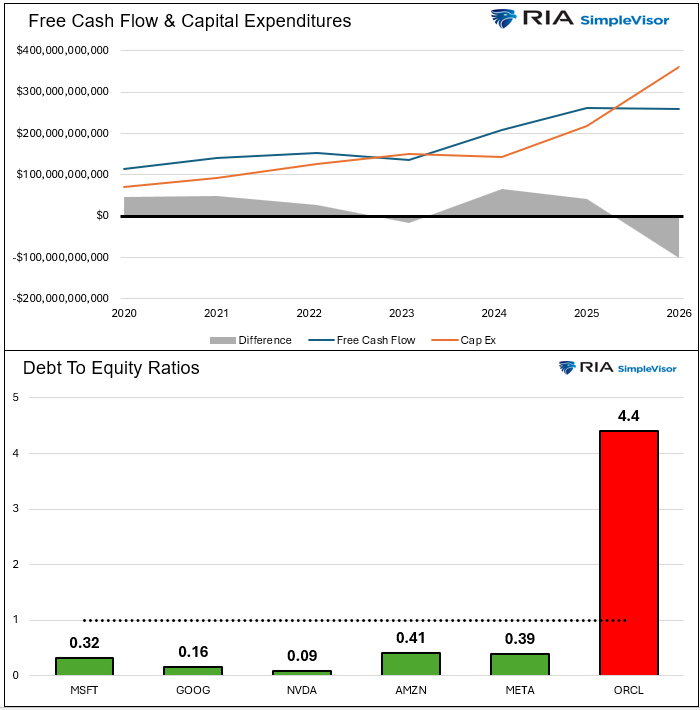

Oracle Puts the AI Infrastructure Trade Back in Action

The AI infrastructure trade stagnated through August, with enthusiasm fading even after NVDA beat earnings and raised guidance. Investors shifted their focus to weakening economic data and looming Fed rate cuts, fueling the narrative that the AI boom had run its course. That changed yesterday, when Oracle reignited the trade with a blockbuster earnings call. …

Read More »

Read More »

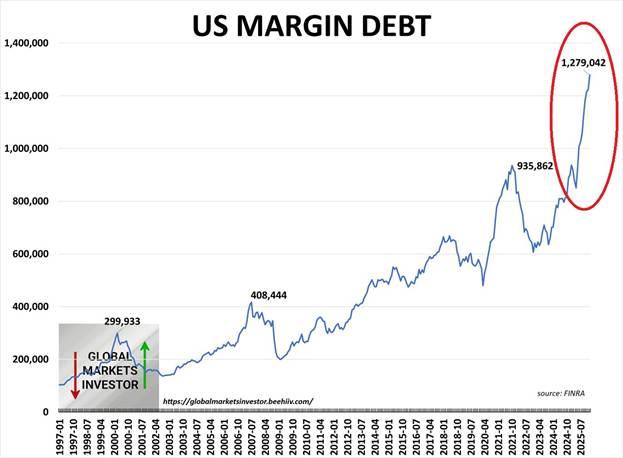

9/10/25 This Market Boom Isn’t Backed By The Data

The market’s rally is not supported by underlying economic data. Weak jobs, disinflation, and slowing demand raise real recession risks.

A recession doesn’t necessarily mean a financial crisis or a 50% market crash, but you have to be ready for one.

In this short video, I break down what a recession could actually look like.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#StockMarket #Recession...

Read More »

Read More »

9-9-25 Let’s Talk About A Correction

$SPY / $QQQ remain resilient and supported by strong money flows, underweight positioning, and short covering.

While an ~8% correction is possible due to stretched valuations and the gap from long-term averages, a major downturn looks unlikely this year.

In this short video, Lance Roberts explains what this means for investors.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#MarketCorrection #SPY...

Read More »

Read More »

9/10/25 Are We On the Edge of Recession?

Are we standing at the edge of a recession? Economic data is showing cracks: slowing job growth, weakening consumer spending, and tightening credit conditions. Meanwhile, the Federal Reserve’s policies continue to weigh on growth.

In this episode, Lance Roberts & Danny Ratliff break down the key signals flashing caution, what they could mean for corporate earnings and market performance, and how investors should think about risk management in...

Read More »

Read More »

Main Street Optimism Ticks Higher Despite Hiring Challenges

Main Street optimism edged higher in August, as the NFIB Small Business Optimism Index rose to 100.8. That reading sits above the long-term average of 98 but missed the consensus estimate of 101. Stronger sales expectations led the improvement, with a net 12% of owners anticipating higher real sales volumes. This represents a six-point jump …

Read More »

Read More »

9/9/25 The Best Way to Buy Bitcoin: Smart Investors Guide

Thinking about buying Bitcoin but not sure of the best approach? You’re not alone. With so many options—crypto exchanges, ETFs, custodians, and even payment apps—the path can feel overwhelming.

In this episode, we break down the smartest ways to buy Bitcoin while considering security, fees, custody, and long-term investing strategy. Should you buy directly on an exchange, use a crypto wallet, or stick to regulated investment vehicles like ETFs?...

Read More »

Read More »

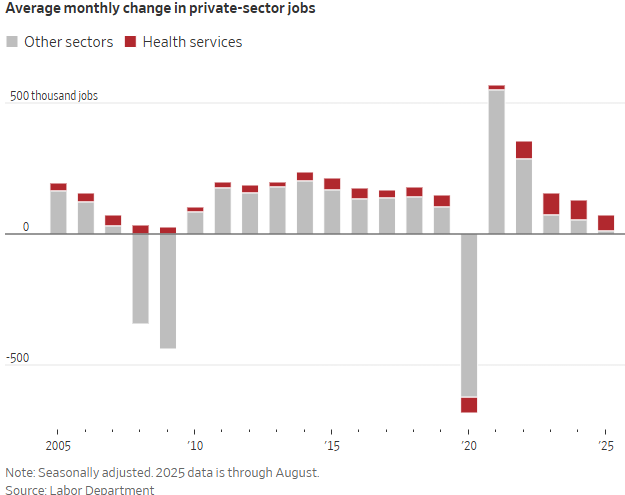

Healthcare Jobs Keep Labor Market Afloat: But For How Long?

The August jobs report clarified what many investors already suspect: the U.S. labor market is stalling. Outside of healthcare and social assistance, private-sector job creation has nearly flatlined this year. So far in 2025, the economy has added an average of 74,000 private-sector jobs per month. Stripping out the ~64,000 monthly additions from healthcare jobs, …

Read More »

Read More »

9/8/25 Why Diversification Is Failing In The Age Of Passive Investing

NOTE: As of 10:50a CDT YouTube has yet to process this video sufficiently for us to edit or add time codes. We'll revise all of these as soon as YouTube allows.

Lance Roberts explores how the rise of passive index funds and ETFs has reshaped markets, leading to higher correlations across asset classes and eroding the traditional benefits of diversification. Once considered the cornerstone of portfolio risk management, diversification now struggles...

Read More »

Read More »

9-8-25 Don’t Be Fooled By The Market: Jobs Report Signals Trouble

Friday’s jobs report revealed deeper cracks: a multi-month downtrend in employment, quality of hires is deteriorating, etc.

Since employment drives growth & earnings, any $SPY / $QQQ pop may be short-lived – disinflation & slowing growth still point to mounting risk for equities.

In this short video, I explain why Friday’s data could matter more than you'd think.

📺 Catch me daily on The Real Investment Show:...

Read More »

Read More »

Why Diversification Is Failing In The Age Of Passive Investing

Diversification has been the backbone of "buy and hold" strategies for the last few decades. It was a boon to financial advisors who couldn't actively manage portfolios, and it created a massive Exchange-Traded Funds (ETFs) industry that allowed for even further simplification of investing. The message was basic: "Buy a basket of assets, dollar cost …

Read More »

Read More »

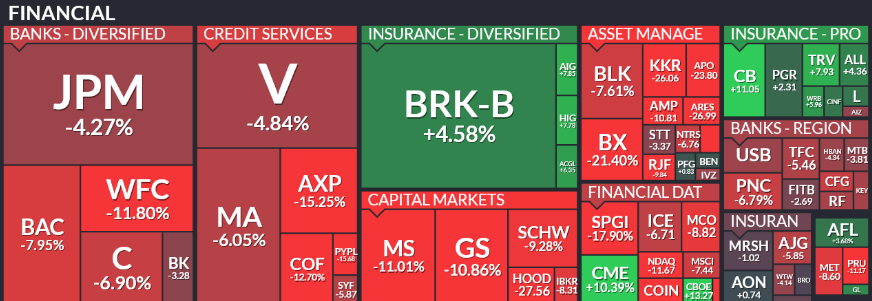

Earnings Are Becoming Harder To Come By

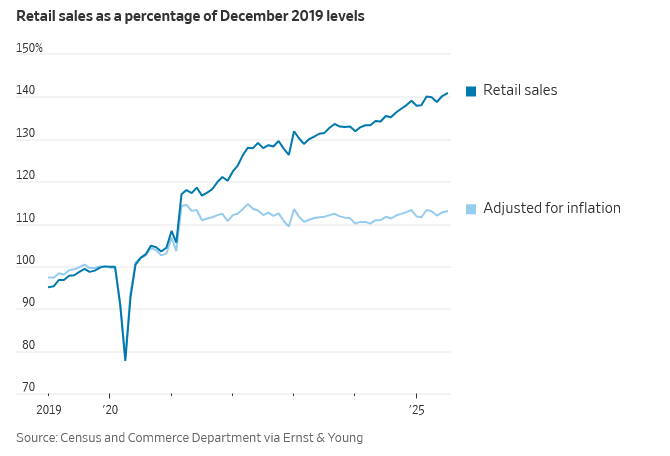

Another round of quarterly earnings reports has come and gone, and once again, many companies beat profit expectations. Yet a glance at the graph below from The Wall Street Journal, showing that retail sales have been flat excluding inflation, suggests that the ways in which companies are growing their earnings must be changing. The Wall …

Read More »

Read More »

Using MACD To Manage Portfolio Risk

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

Pullback or Not? & Time to Trim Gold

A weak jobs report has traders betting on a Fed rate cut – but don’t rule out a pullback in $SPY / $QQQ in September.

Gold $GLD, meanwhile, looks overbought – a good spot to take profits.

In this short video, I break it all down.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#StockMarket #FedRateCut #SPY #QQQ #GoldInvesting #MarketOutlook

Read More »

Read More »

9/5/25 Financial Planning Secrets: Why Your Advisor Should Do More Than Pick Stocks

Too many people think financial planning is just about picking investments—but it’s much more than that. A great plan is a living, breathing roadmap that evolves as your life changes.

Richard Rosso & Jonathan McCarty uncover what makes the perfect financial planning experience—from getting your head straight, to gathering the right documents, to partnering with a fiduciary advisor who looks beyond just returns.

You’ll learn:

• Why real...

Read More »

Read More »

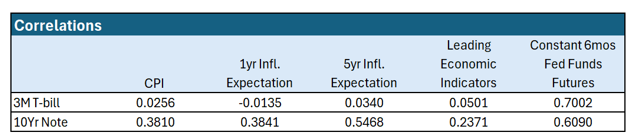

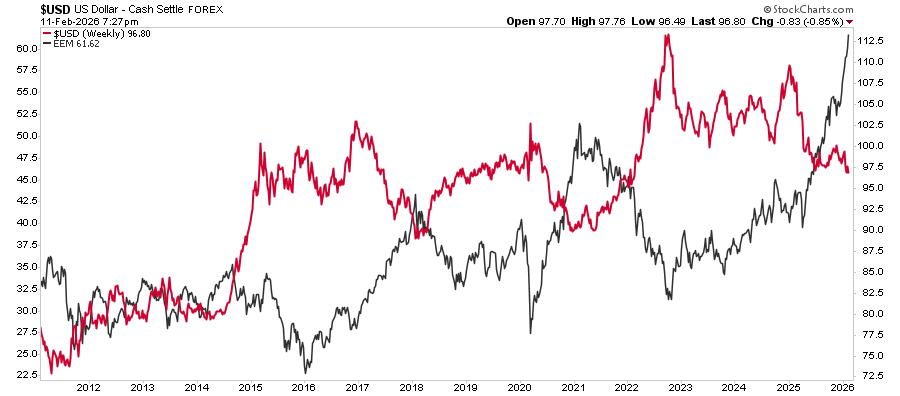

Fed Policy Is More Restrictive Since Rate Cuts

The Fed has cut the Fed Funds rate by 1% since late 2024, and the presumption from many market participants is that the Fed has made policy less restrictive. Technically, they are somewhat correct. Banks and other financial institutions that borrow over very short periods have seen their borrowing costs decline due to the Fed’s …

Read More »

Read More »

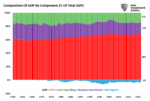

Why Keynes’ Economic Theories Failed In Reality

A recent post from Daniel Lacalle, “How Keynesians Got The US Economy Wrong Again,” exposed the widening gap between John Maynard Keynes' economic theory and reality. Despite the confident forecasts of leading Keynesian economists, the U.S. economy in 2025 continues to defy expectations. The Federal Reserve’s tightening cycle failed to trigger the widely predicted “hard …

Read More »

Read More »