Category Archive: 9a.) Real Investment Advice

10-29-25 A Daily Dose Of Charts & Graphs

In this Short video, I cover $SPY / $QQQ breakout to new highs, $NVDA $5T surge and its potential trade-deal boost, the seasonality tailwind into year-end, and why overbought mega-cap growth may soon rotate into oversold low beta.

I also touch on the strong earnings breadth, Fed rate-cut backdrop, and sentiment parallels to the late-’90s melt-up — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch...

Read More »

Read More »

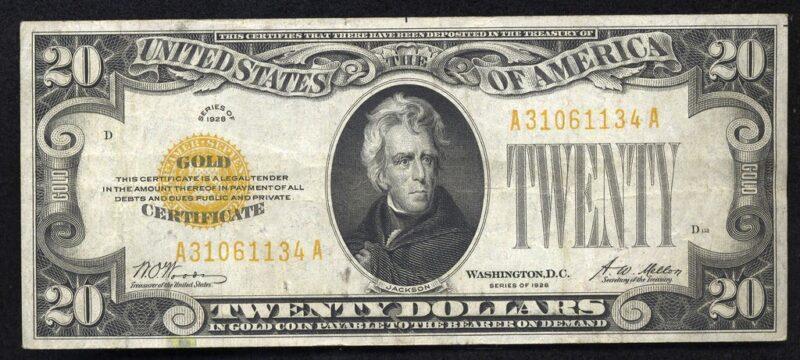

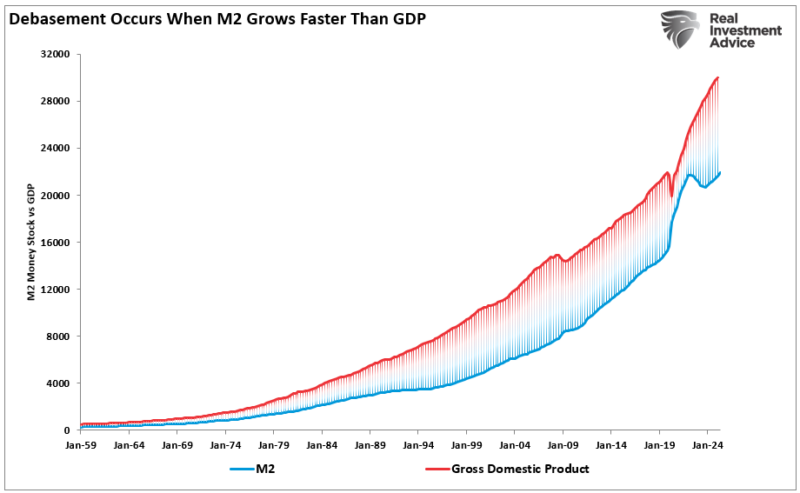

Rebasing The Dollar: Another Look At The Debasing Narrative

The phrase “debasing the currency” is all the rage in the media. Moreover, the debasement narrative is used to support the significant surge in gold and other precious metal prices. We have written a few articles on the subject of debasement, for example: Dollar Debasement and Debasement: What It Is and Isn’t. To help further …

Read More »

Read More »

CAPE Valuations: Does Nvidia Overstate Its Ominous Warning?

As equity valuations approach the record highs of 1999, investors are growing anxious. This unease is partly driven by the media issuing grim warnings, often based in part on CAPE valuations. Consider the following headlines and their summaries. The graph shows the S&P 500 and CAPE since 1920. Given how the market performed after the …

Read More »

Read More »

10-28-25 Navigating Overbought Markets: Don’t Let FOMO Ruin Your Portfolio

FOMO destroys more portfolios than bad stocks ever will.

In this short video, I explain why timing the market never works—and how rebalancing and managing risk can keep you invested when markets get overbought.

📺Full episode: _bQP4

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-28-25 Profit Taking Made Simple

Taking profits sounds easy—until you try it with a smaller account.

Lance Roberts & Jonathan Penn answer listeners' question about managing portfolios spread across myriad stocks, with allocations similar to the S&P 500. When positions are small, trimming into strength or reinvesting during market highs can feel nearly impossible.

0:19 - Profit Taking, Earnings, & FOMC Meeting Previews

4:48 - Market Bullishness Confirmed

10:05 -...

Read More »

Read More »

Gold Or Bitcoin: Which Is The ‘Right’ Dollar Hedge?

Gold and bitcoin are touted as the "anti-dollar", or in some people's minds, possible replacements for the US dollar. Thus, one would expect the dollar-debasement trade to benefit gold and bitcoin similarly. The reality throughout this year has not been what many would expect. For example, gold is up over 50% this year, while bitcoin …

Read More »

Read More »

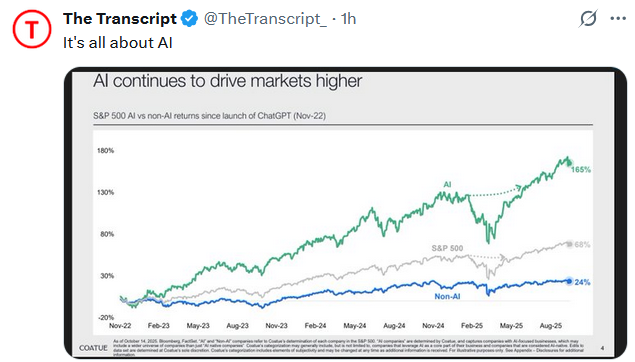

10-27-25 How Greed, Innovation & Leverage Create Every Market Bubble

Speculative bubbles don’t appear overnight – they evolve through cycles of greed, innovation, and leverage.

In this Short video, I explain how the same cycle of easy money and speculation keeps repeating, just with new assets and fancier language each time.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-27-25 The Most Dangerous Era in History

We’re living through one of the most dangerous eras in history — not because of war or politics alone, but because of the extraordinary convergence of economic, financial, and geopolitical risks.

In this episode, we break down:

* How record global debt, AI-driven speculation, and geopolitical instability are colliding.

* Why the current market optimism masks systemic fragility.

* What investors can learn from past cycles — from 1929 to 2008 — to...

Read More »

Read More »

The Most Dangerous Era In History

We live in what Brett Arends claimed as "The Dumbest Stock Market In History," but I believe it is potentially the most dangerous era. That phrase is not hyperbole as it reflects structural distortion, extreme valuations, and an investor base intoxicated by momentum and narrative. The MarketWatch piece puts it bluntly: “At one level, there …

Read More »

Read More »

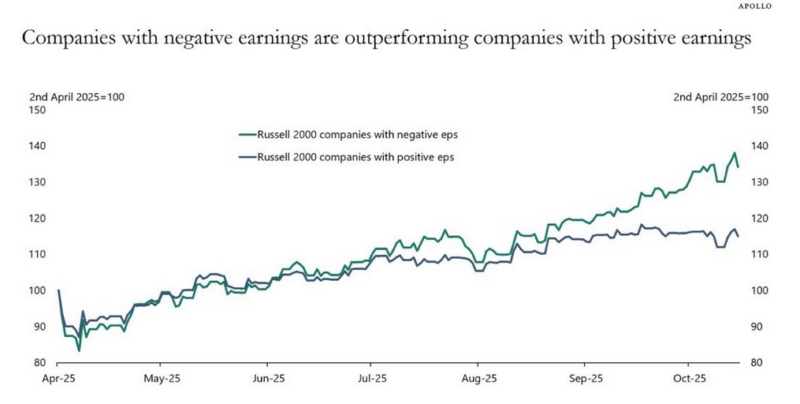

Negative Earnings: Another Speculative Favorite

The chart below, courtesy of Apollo’s Torsten Slok, shows that small-cap companies with negative earnings have outperformed small-cap companies with positive earnings by about 30% since early April. Per Torsten: “Something remarkable is going on in the equity market. Stock prices of companies with negative earnings have in recent months outperformed stock prices of companies …

Read More »

Read More »

Retail Leverage Goes to Extremes

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

10-24-25 Why Gold’s Boom Is More About Calls Than Coins

$GLD rally isn’t real demand – it’s speculation disguised as strength.

In this short video, @michaellebowitz and I explain why the boom in call options, not central bank buying, is driving #gold surge and why a sharp correction may be next.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-24-25 The Art of Retirement Income

Your greatest retirement risk isn’t the market; it’s living longer than you expect.

Richard Rosso shares the Art of Retirement Income—how to enjoy your savings early in retirement while protecting your future lifestyle.

💡 Topics covered:

• Why the 4% rule doesn’t match how most retirees really spend

• How to front-load income for early enjoyment without running out of money

• The role of inflation protection and flexible withdrawal plans

• How...

Read More »

Read More »

Money Supply Growth: A Thesis With A Fatal Flaw

Recently, MarketWatch ran a provocative headline: “When the world’s largest asset manager and the Bond King both agree: Run to gold, silver, and bitcoin.” The article highlighted how Larry Fink’s BlackRock and Jeffrey Gundlach, often dubbed the “Bond King,” see deficits and “money printing” as reasons for investors to escape fiat currencies and pile into …

Read More »

Read More »

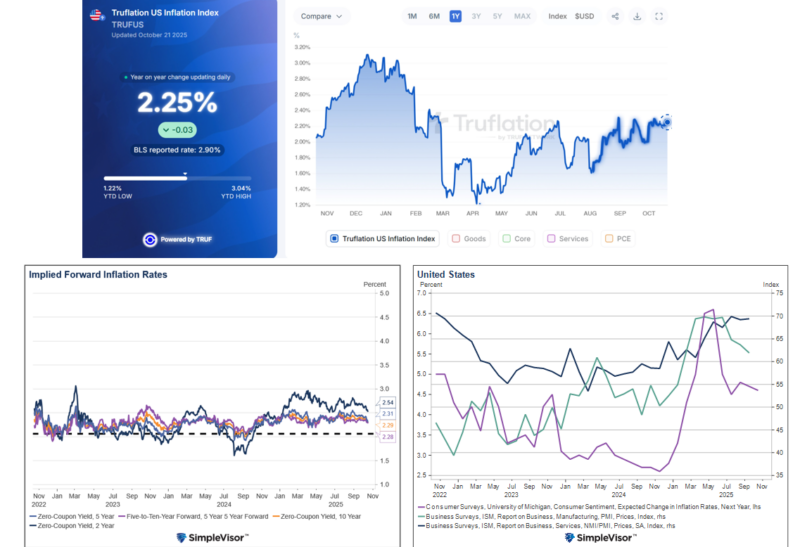

Inflation In Focus: What Market Data Tells Us

As we approach today's delayed CPI report, it's helpful to look beyond government statistics to focus on a more current and robust picture of inflation. Implied Inflation: This is derived from comparing the yields of nominal Treasury securities to Treasury Inflation-Protected Securities (TIPS). The graph below (bottom left) shows that implied inflation, also known …

Read More »

Read More »

10-23-25 Behind the Dollar “Collapse” Narrative – The Real Story

Despite the media noise, the dollar isn’t collapsing. The $DXY is near its long-term fair value, and foreign investors keep buying U.S. debt and equities $SPY / $QQQ – proof that global confidence in the dollar remains strong.

In this short video, Michael Lebwitz and I discuss why the “dollar crash” narrative is overblown.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-23-25 Dollar Debasement: Reality Or Dangerous Narrative?

Gold’s rally has investors shouting “dollar debasement!” — but is the narrative real, or just a speculative illusion?

Lance Roberts & Michael Lebowitz break down the popular debasement argument and expose the facts behind the gold surge. From money supply trends to Fed policy and global confidence in the U.S. dollar, we separate the data from the hype.

0:19 - Stresses Emerging in Lower End of Economy

4:45 - The Oil Price Pop

6:35 -Good News -...

Read More »

Read More »

Beyond Meat Surges: Another Meme Ponzi?

In August 2025, Beyond Meat (BYND), a plant-based meat producer, took to social media to call reports of its bankruptcy "unequivocally false". Despite the assurances, the company was floundering, and bankruptcy was a possibility. The company has significant liabilities and has lost money every year since its IPO. Adding to their woes, sales peaked in …

Read More »

Read More »

A Daily Dose Of Charts & Graphs October 22, 2025

In this Short video, I cover leverage, $GLD key support, the seasonality tailwind, liquidity and sentiment trends, Fed policy context, and valuation vs. narrative — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

📺Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-29-25 Bitcoin: Speculation, Blockchain, & the Future of Money

Why has Bitcoin captured the attention of investors and innovators alike?

Lance Roberts & Vinay Gupta break down what makes Bitcoin unique — from its blockchain backbone to its role as currency, commodity, and speculative asset. We’ll explore how to think about Bitcoin in a diversified portfolio, what risks investors need to understand, and why blockchain may reshape how business is done in the future.

#BitcoinInvesting #BlockchainTechnology...

Read More »

Read More »