Category Archive: 9a.) Real Investment Advice

Nvidia Deals: Round Tripping Or Vendor Financing?

“Nvidia takes a $1 billion stake in Nokia” reads a recent CNBC headline. As part of the agreement, Nokia commits to purchasing Nvidia’s AI chips and computer platforms. Additionally, the companies will collaborate to develop 6G cellular technology. Deals like this are becoming more common in the AI industry. Some view Nvidia’s recent investment in …

Read More »

Read More »

Tariffs Are On The Docket: Will SCOTUS Upset The Market?

The Supreme Court (SCOTUS) will begin hearing arguments challenging President Trump’s use of tariffs. Given the market volatility that tariffs have generated over the last six months, the SCOTUS case could prove to be yet another market-moving event. The tariff challengers argue that the administration overstepped its bounds under the 1977 International Emergency Economic Powers …

Read More »

Read More »

11-10-25 The Rocket Market: AI, Risk, and What Comes Next

Markets have rocketed higher for six straight months — but how long can it last?

Hedgefund Telemetry founder, Tom Thornton joins Lance Roberts to unpack the forces driving this “Rocket of a Stock Market.” From AI euphoria and sector rotation to passive indexing risks and the Fed’s impact on valuations, we dig into what’s really happening under the surface.

#StockMarketAnalysis #AIBubble #InvestorSentiment #MarketVolatility #TomThornton

Read More »

Read More »

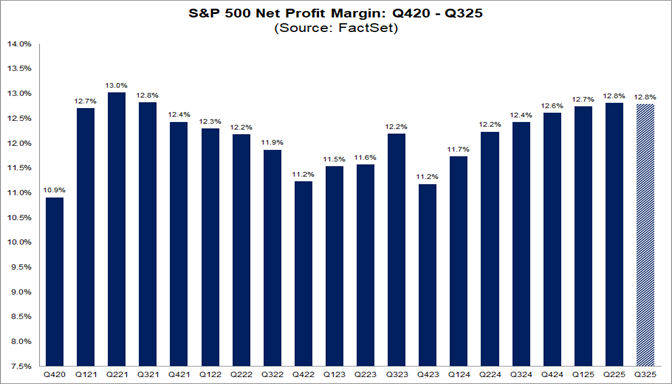

11-4-25 Reality Check For AI Hype Starts Now

AI stocks are finally facing reality after months of run-ups. Stocks like $PLTR and $META crushed earnings but aren’t being rewarded, as investors are finally questioning their sky-high valuations.

In today’s video, I explain why the AI boom faces its first true test—and why managing risk now matters more than ever.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-4-25 Smart or Risky? How Investors Are Adapting to Today’s Markets

In this episode, we explore how today’s investors are adapting to volatility, inflation, and complexity across markets.

Lance Roberts & Jon Penn explore Structured Notes: These complex instruments promise tailored returns, but they come with tax pitfalls and credit risks investors must understand before buying. We’ll break down how structured notes work—and why they may belong inside an IRA rather than a taxable account.

The Return of...

Read More »

Read More »

Amazon And OpenAI: Yet Another Massive Investment In AI

Yesterday morning, OpenAI announced a massive $38 billion strategic partnership with Amazon Web Services (AWS). This deal highlights OpenAI's diversification strategy amid explosive growth and capacity demands for training advanced models like ChatGPT. Before the deal, OpenAI relied 100% on Microsoft for its cloud infrastructure. In addition to diversifying its cloud servers, the deal may …

Read More »

Read More »

11-24-25 Solana vs Bitcoin: The New Treasury Strategy

Is Solana the next evolution of Bitcoin’s corporate playbook? Lance Roberts and DeFi Development Corp. CFA, Parket White, explore how digital assets like Solana, stablecoins, and tokenized treasuries are reshaping balance sheet strategy for companies and investors alike.

💡 From Bitcoin to Solana, learn how digital asset treasuries are changing the rules of modern finance.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO...

Read More »

Read More »

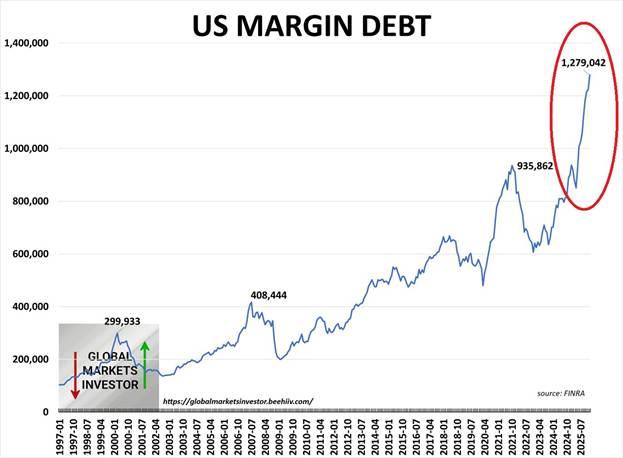

11-3-25 The Pavlovian Market: How Fed Trained Investors To Take Big Risks

Markets got addicted to the Fed.

In this Short video, I explain how years of interventions created a Pavlovian market where traders take bigger risks, expecting the Fed to save them every time — the essence of moral hazard.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-3-25 Investor Dilemma: Pavlov Rings the Bell

Are today’s investors psychologically conditioned to buy every market dip—no matter the risk?

Lance Roberts explores the “Investor Dilemma” through the lens of Pavlov’s classical conditioning, revealing how years of Fed interventions, liquidity injections, and momentum rallies have trained investors to respond to volatility like Pavlov’s dogs to a bell.

#InvestorDilemma #BehavioralFinance #MarketPsychology #BuyTheDip #FinancialEducation

Read More »

Read More »

Investor Dilemma: Pavlov Rings The Bell – Draft

Classical conditioning teaches us a valuable lesson regarding the current investor dilemma. Pavlov's research discovered a basic psychological rule: when a neutral stimulus is repeatedly paired with a reward‑stimulus, eventually it will trigger the same response even when the reward is absent. The famed experiment by Ivan Pavlov illustrated that dogs would salivate at the …

Read More »

Read More »

Hindenburg Strikes: Omen Or False Alarm?

Last Wednesday, for the first time since November 2021, a Hindenburg Omen hit. This gauge is triggered when an upward trend is met with a growing number of stocks hitting both new 52-week highs and lows. Such indicates bad breadth, weakening momentum, and indecision. If all five conditions listed below are met, the indicator gives …

Read More »

Read More »

SimpleVisor Alert

Please be advised that we are making changes to the backend of the SimpleVisor website. As a result, we are facing a few complications with subscriptions and logins. We are currently working on the problems and hope to have them resolved shortly. Thank you for your patience. The post SimpleVisor Alert appeared first on RIA.

Read More »

Read More »

Fed QT Ends. What Does That Mean For Markets?

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

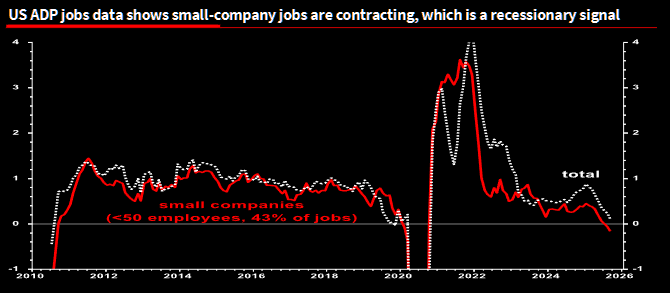

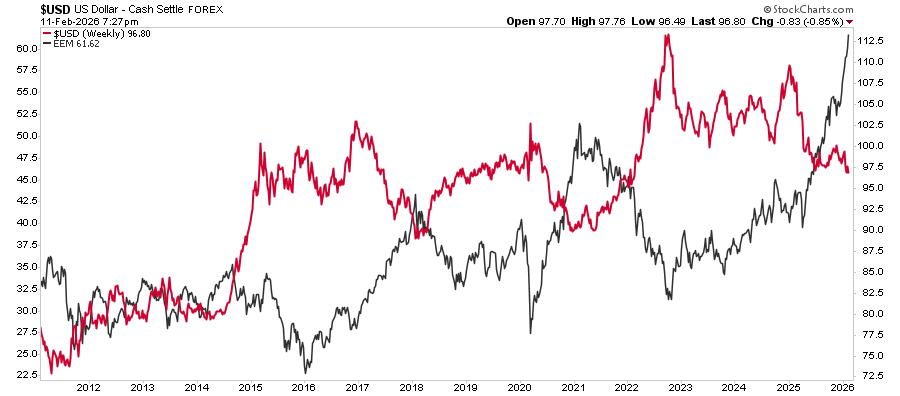

10-31-25 A Daily Dose Of Charts & Graphs

In this Short video, I cover the $DXY breakout from a long base, the EUR weakening outlook, and why $EURUSD could revert toward 1.12 over the next 18 months.

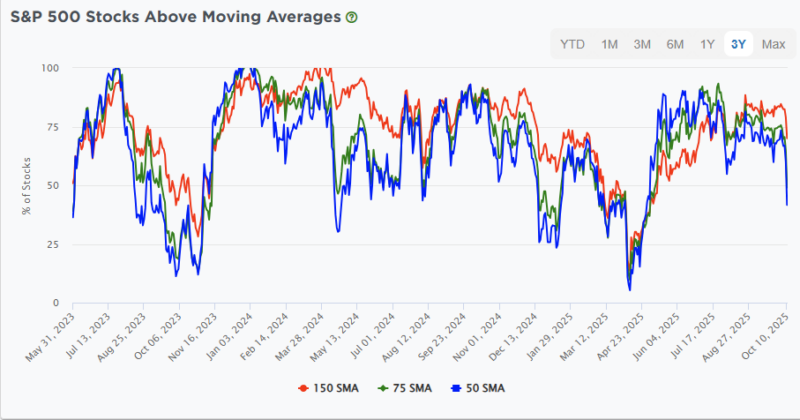

I also touch on labor market strain hinting at a stealth recession, collapsing market breadth, and what these signals mean as we enter the seasonally strongest six months of the year $SPY $QQQ — everything you need in one visual macro update.

Catch me daily on The Real Investment Show:...

Read More »

Read More »

10-22-25 Business Owners’ Retirement Plan Options

Tom Allen, our Senior Benefits Consultant, and Tom Pohlan, the Regional Director with Retirement Plan Consultants, explore how small business owners can create effective retirement plans that benefit both employees and owners.

Starting with Simon Sinek’s “Start with Why” framework, we’ll discuss why offering a retirement plan isn’t just a perk—it’s a powerful financial strategy for growth, retention, and tax efficiency.

💡 Key topics covered:...

Read More »

Read More »

10-31-25 Why Risk Tolerance Questionnaires Don’t Work

Most investors have filled out a risk tolerance questionnaire—but does it really measure how you’ll behave when markets crash? Richard Rosso & Jonathan McCarty break down why traditional risk tolerance tools fail to predict investor behavior, how emotions override risk profiles, and why time horizons, liquidity needs, and cash flow matter far more than a few survey questions.

Understand risk before markets remind you what it really feels...

Read More »

Read More »

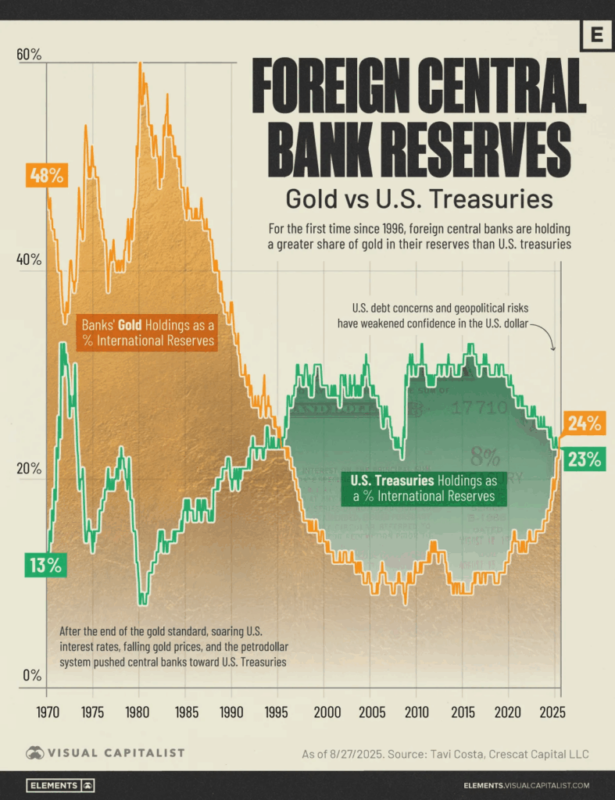

Gold Myths Luring Investors Into Risk

In case you haven't heard, precious metals, particularly gold, have risen sharply this year. Of course, whenever any asset class experiences a more speculative melt-up, investors are quick to rationalize why "this time is different." In stocks, it is about "artificial intelligence" and "data centers." The cryptocurrency community believes all fiat currencies will fail and …

Read More »

Read More »

Dow Theory: A Concerning Divergence Or Artifact?

Dow Theory is a market tool developed by Charles Dow in the very early 1900s. Dow also created the Dow Jones Industrial Average. The basic gist of Dow theory is that market trends are confirmed when gains or record highs are established in the broader market indexes, and then confirmed by similar trends and/or record …

Read More »

Read More »

10-30-25 Microstrategy & Leverage ETFs Trap Explained

$MSTR turned debt into a massive #Bitcoin bet, becoming a leveraged proxy for $BTC. But leverage cuts both ways—especially for 2x ETFs like $MSTU or $MSTX that suffer from volatility decay, turning sharp drawdowns into long-term underperformance.

In this short video, Vinay Gupta and I discuss how MicroStrategy’s debt-fueled Bitcoin strategy works, why leveraged ETFs on $MSTR are so dangerous, and what investors often miss about volatility decay...

Read More »

Read More »

Liquidity Concerns Put An End To QT

Two weeks ago, Jerome Powell stated, "We may be approaching the end of our balance sheet contraction in the coming months.” In simple terms, as we wrote HERE, he is prepping the market for a quicker end to QT than was previously expected. While Powell was cryptic about why, the answer is obvious: liquidity concerns. … Continue reading...

Read More »

Read More »