Category Archive: 9a.) Real Investment Advice

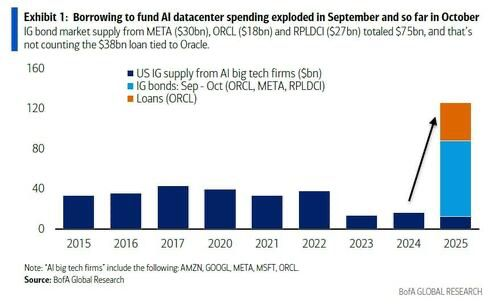

Data Center Debt: Can Oracle Hang With The Big Boys?

Meta and Google recently borrowed a combined $55 billion in the corporate bond market. As we share below, this debt represents a new source of funding for data center expansion. Further, as shown in orange, Oracle tapped the private market for loans to secure the capital needed to sustain AI innovation and the related data … Continue...

Read More »

Read More »

11-25-25 The System Is Broken – Garrett Baldwin Interview

Lance Roberts sits down with Garrett Baldwin to dissect how the financial system became structurally distorted — from the Fed’s collateral-driven era after 2008 to the unchecked rise of passive investing and liquidity engineering.

Other key topics include:

The illusion of value through asset-price debasement

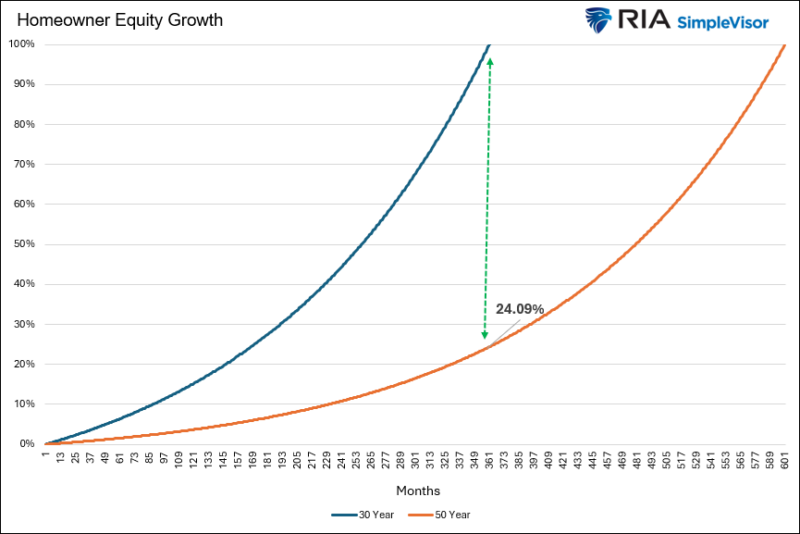

The 50-year mortgage folly and real housing affordability

CATH ETFs and the birth of speculative flows

How ETFs and repo markets reshaped...

Read More »

Read More »

11-12-25 December Rate Cut Back in Play

Soft jobs data and falling rents point to weaker inflation ahead, setting the stage for a potential Fed rate cut in December.

In this short video, I explain why this slowdown may be exactly what the market needs to keep the rally alive.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-12-25 A Daily Dose Of Charts & Graphs

In this short video, I cover the return of risk appetite, falling rents signaling disinflation, and the $5–$7T AI data-center buildout.

I also touch on $AAPL push into robotics and the massive power and funding needs driving the next tech super-cycle — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-12-25 How to Spend Without Regret: Strategies for Enjoying Retirement

Most retirement advice focuses on saving and not running out of money — but few talk about how to spend confidently once you’ve achieved financial independence.

Lance Roberts & Danny Ratliff show how to shift from saving mode to living mode without fear or guilt:

Why it’s okay to enjoy what you’ve earned

How to enjoy your wealth without overspending

The emotional side of leaving the “accumulation” mindset

Practical withdrawal and income...

Read More »

Read More »

QE Is Coming: The 2008 Roots Of Fed Dominance

Here we go again. The overnight funding markets are showing signs of stress, and the scent of QE is in the air. Per New York Fed President John Williams: Based on recent sustained repo market pressures and other growing signs of reserves moving from abundant to ample, I expect that it will not be long … Continue reading »

Read More »

Read More »

50 Year Mortgages: Pros And Cons

President Trump proposed, with the full support of Federal Housing Director Bill Pulte, that homeowners be allowed to take out 50-year mortgages. The goal is to make housing more affordable, especially for younger generations who lack real estate equity and face high home prices and elevated mortgage rates. Read more about the sad state of …

Read More »

Read More »

11-11-25 A Daily Dose Of Charts & Graphs

In this short video, I cover the record $1.2T in U.S. buybacks, flat profit margins outside tech, and Europe’s lagging data capacity.

I also touch on tightening liquidity, rising debt-fueled AI investment, and echoes of the 1990s boom that point to hidden risks beneath the surface — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch me daily on The Real Investment Show:...

Read More »

Read More »

An Economic Data Flood Is Coming: Does It Matter?

Buckle Up! With the end of the government shutdown and the return to work of government employees comes a flood of economic data. Below is a list of old economic data that should be released over the coming weeks: The list goes on. But, of more importance is whether or not the markets will care … Continue reading »

Read More »

Read More »

Forward Return And The Importance Of Math

During strongly trending bull markets, investors often overlook the importance of math in predicting forward returns. Such is easy to do when the market just seemingly continues to rise without regard to fundamentals. The current environment is also heavily influenced by the impact of "passive indexing," which has distorted market dynamics as well. However, none …

Read More »

Read More »

One Trillion Dollar Package For Musk If He Delivers

With over 75% support, Tesla shareholders approved Elon Musk's record-breaking, one trillion dollar executive compensation package. The deal is contingent on Musk delivering significant value to shareholders. The package is an all-stock plan structured into 12 tranches. If he meets all the milestones, Musk could receive as many as 423.7 million additional shares, equating to …

Read More »

Read More »

Repo Market: Critical Warning Or Bullish Signal

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

11-7-25 Top 3 Financial Guardrails You Should Know

RIA Advisors’ Financial Guardrails are timeless principles for building lasting wealth and protecting your financial future. Richard Rosso, CFP®, shares insights from decades of experience helping investors avoid common pitfalls and build financial wellness that lasts generations. From annuities and debt control to emotional investing and realistic return expectations, these guardrails are designed to keep you on track — no matter what markets do....

Read More »

Read More »

OpenAI Seeks Government Support

Sarah Friar, OpenAI's CFO, spoke at a Wall Street Journal technology conference to update the audience on the potential of AI. While her comments were very optimistic, she noted that OpenAI seeks continued capital inflows, highlighting the lynchpin for AI development. Her quote below, courtesy of Bloomberg, takes traditional bank and industry financing a step …

Read More »

Read More »

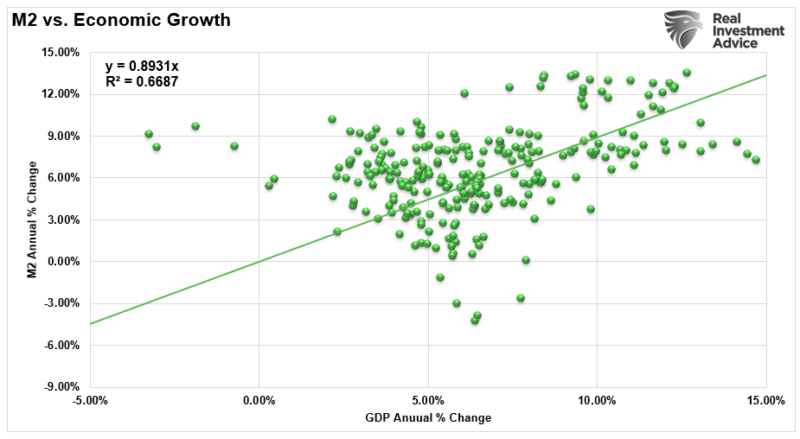

“Money Printing” By The Fed: Fact Or Fiction?

I recently penned an article on "Money Supply Growth," which elicited a very thoughtful response from Garrett Baldwin via Substack. He argued that labeling Federal Reserve operations as "money printing" is not rhetoric, but rather a reality. He points to Ben Bernanke’s 2010 interview, where Bernanke described how the Fed marks up digital accounts. But …

Read More »

Read More »

11-6-25 The Hidden AI Debt Bubble Nobody’s Talking About

AI’s growth is being fueled by massive hidden debt.

In this short video, Lance Roberts & Michael Lebowitz discuss how companies like $META are using off-balance-sheet SPVs to fund AI infrastructure—creating risks that could echo the leverage traps of the late 1990s.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

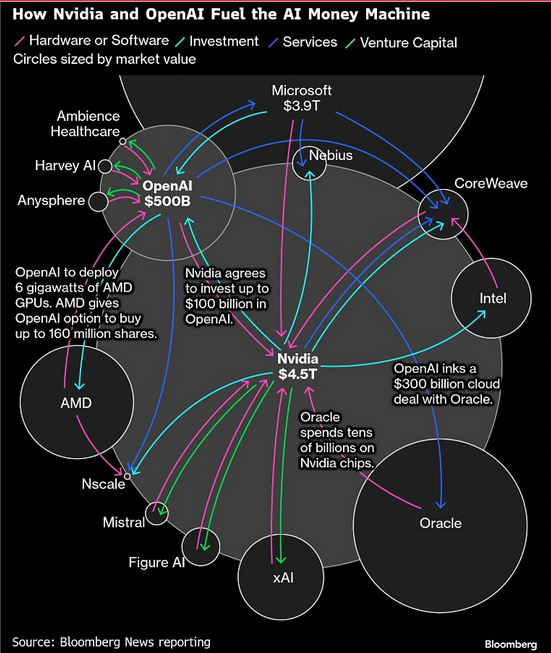

11-6-25 Nvidia’s Money Loop: Smart Move or Red Flag?

Nvidia just took a $1 billion stake in Nokia—and Nokia plans to spend that money buying Nvidia’s own AI chips. It’s not the first time. Nvidia’s done similar deals with OpenAI, CoreWeave, and xAI, fueling record demand for its GPUs. But is this smart strategy—or circular financing? Some call it vendor financing, others say it’s round-tripping—a tactic that helped inflate the dot-com bubble two decades ago.

Lance Roberts & Michael Lebowitz...

Read More »

Read More »

Bitcoin Is Off The Leaderboard: Whats Next?

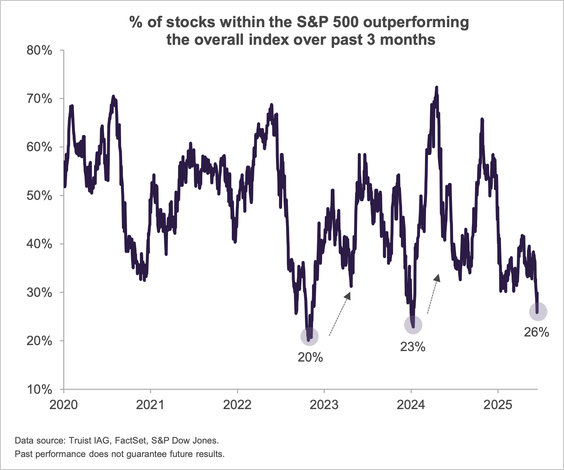

On many recent occasions, we have noted that the market breadth is poor and appears to be worsening. By worsening, we mean that the number of market leaders is declining, and a growing number of stocks, stock factors, sectors, and asset classes are lagging. Currently, the small list of stock factors showing up in SimpleVisor’s …

Read More »

Read More »

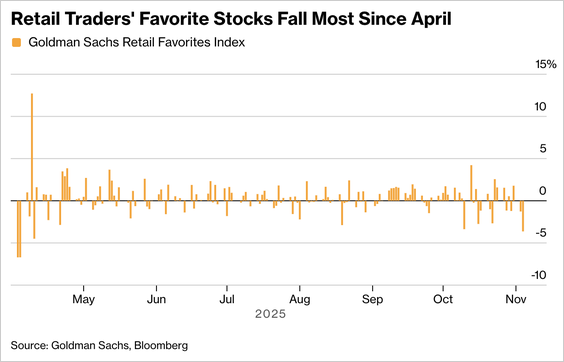

11-5-25 Is This Pullback Just The Calm Before The Santa Rally?

$SPY / $QQQ are easing after a strong run since the April low, as more companies $META / $PLTR go unrewarded despite solid earnings, and investors await a potential Supreme Court ruling on tariffs.

In this short video, I explain why this pullback looks like a normal pause before year-end strength and a possible Santa rally.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-5-25 6 Moves You Should Make Now Before RMDs Start

Required Minimum Distributions (RMDs) can create unexpected tax burdens and impact your retirement income strategy if you’re not prepared. In this episode, we break down six smart financial moves to make before RMDs begin at age 73, so you can stay in control of your taxes, income, and investment strategy.

Whether you’re approaching RMD age or helping a parent prepare, this episode gives you the tools to protect your wealth and avoid common...

Read More »

Read More »