Category Archive: 9a.) Real Investment Advice

12-18-25 Is the 60/40 Portfolio Dead? Global Risks & Opportunities

For decades, the 60/40 portfolio—stocks and bonds—served as the foundation of balanced investing.

Lance Roberts and Michael Lebowitz examine the growing global forces reshaping markets. While Wall Street has remained fixated on AI hyperscalers, major developments abroad are increasingly driving returns and risk.

0:00 - INTRO

0:19 - Inflation Report Preview - Where's the Fed's Soft Landing?

3:05 - Markets working Through the Chop

9:56 - Top 10...

Read More »

Read More »

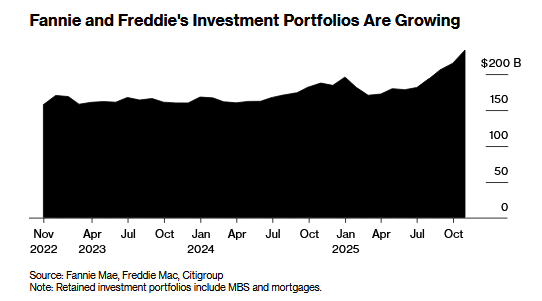

Fannie And Freddie Add Billions To The Bond Market

According to Bloomberg, Fannie Mae and Freddie Mac have been increasing the mortgages and mortgage-backed securities they hold on their own balance sheets. At their peak, before the financial crisis, Fannie and Freddie held a combined total of $1.6 trillion in mortgages. As we share below, courtesy of Bloomberg, their portfolio sizes are well below …

Read More »

Read More »

1-1-26 2026 Market Outlook: Bullish Case, Bear Risks & Strategy

As we begin the new year, this New Year’s Day market outlook takes a balanced, risk-aware look at what 2026 may hold for investors. Lance Roberts & Danny Ratliff examine the bullish case for markets, including the macro and technical backdrops supporting higher prices, while also addressing the growing risks beneath the surface—particularly stress in credit markets and the potential for lower long-term returns.

The discussion explores how...

Read More »

Read More »

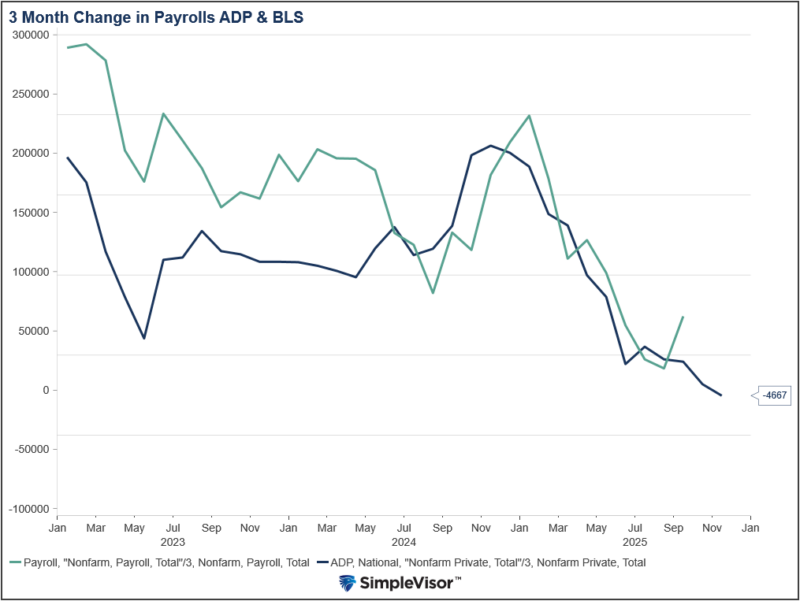

12-17-25 Earnings Revision Risk Explained

Markets are priced for perfection heading into next year. Earnings expectations are unusually high. If those forecasts get revised lower, the market will have to reprice quickly.

In this short video, Lance Roberts explains why high valuations and aggressive earnings forecasts create real revision risk if results fail to measure up.

📺Full episode: -vnHx4Eg

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-17-25 Q&A Wednesday: Live Market Questions & Investor Insights

Today’s Q&A Wednesday is driven entirely by live YouTube chat questions, covering the market topics investors are most focused on right now. Lance Roberts & Danny Ratliff address real-time concerns around market volatility, Federal Reserve policy, interest rates, inflation, portfolio risk, asset allocation, and year-end positioning—without hype or speculation.

This interactive session is designed to help investors better understand what...

Read More »

Read More »

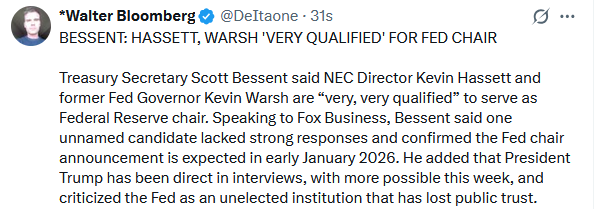

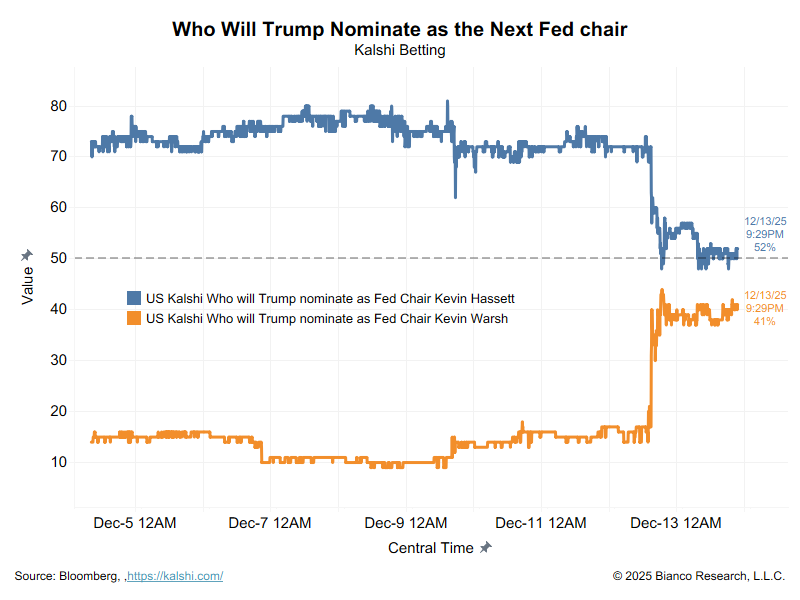

Kevin Warsh Or Kevin Hassett?

Yesterday's Commentary discussed Trump's inclusion of Kevin Warsh in the race for Federal Reserve chair. Today, we compare some key differences between Kevin Warsh and Kevin Hassett. Understanding what each contributes to the Fed helps us better assess their effects on capital markets. Kevin Warsh was a Fed Governor from 2006 through 2011. We learned …

Read More »

Read More »

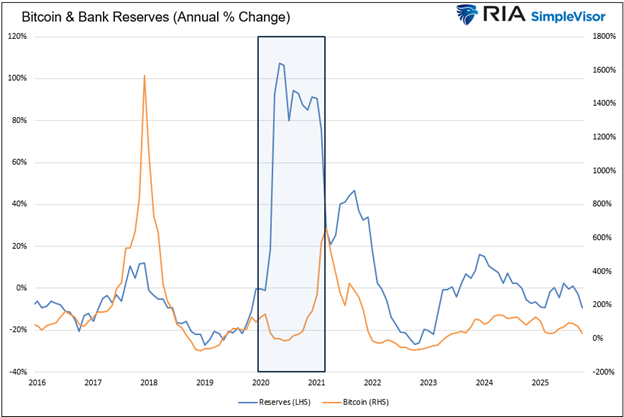

QE Is Back: Which Assets Benefits From The Liquidity Boost

QE is back! On December 10th, the Federal Reserve announced its plan to purchase $40 billion in Treasury securities each month for at least four months. Through these QE purchases, bank reserves will increase, and recent liquidity concerns should lessen. Furthermore, increased liquidity often leads to more speculative market conditions and higher asset prices as …

Read More »

Read More »

12-31-25 Marketing for Financial Advisors in the AI Age

Marketing for financial advisors is being reshaped by artificial intelligence, changing search behavior, and tighter compliance constraints. Lance Roberts & Greg Joslyn break down how advisors can adapt their marketing and PR strategies without sacrificing credibility, consistency, or regulatory discipline.

We discuss why persistence—not virality—is the true driver of long-term visibility, how AI fits into content creation and search...

Read More »

Read More »

12-16-25 Year-End Checklist for Young Investors

As the year comes to a close, young investors have a unique opportunity to make small moves that can compound into meaningful long-term results. In this episode, we walk through a practical, end-of-year checklist designed for early-career investors who want to stay organized, tax-aware, and financially disciplined.

Lance Roberts & Jonathan Penn cover how to confirm you’re capturing all available employer benefits, including 401(k) or 403(b)...

Read More »

Read More »

Warsh Is In The Race: Fed Chair Odds In Flux

Over the last few weeks, it seemed all but a done deal that Kevin Hassett would replace Jerome Powell as the next Fed Chair. That changed this past weekend as President Trump added Kevin Warsh alongside Hassett as his top Fed contenders. It's likely that there are a couple of factors leading Trump to add … Continue reading »

Read More »

Read More »

12-25-25 Christmas Day Q & A

Our Christmas Day Best-Of episode revisits some of the most important investing and financial planning discussions of the year.

Lance Roberts, Danny Ratliff, & Jonathan Penn examine whether the traditional 60/40 portfolio still serves its original purpose of reducing volatility, and what the three legs of investing mean in today’s market environment; whether the Federal Reserve has shifted away from its inflation mandate, how to interpret 2-...

Read More »

Read More »

1-2-26 Trump Accounts: Smart Planning or Marketing Hype?

“Trump Accounts” are being discussed as a new way to help children and young adults invest for the future—but are they a meaningful planning tool or simply clever branding?

Richard Rosso & Sarah Buenger break down how Trump Accounts are structured, how they differ from traditional retirement and custodial accounts, and why return assumptions deserve careful scrutiny. We also discuss funding mechanics, diversification considerations, and what...

Read More »

Read More »

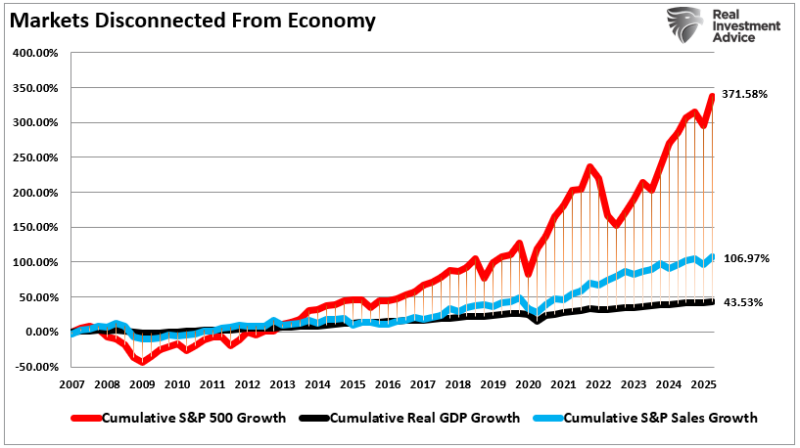

Bull Market Genius Is A Dangerous Thing

During extended upward-trending markets that reward risk-takers and punish caution, everyone is a "bull market genius." That dynamic flips investor psychology and, over time, creates a false sense of control. As the market continues to climb, risk appears to vanish, and investors believe that nothing can go wrong, leading them to take on increasing levels …

Read More »

Read More »

SpaceX: A Financial And Strategic Windfall For Google

In 2015, Google wrote a $900 million check to SpaceX for a roughly 7.5% stake in Elon Musk's budding aerospace/rocket company. At the time, SpaceX was valued at $12 billion. Ten years later, Google’s early investment in SpaceX is now being framed as a great trade, not just because of the massive profit it will …

Read More »

Read More »

12-13-25 Why This Market Is One Disappointment Away From Trouble

The Fed can call it reserve management purchases, but the mechanics are the same: they are adding liquidity, expanding the balance sheet, and supporting financial markets.

In this short video, Michael Lebowitz and I discuss why the terminology matters less than the market impact.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

The “Double Bubble”

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue reading...

Read More »

Read More »

12-12-25 QE or Not QE? That Is the Question

The Fed can call it reserve management purchases, but the mechanics are the same: they are adding liquidity, expanding the balance sheet, and supporting financial markets.

In this short video, Michael Lebowitz and I discuss why the terminology matters less than the market impact.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-26-25 Legacy Conversations for the Holidays

The holidays bring families together—but they also create a rare opportunity to talk about something that truly matters: legacy.

Richard Rosso & Sarah Buenger explore how thoughtful, well-framed conversations about money, wishes, and values can become one of the greatest gifts you give your family. Research shows that nearly 70% of parents have never discussed inheritance with their children, often leaving confusion, conflict, or unresolved...

Read More »

Read More »

12-24-25 The Fed at a Crossroads – Joseph Wang Interview

The Federal Reserve is entering a pivotal phase, and the decisions it makes now will define the next era of monetary policy. Lance Roberts and The Fed Guy, Joseph Wang, examine the structural forces putting the Fed at a crossroads—from rate cuts and shifting labor-market dynamics to the long-term impact of AI, tariff-driven inflation, and changes in the Fed’s balance-sheet strategy.

We explore why markets appear bullish on economic growth despite...

Read More »

Read More »

12-12-25 Facing Your Financial Ghosts

Everyone has financial ghosts—old decisions, forgotten expenses, or long-ignored habits that creep back into the present and shape our financial lives. In this episode, we explore three practical strategies to tackle your financial ghosts, reduce money stress, and build a healthier long-term financial foundation.

Richard Rosso & Jonathan McCarty break down how to evaluate your household debt-to-income ratios, identify where spending silently...

Read More »

Read More »