Category Archive: 9a.) Real Investment Advice

Estate Planning Essentials

Estate Planning Essentials: Protecting Your Legacy Estate planning has a reputation for being complicated, uncomfortable, and easy to delay. That’s a problem; when life moves fast, an outdated estate plan can create confusion, conflict, and unnecessary costs for the family members you care about most. Solid planning replaces guessing with clarity. If you have a …

Read More »

Read More »

Benefits Of Fee-Only Financial Advisors

Benefits of Fee‑Only Financial Advisors: Why It Matters Navigating your financial future takes more than a few online calculators and a diversified portfolio. For high-net-worth families and business owners, the person you trust to manage your wealth carries significant influence over your outcomes. Yet not all financial advisors operate with the same incentives or responsibilities. …

Read More »

Read More »

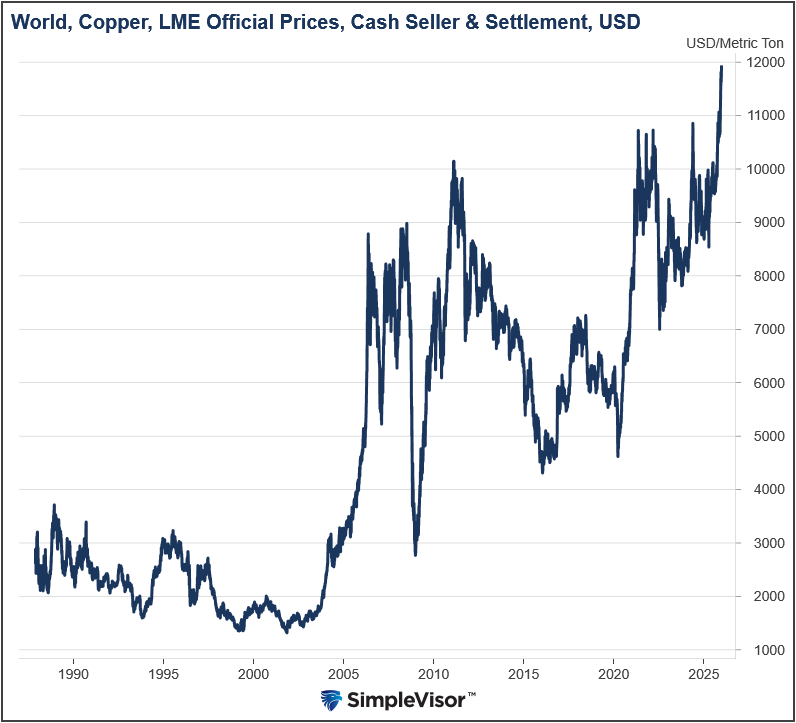

Copper Prices Surge To All Time Highs

On Monday night, copper prices, as shown below, reached an all-time high of over $12,000 per metric ton. Copper is often referred to as "Doctor Copper" because it serves as a barometer of global economic activity. However, the current surge in prices is not due to sharply rising demand; tariffs and physical dislocation are heavily …

Read More »

Read More »

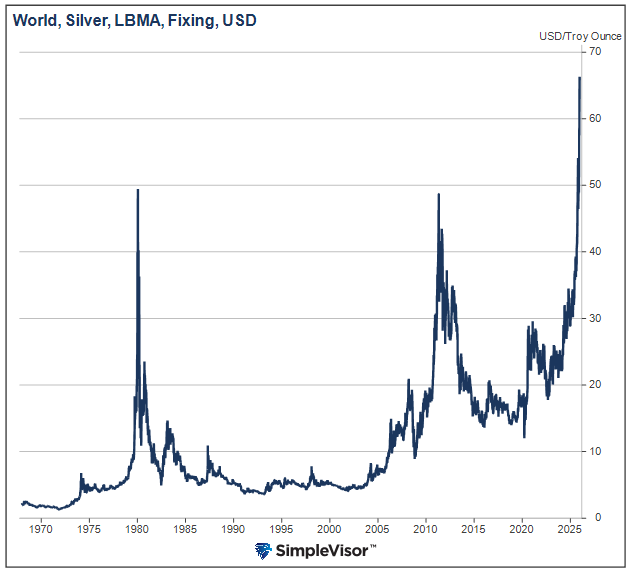

Silver Mania And The Predictable Bust

Silver’s parabolic rise has been remarkable. Its price has more than doubled this year and is nearly three times higher than in 2023. The current surge closely mirrors two previous price jumps shown below. In this article, we examine the two similar price surges shown below to provide context for what may be occurring today …

Read More »

Read More »

The ECB Changes Tone: Will The Fed Follow?

Inflation in the European Union is nearing 2%, expected to dip below it in 2026 and 2027 and then settle at its 2% target thereafter. The ECB's President Lagarde and other ECB members have recently stated that they are comfortable with the central bank's current interest rate level. The markets are taking the ECB's public …

Read More »

Read More »

The Real Investment Show

REGISTER for our 2026 Economic Summit, "The Future of Digital Assets, Artificial Intelligence, and Investing:"

https://www.eventbrite.com/e/2026-ria-economic-summit-tickets-1765951641899?aff=oddtdtcreator

Read More »

Read More »

2025 Holiday Greeting

Merry Christmas and Happy New Year from all of us to all of you!

Thanks for your support in 2025, and we hope you will join us back here in the New Year!

Read More »

Read More »

12-22-25 Why Slowing Consumers Matter More Than AI Spending

The market is underestimating the risk from a slowing consumer.

In this short video, I explain why weakening consumer spending matters more than AI and data-center investment for economic growth and earnings in 2026.

If you like this video, please ❤️like and 🔁retweet

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-22-25 When Fed Narratives Meet Market Data

Markets are heading into year-end with optimism still firmly embedded in prices, but the economic data are telling a more complicated story.

Lance Roberts examines the growing gap between the Federal Reserve’s soft-landing narrative and what inflation, employment, consumer spending, and earnings expectations are actually signaling. While markets have stabilized following recent volatility, participation remains narrow, sentiment is elevated, and...

Read More »

Read More »

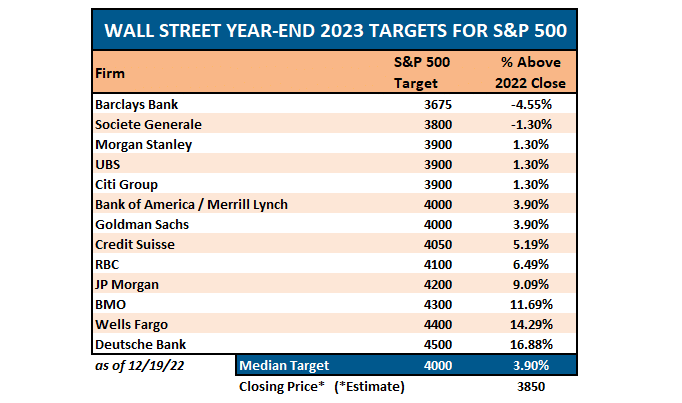

2026 Market Outlook Based On Valuations

It’s that time of year when Wall Street polishes up its crystal balls and begins predicting returns for 2026. Since Wall Street never predicts a down year, which would be unwise for fee-based product revenues, these forecasts are often inaccurate and sometimes significantly wrong. Let's review some previous years. For example, on December 7th, 2021, …

Read More »

Read More »

The Seen And The Unseen Of QE-RMP

In 1850, Economist Frederic Bastiat famously wrote an essay entitled "That which is seen, and that which is not seen.” The first chapter, "The Broken Window," argues that good economics requires considering not just the immediate, visible effects of an action but also the delayed, less obvious (unseen) consequences. Unfortunately, most commentators, when asked about …

Read More »

Read More »

12-21-25 Don’t Fall for the Hype: Safety Isn’t in Bitcoin Or MAG7

Bonds are being ditched at the exact moment investors need them most.

In this short video, Michael Lebowitz and I discuss why Treasuries $TLT remain the only true safety bucket and why replacing them with #Bitcoin $IBIT $BTCUSD or mega-cap tech $AAPL $AMZN $META $NFLX $NVDA $MSFT $GOOGL leaves portfolios exposed in a downturn.

Please ❤️like and 🔁retweet

📺Full episode:

Catch me daily on The Real Investment Show:...

Read More »

Read More »

12-20-25 Why Balanced Portfolios Are Making a Comeback

Balanced portfolios were never broken. Investors just got used to an abnormal era when falling rates made bonds $TLT look like stocks.

In this short video, @michaellebowitz and I discuss why the 60/40 model is returning to its real purpose of stability and income as stretched valuations and long-term forecasts make a diversified mix more attractive for the decade ahead.

Please ❤️like and 🔁retweet

📺Full episode:

Catch me daily on The Real...

Read More »

Read More »

Fed’s Soft Landing Narrative Meets Economic Data

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

12-19-25 What Great Financial Planning Looks Like

What should a great financial planning experience actually look like?

For many investors, “financial planning” is reduced to product selection, performance chasing, or a one-time retirement projection that never gets revisited. In reality, a high-quality financial planning experience is far more comprehensive — and far more valuable.

Richard Rosso breaks down the essential elements of effective financial planning. True financial planning is not...

Read More »

Read More »

12-29-25 Fed Liquidity, Housing Myths & Market Risk

The Federal Reserve’s policy framework is quietly shifting—and investors should be paying close attention. Lance Roberts, Michael Lebowitz, and Danny Ratliff examine why the traditional push toward homeownership may be built on outdated assumptions, and how changing macroeconomic realities could challenge long-held financial narratives.

#FederalReserve #MarketLiquidity #HousingMyths #MacroOutlook #InvestorRisk

Read More »

Read More »

12-18-25 The Fed Turned the Liquidity Back On: Watch These Assets

The Fed is adding liquidity (QE), whatever label they use. The assets most tied to reserves are the ones that will move first: #Bitcoin, major indexes $SPX / $QQQ, transportation, and materials.

In contrast, defensive sectors, $GLD, and $SLV show little to no relationship to changes in reserves.

Please ❤️like and 🔁retweet

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

BLue Owl Roils The AI Narrative

Blue Owl Capital spooked AI investors on Wednesday when the Financial Times reported that the firm, one of Oracle's larger financing partners for major U.S. data centers, decided not to provide equity backing for a $10 billion data center Oracle is building in Michigan. This planned facility is part of Oracle's collaboration with OpenAI under …

Read More »

Read More »

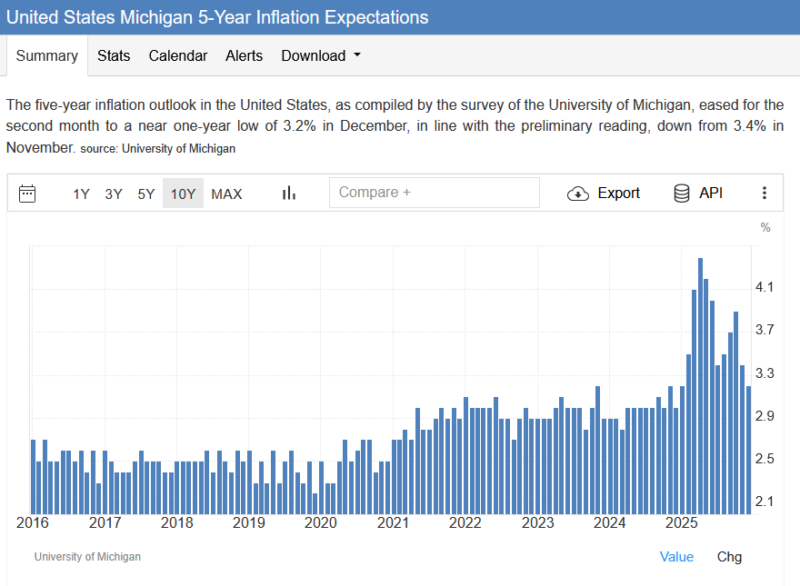

What Inflation Alarmists Missed In Their Warnings

Over the last couple of years, inflation alarmists such as Paul Tudor Jones, James Grant, and Jeff Gundlach have all said that inflation is returning with force. In different ways, they each stated that they would not own Treasury bonds due to the expectation that inflation would rise as the dollar declined due to the … Continue...

Read More »

Read More »

12-30-25 Media, Markets & Reality: A Candid Conversation with Tom Zizka

In this wide-ranging and candid conversation, Lance Roberts is joined by longtime friend and veteran television reporter Tom Zizka to discuss how media, markets, and economic reality have fundamentally changed over the past two decades.

The discussion begins with the evolution of modern media—from the rise of social platforms and the “small screen” revolution to the growing pressures of monetization, speed, and narrative framing. Lance and Tom...

Read More »

Read More »