Category Archive: 9a) Buy and Hold

Miss Pretty – Die Schönen und die Reichen – Nachhilfe in Wirtschaft

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

-

Wie angelt man sich einen reichen Mann? #Dating-Plattformen sind der neue #Heiratsmarkt. Doch es gibt auch eine wirtschaftliche Betrachtungsweise, über die ein hübsches #Mädchen gestolpert ist.

Read More »

Read More »

The Herd is Generally Wrong at Market Tops & Bottoms

(6/13/23) It's CPI Day, and important factors will be the lag effect of Fed rate hikes and Home Owners' Equivalent Rent figures. Markets are hoping for a weaker print because it will mean a further pause in rate hikes, and one step closer to rate cuts. Markets could pull back to the moving averages; investors' panic moves happen at the worst possible moment. Why market technicals are more bullish: We're wired to forget pain. Example: Meme Stocks...

Read More »

Read More »

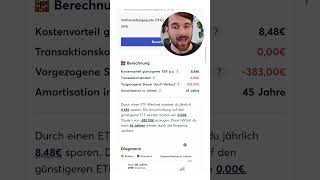

Ist es sinnvoll, seinen ETF zu wechseln? | ETF wechseln Rechner #shorts

Du hast einen günstigeren ETF entdeckt, lohnt es sich zu wechseln?

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=633&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=633&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?...

Read More »

Read More »

How Can Markets Be Bullish as Economy Slows?

(6/12/23) Texas Summer & FOMC Preview, plus Quadruple Witching on Friday; Retail buyers return to the market: Will it continue? We're back into a "new" bull markets, up 20%; the NASDAQ is up 20% above 200-DMA; with extreme deviation, correction is imminent. How can markets be bullish with a slowing economy? Beware bullish commentary: much evidence to suggest the decline is over, but markets' advance will soon slow. (Sidebar: Despite...

Read More »

Read More »

ETF statt BU? Ganzes Video auf dem Kanal

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Saidis Podcast: https://www.finanztip.de/podcast/geld-ganz-einfach/

Instagram: https://www.instagram.com/finanztip

Newsletter: https://newsletter.finanztip.de/

Forum: http://www.finanztip.de/community/

So arbeiten wir: https://www.finanztip.de/ueber-uns/

#Finanztip

*...

Read More »

Read More »

40 Anzeichen dafür, dass du finanziell gut dastehst (auch wenn es sich nicht so anfühlt)

40+ Zeichen, dass du finanziell gut aufgestellt bist!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=632&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=632&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

Finanzguru 3...

Read More »

Read More »

Die 7 größten Fehler beim Immobilienkauf

? https://betongoldwebinar.com/yt ?Jetzt Gratis Immobilien-Webinar ansehen!

Lohnt es sich ein Eigenheim zu kaufen? Oder kann eine Investition in #Immobilien auch schnell zum finanziellen Fiasko werden, wenn man nicht aufpasst? Insbesondere treten in der Praxis häufig die gleichen Fehler auf, die man jedoch durchaus verhindern kann! Worauf muss man beim #Immobilienkauf also achten? Das verrät dir heute der österreichische Immobilieninvestor und...

Read More »

Read More »

Engpässe der Energiewende – Versagen unseres Stromnetzes – E-Autos, Wärmepumpen, Kraftwerke

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

-

Unsere Stromversorgung besteht aus Kraftwerken, Hochspannungsleitungen und Verbrauchern der verschiedensten Arten. Seit Jahrzehnten ist das System gewachsen und wurde dem ständigen, langsamen Wandel angepasst. Jetzt soll der Wandel hin zur #Elektrifizierung des Transports (E-Autos) und der Wärmeerzeugung (Wärmepumpen) politisch erzwungen werden. Doch weder die Kraftwerke...

Read More »

Read More »

Solltest Du mit KI investieren?

ChatGPT hat den Markt geschlagen - zumindest in einem Experiment. Ist künstliche Intelligenz ein Instrument, mit dem Ihr Eure Rendite maximieren könnt? Saidi stellt Euch den Stand der Dinge vor und zeigt, worauf Ihr achten müsst.

? Werde Finanztip Unterstützer: https://www.finanztip.de/unterstuetzer-youtube/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=SSsNNhchSTM

Wertpapierdepots von Finanztip empfohlen (Stand...

Read More »

Read More »

The Fastest Shrinking Jobs in America

(6/9/23) Carvana's crash: Who wants to buy a car from a vending machine? Personal Financial Strategies and habits; from everything-Bitcoin to everything-AI. The fastest Shrinking Jobs in America: McDonald's kiosk revolution; "Soylent Green" and "The Purge" in real life? Financial losses in elder fraud are on the rise; cryptocurrency scams. Subscription purchase scams. The explosion of AI. Moderation in Technology use: Gen-x...

Read More »

Read More »

Verhindert DIESER Ballast dass DU REICH wirst? ?? [Achtung Wahrheit!] #shorts

? https://gratis-workshop.com/yts ? Jetzt Gratis Workshop-Platz sichern!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell den...

Read More »

Read More »

Reich werden mit Cannabis? Der JuicyFields Scam! #shorts

Reich werden mit Cannabis? Die Plattform juicyfields.io versprach Renditen von über 100%.

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=631&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Will They or Won’t They?? (6/8/23): Market Analysis & Commentary from RIA Advisors Chief Investme…

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More....

Read More »

Read More »

Zuhause Energie und 400€ sparen? Saidi zeigt Dir, wie das geht

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Saidis Podcast: https://www.finanztip.de/podcast/geld-ganz-einfach/

Instagram: https://www.instagram.com/finanztip

Newsletter: https://newsletter.finanztip.de/

Forum: http://www.finanztip.de/community/

So arbeiten wir: https://www.finanztip.de/ueber-uns/

#Finanztip

*...

Read More »

Read More »

Is Recession the Elephant (already) in the Room? (6/7/23): Market Analysis & Personal Finance com…

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More....

Read More »

Read More »

Solution to the Student Loan Debt Crisis – Robert Kiyosaki, Laine Schoneberger

Student loan debt has become a major issue in the US, with millions of borrowers struggling to repay their loans. While federal loans have some protections, private loans are often more challenging to manage. That's where Laine Schoneberger's company, yrefy, comes in. In this week's podcast episode, Schoneberger discussed with Robert how his company helps borrowers with private student loan debt and offers investors the opportunity to invest in a...

Read More »

Read More »

8 Elektroauto-Denkfehler (Ladezeiten, Kosten, Reichweite…)

Elektroauto oder Verbrenner: Viele machen diese Entscheidung von veralteten Fakten abhängig - und verlieren dadurch viel Geld und Komfort. Das soll Dir nicht passieren: Deshalb bringen Saidi und Leo Dich auf den aktuellen Stand der Dinge.

? Werde Finanztip Unterstützer: https://www.finanztip.de/unterstuetzer-youtube/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=WhxLZg7G-dI

THG-Quote für E-Auto kassieren ►

Förderung von...

Read More »

Read More »

Rezession in Deutschland? ?? #shorts

Haben wir in Deutschland eine Rezession? ?

Zum Memo: https://www.finanzfluss.de/memo-sign-up/

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=630&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Flat Earth Society, Erddurchmesser und die Lichtgeschwindigkeit

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

-

Heute taucht immer wieder der Begriff der #flachen #Erde auf. Lange habe ich mich dagegen gesträubt überhaupt ein Video über solche historischen #Ansichten zu drehen. Hier ist es nun.

Flat Earth Miami ► -Egaep9E

Chemtrails ► _I

Read More »

Read More »

The Importance of Breadth: Technically Speaking Tuesday (6/6/23): Technical Market Analysis & Com…

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio Models, and More....

Read More »

Read More »