Category Archive: 7) Markets

Does Automation Eliminate All Human Error?

Human error happens all of the time. It’s natural – sometimes, you’ll be typing up a document and later realize you made a grammatical error. Or, you might type a date in wrong. You might think you only make these types of mistakes now and again, but the numbers do add up if you think about how many humans each day must be making them.

Read More »

Read More »

5 Hidden Secrets To Amp-Up Your Company’s Marketing Strategy

You may be wondering why some companies seem leaps and bounds above others when it comes to creating comprehensive marketing strategies that guarantee positive results. Well, they are actually successful for one simple reason, and that is that they have knowledge that their competitors do not have.

Read More »

Read More »

What’s In Your Loan?

Opposing Monetary Directions

“Real estate is the future of the monetary system,” declares a real estate bug.

Does this make any sense? We would ask him this.

“OK how will houses be borrowed and lent?”

“Look at this housing bond,” he says, pointing to a bond denominated in dollars, with principal and interest paid in dollars.

“What do you mean ‘housing’ bond’,” we ask, “it’s a bond denominated in dollars!”

“Yes, but housing is the collateral.”...

Read More »

Read More »

Post-Covid China

The world should take a lesson from how East Asia ran itself in 2020. Japan had no lockdown. None. With an aging population, its death rate has been creeping up for many years. In 2020, it fell by 0.7%, as if Covid-19 was a life-saver.

Read More »

Read More »

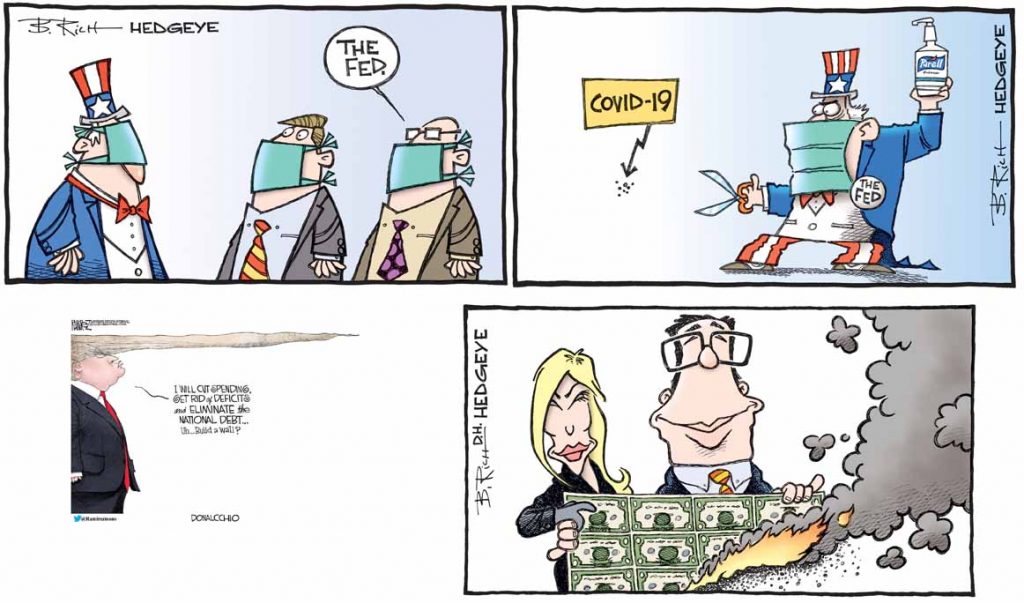

Did You Make Janet Yellen Rich?

The Stress of Losing Billions. Up until the WallStreetBets crowd short squeezed Melvin Capital for a $7 billion loss, Robinhood had it made. But losing billions is stressful. And when your product blows up your customer the clucking that follows comes hot and heavy.

Read More »

Read More »

Grantham’s ‘Real McCoy’ Bubble in a World Gone Mad

The Lure of Easy Money. Right now happens to be an attractive time to do something stupid. What’s more, everyone is doing it. Maybe you are too. Stock valuations and corporate earnings growth no longer appear to matter. Why not buy an S&P 500 index fund and let it ride? Or, better yet, why not buy shares of Nvidia?

Read More »

Read More »

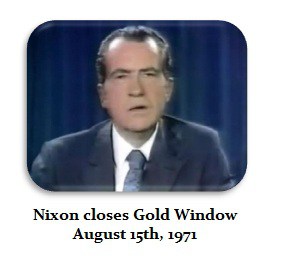

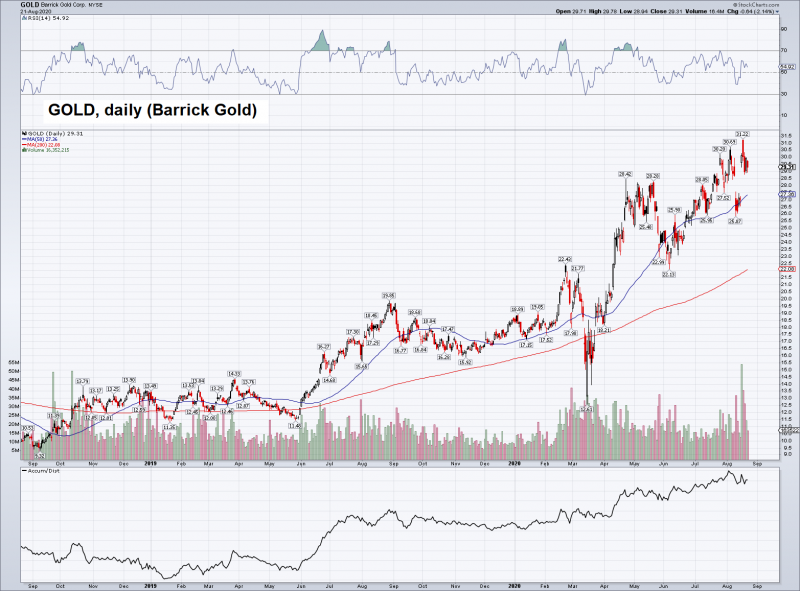

Warren Buffett Shorts The Economy

The big news in the monetary metals is that Warren Buffett — famed disliker of gold — sold bank stocks to buy gold mining shares. What is interesting to us is not that we think he has any special powers to predict the gold price. After all, he famously bet on silver, and lost.

Read More »

Read More »

What You Will Find When You Follow the Money

Lockdown Disaster. It has been a rough go for California Governor Gavin Newsom. Late last week it was revealed that the state Department of Public Health had tickled the poodle on its COVID-19 record keeping. Somehow the bureaucrats in Sacramento under-counted new corona-virus cases by as many as 300,000.

Read More »

Read More »

The Dollar Is Dying

Insulting the Captive Audience. This week, while perusing the Federal Reserve’s balance sheet figures, we came across a rather curious note. We don’t know how long the Fed’s had this note posted to its website. But we can’t recall ever seeing it.

Read More »

Read More »

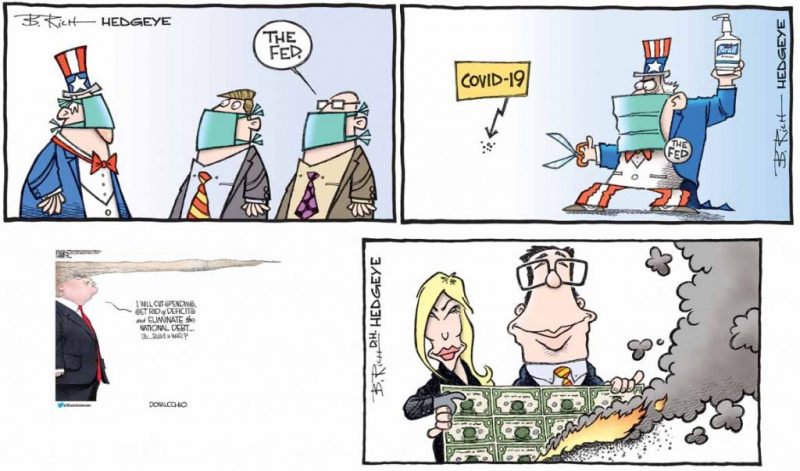

Game Over Spending

Coming and Going Like a Wildfire. Second quarter 2020 came and went like a California wildfire. The economic devastation caused by the government lock-downs was swift, the destruction immense, and the damage lasting. But, nonetheless, in Q2, the major U.S. stock market indices rallied at a record pace.

Read More »

Read More »

The Decline of the Third World

A Failure to Integrate Values. The only region in the world that has proactively tried to incorporate western culture in its societies is East Asia — Singapore, Japan, Hong Kong, South Korea, and Taiwan. China, which was a grotesquely oppressed, poor, Third World country not too far in the past, notwithstanding its many struggles today, has furiously tried to copy the West.

Read More »

Read More »

The Secret to Fun and Easy Stock Market Riches

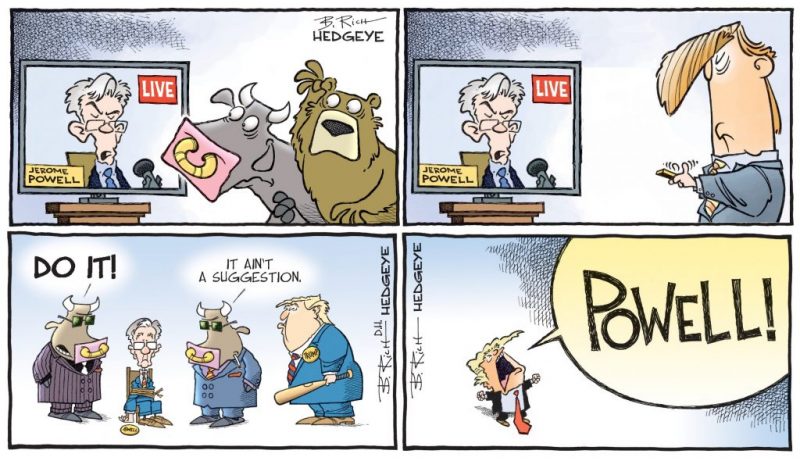

Post Hoc Fallacy. On Tuesday, at the precise moment Federal Reserve Chairman Jay Powell commenced delivering his semiannual monetary policy report to the House Financial Services Committee, something unpleasant happened. The Dow Jones Industrial Average (DJIA) didn’t go up. Rather, it went down.

Read More »

Read More »

A Pharmaceutical Stock That Is Often Particularly Strong At This Time Of The Year

An Example of Strong Single Stock Seasonality. Many individual stocks exhibits phases of seasonal strength. Being invested in these phases is therefore an especially promising strategy. Danish drug company Novo Nordisk.

Read More »

Read More »

The Triumph of Madness

Historic Misjudgments in Hindsight. Viewing the past through the lens of history is unfair to the participants. Missteps are too obvious. Failures are too abundant. Vanities are too absurd. The benefit of hindsight often renders the participants mere imbeciles on parade.

Read More »

Read More »

Markets on Edge as New Week Begins

The coronavirus death toll is just over 900, exceeding the SARS epidemic; the dollar remains firm. President Trump will unveil his budget proposal for FY2021 beginning October 1 today. The faltering eurozone economy comes just as political uncertainty is picking up in Germany.

Read More »

Read More »