Category Archive: 6a) Gold & Monetary Metals

Marc Faber: Central Banks Will Blame Gold For The Financial Crisis

Air Date: June 22nd, 2015 This video may contain copyrighted material. Such material is made available for educational purposes only. This constitutes a ‘fair use’ of any such copyrighted material as provided for in Title 17 U.S.C. section 107 of the US Copyright Law.

Read More »

Read More »

They’re Coming to Take Away Your Cash

They're coming to take away your cash. Not for the sake of control or steal your money, but to protect the banks.

Read More »

Read More »

Marc Faber: Forget a Fed rate hike; QE4 coming

Faber also said the main problem hindering US growth is the lack of affordability in its major cities. “The prices have gone up so much that many cities in the US and Europe are not affordable anymore. What people do is spend money, but they don’t go out too often; they go out once a … Continue reading »

Read More »

Read More »

Marc Faber On ET NOW: U.S. & Indian Markets, Modi Government

One of the biggest market voices Marc Faber – Editor & Publisher of The Gloom, Boom & Doom Report joined us on ET NOW this morning to share his valuable perspective on Indian economy, markets, crude, gold, Asian currencies as well as the US Markets. He is of the view that the US has been … Continue...

Read More »

Read More »

Peter Regli – unwissend? ferngesteuert? verblendet?

Peter Regli, Divisionär ausser Dienst (a D), ehemaliger Unterstabschef Nachrichtendienst der Schweizer Armee (USC ND), ehemaliger Leiter des Nachrichtendienstes der Flieger- und Fliegerabwehrtruppen, ehemaliger Assistent in der Schweizer Botschaft in...

Read More »

Read More »

Armeediskussion: “Reihen schliessen” – das falsche Rezept

Verordnete Einigkeit ist der falsche Weg in der aktuellen WEA-Diskussion. Es braucht die ehrliche Auseinandersetzung mit den Kritikern. Die Ablehnung des Gripen steckt vielen Offizieren, aber auch dem VBS, noch in den Knochen. Zum ersten Mal versenkt...

Read More »

Read More »

Marc Faber : We Are in the End Game – Economic Collapse

Marc Faber : We Are in the End Game – Economic Collapse FOLLOW Tony for Latest on world like WAR / ECONOMIC COLLAPSE / COLLAPSE of AMERICA / U.S. DOLLAR COLLAPSE / END TIMES / NEW WORLD ORDER / FINANCIAL CRISIS

Read More »

Read More »

Marc Faber: The Biggest Bubble Is Belief In Central Bankers

Air Date: April 16th, 2015 This video may contain copyrighted material. Such material is made available for educational purposes only. This constitutes a ‘fair use’ of any such copyrighted material as provided for in Title 17 U.S.C. section 107 of the US Copyright Law.

Read More »

Read More »

Marc Faber: The Chinese Will Not Print Money

Go to http://www.ChinaMoneyNetwork.com for more great interviews! In this episode of China Money Podcast, guest Dr. Marc Faber, renowned investor and publisher of The Gloom, Boom & Doom Report, speaks with our host Nina Xiang. Dr. Faber shares his thoughts on why China’s economic problems are solvable, explains the reasons behind his belief that China …

Read More »

Read More »

Arizona Governor Ducey Vetoes Gold

Arizona Gov. Doug Ducey vetoed a bill Wednesday that would have made Arizona the third state behind Utah and Oklahoma to recognize gold and silver as legal tender. This isn’t yet another in a long series of articles lamenting the Federal Reserve, power, politicians, corruption, and the hopelessness of fighting the status quo.

Read More »

Read More »

The Fed Has No Intention To Raise Rates – Marc Faber

With the U.S. economic recovery being doubted by weaker economic data, and more and more market watchers expecting the Federal Reserve to make a move on rates at a later date, Kitco News speaks with Marc Faber, editor of the Gloom Boom & Doom Report, to find out what he has to say about it. … Continue reading...

Read More »

Read More »

Das Gold-Gschichtli der SNB

Dem Jahresbericht 2014 der SNB entnehmen wir ab Seite 63: Lagerung der Goldreserven Gemäss Art. 99 Abs. 3 der Bundesverfassung hält die Nationalbank einen Teil ihrer Währungsreserven in Gold. Die Nationalbank gab im Frühling 2013 bekannt, dass sie 30...

Read More »

Read More »

The Gold Standard For Democrats

Keith Weiner describes how the Fed pushes down the interest rate and due to that, it drives up prices of food and rents. This implies that businesses are clearly priviliged against workers. The gold standard does the opposite, if prefers savings and workers. Hence Democrats should be fan of the gold standard.

Read More »

Read More »

Your Personal Debt Is Not Entirely Your Fault

When the cost of borrowing is too low, it becomes an irresistible siren song luring people into debt, borrowing becomes too cheap and spending too easy. No wonder that you don’t put 10% of your paycheck into the bank every month for future uncertainties. The Fed, with its zero interest policy, deserves much of the blame for your financial troubles.

Read More »

Read More »

Why Did Both Silver and Gold Become Money?

Keith Weiner explains why gold and silver, two shiny metals, have become money. They fill different human needs, and evolved through different paths. Money solves a problem called the coincidence of wants. Moreover he looks on the choice between gold and silver.

Read More »

Read More »

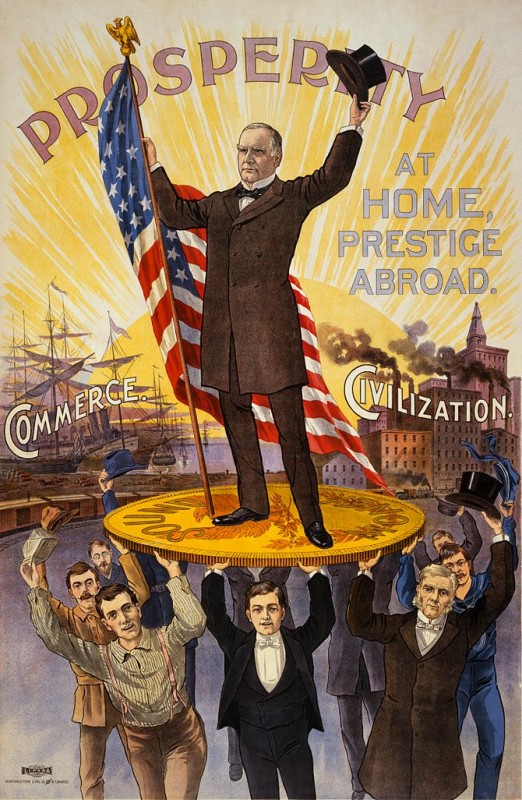

America Needs The Gold Standard More Than Ever

The United States needs the gold standard more than ever. The gold standard is neither barbaric nor impractical, and it is more urgently needed every day. This is because the standard of paper money is failing. It has set in motion an accelerating series of crises, each worse than the previous. The nation cannot continue to borrow to infinity, nor can the U.S. endure zero interest much longer.

Read More »

Read More »