Category Archive: 6a) Gold & Monetary Metals

Thomas Mayer – Why Monetary Reform Could be the Last Resort for the Euro to Survive

Thomas Mayer, the former Chief Economist of Deutsche Bank, explains why the Euro will not survive unless the monetry system is reformed. Learn how monetary reform could be the last resort to rescue the Euro in this video and on the website: http://conference2018.monetative.de/ Speech: “How can the Euro survive? Could money reform be a solution?” … Continue reading »

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 12.14.18

Eric Sprott reviews the week that was and looks ahead to what will be an interesting and consequential week next.

Read More »

Read More »

Sprott Money News Ask the Expert December 2018 – Bart Melek

Bart Melek, Global Head of Commodity Strategy for TD Securities answers your questions regarding gold, Fed policy and the ongoing drop in crude oil prices.

Read More »

Read More »

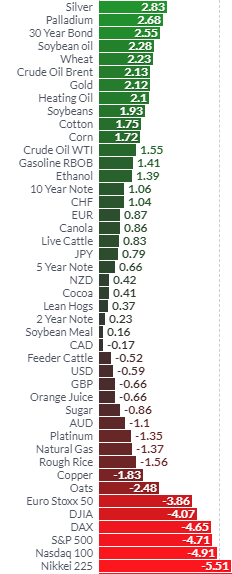

Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

Gold acted as a safe haven last week and is again acting as a safe haven in December. It has performed well despite the rout in stocks in Ireland and globally. U.S. stocks including the S&P500 and Nasdaq were down nearly 5% last week, while gold was 2% higher and silver over 3% higher.

Read More »

Read More »

Stocks, Oil, Gold-Ross Clark. China, Real Estate, Dow-Marc Faber. Silver/Gold-Ed Steer. AMY.V, CRL.C

Air Date: December 8, 2018 Ross Clark – Stock Markets, Oil, Gold. Guest’s website: https://chartsandmarkets.com/ Marc Faber – China, Real Estate, Gold, Dow. https://www.gloomboomdoom.com/ Ed Steer – Silver and Gold. Homepage Larry Reaugh President & CEO of American Manganese Inc. on Company Showcase – American Manganese CEO Discusses Busy Week in Meetings. Regulators to crack …

Read More »

Read More »

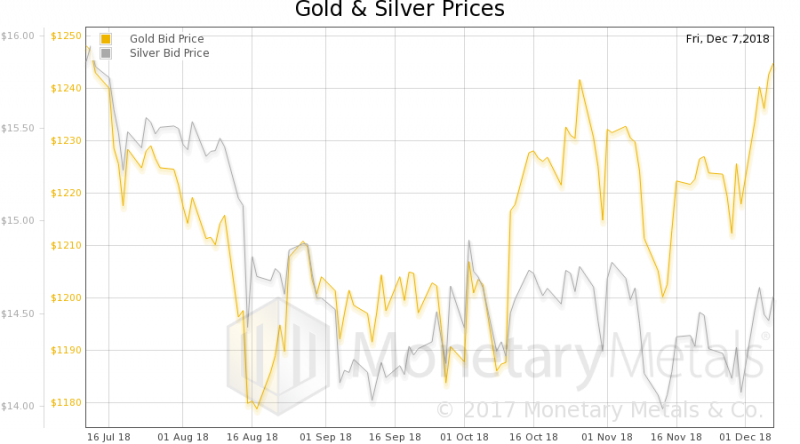

Sprott Money News Weekly Wrap-up – 12.7.18

Eric Sprott discusses the ongoing stock and bond market volatility and begins to look ahead to 2019.

Read More »

Read More »

Why Buy Gold Now? Because Of The “I Don’t Knows”…

From 2000 through 2012, the price of gold increased every year, rising from around $280 an ounce to nearly $1,700. It was an unprecedented run. Then, in 2013, gold took a nose dive, losing over 27% of its value. It was widely reported that the Swiss National Bank, the former bastion of monetary conservatism, lost $10 billion that year just on its gold holdings.

Read More »

Read More »

“Fake Markets” To Lead to Global Financial Crisis? Goldnomics Podcast (Ep 9)

Fake Markets – Are we living in a new era? What are Fake Financial Markets and what effect do they have on the current inflated levels of global stock markets? What do they mean for stock market and bond market performance in the future? In this episode 9 of the Goldnomics Podcast, Stephen Flood GoldCore …

Read More »

Read More »

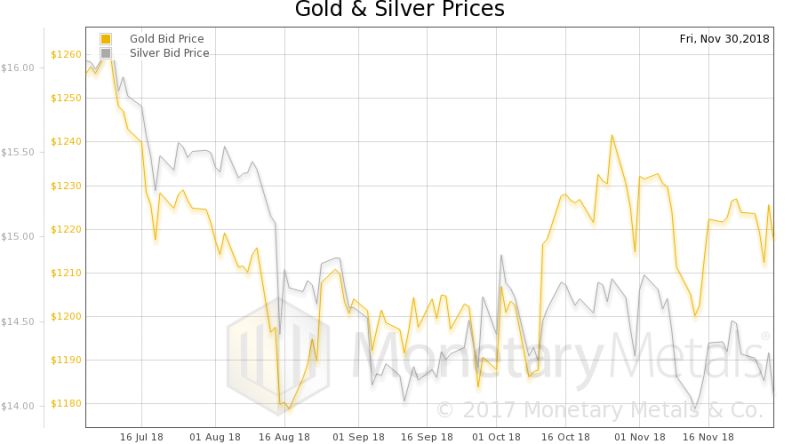

Sprott Money News Weekly Wrap-Up 11 30 18

Legendary Canadian investor Eric Sprott discusses the outlook for precious metals into year end and 2019.

Read More »

Read More »

MARC FABER – The Crypto Market Had Already Given These Warning Signals

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

Jp Cortez: Gold and Silver Are Still Money

Thanks for watching / listening – SUBSCRIBE – SHARE – LIKE Visit Jp Cortez – https://www.soundmoneydefense.org Visit Rory – https://thedailycoin.org Links mentioned in the video Congressman Mooney and Counterfeit Coins: https://www.soundmoneydefense.org/news/2018/03/12/us-mint-counterfeit-coins-000168 and https://www.soundmoneydefense.org/news/2017/10/27/congressmen-mint-counterfeit-gold-000158 2018 Sound Money Index:...

Read More »

Read More »

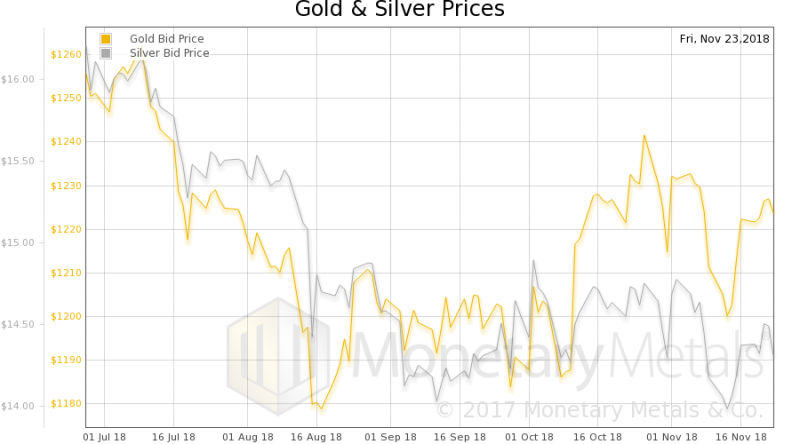

Sprott Money News Weekly Wrap-up – 11.23.18

Eric Sprott discusses the ongoing volatility in the markets and begins to look ahead to year-end and 2019

Read More »

Read More »

Brexit and Global Discontent

Is Brexit a Massive Threat to Globalisation? As Theresa May heads back to Brussels today in a last ditch effort to renegotiate her Brexit deal in order to get it passed through the British Parliament, we take a look not just at the current state of DIS-unity but also ask the question – is Brexit … Continue reading »

Read More »

Read More »

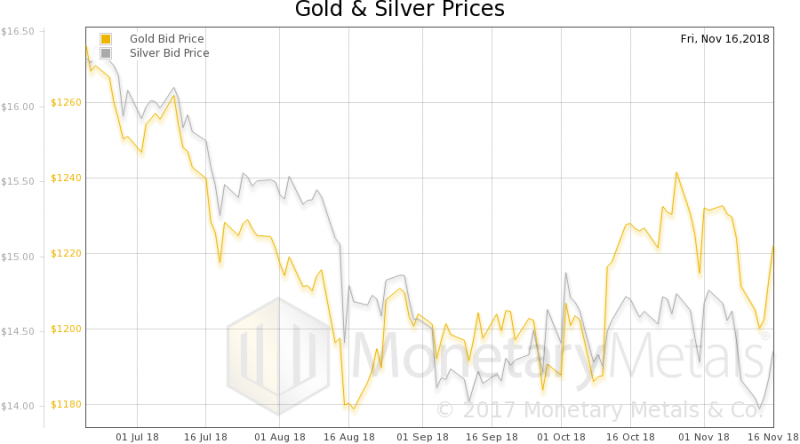

Sprott Money News Weekly Wrap-up – 11.16.18

Eric Sprott discusses this week’s rally in precious metal prices and looks ahead to the remainder of the year.

Read More »

Read More »