Category Archive: 6a) Gold & Monetary Metals

Brexit and Learning To “Live With Boom and Bust Economic Cycles”

Generations of people have learned to live with boom and bust economic cycles. Years of relative plenty were followed, as night follows day, by grief including high unemployment and forced emigration on a large scale. In fact, if you go back much beyond the late 1960s, it would not be too cynical to say the cycles were often more about going from bust to really busted, as for decades the country was hit by crippling rates of largely enforced...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.29.19

Eric Sprott discusses the end-of-quarter selloffs seen in the precious metals but looks ahead to a rebound in the weeks to come.

Read More »

Read More »

Global Risks Increasing – Underlining The Case For Gold in 2019

Online presentation by Research Director of GoldCore, Mark O’Byrne, on the strong case for gold due to increasing global uncertainty and risks. Topics, slides and charts considering – Safe haven gold – History, research, PwC and Mario Draghi – “Gold tends to increase in periods of systemic risk” – “Gold outperforms stocks and bonds in …

Read More »

Read More »

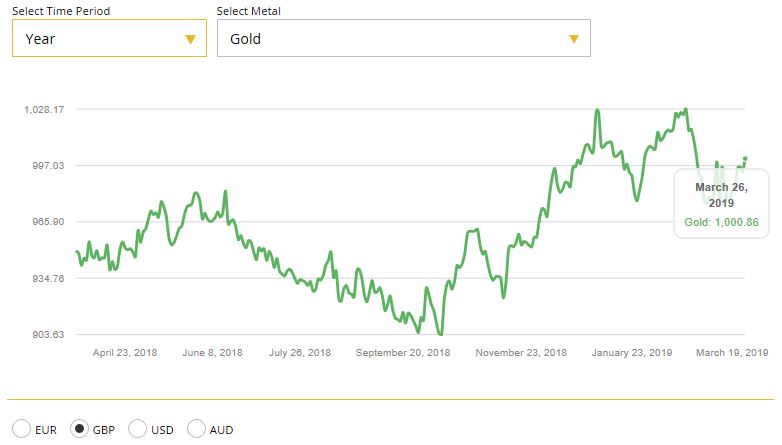

Gold Gains On Recession Concerns and ‘No Deal’ Brexit Risks

– Gold gains due to concerns about slowing growth, monetary and geopolitical risks

– Increasing possibility of ‘No Deal’ Brexit heightens recession risks in UK, Ireland

– Brexit uncertainty is impacting UK & Irish economies; Likely do long term damage

– UK sees sharp slowdown in mortgage approvals in February as housing market slows

– Gold surges to near all time record highs in Australian dollars at $1,860/oz

– Gold in sterling, euros and...

Read More »

Read More »

Sprott Money News Ask The Expert – Richard Hayes of The Perth Mint

Richard Hayes is CEO of The Perth Mint. In this episode, he answers questions about Perth Mint products as well as global gold supply and demand trends.

Read More »

Read More »

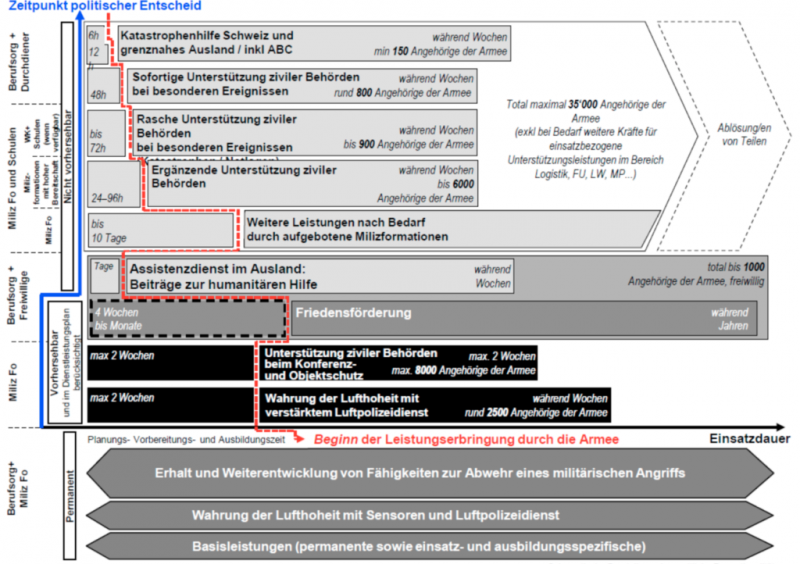

Wunschdenken von Frau BR Amherd

Das VBS hat seit dem neuen Jahr eine Cheffin. Anlässlich der SOG-DV vom 16. März 2019 hat sie sich an die Offiziere gewandt und dabei einige interessante Äusserungen (Hervorhebungen durch den Autor) gemacht, so etwa zu den “Entwicklungen im internationalen Streitkräftebereich”:

Read More »

Read More »

MARC FABER: STORM HASN’T HIT YET, BTC $4,000, GOLD – PEOPLE NEVER LEARN…

http://www.portfoliowealthglobal.com/Faber MUST-READ FOR INVESTORS: LP(S) – Attack LP(S) – Bear LP(S) – Drama Shelter your Portfolio from the Bonds COLLAPSE: http://www.PortfolioWealthGlobal.com/Bonds Get Immediate Access to our Exclusive Report on the Coming STOCK MARKET CRASH: http://www.portfoliowealthglobal.com/crash/ Download Our Top 5 Cryptocurrencies for 2018 AT: http://www.portfoliowealthglobal.com/top5/ The Gold Bull...

Read More »

Read More »

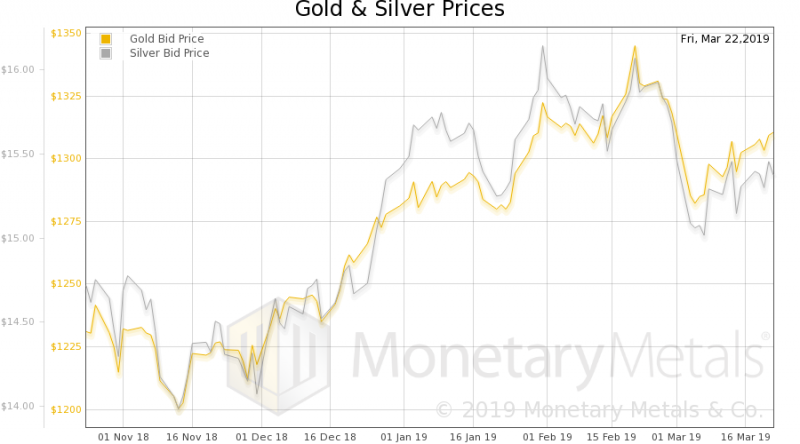

Sprott Money News Weekly Wrap-up – 3.22.19

Eric Sprott discusses the latest policy moves by the Federal Reserve and the pending impact on gold and silver prices.

Read More »

Read More »

5 Key Ways to Prosper in the Coming Systemic Crisis

Time To Take Power and Control Back From The System

1. Diversify Your Investments and Savings

2. Invest and Own Gold and Silver in Safest Ways

3. Avoid Excessive Debt or Leverage

4. Prepare For Investment Opportunities

5. Invest In Your Education. Learn and Grow

Topics considered are

- Political, financial, economic and monetary systems are failing and will likely collapse

- Our human built economic systems are dependent on the...

Read More »

Read More »

5 Ways to Prosper in the Coming Crisis

5 Ways to Prosper in the Coming Crisis – Goldnomics Podcast (Epis. 11) In the 11th Episode of The Goldnomics Podcast Mark O’Byrne and Stephen Flood are interviewed by Dave Russell as they discuss 5 ways to prosper in the coming systemic crisis. There are many risks facing us and Brexit, while important, is just … Continue...

Read More »

Read More »

Cryptocurrencies accepted by Switzerland’s biggest online retailer

Switzerland’s largest online shop, Digitec Galaxus, has announced it will start accepting payments in bitcoin and other cryptocurrencies. The company, which saw turnover of close to a billion francs last year, is by far the largest Swiss retailer to date to take this step. The move may go some way to answering the question posed by many bitcoin holders: “I have cryptocurrencies, now what do I do with them?”

Read More »

Read More »

Marc Faber – Huge Asset Bubble Will Be Deflated

Legendary contrarian investor Dr. Marc Faber warns, “When I started to work in 1970 on Wall Street, the stock market capitalization of the U.S. as a percentage of GDP . . . was between 25% and 30%. Now, the stock market capitalization alone is 150% of GDP, and when you add the bonds to it, … Continue reading »

Read More »

Read More »

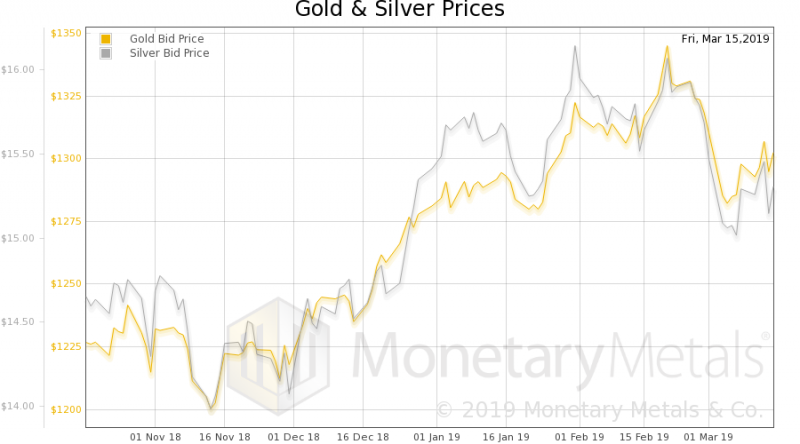

Sprott Money News Weekly Wrap-up – 3.15.19

Eric Sprott discusses the week that was in precious metals and looks ahead to a volatile week next.

Read More »

Read More »

XRP Rally Inevitable , Ripple And Marc Faber Buys Bitcoin

Get A Ledger Hard Wallet For Safe Digital Asset Storage http://bit.ly/2HKGIcO Get A CoolWallet Hard Wallet For Safe Storage: https://bit.ly/2UUYFvd Enter Uphold $500K Giveaway: http://bit.ly/2RFt7ZA Get Cinnamon For Your Coffee Here: https://bit.ly/2UEYIMx Digital Asset Investor Website http://thedai.io _____________________________________________ XRP Donations Welcome And Appreciated Address: rEb8TK3gBgk5auZkwc6sHnwrGVJH8DuaLh Destination Tag...

Read More »

Read More »

#571 Gesetzenwurf für Bitcoin Transparenz, Ethereum kein Wertpapier & Marc Faber kauft BTC

http://bitcoin-informant.de/2019/03/13/571-gesetzenwurf-fuer-bitcoin-transparenz-ethereum-kein-wertpapier-marc-faber-kauft-btc Hey Krypto Fans, willkommen zur Bitcoin-Informant Show Nr. 571. Heute geht’s um folgende Themen: Gesetzentwurf will Bitcoin und Co. gänzlich transparent machen, US-Börsenaufsicht: Ethereum wird nicht als Wertpapier eingestuft & Investor Marc Faber kauft BTC. 1.) Gesetzentwurf will Bitcoin und Co. gänzlich...

Read More »

Read More »

Sprott Money News Weekly Wrap-Up – 3.8.19

Eric Sprott discusses the latest US jobs numbers as well as other global factors that are driving gold and silver prices.

Read More »

Read More »