Category Archive: 6a) Gold & Monetary Metals

How Is Palladium Mined?

https://www.moneymetals.com/precious-metals-charts/palladium-price#how-is-palladium-mined – The vast majority of palladium doesn’t come from primary palladium mines. In fact, only two major pure palladium producers exist. Most palladium is mined as a byproduct of mining for other metals – typically nickel, copper, gold, and/or platinum. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Why Is Palladium so Expensive?

https://www.moneymetals.com/precious-metals-charts/palladium-price#why-is-palladium-so-expensive – Rising demand from automakers has combined with constricting supplies to boost palladium prices. Since 2016, prices for the specialty metal have more than tripled as supply deficits have widened. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤...

Read More »

Read More »

Is Palladium a Good Investment?

https://www.moneymetals.com/precious-metals-charts/palladium-price#is-palladium-a-good-investment – Palladium is a good metal to hold in your investment portfolio for diversification. It shows little correlation with stocks, bonds, and other financial assets. Palladium often zigs while other asset classes – and even other precious metals – zag. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

Is Palladium More Expensive Than Gold?

https://www.moneymetals.com/precious-metals-charts/palladium-price#is-palladium-more-expensive-than-gold – In 2019, palladium surged to a record high – surpassing the price of gold. Later in the year, gold embarked on a strong rally to reclaim the title of the priciest precious metal. Historically, gold tends to be more expensive palladium. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Why Nobody Chants “End the Fed” Anymore

Americans hated it when the Federal Reserve handed trillions of dollars to crooked Wall Street banks following the 2008 Financial Crisis. Politicians were confronted about the merits of central banking and bailouts.

For the first time in history, college students were chanting “End the Fed” at campaign rallies as Ron Paul took the central bank to task during his presidential campaigns.

Read More »

Read More »

Trump Pumps Market With Trade Talks, Stocks Move Higher, Gold Lower

Sue Trinh, Managing Director of global macro strategy at Manulife Investment Management, speaking on Bloomberg. She had some interesting comments regarding the current market structure, in the shadow of the FED, which is expected to drop rates yet again.

Read More »

Read More »

What is the Palladium Spot Price?

https://www.moneymetals.com/precious-metals-charts/palladium-price#what-is-the-palladium-spot-price –The term Spot price for palladium (and other precious metals) refers to the current price of the metal as it is traded via contracts in the futures markets. Technically speaking the spot price is the price of the most recent trade, for a contract with the nearest available delivery date. ? SUBSCRIBE TO MONEY …

Read More »

Read More »

LAST WARNING ? Marc Faber – GLOBAL FINANCIAL COLLAPSE COMING BEFORE 2020

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected] My guest in this interview is Dr Marc Faber. Dr. Faber is the editor of the Gloom, Boom & Doom Report. He is referred to as the Billionaire they call Dr. Doom in Tony Robbins book, Money Master The Game. In …

Read More »

Read More »

Marc Faber ? Prepare For Great Depression !!The Financial Market Storm By 2020

Contact advertising: Would you like to place ads on my youtube channel? Skype: akira10k Email: [email protected] My guest in this interview is Dr Marc Faber. Dr. Faber is the editor of the Gloom, Boom & Doom Report. He is referred to as the Billionaire they call Dr. Doom in Tony Robbins book, Money Master The …

Read More »

Read More »

What is Palladium?

https://www.moneymetals.com/precious-metals-charts/palladium-price#what-is-palladium – Palladium is an extremely rare, silver-white precious metal. It is 30 times more scarce than gold, and it is 15 times more rare than platinum. Palladium was discovered in 1803, but mineable ore deposits are not easy to come by. Much of the current production is confined to Canada, Russia and South Africa. …

Read More »

Read More »

Can I Put Platinum In My IRA?

https://www.moneymetals.com/precious-metals-charts/platinum-price#can-i-put-platinum-in-my-ira –Yes! You hold certain IRS-approved platinum bullion products within a Self-Directed IRA. Simply select an account custodian that handles precious metals IRAs and fund it with IRA-eligible platinum purchased from a dealer such as Money Metals Exchange. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

Where Can I Buy Physical Platinum?

https://www.moneymetals.com/precious-metals-charts/platinum-price#where-can-i-buy-physical-platinum –You can buy platinum coins, rounds, or bars from reputable precious metals dealers such as Money Metals Exchange. As platinum sales tend to be a small fraction of gold and silver sales for most dealers, they may have sparse inventories of platinum products available. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

GATA’s Powell: Attacks on Gold & Silver Prices Are Losing Their Impact

Interview Begins ➡️➡️8:52 Full Transcript here: https://www.moneymetals.com/podcasts/2019/10/25/attacks-on-gold-silver-prices-lose-impact-001894 Check out live precious metals prices ?: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 10.25.19

Eric Sprott discusses the latest surge in precious metals prices as well as the latest earnings reports from some of the mining companies. Submit your questions to [email protected] or visit www.sprottmoney.com to get the transcript for the WWU.

Read More »

Read More »

Sprott Money News Ask The Expert October 2019 – Nomi Prins

Author and journalist Nomi Prins joins us to answer your questions regarding the precious metals, the growing mass of global debt and the future of the U.S. dollar.

Read More »

Read More »

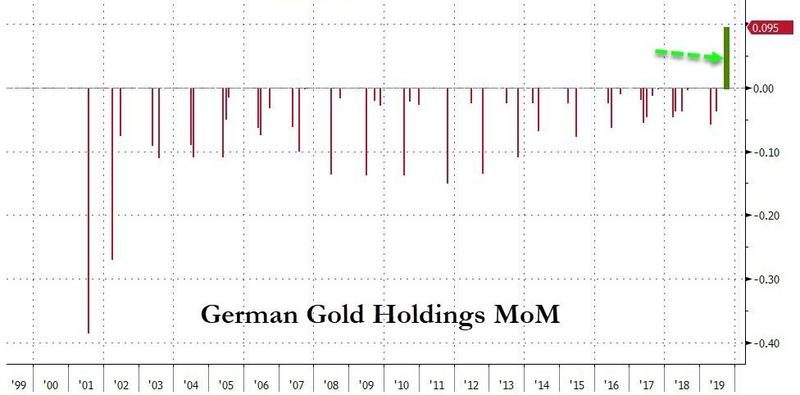

Bundesbank Buys Gold – Increasing Concerns About Deutsche Bank, European Banks, the Euro and Dollar

◆ The End Of Fiat In One Chart?◆ For the first time in 21 years, Germany has openly bought gold into its reserve holdings◆ With ECB mutiny and Deutsche Bank’s rapid demise, fears are rising of a looming financial crisis, and with that, Germany has shown a renewed interest in gold

Read More »

Read More »

Do Platinum Prices Move with Silver and Gold Prices?

https://www.moneymetals.com/precious-metals-charts/platinum-price#do-platinum-prices-move-with-silver-and-gold-prices –Not always. While all precious metals over time tend to reflect the steady depreciation of the currency in which they are denominated, the platinum group metals have their own unique cycles and price drivers. That makes them useful portfolio diversifiers. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

Are Platinum Prices Manipulated?

https://www.moneymetals.com/precious-metals-charts/platinum-price#are-platinum-prices-manipulated – In recent years, rogue traders at large global financial institutions including Deutsche Bank and JP Morgan Chase, have been caught manipulating gold and silver markets. The platinum market doesn’t attract as much attention, but it is by no means free from the forces of price manipulation. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON …

Read More »

Read More »

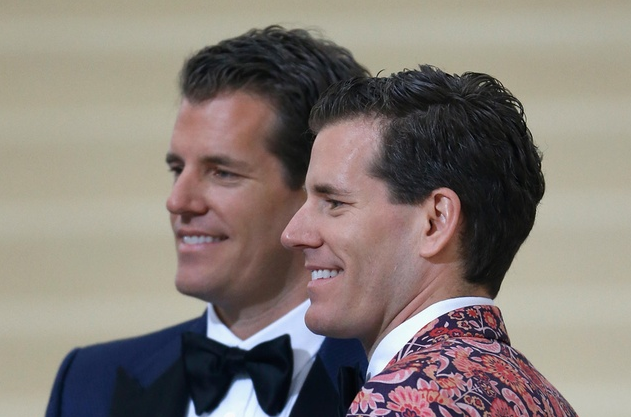

Bitcoin billionaire twins to address St Moritz crypto event

Cameron and Tyler Winkelvoss, who made a fortune out of bitcoin, are to deliver a keynote speech at next year’s Crypto Finance Conference in St Moritz. The annual gathering of cryptocurrency entrepreneurs and investors has become a fixture event, running just before the World Economic Forum’s flagship Davos summit.

Read More »

Read More »