Category Archive: 6a) Gold & Monetary Metals

FOMO to GMO – Ross Clark. Corona, Corruption, China, Gold – Marc Faber. PDAC – John Kaiser. AMY.V

Air Date: March 7, 2020 Ross Clark – From Fear of Missing Out to Get Me Out Guest’s website: https://chartsandmarkets.com/ Marc Faber – Corona Virus, Corruption, China, Gold Guest’s website: https://www.gloomboomdoom.com/ John Kaiser – Mood at PDAC Mining Conference Guest’s website: https://secure.kaiserresearch.com/ Larry Reaugh – President & CEO of American Manganese Inc. on Company Showcase …

Read More »

Read More »

Jacob Hornberger: Let the Free Market Determine Rates, Pick the Best Money

Interview ?️begins at 6:20 Full transcript here ?: https://www.moneymetals.com/podcasts/2020/03/06/fed-panic-boosts-gold-bonds-stock-market-dives-001978 Gold & Silver prices ?: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.6.20

Legendary Canadian investor Eric Sprott discusses the impact of the coronavirus on the global economy and the precious metals.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.6.20

Legendary Canadian investor Eric Sprott discusses the impact of the coronavirus on the global economy and the precious metals.

Read More »

Read More »

Gold Surges 3 percent After U.S. Fed’s First Emergency Rate Cut Since 2008

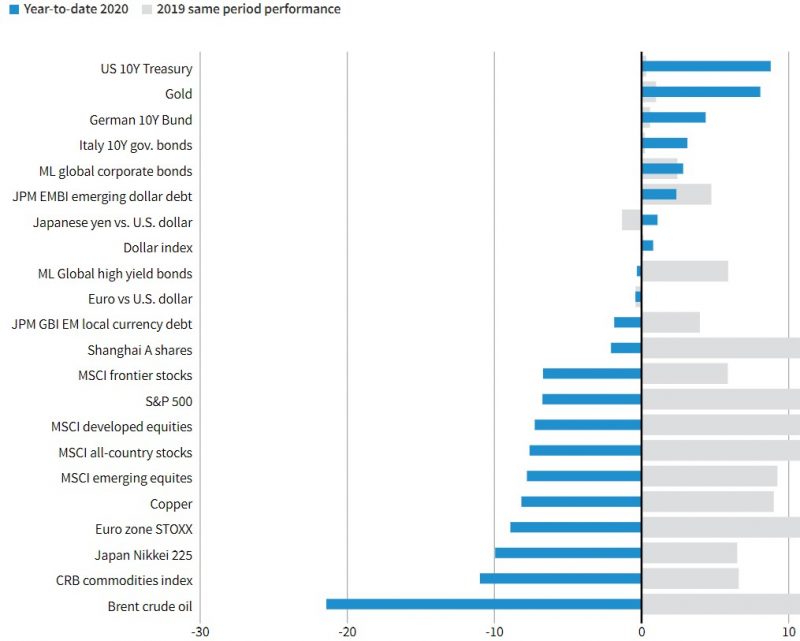

◆ Gold surges 3% and has largest daily gain since June 2016 as the Fed delivers a surprise emergency rate cut, the first since 2008 ◆ Gold has gained over 10% in dollars and by more in other currencies so far in 2020 and along with U.S. Treasuries, it is a one of the best performing assets in 2020 as stock markets globally fall sharply (see 2020 Asset Performance table)

Read More »

Read More »

Marc Faber – Investors Complacent To Economic Fallout From Coronavirus

Returning SBTV guest Marc Faber, editor and publisher of “The Gloom, Boom & Doom Report”, believes the biggest economic issue today is the spread of the coronavirus and its psychological impact on people’s habits causing detrimental effects on the economy. Discussed in this interview: 01:48 Doom and gloom in 2020 06:37 How plagues have influenced …

Read More »

Read More »

Marc Faber: Coronavirus changes society FOREVER! Plus: GOLD, stocks, interest rates, China & HK

Exclusive interview with the “congenial contrarian”, investing legend Dr. Marc Faber! Sign up for Marc Faber newsletter at: https://www.gloomboomdoom.com/ SUBSCRIBE to our channel: https://bit.ly/2x22Q1C Follow Us for Frequent Updates and Videos! 1️⃣ FB: https://www.facebook.com/WallStreetReporter1843 2️⃣ TW: https://www.Twitter.com/WallStreetRprtr 3️⃣ IN: https://www.linkedin.com/company/18917144/ ? Website:...

Read More »

Read More »

Marc Faber explains the risk-off mode | EXCLUSIVE

Oil stocks trading at depressed valuations. Developing real estate will add value to a portfolio, says Marc Faber. Tune in for the exclusive conversation on the impact of coronavirus on business, global currencies, and precious metals. Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► https://goo.gl/SEjvK3 Subscribe Now To Our Network …

Read More »

Read More »

Eric Sprott, Terry Lynch: Protect Retail Investors, Let Them Make Money

At the Prospectors & Developers Association of Canada convention, the Investing News Network got an update from Terry Lynch and Eric Sprott on the Save Canadian Mining initiative. #PDAC2020 #SaveCanadianMining #Investing

Save Canadian Mining's goal is to have a securities trading rule known as the “uptick rule” or “tick test” reinstated. Lynch is its founder and Sprott is one of its backers. ...

Read More »

Read More »

Marc Faber : HOW REVOLUTIONS, WARS AND PLAGUES ARE HARBINGERS OF “GREAT CHANGES” IN ECONOMICS

Marc Faber : HOW REVOLUTIONS, WARS AND PLAGUES ARE HARBINGERS OF “GREAT CHANGES” IN SOCIETIES AND IN ECONOMICS economic collapse,rich dad poor dad,super rich,greed,rich,ww3,documentary bbc,deutsche bank,China trade war,Argentina depression,Stock Market Crash,Dr. Marc Faber,Marc Faber,asset bubble,contrarian investor,inflation,stock market capitalization,recession,marc faber this week,marc faber september 2019,marc faber interview,marc...

Read More »

Read More »

Goldman: 3 Key Reasons Why We Are Bullish On Gold

On “Bloomberg Commodities Edge”, Bloomberg’s Alix Steel and Naureen Malik talk with Jeff Currie, global head of commodities research at Goldman Sachs. They discuss Goldman’s bullish stance on gold.

Read More »

Read More »

Greg Weldon: Could Get Worse for Markets But Is a Gold/Silver Buying Opportunity

Interview ?️begins at 6:03 Full transcript ?: https://www.moneymetals.com/podcasts/2020/02/28/gold-and-silver-dip-as-coronavirus-crashes-stock-market-001972 Live Gold & Silver Prices ??: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 2.28.20

Eric Sprott discusses the devastating impact the coronavirus is having on the global markets, including for now the precious metals and the mining shares.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 2.28.20

Eric Sprott discusses the devastating impact the coronavirus is having on the global markets, including for now the precious metals and the mining shares.

Read More »

Read More »

What Does Low Crude Oil Prices Mean For India? | Marc Faber to ET NOW

Investors should not panic & sell-off on rebound. India is a special case; low crude oil is beneficial for India to an extent, says Marc Faber to ET NOW. Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► https://goo.gl/SEjvK3 Subscribe Now To Our Network Channels :- Times Now : http://goo.gl/U9ibPb The …

Read More »

Read More »

Michael Rivero Discusses a Deep State Coup Attempt & How Hillary Might Sneak into the Election

Interview begins at 6:12 Full transcript here: https://www.moneymetals.com/podcasts/2020/02/21/gold-if-bernie-sanders-wins-election-001967 Gold & Silver prices: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals...

Read More »

Read More »

Gold May Rise To $2,000/oz This Year Due To Strong Coin and Bar, ETF and Central Bank Demand

IGTV interviewed Mark O’Byrne, Research Director at GoldCore about the outlook for gold and silver bullion. He is bullish on both precious metals in the medium and long term. The fundamentals are very strong with strong central bank demand and ETF gold holdings reaching an all time record high due to deepening political and economic risks.

Read More »

Read More »

Marc Faber Monthly Market Commentary: February 1, 2020

Marc Faber Monthly Market Commentary: February 1, 2020 — Economic Collapse 2020 The other day, I came across an essay that aroused my interest because of its title: Universal Basic Income: A Dream Come True for Despots by Antony Sammeroff (he is the author of Universal Basic Income – For and Against. According to Sammeroff, …

Read More »

Read More »