Category Archive: 6a) Gold & Monetary Metals

Is Your Pension ‘Good as Gold’?

With the current level of uncertainty in world markets we have received numerous requests for information on how self directed pension schemes (pre and post retirement) can hold gold and silver.It is accepted that if gold bullion is held via a gold certificates ( Perth Mint Certificates with GoldCore) or in Secure Storage in a variety of local or international locations with GoldCore, then it is not considered a ‘pride in possession’ article or...

Read More »

Read More »

Gerald Celente Unloads: “We Got Sick Bastards DESTROYING Our Lives and There’s Hardly Any Protests…”

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤ https://instagram.com/moneymetals/

LINKEDIN ➤ https://www.linkedin.com/company/mone...

SOUNDCLOUD ➤ https://soundcloud.com/moneymetals

TUMBLR ➤ http://money-metals.tumblr.com/...

Read More »

Read More »

Gerald Celente Unloads: “We Got Sick Bastards DESTROYING Our Lives and There’s Hardly Any Protests…”

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤ https://instagram.com/moneymetals/ LINKEDIN ➤ https://www.linkedin.com/company/mone… SOUNDCLOUD ➤ https://soundcloud.com/moneymetals TUMBLR ➤ http://money-metals.tumblr.com/...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 5.29.20

Eric Sprott discusses the past week in precious metals and looks ahead to what promises to be a very interesting month of June.

Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 5.29.20

Eric Sprott discusses the past week in precious metals and looks ahead to what promises to be a very interesting month of June. Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

An unexpected blow to the ECB

Since the beginning of the year, the corona crisis has come to monopolize the news coverage to the extent that a lot of very important stories and developments either went underreported or were ignored altogether. One such example was the very surprising ruling out of the German Constitutional Court in early May, that challenged the actions and remit of the ECB.

Read More »

Read More »

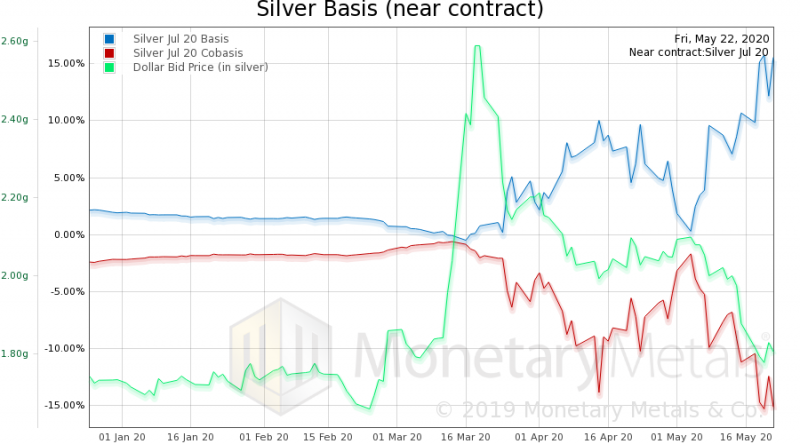

Alasdair Macleod: Banks Are Losing Control of Gold Price

#AlasdairMacleod: Banks Are Losing Control of #GoldPrice

What’s been talked about in the #gold and #silver markets for decades, appears to finally be manifesting. As the mismatch between the amount of paper gold, and the amount of actual gold that’s in the system and available for trade continues to grow.

Fortunately, Alasdair Macleod of #Goldmoney.com joined me on the show to talk about what he’s seeing. He also shared what’s going on inside...

Read More »

Read More »

Larry Parks Reveals the REAL REASON Why The Government & Financial Elite ABSOLUTELY HATE Gold

Full transcript: https://www.moneymetals.com/podcasts/2020/05/22/why-the-global-elite-hate-gold-002038

Gold & Silver Prices: https://www.moneymetals.com/precious-metals-charts

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤...

Read More »

Read More »

Larry Parks Reveals the REAL REASON Why The Government & Financial Elite ABSOLUTELY HATE Gold

Full transcript: https://www.moneymetals.com/podcasts/2020/05/22/why-the-global-elite-hate-gold-002038 Gold & Silver Prices: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 5.22.20

Eric Sprott provides analysis of recent developments in the gold and silver markets as well as commentary on some of his recent investments.

Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 5.22.20

Eric Sprott provides analysis of recent developments in the gold and silver markets as well as commentary on some of his recent investments. Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

MARC FABER uncensored: Central banks exposed? Leaders showing their REAL faces now?

Frank Walbaum from FX Strategies meets up with the one and only Dr. Marc Faber alias Dr. Doom. Together they talk about the markets regarding Covid-19. To find out more about Dr. Marc Faber check out his “Gloom, Boom & Doom Report”: http://www.gloomboomdoom.com Are you also infected with the Trading Virus? To find out more …

Read More »

Read More »

Dr Marc Faber: How Is Silver $15 With Unlimited Fed QE

#DrMarcFaber: How Is #Silver $15 With Unlimited #Fed #QE Does it seem somewhat bizarre that with #theFed running an open-ended #hyperinflation campaign, that silver is still trading at $15? Dr. Marc Faber of the #GloomBoomandDoomReport finds it odd, although simultaneously one of the more attractive investing opportunities most have ever seen. Dr. Faber also comments …

Read More »

Read More »

Clean gold: How Switzerland could set new supply chain standards

Switzerland is the undisputed top dog of the global gold industry, refining a majority of the world’s gold, as well as being the leading exporter. But how seriously does the country take its responsibility to ensure sustainable mining and the protection of human rights?

Read More »

Read More »