Category Archive: 6a) Gold & Monetary Metals

Markets, Gold, CAD – Ross Clark. Marxism, Lockdowns – Marc Faber. Gold, Silver – Ed Steer. AMY, ABN

Air Date: June 27, 2020 Ross Clark – Summer Correction in Markets, Flight to Safety, Gold and Miners, Canadian Dollar Guest’s website: https://chartsandmarkets.com/ Marc Faber – Marxism, Lockdowns, Real Estate Guest’s website: https://www.gloomboomdoom.com/ Ed Steer – Gold and Silver Guest’s website: https://edsteergoldsilver.com/ Larry Reaugh – President and CEO American Manganese Inc. on Company Showcase – …

Read More »

Read More »

Stefan Gleason: Why You Need REAL MONEY Like Never Before and How to Avoid One HUGE Mistake…

Full transcript: https://www.moneymetals.com/podcasts/2020/06/26/new-money-as-dollar-weakens-002063

Gold & Silver Prices: https://www.moneymetals.com/precious-metals-charts

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤...

Read More »

Read More »

World’s Ultra Wealthy Urged By Financial Advisers and Largest Banks to “Hold More Gold”

◆ World’s wealthy are being urged by their financial advisers to hold more gold as they question the strength of the stock market rally and are concerned about the long-term impact of global central banks’ cash splurge.

Read More »

Read More »

Outlook For Property, Bitcoin, Cryptos and Gold in the Zombie Economy – Goldnomics Podcast (Part II)

◆ Zombie Currencies Cometh! How To Protect Your Assets and Invest - Goldnomics Podcast (Episode 15, Part II)

◆ Outlook for property (residential and commercial), bitcoin and cryptos and gold and silver bullion (versus gold exchange traded funds or ETFs) is looked at by GoldCore's Mark O'Byrne (Research Director), Stephen Flood (CEO) and Dave Russell (Director).

◆ Opportunities and risks for investments in a world of "infinite currency"...

Read More »

Read More »

WARNING: The U.S. Banking System ISN’T as Strong as Advertised

Despite a year of tumult on Wall Street and Main Street, the banking system seems to be holding up remarkably well… for now. Whereas previous financial crises were marked by a surge in bank failures, hardly any have gone under so far in 2020. The Federal Deposit Insurance Corporation (FDIC) reports that only 1% of FDIC-insured banks are on the “problem list” for financial weakness.

Read More »

Read More »

The War On Cash – COVID Edition Part II

The digital “toll” It doesn’t require too dark an imagination to realize the gravity of the concerns over the digital yuan. China is a true pioneer when it comes surveillance, censorship and political oppression and the digital age has given an incredibly efficient and effective arsenal to the state. Adding money to that toolkit was a move that was planned for many years and it is abundantly clear how useful a tool it can be for any totalitarian...

Read More »

Read More »

ALASDAIR MACLEOD – The Currency Within A 7 Months Completely Collapsed

Will there be currency collapse? How will the collapse of the currency be?

SUBSCRIBE For The Latest Issues About ;

#useconomy2020

#economynews

#useconomy

#coronaviruseconomy

#marketeconomy

#worldeconomy

#reopeneconomy

#openeconomy

#economynews

#reopeningeconomy

#globaleconomy

#silverprice

#stockmarket

#recession

#goldpricetoday

#goldprice

#goldpriceprediction

#preciousmetals

#economics

#silverpriceprediction...

Read More »

Read More »

Marc Faber Discusses Why You Need To Prepare For What Is Ahead

My guest in this interview is Dr Marc Faber. Dr. Faber is the editor of the Gloom, Boom & Doom Report. He is referred to as the Billionaire they call Dr. Doom in Tony Robbins book, Money Master The Game. In this episode, we will look at what the global economy and markets are telling … Continue reading...

Read More »

Read More »

“The Day Everything Changed” Just Happened | Alasdair Macleod

Alasdair Macleod, Head of Research at GoldMoney, returns to Liberty and Finance / Reluctant Preppers to alert us that his latest research indicates we have recently passed an inflection nexus of numerous critical indicators, signaling a probable systemic failure of the banking system within months, and a collapse of the USD this year.

Alasdair also answers viewers’ questions about gold & silver, buying land, and protecting ourselves from...

Read More »

Read More »

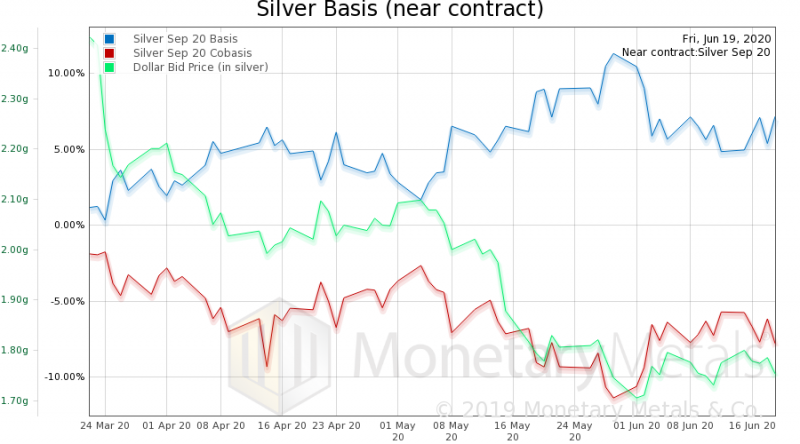

David Morgan: Silver Supply Crashed in Shutdowns, Investment Remains Robust

Full transcript ?:

https://www.moneymetals.com/podcasts/2020/06/19/silver-supply-crashed-in-shutdowns-002058

Gold & Silver Prices ?:

https://www.moneymetals.com/precious-metals-charts

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤...

Read More »

Read More »

Ronald Stöferle at Sprott Money News

Ronald Peter Stöferle continues his interview series. Today he is a guest of Craig Hemke of Sprott Money News. The topic of discussion was of course this year's In Gold We Trust report and its content.

The Boogeyman, Inflation

Even if mainstream economists do not believe stagflation is possible in our current climate, Ronald Stöferle sees the possibility that it could make a comeback. This would be a situation like in the 70s where gold is...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 6.19.20

With gold prices nearing their all-time highs, legendary investor Eric Sprott discusses the precious metals and some of his investments in the mining sector.

Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

Attack of the Zombie Economy – How To Protect Your Assets

◆ Zombie Banks, Corporations, Markets, Economy and Currencies Cometh! - Goldnomics Podcast (Episode 15)

◆ What is the outlook for markets, investments, savings and assets in a world of "infinite currency"?

◆ The opportunity and risks are looked at by GoldCore's Mark O'Byrne (Research Director), Stephen Flood (CEO) and Dave Russell (Director).

◆ In Part I, we look at the outlook for digital and paper assets - deposits, currencies, bonds...

Read More »

Read More »

David Brady: JP Morgan Positioned For Gold, Silver To Soar

David Brady: #JPMorgan Positioned For #Gold, #Silver To Soar

With the #FederalReserve buying #ETFs and corporate #bonds, it's becoming more and more clear to the world that they’re never going to stop printing money. Which has placed a lot of pressure on the paper gold and silver markets.

Of course one of the factors that many in the market follow closely is what mega-bank JP Morgan is doing. And #DavidBrady of #SprottMoney joined me on the show...

Read More »

Read More »

Fed Chairman: “We’re Not Even Thinking About Thinking About Raising Rates”

Market volatility has suddenly spiked in recent days came after the Federal Reserve vowed last Wednesday to keep its benchmark rate near zero through 2022. That’s an unusually long period for the Fed to be projecting rate policy. It reflects the fact that it will take many months and perhaps years for the tens of millions of jobs that were recently lost to return.

Read More »

Read More »