Category Archive: 6a) Gold & Monetary Metals

* Global Currency Reset: Will COVID 19 Lead to a Gold Standard? (Alasdair Macleod )

Full Document transcript go to:https://www.financialanalysis.tv

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Skype: akira10k

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 8.28.20

Eric Sprott discusses the events of the past week and explains again his rationale for investing in silver and silver mining companies.

Visit our website https://www.sprottmoney.com/ for more news.

You can submit your questions to [email protected]

Read More »

Read More »

?Marc Faber Warns of a Severe Recession ,This is Just The First leg in a Long Term Bear Market

?Marc Faber Warns of a Severe Recession ,This is Just The First leg in a Long Term Bear Market ? Subscribe to my Backup Channels : ? https://tinyurl.com/vhaftlj And ? https://tinyurl.com/rns93e6 The United States is only weeks away from a complete shutdown. The world economy is only a couple of months away from a total …

Read More »

Read More »

* Eric Sprott Confirm ? Gold Goes To $1600- Basel III & Global Currency Reset By July

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Contact advertising :[email protected]

Read More »

Read More »

BullionStar Perspectives – Ned Naylor-Leyland – Early Days in a Gold Bull Market

Filmed in August 2020

BullionStar's Ronan Manly catches up with Ned Naylor Leyland, discussing recent trends in precious metals and what that means for the future. Ned gives insight into the institutional market and discusses the topic of inflation adjusted prices with Ronan. Ronan and Ned share their views on the possibility of a systemic change in the monetary system of today.

Read More »

Read More »

* Marc Faber (Investment Legend) Rebel Capitalist Show Ep. 22!

Marc Faber reveals insights ? YOU CAN’T AFFORD TO MISS! ? Especially in these tumultuous times Marc Faber offers a voice of sanity. His analysis is always backed up by data and extensive research. He has seen it all in the world of finance, investing and economics. I have been following Marc Faber since the …

Read More »

Read More »

Warren Buffett Shifts Wall Street Focus to Hard Assets

Earlier this week, precious metals markets got a surprising Buffett bounce. Legendary investor Warren Buffett isn’t often associated with gold – at least not in a positive way. In the past Buffett has made derisive comments about the monetary metal. He once quipped that gold “has no utility.”

Read the Transcript here: https://www.moneymetals.com/podcasts/2020/08/21/warren-buffett-shifts-wall-street-focus-to-hard-assets-002111

Do you own precious...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 8.21.20

Eric Sprott discusses the events that moved the precious metals markets this week and looks ahead to an interesting week next.

Visit our website https://www.sprottmoney.com/ for more news.

You can submit your questions to [email protected]

Read More »

Read More »

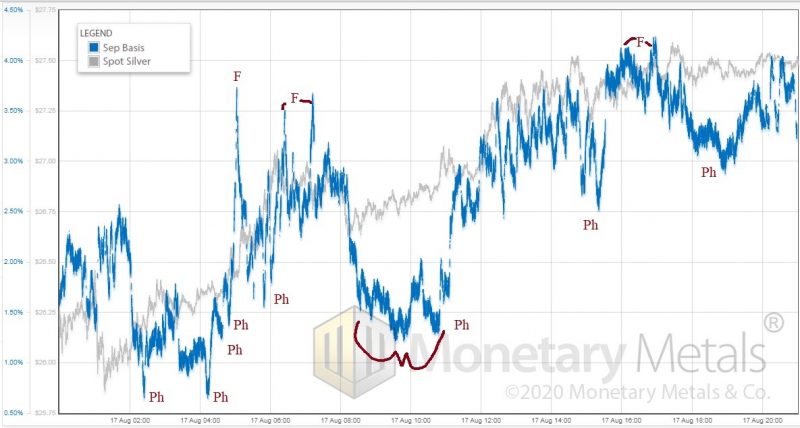

Gold doing what it does best – Part II

While the economic forces that drive this rush to precious metals are clearly understandable, there are other, deeper and less obvious factors that must also be taken into account. This “fear of uncertainty”, which pushes demand for gold higher as it has done so many times in the past, is different this time.

Read More »

Read More »

* Silver Price Analysis June 2020 – Silver Acceleration | Uranium Market, Marc Faber Is Silver $15

Full Document transcript go to:https://www.financialanalysis.tv Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected] Skype: akira10k Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

The Debt-Inflation Spiral Is Driving up the Demand for Gold: Alasdair Macleod

Https://rebrand.ly/rawealthpartners6

Join Now

The Debt-Inflation Spiral Is Driving up the Demand for Gold: Alasdair Macleod , Keyword

Measured in dollars, the current bull market for gold started in December 2015, since which its price in dollars has almost doubled. Other than the odd headline when gold exceeded its previous September 2011 high of $1,920, only gold bugs seem to be excited. But in our modern macroeconomic world of...

Read More »

Read More »

Keiser Report | Free Money Drives Hard Money Higher | Summer Solutions | E1581

In this episode of Keiser Report’s annual Summer Solutions series, Max and Stacy chat to hard money advocate, Alasdair Macleod of GoldMoney.com, about the headline-grabbing moves in gold prices. Goldman Sachs says that soaring gold prices are, indeed, signalling that the US dollar’s days as world reserve currency may be coming to an end. And, while they spoke before it was announced that Warren Buffett has gone long gold miner, Barrick Gold, they...

Read More »

Read More »

Gold, Silver Jump After Swings Amid Weak Dollar and Economic Woe

Spot gold headed for back-to-back gains as investors weighed the outlook for the metal’s record-setting rally after this week’s dramatic price swings. Silver climbed the most in more than five years.

Read More »

Read More »

Alasdair Macleod Warns? Monetary Reset After the COVID-19 Crisis -NEW WORLD ORDER

Full Document transcript go to:https://www.financialanalysis.tv

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected]

Skype: akira10k

Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

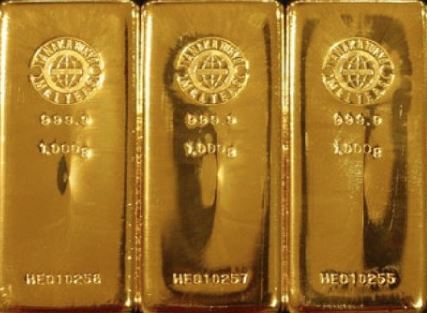

Value of gold stored by Irish metals broker GoldCore surges past €100m

Investment in gold has risen during pandemic. The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

Gold prices last week topped the $2,000-per-ounce level for the first time as investors seek havens...

Read More »

Read More »

ALASDAIR MACLEOD – Government Doing Everything To Resist To Collapse Of Paper Currencies

The US Dollar and all paper currencies are collapsing, but we watch it without doing anything. Our assets are constantly losing value. The government should do something about it, the Central Bank should do something about it.

SUBSCRIBE For The Latest Issues About ;

#useconomy2020

#economynews

#useconomy

#coronaviruseconomy

#marketeconomy

#worldeconomy

#reopeneconomy

#openeconomy

#economynews

#reopeningeconomy

#globaleconomy...

Read More »

Read More »

Physical Gold & Silver Demand Rising to Unprecedented Levels

As Joe Biden announced his VP pick, Wall Street’s hopes for a V-shaped economic recovery were revived by falling jobless claims and the S&P 500 inching closer to an all-time high. Precious metals markets, meanwhile, were hit with a big V for Volatility.

Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤...

Read More »

Read More »