Category Archive: 6a) Gold & Monetary Metals

Gold Protects from Financial Crisis and Crashes Throughout History – Lucey and O’Connor

This is an interesting interview between Professor Brian Lucey and Dr. Fergal O’Connor, lecturer in finance and economics at University College Cork (UCC) on gold’s performance as a safe haven asset in the last 200 hundred years and in recent history including the 2008-2012 global financial crisis.

Read More »

Read More »

Marc Faber on The Income Generation | July 19, 2020

With Guest Marc Faber The Income Generation With David J. Scranton ***Disclaimer: Sound Income Strategies, LLC is a registered investment advisor. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, …

Read More »

Read More »

NGOs warn conflict gold can reach Swiss refiners via Dubai

Swiss refiners — chief among them Valcambi — are under scrutiny due to the high risk of conflict gold originating in Africa entering their supply chain via the United Arab Emirates. Two parallel NGO reports on the subject were published on Thursday.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 7.17.20

Eric Sprott discusses the precious metals and looks ahead to earnings season for the mining companies.

Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

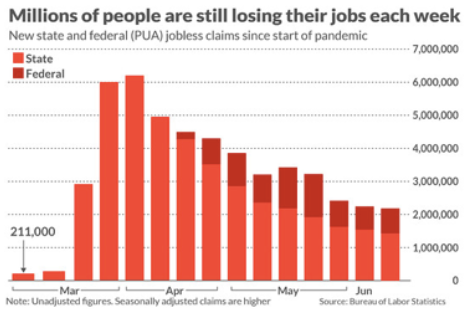

War on poverty, or just war on the poor?

As the dust is now begging to settle, both from the heights of the COVID panic and from the riots that shook the western world, we are starting to get an idea about where we stand after this unprecedented and tumultuous time.

Read More »

Read More »

‘Death Cross’ Strikes U.S. Dollar As Virus Cases Grow

A resurgent coronavirus pandemic in the United States and the prospect of improving growth abroad are souring some investors on the dollar, threatening a years-long rally in the currency.

Read More »

Read More »

Precious metal stablecoin plugs into gold frenzy

The price of gold and silver is rising in the face of a sharp economic downturn. Swiss company AgAu has chosen this moment to announce a precious metal-backed stablecoin onto the blockchain. It aims to provide better access to gold and silver and an alternative to bank-printed money.

Read More »

Read More »

Alasdair Macleod – Price of Gold & Silver is Infinity

Finance and economic expert Alasdair Macleod says, “I think the problems with the currency are going to happen by the end of this year. I think the problems of the COMEX are going to happen considerably before that. I think they are going to be tied into a wider banking crisis. A banking crisis is certain. I cannot see how it can be avoided. . . . If our end point is the purchasing power of the dollar goes to zero, then you can see $1,800 for...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 7.10.20

Legendary investor Eric Sprott discusses the precious metals markets and answers listener questions regarding a few specific mining company shares.

Visit our website https://www.sprottmoney.com/ for more news.

Read More »

Read More »

Sprott Physical Bullion Trusts Things To Know Before You Get This

Https://rebrand.ly/rawealthpartners1

Sign up Now

Sprott Physical Bullion Trusts Things To Know Before You Get This

Investors can invest in gold through exchange-traded funds (ETFs), buying stock in gold miners and associated companies, and buying physical item. These investors have as lots of reasons for buying the metal as they do approaches to make those investments. Some argue that gold is a barbaric antique that no longer holds the monetary...

Read More »

Read More »

Banking Crisis This Month & Fiat Failure This Year | Alasdair Macleod

This dire assessment of our financial future is being issued by a respected analyst who is not prone to making rash claims. Alasdair Macleod, Head of Research at GoldMoney.com, returns to Liberty and Finance / Reluctant Preppers to double-down on his recent headlines, articles, and media warnings. His latest analysis indicates that the inflection of credit, interest rates, commodity prices, bank insolvency, failing interventions, and breakdown of...

Read More »

Read More »

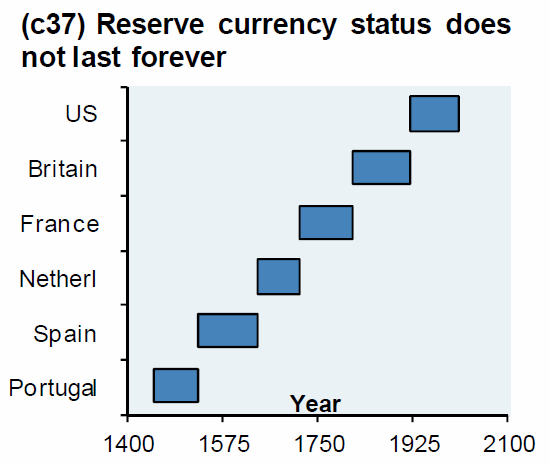

Alasdair Macleod-Dollar Destruction & A Golden Chinese Currency

Alasdair Macleod with a background as a stockbroker, banker and economist, talks about the collapse of the dollar and China’s move to have its own world reserve currency.

Read More »

Read More »

Stefan Gleason Explains Which Metal Has the Most Upside & When You Should Sell

Full transcript: https://www.moneymetals.com/podcasts/2020/07/02/declare-independence-currency-debasement-002072

Gold & Silver Prices: https://www.moneymetals.com/precious-metals-charts

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤...

Read More »

Read More »

Gold Will “Trend Toward $10,000 Per Ounce Or Higher” Over The Next Four Years

You’re likely aware of the price action in gold lately. Gold has rallied from $1,591 per ounce on April 1 to $1,782 per ounce as of today. That’s a 12% gain in less than three months.

Read More »

Read More »

?Dr. Marc Faber Exclusive Interview With The Atlantis Report 2nd July 2020

?Dr. Marc Faber exclusive Interview With The Atlantis Report 02 July 2020. We are proud to bring you Dr. Marc Faber of the https://www.gloomboomdoom.com Dr. Marc Faber, you are the author, the editor, and the publisher of The Gloom Boom and Doom report, which highlights unusual investment opportunities, and you are the author of several …

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 7.2.20

Eric Sprott discusses a volatile week in precious metals and looks ahead to an interesting month of July.

Read More »

Read More »

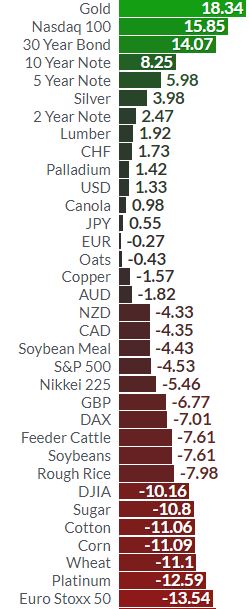

Gold Outperforms All Assets In 2020 YTD as Enters Seasonal Sweet Spot of July, August and September

Source: Finiz.com

◆ Gold is the top performing asset in the world in the first half of 2020, outperforming all stock markets including the S&P 500 and the Nasdaq and outperforming “safe haven” U.S. government bonds (see table above).Gold had an 18% gain in dollars in the first half of 2020 as risk assets, especially stock markets, fell sharply with the S&P down 4.5% and other stock markets down more than 10% (see table). Gold gained...

Read More »

Read More »