Category Archive: 6a) Gold & Monetary Metals

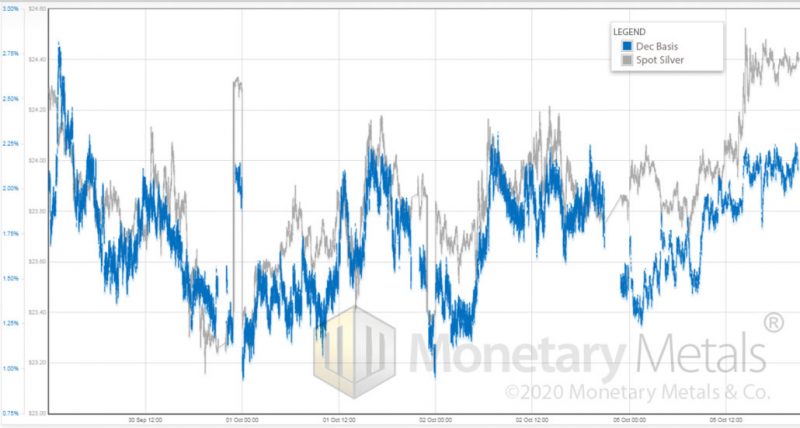

Is Silver about to “Pop” or “Drop”

The chart of silver at the moment shows that it is poised for a breakout move. It has failed on a number of occasions recently to close above resistance at $24.40.

Read More »

Read More »

Marc Faber: India Will be a Top 3 Global Economy

We’re in conversation with one of the top investing minds in the world on the Investor Hour: Dr Marc Faber. It was a pleasure having Dr Marc Faber on the Investor Hour again. He was our very first guest on the podcast and did a 2-part episode. At that time he talked to us about … Continue reading »

Read More »

Read More »

Kantonaler Wahlnotstand

In wenigen Tagen wird im Kanton Aargau, aber auch in anderen Kantonen, das Kantonsparlament und die Kantonsregierung gewählt. Der Wahlkampf ist eher flau. Vielleicht weil es daran liegt, dass das grösste Thema einfach totgeschwiegen wird: Corona wird bei keiner Partei auch nur schon erwähnt (und wenn doch, bitte zeigen Sie’s mir!).

Read More »

Read More »

PBOC Has At Least 20k Tons of Gold

During this 40+ minute interview, Jason asks Alasdair if he thinks China will announce a gold reserves update about its official public government gold holdings.

Read More »

Read More »

Marc Faber PREPARE NOW: Prospects for the Dollar’s Collapse? Stock Market Crash On October

Full Document transcript go to:https://www.financialanalysis.tv Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected] Skype: akira10k Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »

Read More »

The Fed is the Worst Bureaucracy -Marc Faber

Subscribe to our Free Financial Newsletter: Crush The Street To get mor from Marc visit: https://www.gloomboomdoom.com/ TOPICS IN THIS INTERVIEW: -Overriding issues looming over the economy. -Inflation is an ambiguous measurement for different demographics. -Dollar falling against other currencies in 2020. -Energy sector is depressed and cheap. -Politicians voice what the population wants to hear.

Read More »

Read More »

Washington Politicians Bear Down on New Bailout Negotiations

Precious metals markets are advancing this week as a massive new stimulus bill makes its way through Congress. On Thursday evening the House of Representatives passed a $2.2 trillion coronavirus relief bill on a party line vote. It’s a big deal whenever Congress commits to spending that kind of cash, especially when it’s money that has to be borrowed into existence. These days, though, it’s not that unusual for Washington to dole out trillions of...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 10.2.20

Eric Sprott discusses the events of the past week and begins to look ahead to what will be a busy month of October for the metals and mining companies.

Visit our website https://www.sprottmoney.com for more news.

You can submit your questions to [email protected]

Read More »

Read More »

Marc Faber: Pandemic predictions for gold, silver, stocks, real estate, bonds & bitcoin

October 2020 – Marc Faber is a Swiss investor based who resides in Thailand and the publisher of the Gloom Boom & Doom Report newsletter, also acting as investment advisor and fund manager and involved in a number of investment funds focused on emerging and frontier markets. Marc speaks with The Capital Network’s Lelde Smits …

Read More »

Read More »

Where Next for Gold & Silver

Markets have struggled to find a clear direction as they attempt to digest US election news, debate performance, the impact of increased Covid-19 restrictions in many countries and vaccine news.

Read More »

Read More »

Die Legende Dr. Marc Faber im Talk: Was ist die Freiheit wert?

Ein Marktgespräch von 3 Markt-Experten besprechen die aktuell politische und wirtschaftliche Situation. Dr. Marc Faber, Rainer Hahn und Robert Rother sprechen über die US-Wahlen, die Auswirkungen der Corona-Pandemie, den Wahnsinn der Zentralbankpolitik mit teilweise totalitären Regierungen. Kommen wir langsam an die Grenzen des Finanzsystems? – Und welche Werte kann man überhaupt noch als eigenen Besitz …

Read More »

Read More »

We don’t have to kill the king, if we just can ignore the king

“The right of self-determination in regard to the question of membership in a state thus means: whenever the inhabitants of a particular territory, whether it be a single village, a whole district, or a series of adjacent districts, make it known, by a freely conducted plebiscite, that they no longer wish to remain united to the state to which they belong at the time, but wish either to form an independent state or to attach themselves to some...

Read More »

Read More »

Is The Fed’s Jerome Powell The Next John Law?

GoldMoney's Alasdair Macleod joined us today for an extensive discussion of the collapsing dollar. Alasdair believes that the current state of the Fed guarantees a hyper-inflationary collapse. And that means that investments, savings and pensions will become near worthless.

Read More »

Read More »