Category Archive: 6a.) Monetary Metals

Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

Scottsdale, AZ – September 23, 2024 – Monetary Metals® is pleased to announce the addition of gold investment experts Ronald-Peter Stöferle and Mark Valek to its Advisory Board. Both Ronald and Mark bring decades of experience in traditional asset management as well as precious metals investment and research.

Read More »

Read More »

Monetary Metals Achieves SOC 2 Certification

Scottsdale, AZ – September 3, 2024 – Monetary Metals® is proud to announce that it has achieved SOC 2 certification. This significant milestone demonstrates the company’s unwavering commitment to maintaining a secure environment for its innovative Gold Yield Marketplace® platform.

Read More »

Read More »

Bryan Caplan: Why Housing Costs DOUBLED

Best-selling author and economist Bryan Caplan joins the podcast to discuss why housing prices continue to rise, what we can do about it, and why everyone seems to hate markets.

Read More »

Read More »

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money. The cash-value of promoting each of these anti-concepts is that they lead people to think that the central bank should impose a monetary policy. To make our lives better.

Read More »

Read More »

Is gold an inflation hedge?

Jeff Deist and Ben Nadelstein discuss narratives surrounding the merits of gold ownership. Is gold an inflation hedge, store of value, or a safe haven asset? The episode ends with questions regarding gold’s monetary premium and the different types of inflation.

Read More »

Read More »

Gold Outlook 2024 Brief

This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market dynamics and drivers and finally, give our predictions for gold and silver prices over the coming year.

Read More »

Read More »

Monetary Metals Publishes Eighth Annual Gold Outlook Report

Scottsdale, AZ – March 12, 2024 Monetary Metals has released its eighth annual Gold Outlook Report. The report features Monetary Metals’ award-winning economic analysis and their price forecasts for gold and silver in 2024.

The report makes a case against the mainstream notion that inflation continues to be the primary driver of the Federal Reserve’s interest rate policy.

Read More »

Read More »

Money versus Monetary Policy

With all due respect to Niall Ferguson, whom I’ve heard of, and Huw van Steenis, whom I’ve not, this tweet is quite preposterous. I’ve personally met more than five people who understand money just in my own circles.

Read More »

Read More »

CEO Keith Weiner Quoted in Barron’s

Published February 2nd, CEO Keith Weiner’s commentary was featured in a Barron’s article discussing “Why Silver is Outperforming Gold” written by Myra Saefong.

Read More »

Read More »

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Jeff Snider, Headmaster of Eurodollar University, joins the podcast to talk about the perverse complexities of the Eurodollar system. What even is a Eurodollar? Why was the system created?

Keith and Jeff discuss the Eurodollar market and then give their hot takes in a hilarious lightning round. We hope you enjoy this insightful, whirlwind of an episode!

Read More »

Read More »

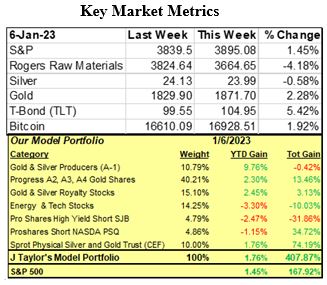

Evidence Of A Declining Economy

The first week of 2023 was a “bad news is good news” from the Wall St. perspective. Evidence of a declining economy should drive stock prices lower, but since markets are so distorted by counterfeit money rather than wages and profits, stocks and bonds can’t wait to cheer until those less fortunate are in a world of hurt!

Read More »

Read More »

Reflections Over 2022

The life of an entrepreneur is not what most people would call “normal”. I don’t refer to the guy who buys a fast-food franchise. Nor to the gal who builds a chain of hair salons. Nor to the folks who have law or accounting firms. These are all entrepreneurship. I don’t know a lot about how these businesses work, but I do know one thing.

Read More »

Read More »

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Bryan Caplan, Professor of Economics at George Mason University, joins the podcast to talk about his latest book, the minimum wage, betting, and much more! Is nature or nurture more important? Why should a Keynesian be against the minimum wage? What is the trillion dollar tab waiting for us to pick up? Watch this whirlwind episode, and let us know what you think in the comments!

Read More »

Read More »

Why Invest in Gold if the Dollar is Strong?

Keith Weiner, Quinton Hennigh and Chen Lin return.

Keith Weiner’s Monetary Metals encourages investors to lease or lend their gold or silver to Monetary Metals’ clients in exchange for interest payable in kind. At the same time, Keith makes a very strong case that the dollar will continue to get stronger relative to the Euro, Swiss franc, Japanese yen, Canadian dollar, British pound and Swedish krona. Generally, a strong dollar is viewed as...

Read More »

Read More »

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Is the dollar heading to new heights or new lows? Brent Johnson of Santiago Capital joins the Gold Exchange Podcast LIVE in New Orleans! Listen to Brent discuss the historic rise of the DXY, the effects on (d)emerging markets, and how he sees a currency and sovereign debt crisis playing out. Will Powell be able to solve Triffin’s Dilemma?

Read More »

Read More »

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Scottsdale, AZ–Nov 15, 2022 Monetary Metals is pleased to announce it has closed a Gold Bond for Akobo Minerals AB (AKOBO.OL), a publicly traded company, headquartered in Oslo, Norway. The term of the bond is two years, and investors are earning an annual interest rate of 19% on gold, paid in gold.

Read More »

Read More »

Sam Bankman-Fried FTX’ed Up

You can listen to the audio version of this article here. Last week the cryptocurrency exchange FTX, which was recently valued at $32 billion, imploded. While the tragedy continues to play out, let’s summarize what has happened so far: FTX is a cryptocurrency exchange, co-founded by Sam “SBF” Bankman-Fried. FTX enables customers to make leveraged bets (as high as 20 to 1) on cryptocurrencies.

Read More »

Read More »

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

In this latest installment of our Zombie Month series, we welcome Daniel Lacalle onto the Gold Exchange Podcast. Daniel is an economist, fund manager and professor of Global Economics. Daniel discusses the recent fallout in the UK, the pressures building up in the global economy, and the central banks’ creation of zombie firms. Listen to Ben, Keith and Daniel get into everything from quantitative easing to zombie slaying.

Read More »

Read More »

How to Build and Destroy a Pension Fund System in 22 Easy Steps

CEO of Monetary Metals Keith Weiner gave a talk at the New Orleans Investment Conference on how to build and destroy a pension fund system in 22 easy steps. If you’d like to see an excellent case study of these steps in action, see the United Kingdom. This is a summary of Keith’s talk published with his permission.

Read More »

Read More »

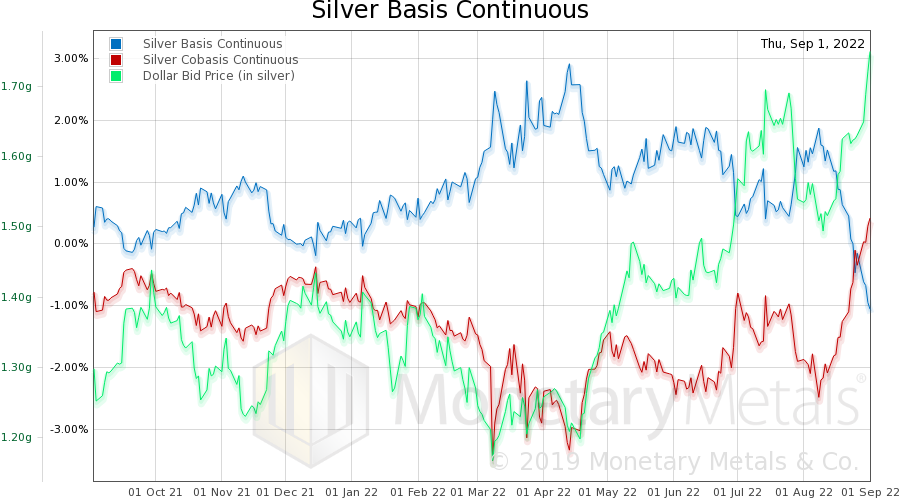

Silver Fever, or Silver Fading?

We finally had a resolution, of sorts, in silver. Since April 13, we have had a falling price of silver (indicated as a rising price of the dollar, as measured in silver). And along with this price trend, a growing scarcity of the metal to the market (i.e. the cobasis, the red line). Indeed, the price (of the dollar) and silver scarcity move with uncanny coordination. Almost as if they are linked.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist -

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”!

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”! -

Switzerland, the country of four seas

Switzerland, the country of four seas -

The Business Cycle Narrative & War With Iran

The Business Cycle Narrative & War With Iran -

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen -

Cash für Medaillen

Cash für Medaillen -

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby -

Achtung: Elon Musk zerstört gerade Wikipedia!

Achtung: Elon Musk zerstört gerade Wikipedia! -

1776 Patriot Silver Bars Are Selling Out

1776 Patriot Silver Bars Are Selling Out

More from this category

- Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

23 Sep 2024

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

Bryan Caplan: Why Housing Costs DOUBLED

Bryan Caplan: Why Housing Costs DOUBLED11 Jun 2024

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022