Category Archive: 6a.) GoldCore

Perth Mint Silver Bullion Sales Rise 43 percent In March

Perth Mint’s silver bullion sales rise 43% in March. Perth Mint’s monthly gold coin, bars sales fall 12%. Gold silver ratio of 32 – 32 times more silver ounces sold. Gold: 22,232 oz and Silver: 716,283 oz – bullion coins and minted bars sold. Gold is 2.6% higher and silver surged 3.1% in the shortened week with markets closed for Good Friday tomorrow.

Read More »

Read More »

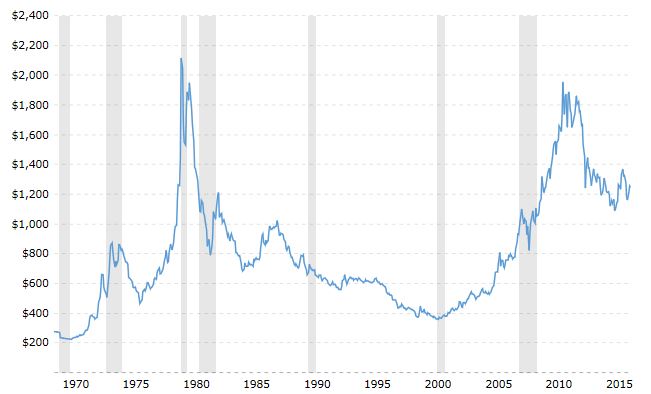

Gold Price Surges Above Key 200 Day Moving Average $1270 Level

Gold price breaks above key 200-day moving average. Gold hits 5-month high on back of investor nervousness. Safe haven has 10% gains in 2017 after 9% gains in 2016. Gold options signal more gains as ETF buying increases. Geopolitical uncertainty over North Korea & Middle East. Tensions high -World awaits US move & Russia response.

Read More »

Read More »

Bank of England Rigging LIBOR – Gold Market Too?

Bank of England implicated in LIBOR scandal by BBC. “We’ve had some very serious pressure from the UK government and the Bank of England about pushing our Libors lower.” “This goes much much higher than me”- UBS’ Tom Hayes. Libor distraction as all markets are manipulated today. Central bank’s “rigging” bond markets and likely gold.

Read More »

Read More »

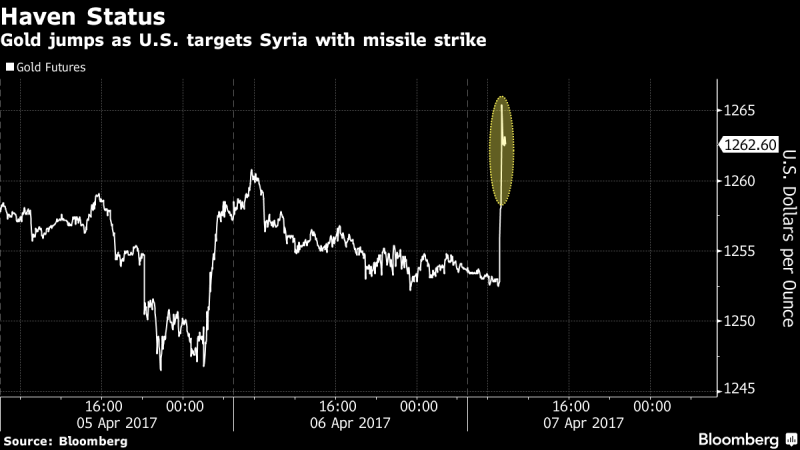

Gold Silver Oil Spike After U.S. Bombs Syria

Gold silver oil spike after U.S. bombs Syria. Gold and silver spike 1% as oil rises 1.4%. Gold breaks 200 day moving average, 4th week of gains. Stocks fall after U.S. strikes in Syria rattle markets. U.S. missiles hit airbase; Lavrov says no Russian casualties; Russia deploys cruise missile frigate to Syria.

Read More »

Read More »

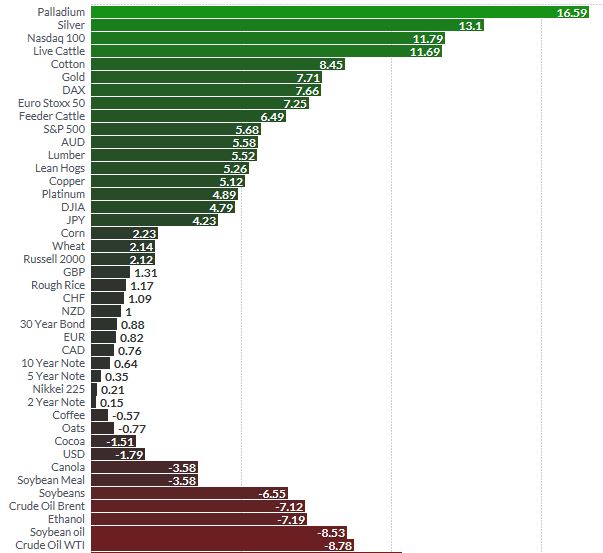

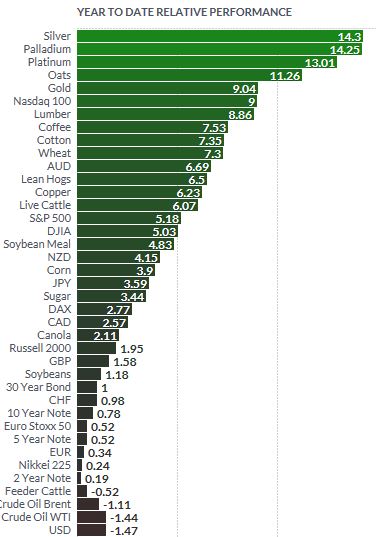

Gold, Silver Best Performing Assets In Q1, 2017

Gold, silver two of the best performing assets in the first quarter of 2017 with gains of 8% and 14% respectively. Gold outperforms benchmarks – S&P 500 up 6%, MSCI (All Country World Index) up 6.4% (see tables). Nasdaq and German DAX rise 11.8% and 7.6%. Silver best performing currency in quarter. Five best performing currencies in Q1 are in order – silver, bitcoin, Mexican peso, Russian ruble and gold.

Read More »

Read More »

Brexit Gold Buying – UK Demand for Gold Bars Surges 39 percent

As the UK triggered its formal departure from the European Union yesterday, gold demand from UK investors remained ongoing and robust with increased numbers of British investors diversifying into physical gold in order to hedge the considerable uncertainty and volatility that the coming months and years will bring.

Read More »

Read More »

Safe Haven Gold Rises 2.5 percent As Stocks Fall and ‘Trump Trade’ Fades

Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The ‘Trump trade’ is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening.

Read More »

Read More »

Gold ETFs or Physical Gold? Dangers In Exchange Traded Funds

Considering the public’s waning trust in the banking system, many investors find themselves wondering how GLD stacks up to owning the real thing. When you look at both assets more closely, it’s clear that gold ETFs and gold bullion are very different investments.

Read More »

Read More »

Peak Gold – Biggest Gold Story Not Being Reported

Peak gold – Biggest gold story not being reported. Gold ‘Mining Zombie Apocalypse’ caused miners to slash exploration budgets. Decline in gold production at world’s top 10 gold mining companies - Byron King. “No new big mines being built in the world today” – Glencore CEO Glasenberg. Primary global gold output declined in 2016 – Thomson Reuters via Mining.com.

Read More »

Read More »

The Best Ways to Invest in Gold Today

The cost of buying and selling gold. How to buy gold on the cheap. How to avoid paying capital gains tax (CGT) on your gold. Open an account with one of the online bullion dealers – the likes of GoldMoney, GoldCore or Bullion Vault. Gold Sovereigns and Gold Britannias make for a considerable saving on cost because of the CGT exemption.

Read More »

Read More »

James Rickards: Long-Term Forecast For $10,000 Gold

James Rickards: Long-Term Forecast For $10,000 Gold. James Rickards, geopolitical and monetary expert and best selling author of the ‘The New Case for Gold’ has written an interesting piece for the Daily Reckoning on why he believes gold will reach $10,000 in the long term.

Read More »

Read More »

Art Market Bubble Bursting? Gauguin Priced At $85 Million Collapses 74 percent

Art Market Bubble Bursting? Russian Billionaire Takes 74% Loss On “Investment”. $85 Million Gauguin Bought By Dmitry Rybolovlev in 2008. Christie’s auctioned the work at its evening sale in London. Global art sales plummet, but China rises as ‘art superpower’. China soon to dominates global art and gold market. Art price volumes doubled since 2009. As currencies debase super rich seek out stores of value. Gold remains accessible store of value...

Read More »

Read More »

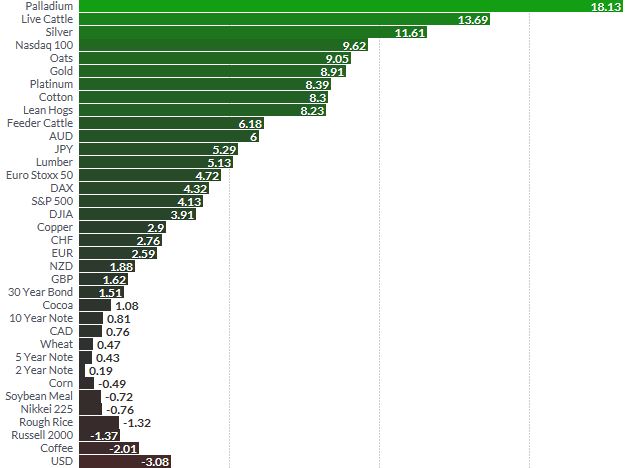

Gold Up 9 percent, Silver 14 percent YTD As Le Pen’s Lead Widens

Gold up 1.5% in euros and dollars this week. Silver up 1.4% this week and now up 14.3% and is the best performing market YTD. Gold up 9% year to date – fourth consecutive higher weekly close and breaks resistance at $1,250/oz. Gold up 9.4% in euros year to date as Le Pen’s lead in polls widened. Gold up another 6.4% in sterling pounds year to date as ‘Hard Brexit’ looms.

Read More »

Read More »

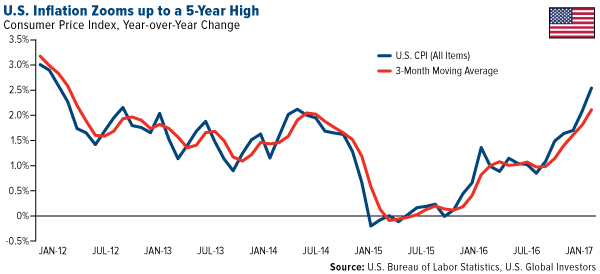

Gold To Benefit from Rising Inflation and Higher Than “Official” China Gold Demand

Frank Holmes joins Lawrie Williams, Koos Jansen and many others in questioning the “official” Chinese gold demand numbers. Real gold demand is likely much higher than the official numbers. Inflation just got another jolt, rising as much as 2.5 percent year-over-year in January, the highest such rate since March 2012. Led by higher gasoline, rent and health care costs, consumer prices have now advanced for the sixth straight month.

Read More »

Read More »

Russia Gold Buying Returns – Buys One Million Ounces In January

Russia Gold Buying Returns – Adds Substantial One Million Ounces To Reserves In January. Russia gold buying returned in January with the Russian central bank buying a very large 1 million ounces or 37 metric tonnes of gold bullion. The increase in the gold reserves came after Russia did not buy a single ounce in December – a move seen as potentially a signal or an olive branch to the U.S. and the incoming Trump administration.

Read More »

Read More »

Greenspan Says Gold “Ultimate Insurance Policy” as has “Grave Concerns About Euro”

“The eurozone isn’t working …” warns Greenspan, “I view gold as the primary global currency” said Greenspan, “Significant increases in inflation will ultimately increase the price of gold”, “Investment in gold now is insurance…”

Read More »

Read More »

Gold Is Undervalued Say Leading Money Managers

Gold is undervalued according to a record number of fund managers. Last time gold was considered undervalued, the price surged. BAML surveyed 175 money managers with $543 billion in assets under management. 34% of investors believe protectionism is the biggest threat to markets. Gold viewed as the best protectionist investment by a third of investors.

Read More »

Read More »

Gold Prices Up 6 percent YTD As Trump ‘Honeymoon’ Ends

Gold prices continued to shine this week reaching $1,244.70 per ounce and and has posted gains in five of the last six weeks. This week it reached a new three-month high – it’s highest since the Trump win and has climbed over 6% this year, beating the gains made in the same period in 2016.

Read More »

Read More »

Gold Prices Rising As “World Has Never Been More Uncertain”

Gold prices rising & up 6.6% YTD. Signal “impending market volatility”. World has never been more uncertain (see chart). Fear in Wall Street versus Fear in Washington. Price of ‘plunge protection’ rising even as VIX remains low. Smart money diversifying into gold. Important to watch rising gold and rising bond yields. Gold may prove the “tell”.

Read More »

Read More »

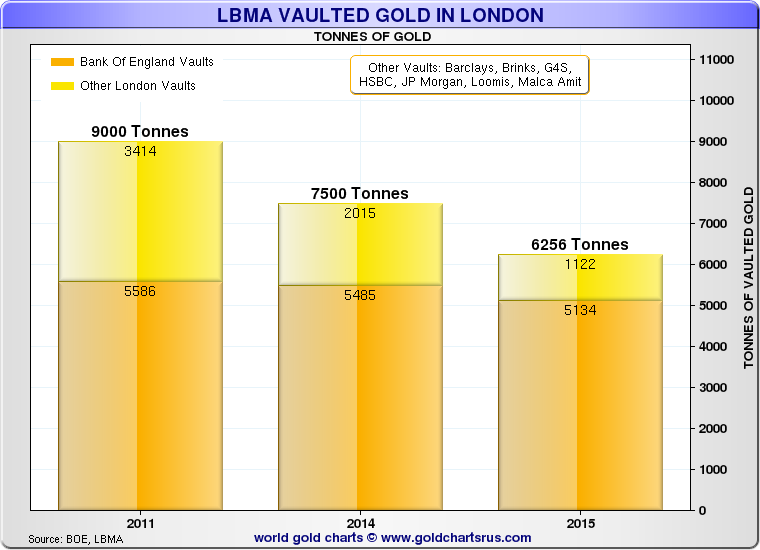

Gold Bullion Banks To “Open Vaults” In Transparency Push

London Gold Bullion Banks To “Open Vaults” In Transparency Push. London’s gold bullion market, which is centuries old, is said to be seeking transparency with plans to reveal how much gold bullion is held in vaults in and around London city according to gold bullion banks.

Read More »

Read More »