Category Archive: 6a.) Gold Standard

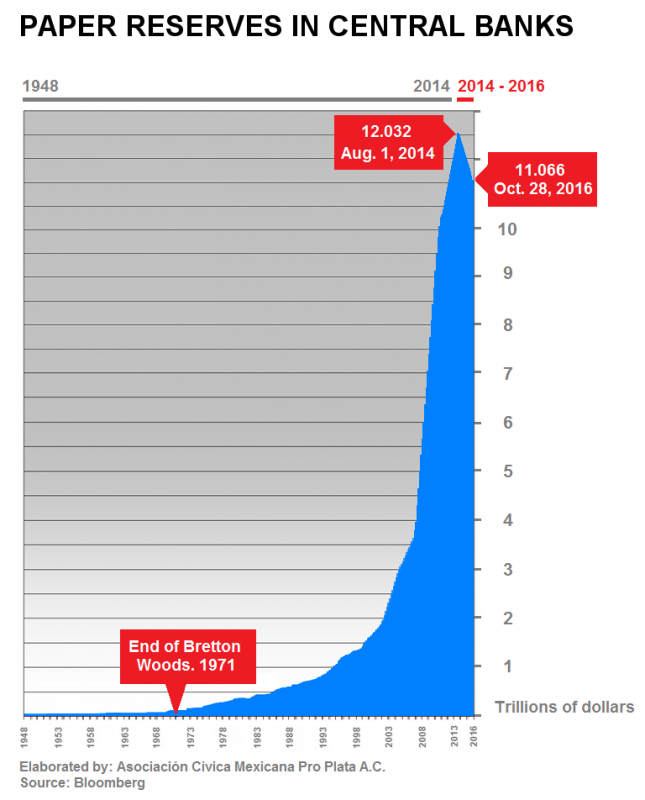

If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

The U.S. will never go back on a gold standard. The notion that a U.S. Dollar backed by gold would solve our financial problems is pure folly. Why? Because, if the U.S. Empire didn’t abandon the gold standard in 1971, it would have collapsed decades ago. Unfortunately, some of the top experts in the precious metals community continue to suggest that revaluing gold much higher, to say…. $15,000-$50,000 an ounce, would bring confidence back into the...

Read More »

Read More »

How to Sell Your Gold & Silver to Money Metals Exchange

Learn more here: https://goo.gl/yA027t?sell-gold What you’ll need: 1. A new cardboard box that is large enough to fit all of the product that you are selling and extra packing material 2. Your precious metals that you are selling to Money Metals Exchange 3. Strong packing tape 4. Your P.O. paperwork 5. Packing material like packing …

Read More »

Read More »

Stefan Gleason on the Biggest Mistakes Precious Metals Investors Make

Listen to this interview with Money Metals president Stefan Gleason, who was a featured guest during the recent 360 Gold Summit. Stefan addressed the fundamental question of “why precious metals” and also gave some helpful tips on how to avoid making big mistakes when investing in gold and silver. Don’t miss this fundamentally important and enlightening conversation coming up after this week’s market update.

Read the full transcript:...

Read More »

Read More »

Sound Money and Your Personal Finances

Sound money principles can serve to help grow the economy and restrain government. The political class, however, doesn’t particularly want to restrain itself. Washington, D.C. is addicted to the easy money policies that have enabled $20 trillion in national debt accumulation and tens of trillions more in unfunded liabilities.

Read More »

Read More »

David Smith: Turning Points Appear Suddenly, So You Must Be Prepared…

David Smith of The Morgan Report and MoneyMetals.com columnist joins Money Metals Exchange to share his thoughts on the metals market action so far in 2017. He’ll also offer a stern warning for those who try to get cute with the timing of a purchase and lays out the potential harm of putting off what you …

Read More »

Read More »

Pension Funds Need Gold before It’s Too Late

Tens of millions of Americans and their employers pour money into pension plans each month, counting on those funds to grow and to be there when needed at retirement. But a time bomb awaits. The bulk of U.S. pension funds are dangerously underfunded, and the assets are often invested in securities that have bleak prospects for providing income that keeps up with a general decline in purchasing power.

Read More »

Read More »

Keith Neumeyer Damage Inflicted by Precious Metals Manipulation Is in the Multi Billions

Keith Neumeyer, founder and CEO of First Majestic Silver and outspoken voice on the manipulation that’s occurring in the futures market for silver, weighs on the Deutsche Bank market rigging case, gives us his outlook for the metals under a Trump presidency and explains how silver’s gains in the future may end making the recent …

Read More »

Read More »

Frank Holmes Gold Rally Extremely Likely in January and February

Frank Holmes, CEO of U.S. Global Investors and author of the book The Goldwatcher: Demystifying Gold Investing tells us where he thinks gold is headed in the near term, gives us a 2017 outlook for the metals and tells us why he believes the next 100 days will be very key in the financial markets. …

Read More »

Read More »

Dr Chris Martenson Next Crisis to Be Global Getting Gold Silver Difficult

Dr. Chris Martenson will tell you why the central planners DON’T want you to own gold – and issues a chilling warning to those who are caught unprepared before the next major financial crisis. Be sure to stick around for a tremendous interview with Chris Martenson, coming up after this week’s market update. Read the …

Read More »

Read More »

GIA President Bill Boyajian on VULT Diamonds

Invest in diamonds here: https://goo.gl/8q7X50 Special Interview w/ Bill Boyajain, Former President of Gemological Institute of America (GIA) ================== Follow Money Metals: ================== Facebook: https://www.facebook.com/MoneyMetals Instagram: https://www.instagram.com/moneymetals/ Twitter: https://twitter.com/MoneyMetals Google Plus: https://plus.google.com/+Moneymetals

Read More »

Read More »

Rare Diamonds for Investment: What is VULT

Tradable Certified Diamonds for Investment Invest in Diamonds at Money Metals Exchange: https://goo.gl/8q7X50 A Beautiful Investment That’s 5,000 Times More Precious Than Gold! Money Metals Exchange announces a breakthrough in precious commodities investing … tradeable certified diamonds – ounce for ounce, up to 5,000 times more precious than gold! Money Metals is pleased to bring …

Read More »

Read More »

David Morgan: Lower Taxes and HIGH Inflation Coming under Trump

Read the interview transcript here: https://goo.gl/6S6398 David Morgan of The Morgan Report gives his insights on current industry sentiment following a few rough months for the metals, tells us what to expect with the upcoming price action for gold and silver, and gives us his predictions on how the financial markets will react to Donald …

Read More »

Read More »

How Trump Can Bring Outside-the-Box Thinking to Bear on the Fed

President-elect Donald Trump will soon have the opportunity to put his stamp on the Federal Reserve. And that is making the elite body of central bankers nervous. On the campaign trail, Trump harangued Fed chair Janet Yellen for pumping up financial markets with cheap money – accusing the Obama appointee of being politically motivated. Trump also called for the Federal Reserve to be audited.

Read More »

Read More »

Silver Coin vs Zimbabwe Dollar Frame

The Zimbabwe hyperinflation of 2008 – 2009 is just the most recent example of an irresponsible government destroying its currency. In truth, no fiat currency has ever survived long term. This beautiful frame highlights the risks associated with saving in paper money as well as essential nature of precious metal as a store of value. …

Read More »

Read More »

Victorinox Knife & PAMP Gold Inlay 1 gram

Money Metals Exchange has combined Victorinox, one of the world’s finest knife makers. with the preeminent name in gold – PAMP Suisse. This swiss-made Victorinox knife is inlaid with a beautiful PAMP 1 gram gold bar. Get yours today: https://goo.gl/7nvCko “Swiss Army” style knives offer many useful tools. Only ours offers a tool to protect …

Read More »

Read More »

Silver & Gold Storage: Book Safe from Money Metals Exchange

A great place to store your gold and silver in plain sight is by storing them in a hollowed out book, such as Money Metals’ book safe. Our precious metals book safe looks just like a real book, but offers added security by having a strong lock box on the inside. The safe can hold … Continue reading »

Read More »

Read More »

We Should Take Our Cues From Markets – Not Politicians

I grew up a block away from the 7-train, where I’d take a short ride from the 90th Street station to the Willets Point–Shea Stadium station to watch my favorite team, the New York Mets. Sitting in the stands as a young child, I learned quickly that there were a number of ways to obtain and interpret information. I could watch the umpire and immediately have known whether Al Leiter threw a strike or a ball. Another option was to watch the scoreboard...

Read More »

Read More »

New Zealand Mint HMS Bounty 1 Oz Silver Coin [Exclusive] Money Metals Exchange

A Money Metals Exchange Exclusive – The Ultra Low Premium Silver HMS Bounty from the New Zealand Mint: https://goo.gl/b0ZwQE?new-zealand-mint-1-oz-silver-coin Money Metals is pleased to announce that we have been designated as the only dealer worldwide for a stunning new 1 oz .999 silver coin, the New Zealand Mint’s 2017 “HMS Bounty” – the lowest priced …

Read More »

Read More »

Michael Pento Exclusive: Trump Honeymoon Won’t Last

To read the full transcript, click here: https://goo.gl/RXrZNk?michael-pento-interview More From Michael Pento: http://pentoport.com/ Money Metals Exchange interviews Michael Pento of Pento Portfolio Strategies and author of the book The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market. Michael tells us whether or not the correction in metals is going …

Read More »

Read More »

Craig Hemke of TF Metals Report: A Debt Train Wreck Is Inevitable, Even with Trump

Read full transcript here: https://goo.gl/H8qV2E Coming up we’ll digest the election results and what it all means for precious metals with Craig Hemke of the TF Metals Report. Craig cautions everyone to not get ahead of themselves when declaring happy days are here again and discusses what he sees as very real market turmoil uncertainties …

Read More »

Read More »