Category Archive: 6a.) Gold Standard

It’s Better to Buy Gold & Silver When It DOESN’T Feel Good (David Smith Interview)

Read the full transcript here: https://goo.gl/PYbJdM David Smith, Senior Analyst at The Morgan Report and MoneyMetals.com columnist shares his thoughts on the potential effects of the newfound rise of digital gold based investments. And he comments on some new industrial applications for gold and silver that could have a major impact on the supply-demand fundamentals …

Read More »

Read More »

Win 50 American Silver Eagle Coins from Money Metals Exchange

Click here to enter: https://goo.gl/Juycai ================== Follow Money Metals: ================== Facebook: https://www.facebook.com/MoneyMetals Instagram: https://www.instagram.com/moneymetals/ Twitter: https://twitter.com/MoneyMetals Google Plus: https://plus.google.com/+Moneymetals

Read More »

Read More »

False Narratives and Short Memories about Bitcoin

It saddens us how many people don’t understand the difference between the maximum block size, and the actual block size. We dive into this and try not to get TOO excited about Litecoin

Thanks for Watching!!!!!

-----------------------------------------------------

Read More »

Read More »

Stefan Gleason on the Biggest Mistakes Precious Metals Investors Make

Coming up we’ll hear an interview with Money Metals president Stefan Gleason, who was a featured guest during the recent 360 Gold Summit. Stefan addressed the fundamental question of “why precious metals” and also gave some helpful tips on how to avoid making big mistakes when investing in gold and silver. Don’t miss this fundamentally important and enlightening conversation coming up after this week’s market update.

Read More »

Read More »

Stefan Gleason on Silver, Product Selection, and How to Make Sure You Don’t Get Burned

Coming up we’ll hear part two of the recent interview Money Metals president Stefan Gleason did with Pete Fetig during the 360 Gold Summit. Stefan gives some important warnings to precious metals investors, discusses why he favors one of the precious metals over the others and also talks about some absolutely critical things to consider when selecting a precious metals dealer. Don’t miss the fantastic conclusion of Stefan’s interview, coming up...

Read More »

Read More »

Stefan Gleason on Silver, Product Selection, and How to Make Sure You Don’t Get Burned

Coming up we’ll hear part two of the recent interview Money Metals president Stefan Gleason did with Pete Fetig during the 360 Gold Summit. Stefan gives some important warnings to precious metals investors, discusses why he favors one of the precious metals over the others and also talks about some absolutely critical things to consider …

Read More »

Read More »

Money Metals President Stefan Gleason & Cong. Ron Paul Testify on Behalf of Gold & Silver Investors

Coming up on today’s program we’ll have a special report on some important new developments in sound money legislation at the state level. Be sure to stick around to find out which states are in the process of advancing the cause of restoring gold and silver as money. First, though, let’s take a brief look at this week’s market action in the precious metals.

Gold and especially silver succumbed to heavy selling in the futures markets this week....

Read More »

Read More »

Money Metals President Stefan Gleason & Cong. Ron Paul Testify on Behalf of Gold & Silver Investors

Coming up on today’s program we’ll have a special report on some important new developments in sound money legislation at the state level. Be sure to stick around to find out which states are in the process of advancing the cause of restoring gold and silver as money. First, though, let’s take a brief look …

Read More »

Read More »

Frank Holmes: Gold Could Hit $1,500 in 2017 Amid Imbalances & Weak Supply

Read the full transcript here ⇨ https://goo.gl/3lUN62 Interview starts at: 6:36 Frank Holmes, CEO of U.S. Global Investors joins Money Metals Exchange to share his thoughts on Trump’s first 100 days, the resetting that’s going on the global political front and gives what he sees as a very realistic price target for gold before the …

Read More »

Read More »

Money Metals President Stefan Gleason on Managing Your Risks, How to Sell, and IRAs

Coming up we’ll here part two of a wonderful interview Money Metals president Stefan Gleason did with Alan James on the Sustainable Money Podcast. Stefan gives some more advice on what to look for when choosing a precious metals dealer, when and how to sell when the times comes one, and also talks about some of the ins and outs of gold and silver IRAs. Don’t miss the must-hear conclusion of this recent interview coming up after this week’s market...

Read More »

Read More »

Money Metals President Stefan Gleason on Managing Your Risks, How to Sell, and IRAs

Coming up we’ll here part two of a wonderful interview Money Metals president Stefan Gleason did with Alan James on the Sustainable Money Podcast. Stefan gives some more advice on what to look for when choosing a precious metals dealer, when and how to sell when the times comes one, and also talks about some …

Read More »

Read More »

Time to Hedge State Reserve Funds with Gold?

Financially prudent individuals set aside surplus funds to protect against unforeseen expenditures. This way, when faced with loss of income, house repairs, car trouble, or anything else, they will have a buffer against unanticipated downturns. In the same vein, almost every state in the United States has established a “savings account” for government operations.

Read More »

Read More »

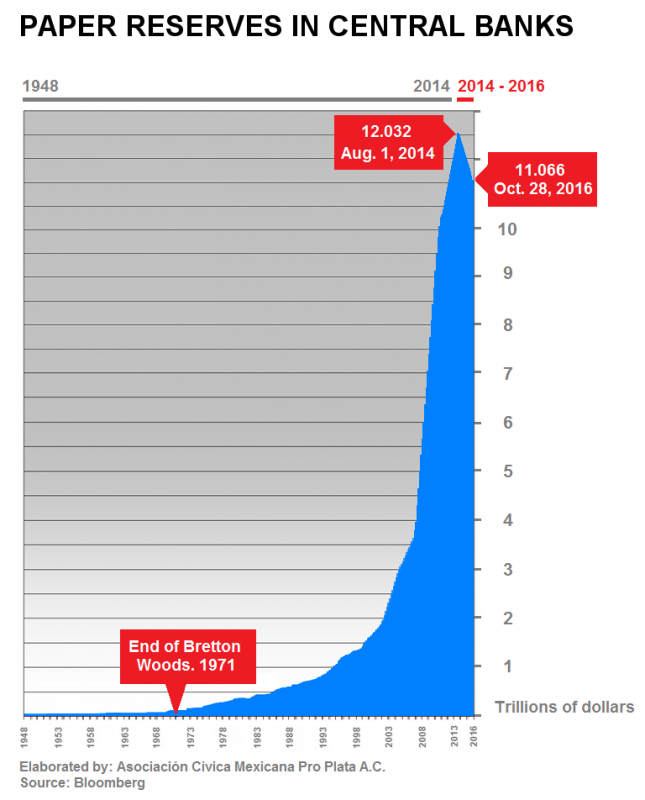

Physical Metals Demand Plus Manipulation Suits Will Break Paper Market

Read the full transcript here: https://goo.gl/R659Nt Craig Hemke of the TF Metals Report speaks out on the technical situation for the metals, whether or not the economy his headed towards a recession and reveals something that could ultimately break the paper markets for gold and silver and get us back to free and fair pricing …

Read More »

Read More »

Michael Pento: Plan to Protect Yourself from THIS…

Read the interview transcript here: https://goo.gl/7LfVOZ Later in today’s program I’m joined by Michael Pento who makes a couple explosive predictions for the economy, the bond market, and precious metals and also talks about the market fallout he expects if President Trump fails to push any of his policies through Congress. His comments may surprise …

Read More »

Read More »

If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

The U.S. will never go back on a gold standard. The notion that a U.S. Dollar backed by gold would solve our financial problems is pure folly. Why? Because, if the U.S. Empire didn’t abandon the gold standard in 1971, it would have collapsed decades ago. Unfortunately, some of the top experts in the precious metals community continue to suggest that revaluing gold much higher, to say…. $15,000-$50,000 an ounce, would bring confidence back into the...

Read More »

Read More »

How to Sell Your Gold & Silver to Money Metals Exchange

Learn more here: https://goo.gl/yA027t?sell-gold What you’ll need: 1. A new cardboard box that is large enough to fit all of the product that you are selling and extra packing material 2. Your precious metals that you are selling to Money Metals Exchange 3. Strong packing tape 4. Your P.O. paperwork 5. Packing material like packing …

Read More »

Read More »

Stefan Gleason on the Biggest Mistakes Precious Metals Investors Make

Listen to this interview with Money Metals president Stefan Gleason, who was a featured guest during the recent 360 Gold Summit. Stefan addressed the fundamental question of “why precious metals” and also gave some helpful tips on how to avoid making big mistakes when investing in gold and silver. Don’t miss this fundamentally important and enlightening conversation coming up after this week’s market update.

Read the full transcript:...

Read More »

Read More »

Sound Money and Your Personal Finances

Sound money principles can serve to help grow the economy and restrain government. The political class, however, doesn’t particularly want to restrain itself. Washington, D.C. is addicted to the easy money policies that have enabled $20 trillion in national debt accumulation and tens of trillions more in unfunded liabilities.

Read More »

Read More »

David Smith: Turning Points Appear Suddenly, So You Must Be Prepared…

David Smith of The Morgan Report and MoneyMetals.com columnist joins Money Metals Exchange to share his thoughts on the metals market action so far in 2017. He’ll also offer a stern warning for those who try to get cute with the timing of a purchase and lays out the potential harm of putting off what you …

Read More »

Read More »