Category Archive: 6a.) Gold Standard

Oklahoma to Consider Holding Gold and Silver, Removing Income Taxes

(Oklahoma City, Oklahoma -- January 20, 2022) - An Oklahoma state representative introduced legislation today that would enable the State Treasurer to protect Sooner State funds from inflation and financial risk by holding physical gold and silver.

Read More »

Read More »

Pro-Sound Money Lawmaker Wants To End Income Taxes on Gold and Silver in Oklahoma

(Oklahoma City, Oklahoma, USA – January 20, 2022) - Oklahoma ended sales taxes on purchases of precious metals long ago, but now a representative from Broken Arrow wants to eliminate yet another tax on on gold and silver transactions.

Introduced by Sen. Nathan Dahm, Senate Bill 1480 would end capital gain transactions on the exchange of gold and silver.

Read More »

Read More »

Will 2022 Be “The Year of Sound Money” in the States?

Last year was a good year for state-level sound money legislation across the United States. 2022 could be even better. Building on the success enjoyed by sound money advocates in Arkansas and Ohio last year, more than a half dozen states are now considering legislation that rolls back discriminatory taxes and regulations on the sale, use, and purchase of gold and silver.

Read More »

Read More »

Consumers Feel Major Inflation Pain as Biden and Fed Dither

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Another set of bombshell inflation reports rattled markets this week.

On Wednesday, the Bureau of Labor Statistics released data showing consumer prices continue to rise at the fastest rate since 1982. The all-items index has risen 7% for the past 12 months ending in December. The energy index rose a staggering 29% over the last year.

Read the Full Transcript Here:...

Read More »

Read More »

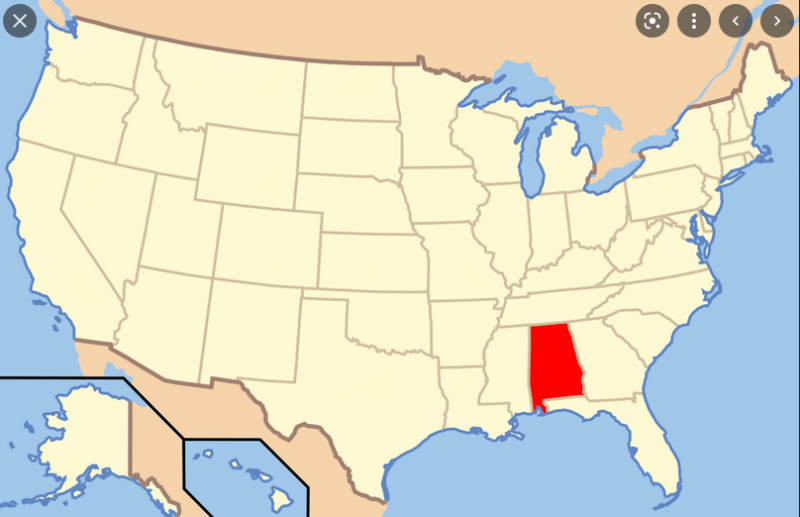

Alabama to Consider Extending Sales Tax Exemption on Sound Money

(Birmingham, AL, USA – January 10, 2022) – Alabama currently exempts precious metals from state sales tax, however this exemption is set to expire in 2022. A senator in the Yellowhammer State hopes to extend this popular exemption.

Read More »

Read More »

Fear of Rate Hikes a Greater Threat than Actual Hikes

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Precious metals markets are ringing in the New Year on a bit of a down note. Despite seeing some strength in late December, gold and silver prices retreated in the first few trading days of 2022.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2022/01/07/the-onset-of-fed-tightening-usually-sparks-major-precious-metals-gains-002438

Do you own precious...

Read More »

Read More »

Could Gold & Silver Be Investment Outcasts in 2022 Too?

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

In this special year-end edition of the Money Metals podcast, we’ll look back at the year that was and look ahead to the year that might be in 2022.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2021/12/30/precious-metals-down-in-2021-what-about-2022-002434

Do you own precious metals you would rather not sell, but need access to cash? Get Started...

Read More »

Read More »

Strong 2021 Demand for Physical Precious Metals, Despite Paper Prices

Even as Omicron casts a smidge of doom over markets and upcoming Christmas celebrations, precious metals investors are feeling at least some holiday cheer this week.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2021/12/23/omicron-casts-pall-while-metals-prices-perk-up-002431

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★...

Read More »

Read More »

Fed WAY behind Curve, Real Rates to Remain Deeply Negative

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As the Federal Reserve prepares to taper its asset purchases, investors are preparing to adjust their portfolios.

Some are dumping gold. They could be making a big mistake.

READ THE FULL TRANSCRIPT HERE: https://www.moneymetals.com/podcasts/2021/12/17/precious-metals-may-rise-during-fed-tightening-002426

Do you own precious metals you would rather not sell, but need...

Read More »

Read More »

Wall Street Types Are Baffled Why Americans Are So Dissatisfied

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Gold and silver markets are coming under pressure again this week as investors weigh economic growth prospects against the risks of inflation and deleveraging.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2021/12/10/stock-market-bounces-but-americans-not-thrilled-002423

Do you own precious metals you would rather not sell, but need access to cash?...

Read More »

Read More »

U.S. Treasury Refuses to Answer Questions about Disposition of Its Own Gold

Recent correspondence between U.S. Rep. Alex X. Mooney, R-West Virginia, and the U.S. Treasury Department suggests that the department has given the Federal Reserve and International Monetary Fund unfettered control of a portion of U.S. gold reserves.

Read More »

Read More »

Fears of Federal Reserve Actions Greater Than Virus Angst

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As Omicron concerns continue to unnerve investors, precious metals markets suffered another setback. Volatile trading in the stock market this week is failing to give a safe-haven boost to gold and silver.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2021/12/03/fed-omicron-unnerve-investors-precious-metals-sag-002419

Do you own precious metals you...

Read More »

Read More »

Federal Reserve Asks Americans to Eat Soy “Meat” for Thanksgiving

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

On this special mid-week edition of the Money Metals podcast ahead of the Thanksgiving holiday, we’ll cover the sudden setback in precious metals markets.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2021/11/24/federal-reserve-soy-thanksgiving-fed-nomination-002414

Do you own precious metals you would rather not sell, but need access to cash? Get...

Read More »

Read More »

Biden Demonizes Businesses over High Prices Caused by Inflation

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Precious metals markets pulled back a bit this week as the U.S. dollar strengthened versus foreign currencies.

Read the Full Transcript Here: moneymetals.com/podcasts/2021/11/19/senate-considers-nomination-of-marxist-to-comptroller-of-currency-post-002409

Do you own precious metals you would rather not sell, but need access to cash? Get Started...

Read More »

Read More »

Ferocious Inflation Showing Up in Most Goods & Services

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Gold and silver markets are registering big breakouts this week as the latest reports on inflation send shockwaves through the Biden administration.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2021/11/12/inflation-readings-come-in-screaming-hot-002405

Do you own precious metals you would rather not sell, but need access to cash? Get Started...

Read More »

Read More »

Fed’s Stunning Inflation Abdication; Gold Gearing Up

When will precious metals markets finally make their move? It’s a question that has frustrated many investors in 2021. Gold and silver prices have remained stubbornly rangebound for the past several months.

There is no way to know exactly when this consolidation period will end. Long-term investors would be wise to hold their core positions regardless of market conditions (and grow them when feasible).

Read More »

Read More »

Fed Chairman Admits Failure to Maintain Stable Prices

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Precious metals markets reacted this week to news of the Federal Reserve’s tapering plans. The Fed didn’t deliver any real surprises, though. It left interest rates unchanged as expected and confirmed that it would gradually cut back on monthly asset purchases.

Read the Full Transcript:...

Read More »

Read More »

Central Planners Clinging to Hope That Inflation Is “Transitory”

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As trading closes out for October ahead of Halloween, the specter of inflation is haunting markets.

While some investors still cling to the hope that it will be transitory, a growing number are now worried that pricing pressures and even shortages will intensify heading into Christmas – and possibly get worse in 2022.

Read the Full Transcript Here:...

Read More »

Read More »

Big Week for Cryptos… Better Inflation Hedges Than Gold?

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Gold and silver markets continue to gather upside momentum as inflation pressures spread throughout the economy.

Read the Full Transcript Here: https://www.moneymetals.com/podcasts/2021/10/22/is-bitcoin-a-better-inflation-hedge-than-gold-002395

Do you own precious metals you would rather not sell, but need access to cash? Get Started...

Read More »

Read More »

Prices of Nearly Everything Now Surging

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

A big week for precious metals markets as inflation pressures push consumer prices to painful new heights.

On Thursday, the U.S. Labor Department reported that inflation at the wholesale level is up 8.6% from a year ago. That’s the steepest annual advance since the data started being reported.

Read the Full Transcript Here:...

Read More »

Read More »