Category Archive: 6a) Gold and its Price

Gold Stocks Break Out

No Correction Yet Late last week the HUI Index broke out to new highs for the move, and so did the XAU (albeit barely, so it did not really confirm the HUI’s breakout as of Friday). Given that gold itself has not yet broken out to a new high for th...

Read More »

Read More »

BANK BAIL-INS – with Goldcore.com Mark O’Byrne

Bank Bail-Ins are coming and people need to prepare by owning bullion outside the banking system. They will be counterproductive and could lead to financial collapse. “Unfortunately, we don’t learn the lessons of history to our own downfall!”. For more information http://www.GoldCore.com

Read More »

Read More »

Why Silver Bullion Is Set To Soar – GoldCore Interview

Jan Skoyles presents a Get REAL special on silver. She talks to Mark O’Byrne of www.GoldCore.com about how silver bullion is set to soar and the importance of owning physical silver coins and bars. GoldCore now offer silver coins VAT free in the UK and throughout the EU.

Read More »

Read More »

GoldCore on What Driving Gold Prices Up Now

www.GoldCore.com give detailed insight on the gold bullion coin and bar market, answering questions about sudden rise of physical gold prices, the British Economy in the run up to Brexit Referendum and it’s influence on the gold bullion market. Sign Up For News, Research & Special Offers from GoldCore Here – http://info.goldcore.com/goldcore_email_subscription_preferences

Read More »

Read More »

Bail-In Regimes Are “Insane” – GoldCore Warn On Bail-Ins

Mark O’Byrne, founder of the hugely successful Irish bullion broker GoldCore recently spoke to WAM’s Josh Sigurdson and John Sneisen about the value of silver & gold bullion as well as the many problems with central banks and the printing of worthless IOU note currency. During the 40 minute interview, Mark spoke about the coming …

Read More »

Read More »

Gold Bullion Demand From China Causing Paradigm Shift – GoldCore.com

Gold bullion coins and bars surging demand and the ongoing paradigm shift that is China’s gradual move to become a dominant player, if not the dominant player, in the global gold market continues according to www.GoldCore.com. China was the largest buyer of gold in the world again in 2015. Sign Up For News, Research & …

Read More »

Read More »

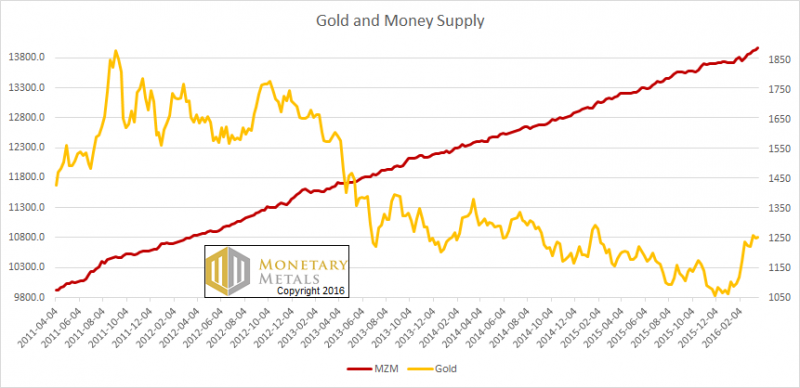

The Gold Money Supply Correlation Report, 3 Apr, 2016

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on...

Read More »

Read More »

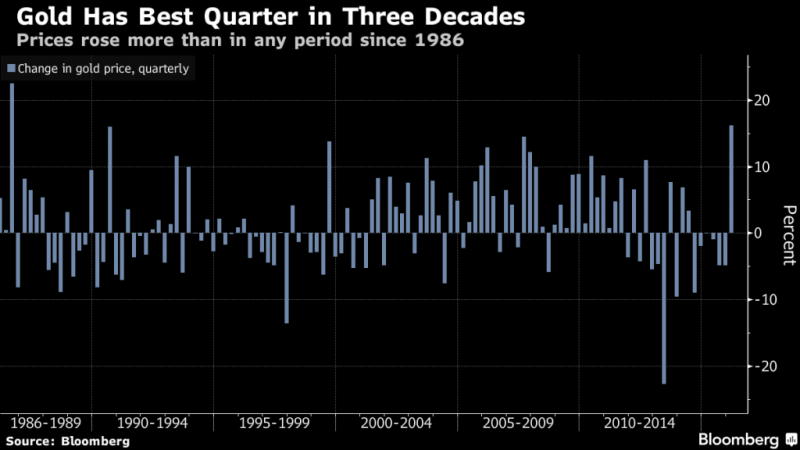

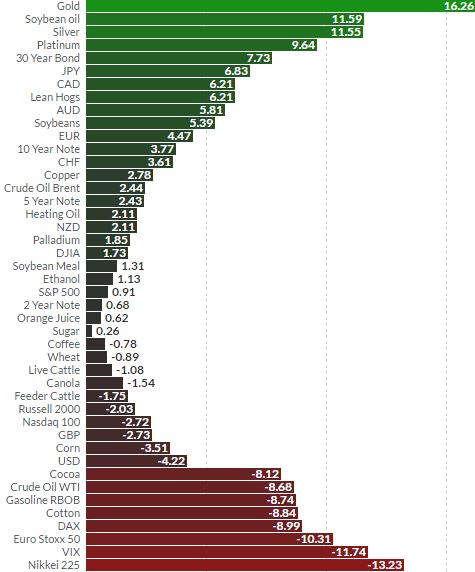

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

– Gold prices gained 16% in Q1 – best quarterly performance since 1986– Gains due to increasing global financial, macroeconomic and monetary risk– Stocks come under pressure – Flat in U.S.; Falls ...

Read More »

Read More »

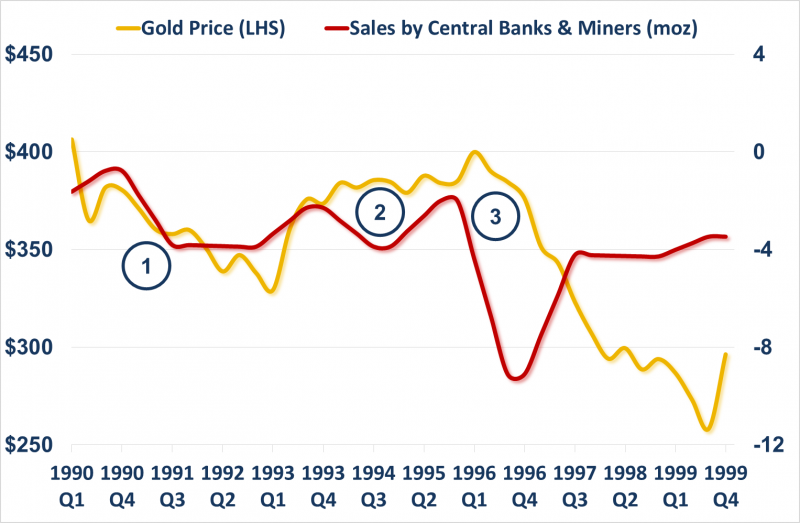

The Voldemort Effect: Gold Price and Gold Sales

Gold market analysts have for many years puzzled over the unusual behaviour of the gold market during the 1990s, specifically the bizarrely flat gold price from 1993 to 1996 in the face of sustained selling pressure from central banks and gold miners...

Read More »

Read More »

Silver Relative Strength Report, 27 Mar, 2016

Gold went down (as the muggles would measure it, in dollars). It dropped almost 40 bucks. Silver fell almost 60 cents. Since silver fell proportionally farther than gold, the gold-silver ratio went up.

Read More »

Read More »

Der weiterentwickelte Hof – ein Drama in vier Reformen

Es war einmal ein Bauer. Willy hiess er. Er hatte einen Hof, 65 Kühe, seine Frau Vreneli, einen anständigen und allseits respektierten Fuhrpark, war glücklich, zufrieden und wohlhabend. Dann kam die Wende auf dem Milchmarkt: Milch kam ausser Mode. Er...

Read More »

Read More »

Silver Gone Wild Report, 20 Mar, 2016

Early on Monday morning (Arizona time), silver began to rise. From its close on Friday of $15.46, it ran up to $15.82. Then it began to slide, eventually dropping to $15.17 by midmorning on Wednesday. Then…

Read More »

Read More »

Supply and Demand Report, 13 Mar, 2016

On the week, the prices of the metals didn’t move all that much. However, the move around 6am (Arizona time) on Thursday is notable. The price of silver spiked up from around $15.12 to $15.64—3.4%—by around 8am. Twelve hours later, the price touched ...

Read More »

Read More »

Gold-Silver Ratio Reversal Report, 6 Mar, 2016

So the price of silver rocketed up 80 cents, while the price of gold jumped $37. Silver is now more expensive than it was two weeks ago; the price decline of last week was more than overcompensated. This pushed the gold-silver ratio down about two wh...

Read More »

Read More »

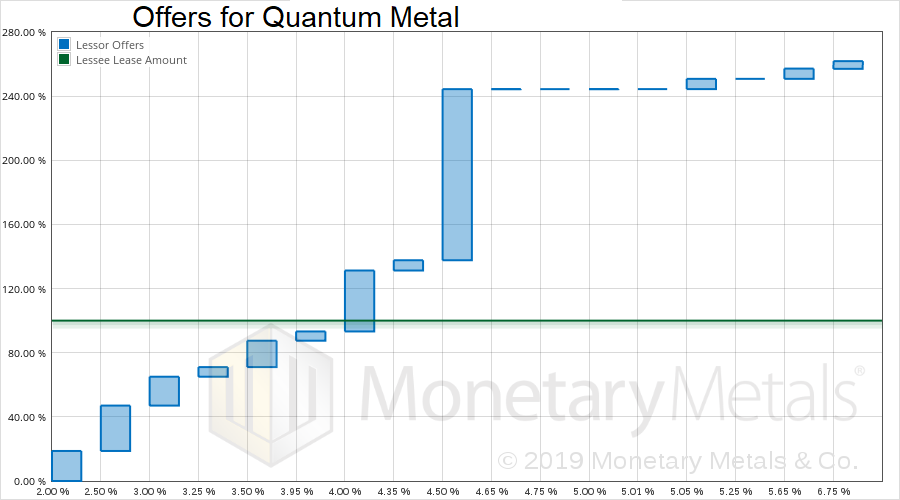

Interest on Gold Is the New Tempest in a Teapot

Zero Hedge published an article on Canadian Bullion Services (CBS) last week. Other sites ran similar articles. The common thread through these articles, and in the user comments section, is that CBS is committing criminal fraud. Or, if not, then it’...

Read More »

Read More »

Gold-Silver Ratio Breakout Report, 28 Feb, 2016

The gold to silver ratio moved up very sharply this week, +4.2%. How did this happen? It was not because of a move in the price of gold, which barely budged this week. It was due entirely to silver being repriced 66 cents lower.

Read More »

Read More »