Category Archive: 6a) Gold & Monetary Metals

SO VIEL GELD VERLIEREN SIE JEDES JAHR! – INTERESSANTE ANALYSE VON MAX OTTE…

Wir freuen uns sehr, wenn du ebenfalls deine Meinung, Handlungsempfehlungen oder deine eigenen Prognosen in den Kommentaren postest. Das würde uns und der Community sehr viel bedeuten.

Read More »

Read More »

? MAX OTTE: KRISE VERSCHÄRFT SICH! – MAX OTTE EINSCHÄTZUNG WURDE BESTÄTIGT… – WAS DENKST DU?

? Werde TEIL unserer Community: https://bit.ly/2ZFTlRl ?

? FREI DENKEN - Alle Sendungen: https://bit.ly/3iJn972 ?

? WIE DENKST DU ÜBER DAS THEMA? - SCHREIB UNS DEINEN KOMMENTAR ?

---------------------------

DAS WICHTIGSTE ZUERST:

Wir freuen uns sehr, wenn du ebenfalls deine Meinung, Handlungsempfehlungen oder deine eigenen Prognosen in den Kommentaren postest. Das würde uns und der Community sehr viel bedeuten.

Ebenfalls kannst du die...

Read More »

Read More »

Precious Metals Nowhere Near Cycle Highs – Brace for Gains!

GoldCore's Mark O'Byrne interviewed by the Wealth Research Group talking about the start of a new bull run for gold and silver and answering the following questions...

Read More »

Read More »

? MAX OTTE: WIR KOMMEN HIER NICHT WEITER! – INTERESSANTE ANALYSE VON MAX OTTE – STIMMST DU ZU?

Wir freuen uns sehr, wenn du ebenfalls deine Meinung, Handlungsempfehlungen oder deine eigenen Prognosen in den Kommentaren postest. Das würde uns und der Community sehr viel bedeuten.

Read More »

Read More »

Tyrants Are Waging War Against Their Own Citizens

As [D] Mayor de Blasio shuts down schools and restaurants in NYC yet AGAIN, and as cops in Australia arrest women on beaches for traveling outside of 5 KM from their homes, it’s clear that tyrants around the world are openly waging war against their own people. Claudio Grass joins me to discuss.

Read More »

Read More »

Prof. Max Otte: Der Reset ist programmiert

Wohin führt die Krise? Planwirtschaft oder chinesische Verhältnisse? Michael Mross im Gespräch mit Professor Max Otte.

Read More »

Read More »

The Fed’s Quest for Higher Inflation: What Could Go Wrong?

The Federal Reserve is warning investors in no uncertain terms that higher rates of inflation are coming. Yet markets, for the most part, have disregarded that warning. Bond yields, for example, remain well below 2% across the entire duration range.

Read More »

Read More »

MARC FABER – The Price Of Gold and Dow Jones Are Incredibly Depressed

The gold price and the dow jones are extremely depressed, ready to explode but in what direction?

SUBSCRIBE For The Latest Issues About ;

#useconomy2020

#economynews

#useconomy

#coronaviruseconomy

#marketeconomy

#worldeconomy

#reopeneconomy

#openeconomy

#economynews

#reopeningeconomy

#globaleconomy

#silverprice

#stockmarket

#recession

#goldpricetoday

#goldprice

#goldpriceprediction

#preciousmetals

#economics

#silverpriceprediction...

Read More »

Read More »

Fed Chairman to Congress: “You Cannot Overdo the (Stimulus) Package”

Precious metals investors faced choppy market seas this week. Gold bobbed to a slight decline while silver essentially treaded water through Thursday’s close. Both are advancing here today.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 10.9.20

Legendary investor Eric Sprott discusses current events impacting the precious metals markets and then looks ahead to the pending earnings releases of some of the major mining companies.

Visit our website https://www.sprottmoney.com for more news.

You can submit your questions to [email protected]

Read More »

Read More »

Dr. Marc Faber & Yra Harris on What’s Happening in the Economy and Financial Markets

Dr. Marc Faber & Yra Harris on What’s Happening in the Economy and Financial Markets The Roundtable Insight – Dr. Marc Faber & Yra Harris on What’s Happening in the Economy and Financial Markets Receive trading ideas weekly from Yra: https://cedarportfolio.com/yra-signup-form

Read More »

Read More »

Emerging Hyperinflation: DEBT TRAP IS SET

Despite official sources claiming our inflation is under 2%, this well-respected analyst claims emerging evidence reveals we are accelerating from inflation towards hyperinflation. Worse yet, the Fed and other central banks, having no escape will destroy the currency itself, destroying the value of earnings, savings, pensions, and retirement plans.

Read More »

Read More »

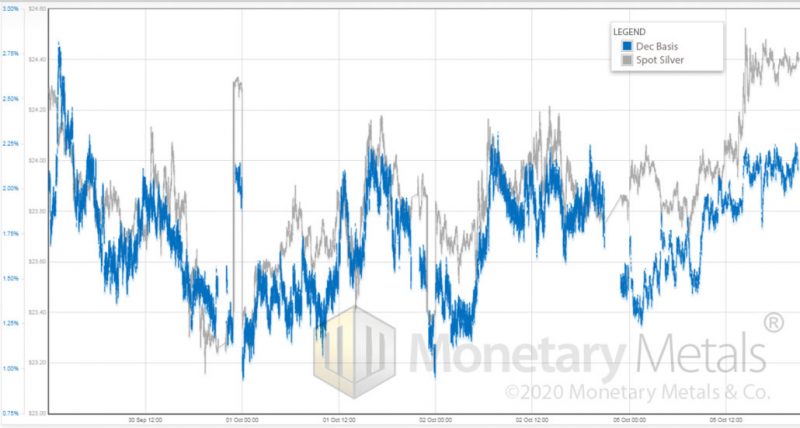

Is Silver about to “Pop” or “Drop”

The chart of silver at the moment shows that it is poised for a breakout move. It has failed on a number of occasions recently to close above resistance at $24.40.

Read More »

Read More »

Marc Faber: India Will be a Top 3 Global Economy

We’re in conversation with one of the top investing minds in the world on the Investor Hour: Dr Marc Faber. It was a pleasure having Dr Marc Faber on the Investor Hour again. He was our very first guest on the podcast and did a 2-part episode. At that time he talked to us about … Continue reading »

Read More »

Read More »