Category Archive: 6a) Gold and its Price

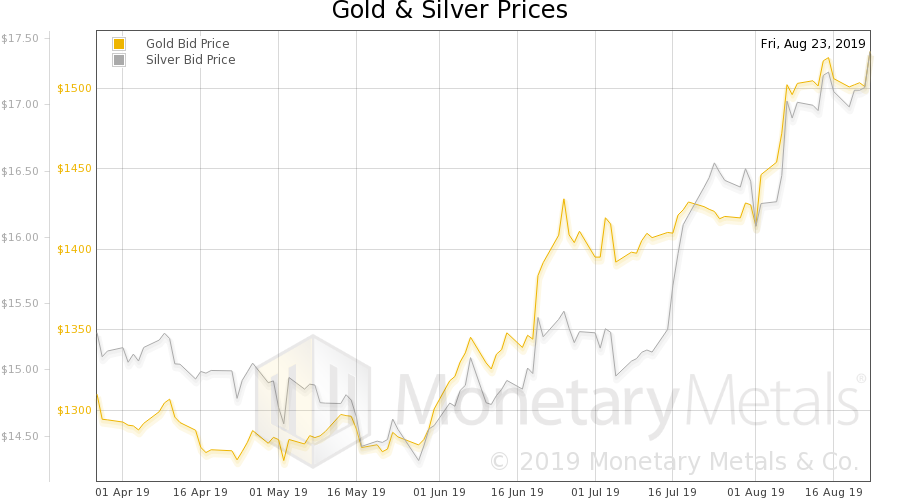

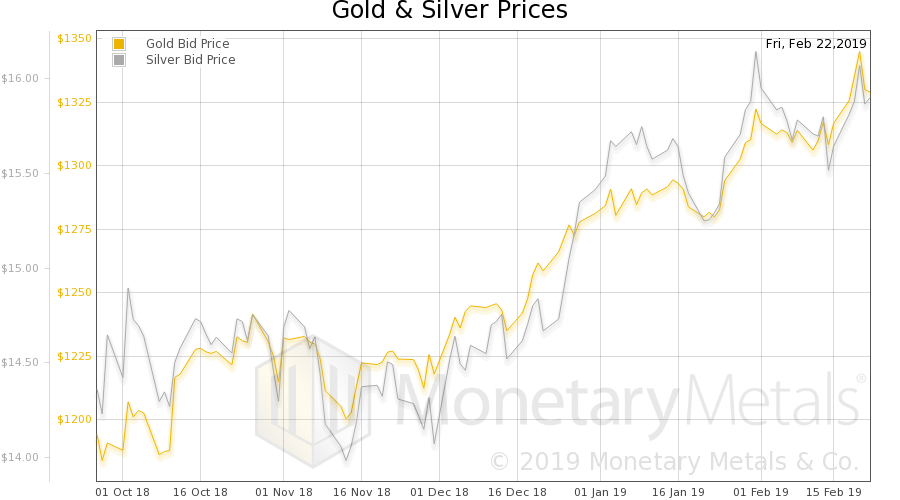

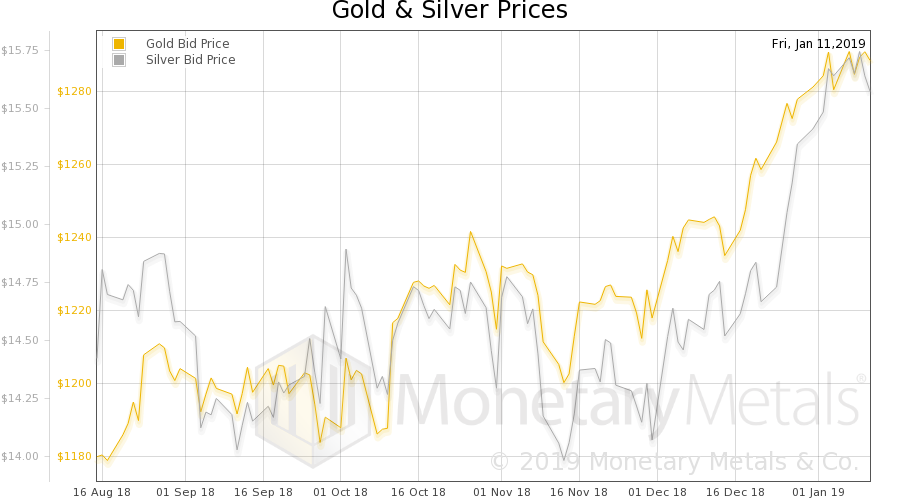

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

Gold futures settled above $1,300 an ounce on Friday, with prices for the yellow metal at their highest since June as the U.S. dollar pulled back and investors eyed geopolitical turmoil and global growth worries. Rising gold prices reflect “political uncertainty” in the U.S., Eurozone, Venezuela and pockets of South America, as well as China-U.S. trade talks, said George Gero, managing director in RBC.

Read More »

Read More »

Brexit – The Pin That Bursts London Property Bubble

Brexit – The Pin That Bursts London Property Bubble – Investors need a ‘Plan B’ to protect against Brexit, currency and many other risks – Brexit uncertainty is impacting Irish and UK consumers, companies and economy – London home asking prices slump and drop below £600,000: Lowest since 2015 but still very over valued – …

Read More »

Read More »

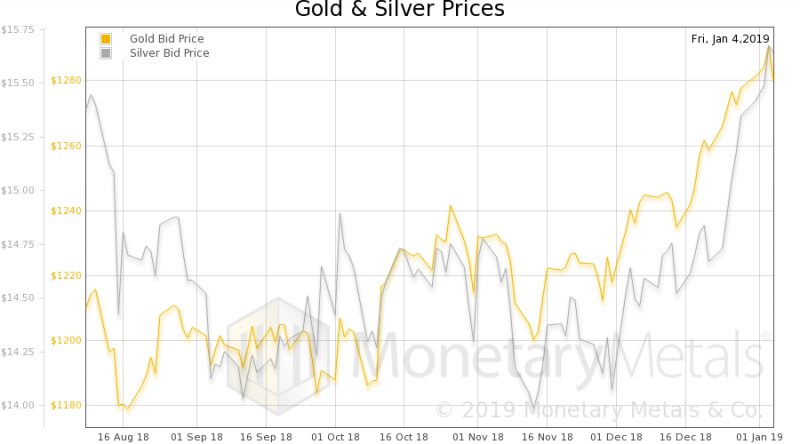

Gold and Silver Prices To Rise To $1,650 and $30 By 2020

Gold To Outperform Stocks Again In 2019 As Has Done In Last 15 Years – Gold to outperform stocks again in 2019 as seen in 2018 and last 15 years – Gold and silver likely to reach highs over $1,650 and $28 per ounce – Gold likely to see 15% to 20% gains and silver … Continue reading »

Read More »

Read More »

Prepare for Global Debt Bubble Collapse with Gold and Silver

Prepare for a Global Debt Bubble Collapse in 2019 – Goldnomics Episode 10 – 2019 to see the political and economic uncertainty of 2018 continue and likely to deepen – Investors lulled into a false sense of security by politicians, brokers, bankers etc – Much “cheer leading” of the “economic recovery” narrative and by extension …

Read More »

Read More »

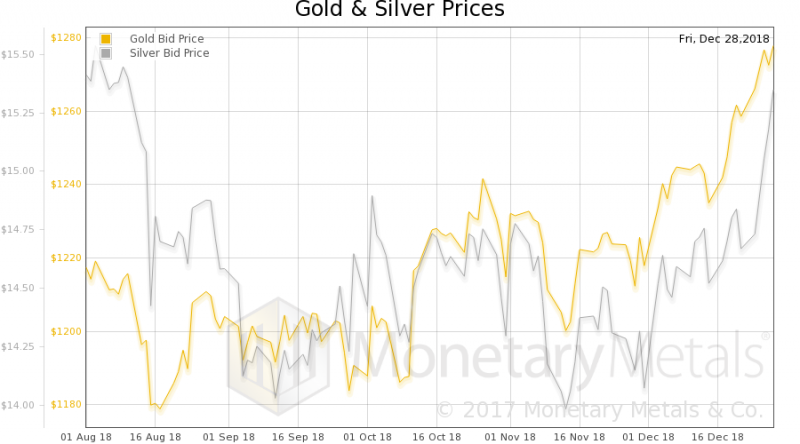

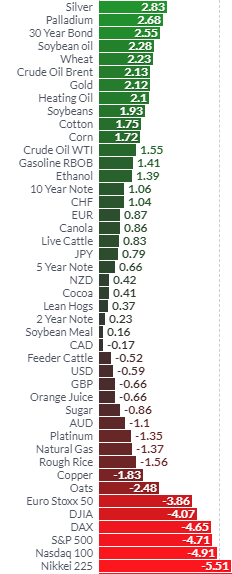

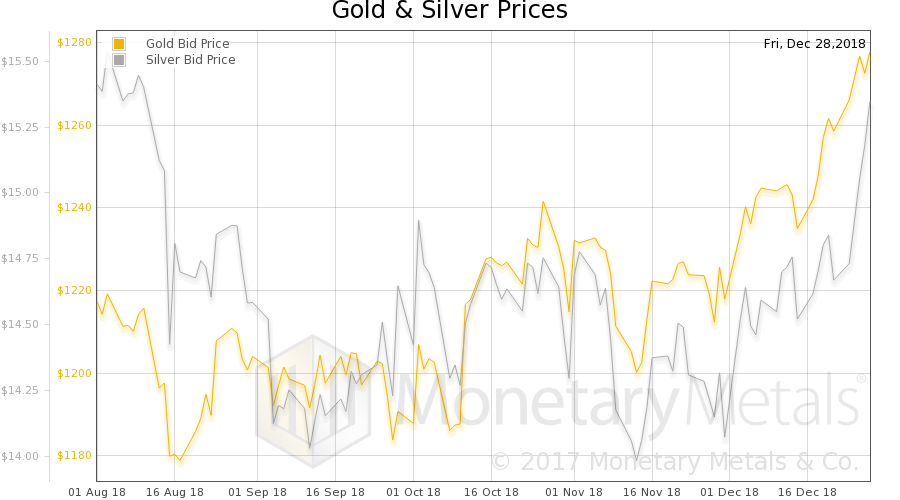

2018 – Everything Bubble Starts Bursting

– Review of 2018: ‘Everything bubble’ started bursting – Stocks and many property markets have fallen sharply – S&P 500 -4.5%, Nikkei -8%, EuroStoxx 50 -12.5%, FTSE -13%, DAX -16.5% – Of 54 major stock market indices in the world, only 6 are higher (see table) – Global property bubble bursting – London, Sydney and …

Read More »

Read More »

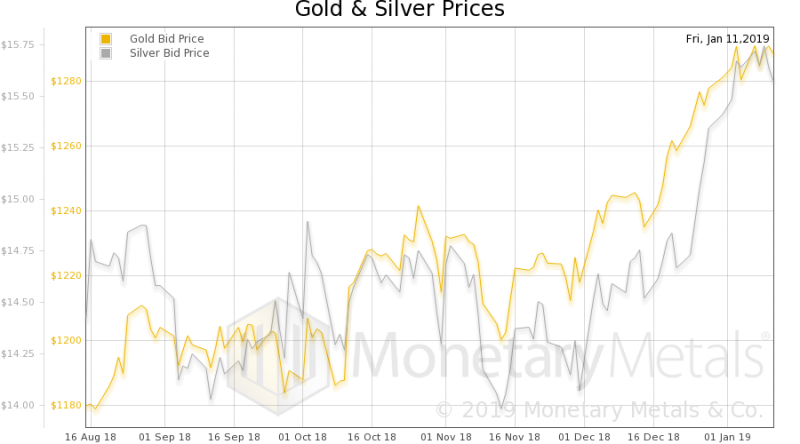

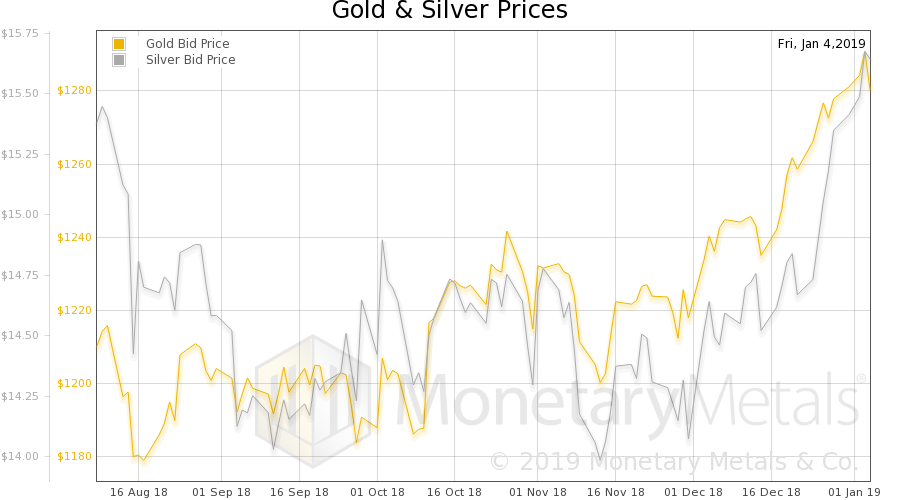

Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

Gold acted as a safe haven last week and is again acting as a safe haven in December. It has performed well despite the rout in stocks in Ireland and globally. U.S. stocks including the S&P500 and Nasdaq were down nearly 5% last week, while gold was 2% higher and silver over 3% higher.

Read More »

Read More »

“Fake Markets” To Lead to Global Financial Crisis? Goldnomics Podcast (Ep 9)

Fake Markets – Are we living in a new era? What are Fake Financial Markets and what effect do they have on the current inflated levels of global stock markets? What do they mean for stock market and bond market performance in the future? In this episode 9 of the Goldnomics Podcast, Stephen Flood GoldCore …

Read More »

Read More »

Brexit and Global Discontent

Is Brexit a Massive Threat to Globalisation? As Theresa May heads back to Brussels today in a last ditch effort to renegotiate her Brexit deal in order to get it passed through the British Parliament, we take a look not just at the current state of DIS-unity but also ask the question – is Brexit … Continue reading »

Read More »

Read More »

Secure Storage Ireland – Store Gold In The Safest Vaults In Ireland – Goldnomics Podcast Special

Do you wish to store gold in Ireland a highly liquid way in ultra secure, specialist gold vaults? We are delighted to announce that Irish, UK and international investors can for the first time store gold in professionally managed, secure, institutional grade vaults in Ireland. Store Gold In The Safest Vaults In Ireland GoldCore Secure …

Read More »

Read More »

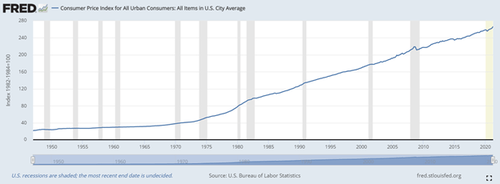

American Elections Farce as Politicians Ignore the Looming $121.7 Trillion Debt Crisis

AMERICAN ELECTIONS FARCE – IN TODAY’S VIDEO UPDATE WE LOOK AT YET ANOTHER ‘PUNCH & JUDY’ ELECTION WHICH ONCE AGAIN IGNORED THE ELEPHANT IN THE ROOM – THE INEVITABLE U.S. $121.7 TRILLION DEBT CRISIS AND THE GLOBAL $250 TRILLION DEBT CRISIS We briefly look at the outcome of the elections, how markets have reacted in …

Read More »

Read More »

Bron Suchecki

Bron Suchecki, Precious Metals Consultant, Suchecki Consulting presenting at the 2018 Precious Metals Investment Symposium in Perth.

Read More »

Read More »

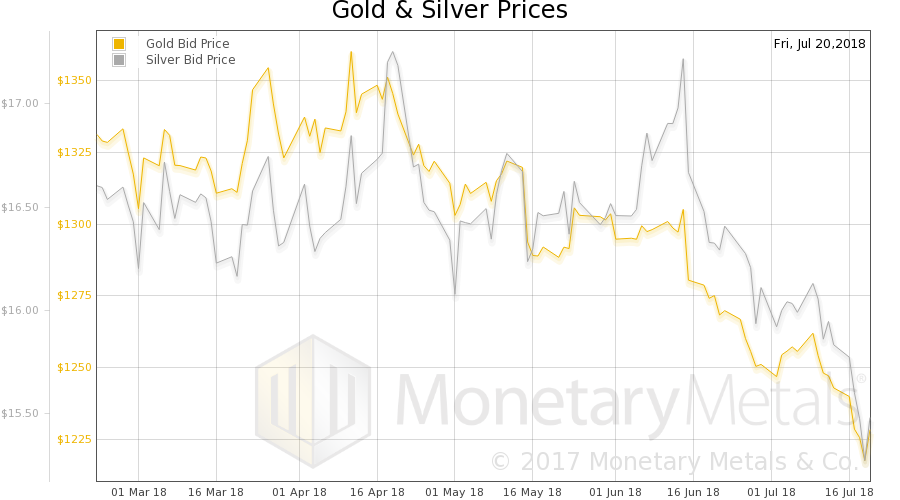

Alarm Bells Ring and Gold Rises In October As Stocks and Property Fall Globally

In our latest video update, we consider the performance of markets in a volatile October. Stock markets globally fell sharply while gold acted as a hedge in all currencies, rising 1.7% in dollars, 4.4% in euro terms and 4.2% in sterling terms. Many political, economic and financial risks have been ‘bubbling’ away under the surface …

Read More »

Read More »

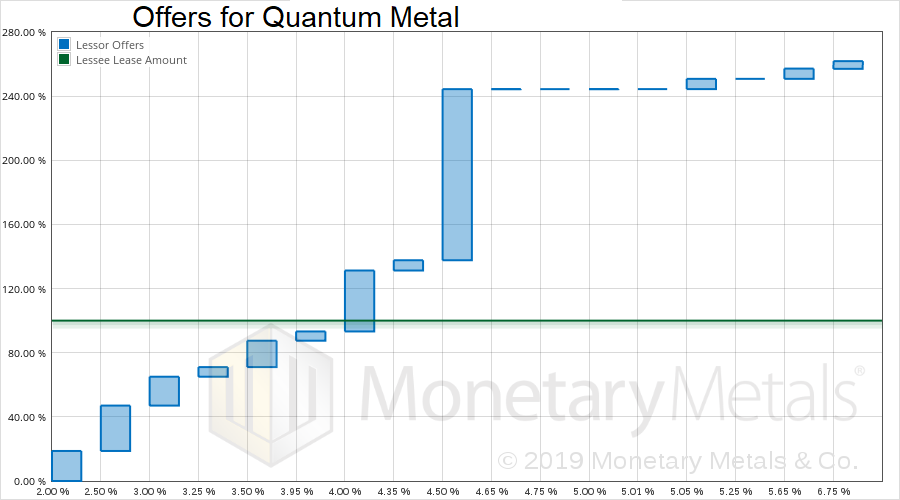

Direct Access Gold Podcast Special – The Safest Way To Own Gold

Direct Access Gold – The Safest Way to Own Gold Globally Do you own gold in the safest way possible? GoldCore has launched a service that is being considered as a game-changer when it comes to the level of safety, security and access that precious metals investors have when it comes to their gold. It …

Read More »

Read More »

We’ve Got A Special Announcement Coming This Thursday

This Thursday we are going to have a very special announcement about a new service that we are launching. This service is going to be a first for the precious metals industry and frankly we think that is going to be a game changer! We can’t say anything about it until its official launch but … Continue reading...

Read More »

Read More »

Are Global Property Bubbles Starting to Burst?

Are Global Property Bubbles Starting To Burst? – London, Dublin, Sydney, Vancouver and Hong Kong property prices fall as global risks increase… – Property bubbles in many cities internationally according to The Economist, UBS and others https://www.bloomberg.com/news/articles/2018-09-28/the-cities-around-the-world-most-at-risk-of-property-bubbles – UBS found that six of the world’s largest cities are now subject to a...

Read More »

Read More »