Category Archive: 6a) Gold and its Price

Bron Suchecki Q&A

The Pick sits down with precious metals analyst Bron Suchecki before the Precious Metals Investment Symposium on the 3rd and 4th of October. The Pick is Australasia’s premier resource sector new platform. It is backed by some of the regions most connected journalists, content creators and digital specialist. It is more than a news site … Continue...

Read More »

Read More »

Silver Guru – David Morgan – Silver and Gold Will Surge in the Coming Currency Collapse

Silver Guru – David Morgan, joins Mark O’Byrne for Episode 8 of the Goldnomics Podcast. Talking about silver and gold and how they will perform as the current fiat monetary system collapses under the pressure of money printing, quantitative easing, trade wars and geopolitical tensions. Listen to the full episode or skip directly to one …

Read More »

Read More »

Silver Guru – David Morgan – This Is When Fiat Currencies Will Collapse.

Today we are bringing you an excerpt from the upcoming episode 8 of the Goldnomics Podcast where I talk with our special guest Silver Guru, David Morgan. – “Every fiat currency in history has failed and this one is failing” warns ‘Silver Guru’ David Morgan – “I do not think we can go another 5 …

Read More »

Read More »

BREXIT To Contribute To London Property Bubble Bursting

Mark O’Byrne, Research Director of GoldCore.com considers the growing and unappreciated risks from Brexit to the London property market – Brexit in conjunction with severe price unaffordability, rising interest rates and global economic uncertainty is leading to sharp price falls in London home prices – London home prices have fallen five months in a row …

Read More »

Read More »

Gold Surges to Record Highs in Emerging Market Currencies

– As emerging market currencies internationally collapse in value, there is a real risk of contagion in bond and currency markets – Turkish lira falls 43.6% and Argentine peso falls 51% and are the 2nd worst and worst internationally traded and non pegged performing currencies in 2018 – Venezuelan bolivar has completely collapsed – Inflation …

Read More »

Read More »

Will Indebted Nations Globally Follow Venezuela Into Hyperinflation?

Will your fiat paper or #digital #currency become worthless as currency wars deepen? – Fiat currency has become worth less than toilet paper in #Venezuela – Venezuela was once one of the wealthiest countries in South America – Currency collapse due to massive currency “printing”, digital currency creation and socialist government – A roll of …

Read More »

Read More »

Is Silver Set for a Massive Breakout?

Is silver set for a massive breakout? Stephen Flood (GoldCore.com CEO) takes a look at the silver price chart with commodities technical analyst Carley Garner of DeCarleyTrading.com Silver looks to be forming a base with very strong support. After a long period of consolidation is silver set to soar? How will its volatility compare with …

Read More »

Read More »

What If Gold Breaks $1200?

Gold is technically still in an uptrend with higher lows still being achieved. The strong support level at $1,200 has now been breached since this video was recorded. So what is next for the price of gold? Are we going to see a further leg down in the price or will it rally from here? … Continue reading »

Read More »

Read More »

Gold Speculators Least Bullish in Years

Are gold speculators really the least bullish that they have been in years? In this video we look at what the charts are suggesting. While gold speculators are almost always long the charts are showing that they are the least long that they have been in a while. Historically when this has happened gold has … Continue reading...

Read More »

Read More »

Gold Season – Is This It?

Gold prices have a certain seasonality to them. Typically gold prices tend to bottom in July and August and then rally in to the end of the year. According to Carley Garner of DeCarlyTrading.com this is driven by a number of underlying factors. However as of yet we haven’t seen gold turn up again and … Continue reading »

Read More »

Read More »

Jim Rogers on Gold, Silver & Surviving the Coming Crash – Goldnomics Episode 7

Talking about gold, silver and surviving the next financial crash, Jim Rogers, legendary investor and “Adventure Capitalist” speaks with Mark O’Byrne GoldCore’s Director of Research in Episode 7 of the Goldnomics Podcast. Are the actions of the US administration making China great again? What currency is going to challenge the US dollar as the global …

Read More »

Read More »

Jim Rogers US Dollar Safe Haven Status Under Threat

Another clip from our upcoming Episode of the Goldnomics Podcast with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the Quantum Fund and creator of the Rogers International …

Read More »

Read More »

Jim Rogers – Making China Great Again!

We are delighted to announce a very special guest for our next episode of the Goldnomics Podcast, due for release later this week. We recently had the opportunity to speak with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of …

Read More »

Read More »

Russia Sells 80% Of Its US Treasuries

– Russia has liquidated 85% of its US Treasury holdings in just two months – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion – Deepening geo-political tensions between Russia and U.S. and Russian concerns about the dollar lead to selling – …

Read More »

Read More »

Gold Production In South Africa Continues To Collapse – Down 85% Since 1970

– South African gold production collapsed again in May – down 16% – South Africa production has collapsed 85% (1,000 to 145 tonnes) – Long term, ongoing collapse appears to have escalated – Gold suppression has destroyed gold mining in South Africa and rest of Africa, impacted African economies, jobs and people – Geological challenges suggest ‘peak gold’ or ‘plateau gold’ production while...

Read More »

Read More »

Bron Suchecki – Gold Confiscation: How Likely and What You Can Do About It?

Bron Suchecki, a returning SBTV guest, speaks with us at The Safe House about the topic of gold confiscation (like when FDR issued Executive Order 6102 in 1933), how likely it is to happen again and how precious metals owners can minimize this risk. Bron Suchecki discusses the possible impact of the occurrence of a …

Read More »

Read More »

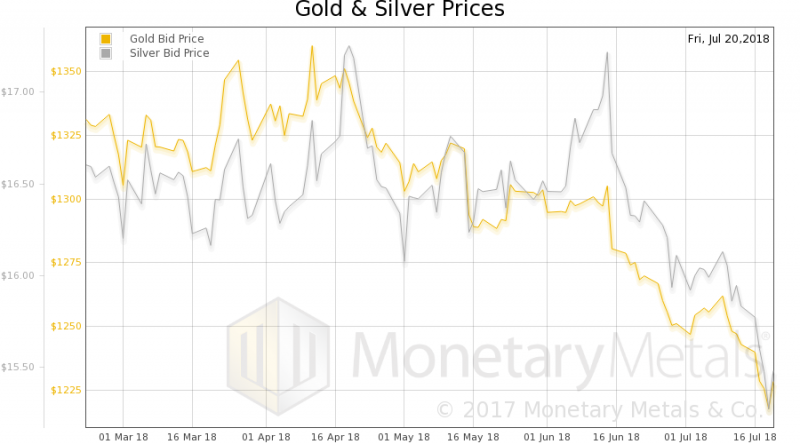

Crying Wolf, Report 22 July 2018

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Trump and War With China? Goldnomics Podcast ( Episode 6 )

In this the sixth episode of the Goldnomics podcast we discuss the deepening trade war between the U.S. & China and the risk of a wider war. GoldCore CEO Stephen Flood and GoldCore’s Research Director and respected precious metals commentator Mark O’Byrne in discussion with Dave Russell. Our discussion starts with the “Tweet” from Ray …

Read More »

Read More »